Municipals Posted Negative Returns

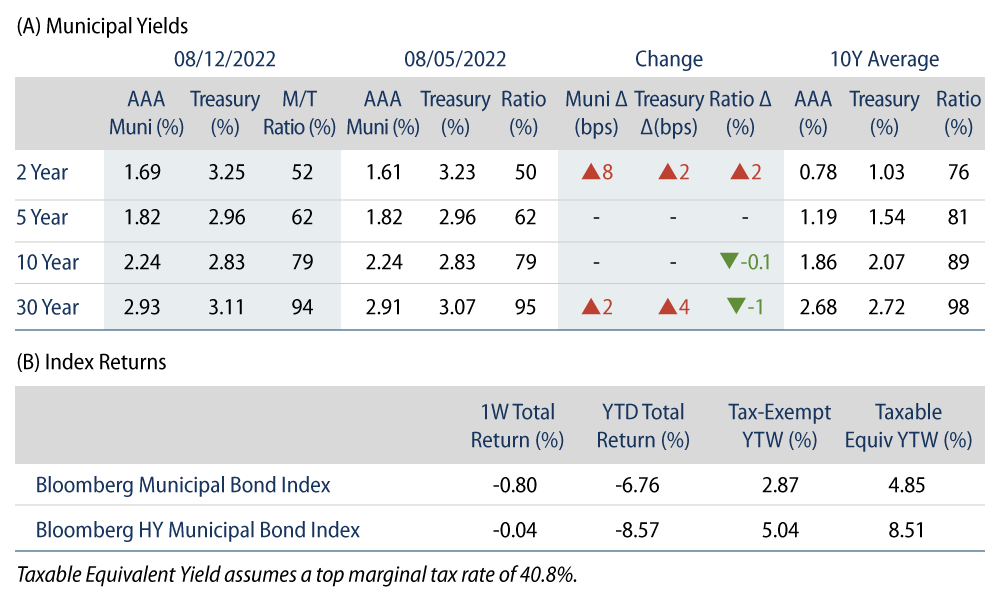

Municipals posted negative returns during the week as yields moved higher in short and long maturities. Treasury rates were volatile during the week, driven by a softer than expected CPI report that highlighted signs of potentially peaking inflation, but was contrasted by policy rhetoric from select Federal Open Market Committee (FOMC) members reiterating a hawkish tone. High-grade municipal yields moved 2 bps and 8 bps higher in long and short maturities, respectively, in sympathy with Treasuries. Meanwhile, municipal mutual fund flows turned back to negative. The Bloomberg Municipal Index returned -0.08% while the HY Muni Index returned -0.04%. This week we highlight the rate dynamics that have challenged the municipal market in the first half of the year, which could be stabilizing.

Municipal Fund Flows Turn Back Negative

Fund Flows: During the week ending August 10, weekly reporting municipal mutual funds recorded $635 million of net outflows, according to Lipper. Long-term funds recorded $322 million of outflows, high-yield funds recorded $24 million of inflows and intermediate funds recorded $82 million of outflows. The week’s outflows extend year-to-date (YTD) outflows to $80 billion.

Supply: The muni market recorded $7 billion of new-issue volume, up 42% from the prior week. Total YTD issuance of $244 billion is 10% lower than last year’s levels, with tax-exempt issuance trending 2% higher year-over-year (YoY) and taxable issuance trending 45% lower YoY. This week’s new-issue calendar is expected to jump to $13 billion. Large deals include $2.7 billion Commonwealth of Massachusetts and $1.4 billion Oklahoma Development Finance Authority (OK Natural Gas) transactions.

This Week in Munis: Stabilizing Rate Dynamics

While many hoped 2022 would be a year of healing from the COVID-19 pandemic, several other factors arose. In the first half of this year we’ve seen geopolitical tensions, ongoing supply-chain challenges and a global economic reopening all contribute to three interest-rate dynamics that roiled municipal investors’ portfolios.

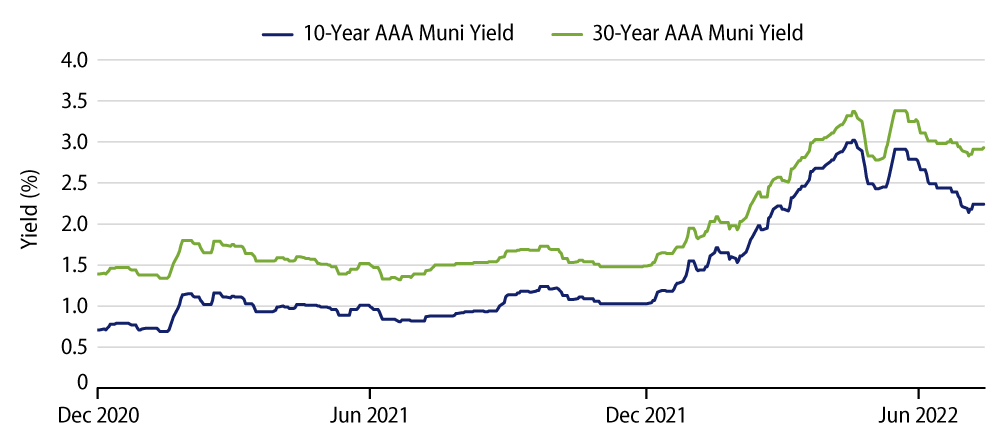

First, 1H22 municipal returns reflected the impact of higher nominal rates. Negative municipal returns in the first half of the year reflected the duration risk, or the price sensitivity to interest rate movements, embedded within municipal portfolios. The Bloomberg Municipal Index began 2022 with a 5.0-year duration, and 10- and 30- Year AAA municipal yields each moved more than 160 bps, implying that more than 8% of the 8.98% negative return of the index over the first half of the year was related to rate movements. Notably, considering the callable bonds that comprise most of the municipal index, the duration of the index extended to 6.79 years by mid-year, highlighting an increasing sensitivity to interest-rate changes as rates moved higher.

Second, the municipal curve flattened. Short and intermediate rates moved higher at a faster pace than the long part of the municipal curve, which implied that investors were simply not being compensated for the risk that a rising-rate trend would persist over the long term. The duration extension of these long-term municipal securities, without a commensurate rate move, could have potentially diminished the duration-adjusted relative value proposition of the muni asset class, and could have contributed to the record negative demand cycle observed this year.

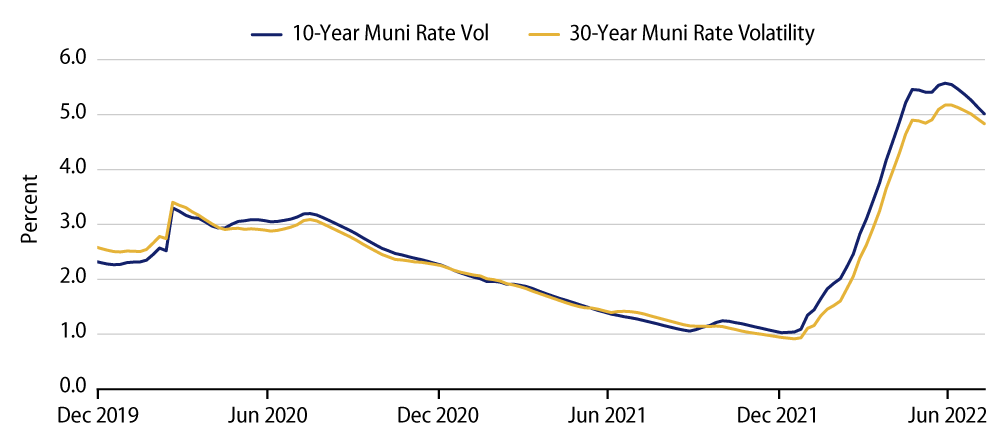

Third, rate volatility trended sharply upward. The majority of municipal bonds include embedded call options that allow muni issuers to refund outstanding debt. High rate volatility has a negative impact on the price of callable municipal debt.

While the key nominal rate, slope and volatility factors have contributed to underperformance in the first half of 2022, since June, Western Asset has observed a moderation of each of these factors which—if any of them persists—could bode well for forward-looking municipal performance. Considering the varying risk dynamics across structures of the fragmented municipal market, an active manager can help to navigate these isolated rate factors to manage downside risks and value forward-looking opportunities.