Headline retail sales rose 1.7% in October, with a large +1.4% revision to September. We and other analysts customarily focus on “control” retail sales, which excludes the sale of vehicles, gasoline, building materials and restaurants, sectors that are especially volatile and that are frequented by businesses as much as by consumers. This more “consumer-oriented” control sales measure also rose 1.7% in October, with a +0.8% revision to September.

The September/October sales gains were concentrated in sectors that had seen large sales declines in preceding months and/or that had seen especially large price increases recently. Thus, gas station sales were up 3.9% in October, electronics store sales up 3.7%, nonstore (online) sales up 4.2%, building material stores up 2.8%, vehicle dealers up 1.7% and books/sporting goods stores up 1.5%. Sales gains were more modest (or negative) at groceries (+0.9%), restaurants (+0.1%), health/drug stores (-0.4%) and apparel stores (-0.7%).

The gas station sales gains were a good bit smaller than the increase in retail gasoline prices reported last week within the Consumer Price Index (CPI). The rise in online sales likely outpaced price increases but followed six months of slightly declining sales for this sector. The gains for vehicles, building materials, electronics and books/sporting goods were all preceded by larger sales declines in preceding months.

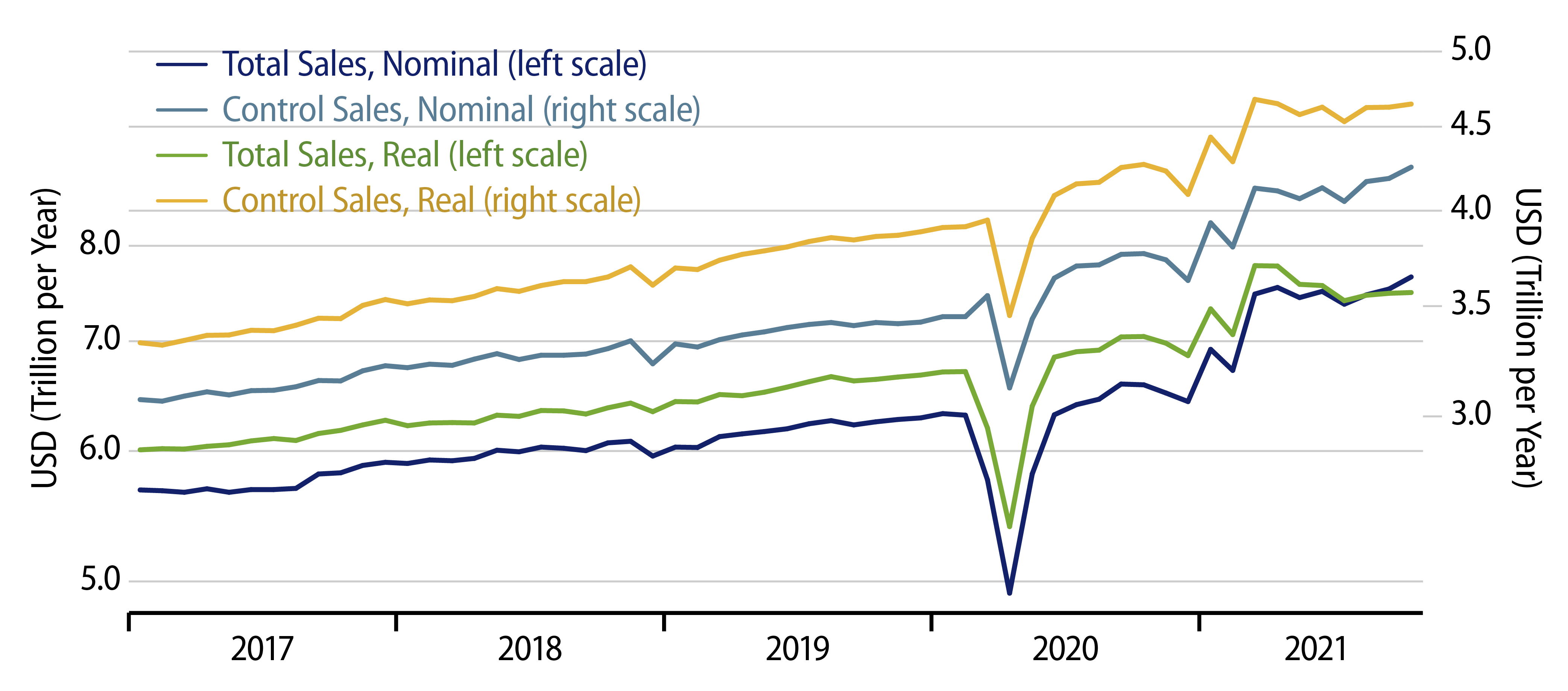

The bottom line is that as impressive as the October sales gains sound on paper, it does not appear that they materially change the sluggish sales growth picture that has emerged for retailers over the last six months. You can see this in the accompanying chart. The dark blue and light blue lines show nominal (reported) levels for total retail sales and for the control measure. The green and gold lines, respectively, show estimates of real sales for these, using retail price deflators through September, as reported by the Bureau of Economic Analysis, augmented by goods price increases reported for the CPI for October.

While the nominal sales aggregates give some hint of a move higher in October, neither price-deflated measure shows any break from the flat-to-down patterns of recent months. In other words, allowing for price increases, not much was going on in the retail sector in October.

Now, we have been arguing that recent elevated increases in prices reflected special, supply-chain-related factors, rather than a general increase in price inflation. Still, those price increases are a reality, and the sales data should be interpreted in light of them.

An important factor for price changes in the future is whether consumer spending is rising rapidly enough to absorb the price increases without pressure on retailers. Today’s retail sales news does not support such a contention. As reported here previously, economic growth ratcheted down in 3Q on slower consumer spending growth. Today’s news does not appear to show any resurgence in “real” consumer demand. At present trends, retailers still look to have to choose between growing actual sales volumes and passing on higher costs to consumers.