Data released today by the Bureau of Labor Statistics (BLS) show private-sector jobs rising by 604,000 in October, with the September jobs estimate revised upward by 220,000, and with the upward revision to job gains split about equally between August and September. A cigarette manufacturer used to float the canard “Not a cough in a carload.” I was reminded of that slogan when I saw today’s data, with substantial job gains occurring in virtually every industry group.

The one sector not showing big October job gains was public schools, where Covid restrictions in the face of “normal” school patterns continue to skew the data. That is, prior to seasonal adjustment, public school jobs rose by 330,000, but because that rise was not as large as usual, with many schools still closed, it was seasonally adjusted into a decline of 65,000.

Speaking of Covid restrictions, mask mandates and seating restrictions seem to be still in place for sectors such as restaurants, passenger travel and recreation facilities. Yet, each of these sectors saw nice October gains and upward revisions—109,000 and 27,000 for restaurants, 28,000 and 1,000 for travel, and 21,000 and 11,000 for recreation.

Meanwhile, manufacturing saw gains of 60,000, with 23,000 of revisions. Even construction, which had been hit by declining activity in recent months, saw October job gains of 44,000, with 7,000 of revisions.

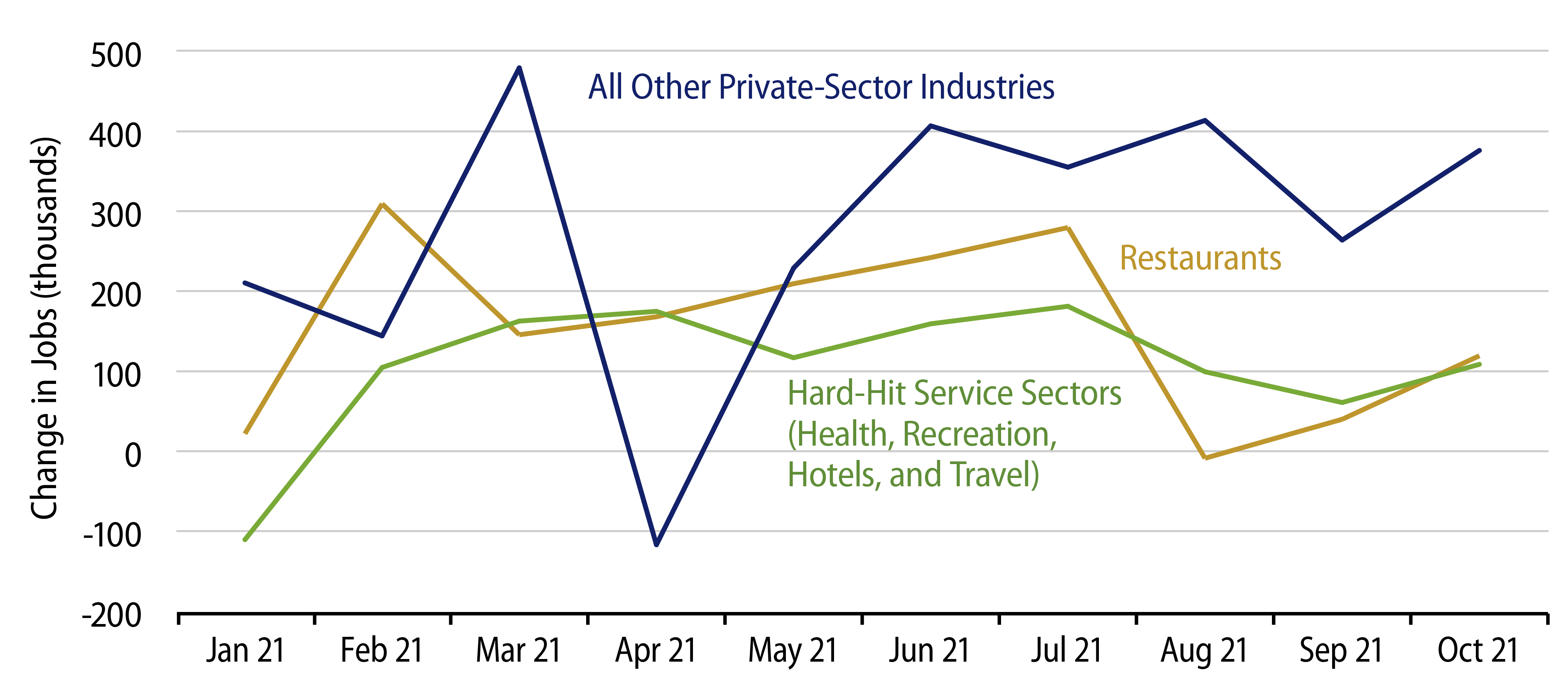

The accompanying chart provides some perspective. Total job growth crested around 800,000 per month in early-summer, when reopening of the economy was in full flower. The restaurant industry appeared to have fully recovered by then, and both job and sales growth there then flattened over August/September. However, jobs there, at least, bounced nicely in October. The same was true of other sectors that have been hit hard by Covid restrictions. In remaining sectors, it looked like there was some slowing in mid- to late-summer, but with today’s October gains and August/September revisions, job growth there looks like it may be coming back on track.

A logical question is, “where are the workers coming from?” The reports of worker scarcity are continuous, and BLS’s separate survey shows the workforce rising by only 104,000 in October opposite these job gains. Meanwhile, even with the October gains, payroll jobs are likely still a year or more away from re-attaining pre-Covid growth trends.

We’ll leave these issues for another time. For now, suffice it to say that today’s payroll report marked a welcome break from the apparently softer trends of preceding months.