Municipals Posted Negative Returns During the Week

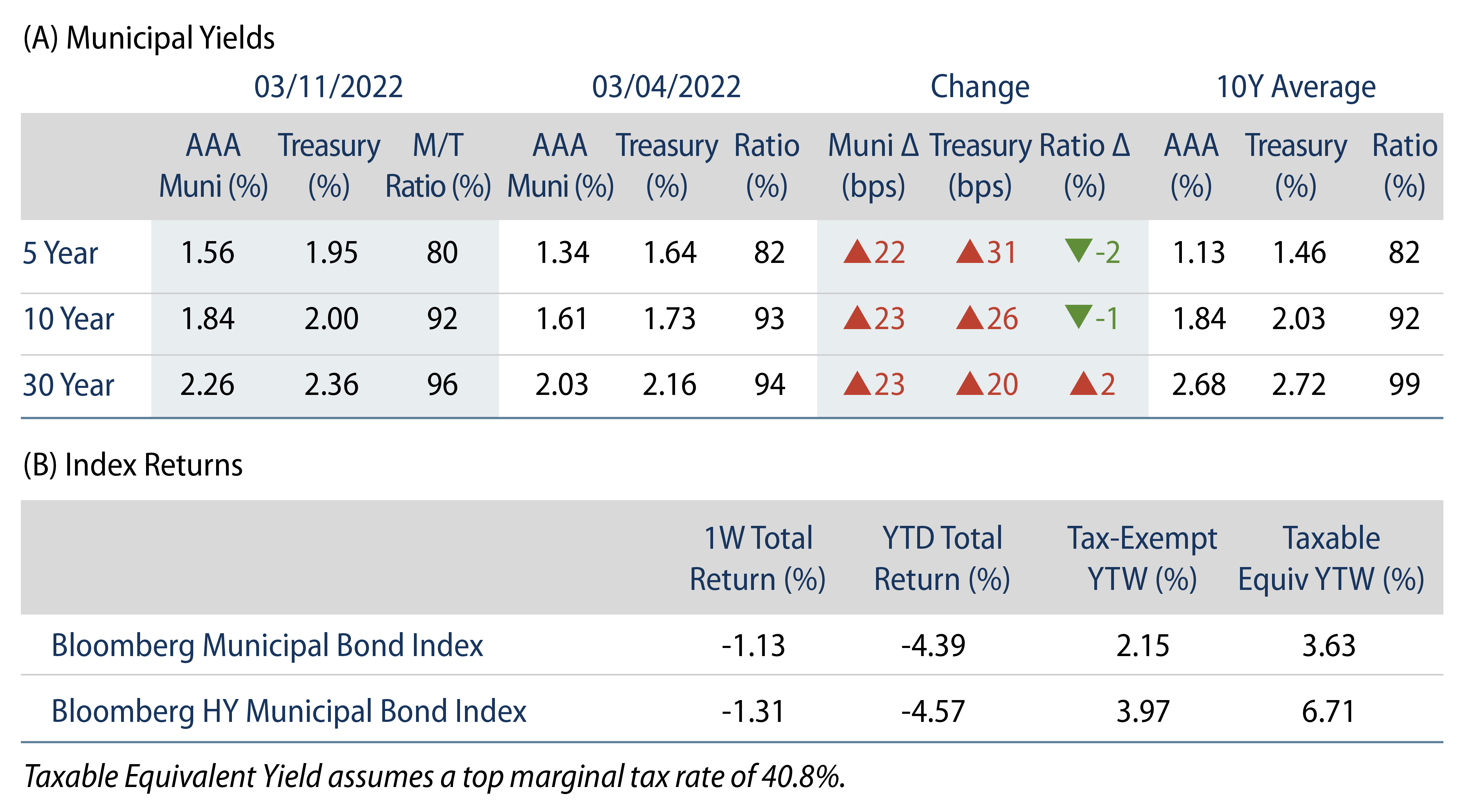

Municipals sold off in sympathy with Treasuries. Technicals remained weak amid persistent fund outflows. High-grade municipal yields moved 22-23 bps higher across the curve. The municipal yield move was in sympathy with Treasury markets, as ratios moved just 2% lower in short maturities and 2% higher in longer maturities. The Bloomberg Municipal Index returned -1.13%, while the HY Muni Index returned -1.31%. This week we highlight market oil price implications on state budgets.

Market Technicals Remain Weak as Outflows Persist

Fund Flows: During the week ending March 9, weekly reporting municipal mutual funds recorded $662 million of outflows, according to Lipper. Long-term funds recorded $950 million of outflows, high-yield funds recorded $320 million of outflows and intermediate funds recorded $185 million of outflows. Municipal fund outflows year to date (YTD) extended to $16.2 billion.

Supply: The muni market recorded $13 billion of new-issue volume, up 85% from the prior week. Total YTD issuance of $77 billion is 12% higher from last year’s levels, with tax-exempt issuance trending 35% higher year-over-year (YoY) and taxable issuance trending 39% lower YoY. This week’s new-issue calendar is expected to decline to $6 billion. Largest deals include $3 billion State of New York (Personal Income Tax) and $632 million University of Massachusetts Building Authority transactions.

This Week in Munis: Oil Impact on State Budgets

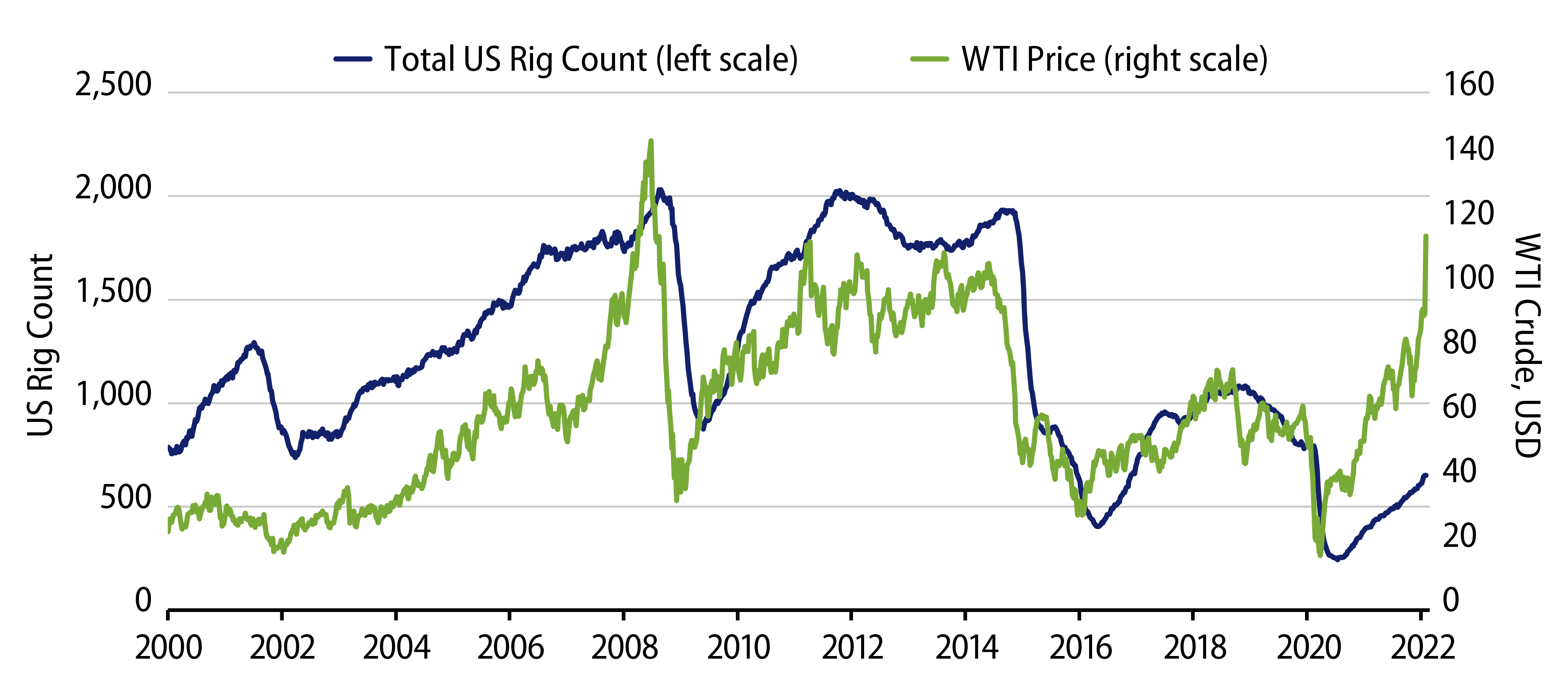

Due to the geopolitical conflict in Ukraine and the subsequent ban on Russian oil imports by the US and other countries, oil (WTI crude) has hit a multi-year high of $129 (on 3/8/2022). While the Russia/Ukraine conflict has exacerbated oil price increases, the price of crude has been slowly climbing since early 2020 as energy demand rebounded with regional economic reopenings and the resumption of travel following the COVID-19 vaccine rollouts. The rebound in oil prices has led to an increase in domestic oil drilling rigs (a signal for oil production), at a much slower rate, however, as producers remained cautious amid price volatility while facing labor and logistical challenges.

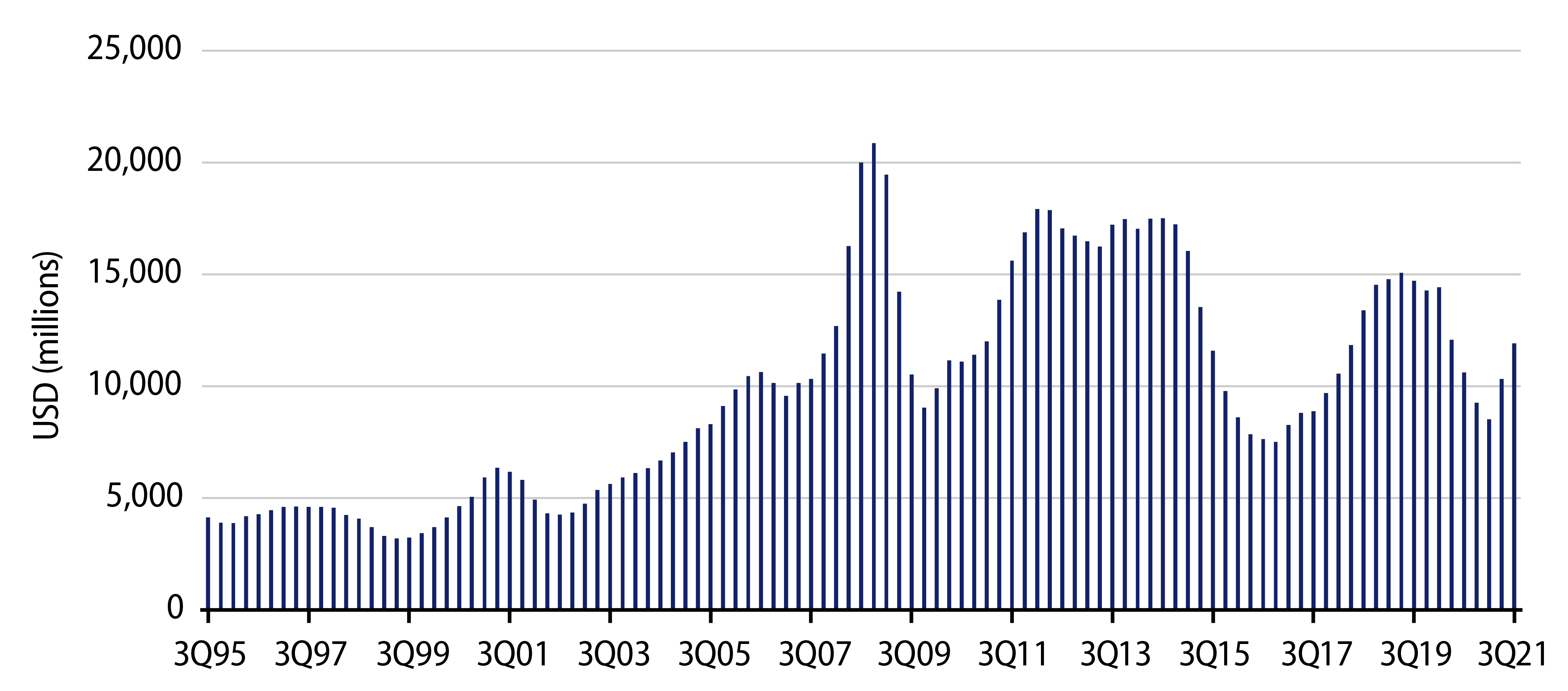

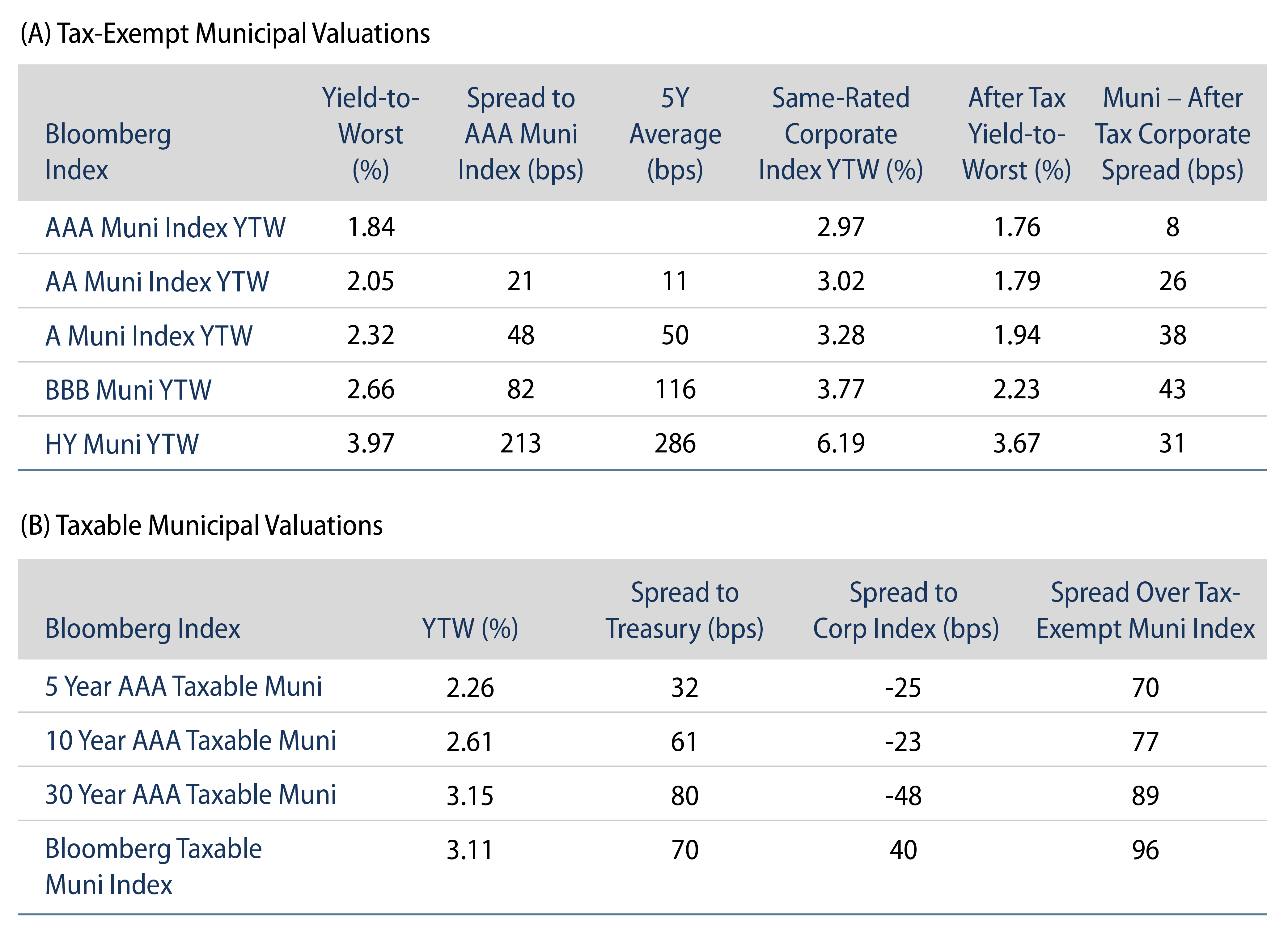

Potential beneficiaries of higher oil prices and increasing number of rigs include states that levy severance taxes, taxes levied on natural resource extraction (most commonly for oil). In the 12-months through 3Q21, total US severance tax collections totaled $11.9 billion, up from 40% from the lows observed in 1Q20. Severance tax collections are projected to march higher in the coming quarters, given recent oil price increases and the likelihood of additional production. At the individual state level, based on Western Asset’s analysis of 2020 BEA state employment data, and 2020 Census Bureau state and local tax data, we find that nine states have higher exposure to oil and gas employment, and/or severance tax collections: Alaska, Colorado, Louisiana, New Mexico, North Dakota, Oklahoma, Texas, West Virginia, and Wyoming. Many of these states also sit on top of reserves from major US shale regions.

We believe increased severance taxes to be a credit positive for these states, which will benefit from higher revenue collections that could replenish reserves and provide additional cushion for the years ahead. Higher oil prices should also help support overall economic conditions for these states and their associated local governments, as demand for energy production in these regions should have knock-on effects around employment, spending and overall tax collections. We expect elevated oil prices, and these benefits could persist through the medium term amid escalating global tensions and domestic production that will need time to ramp up to meet higher demand. However, we caution that severance taxes remain one of the more volatile tax streams, and could quickly underperform during periods of lower oil prices.