Municipals Posted Positive Returns During the Week

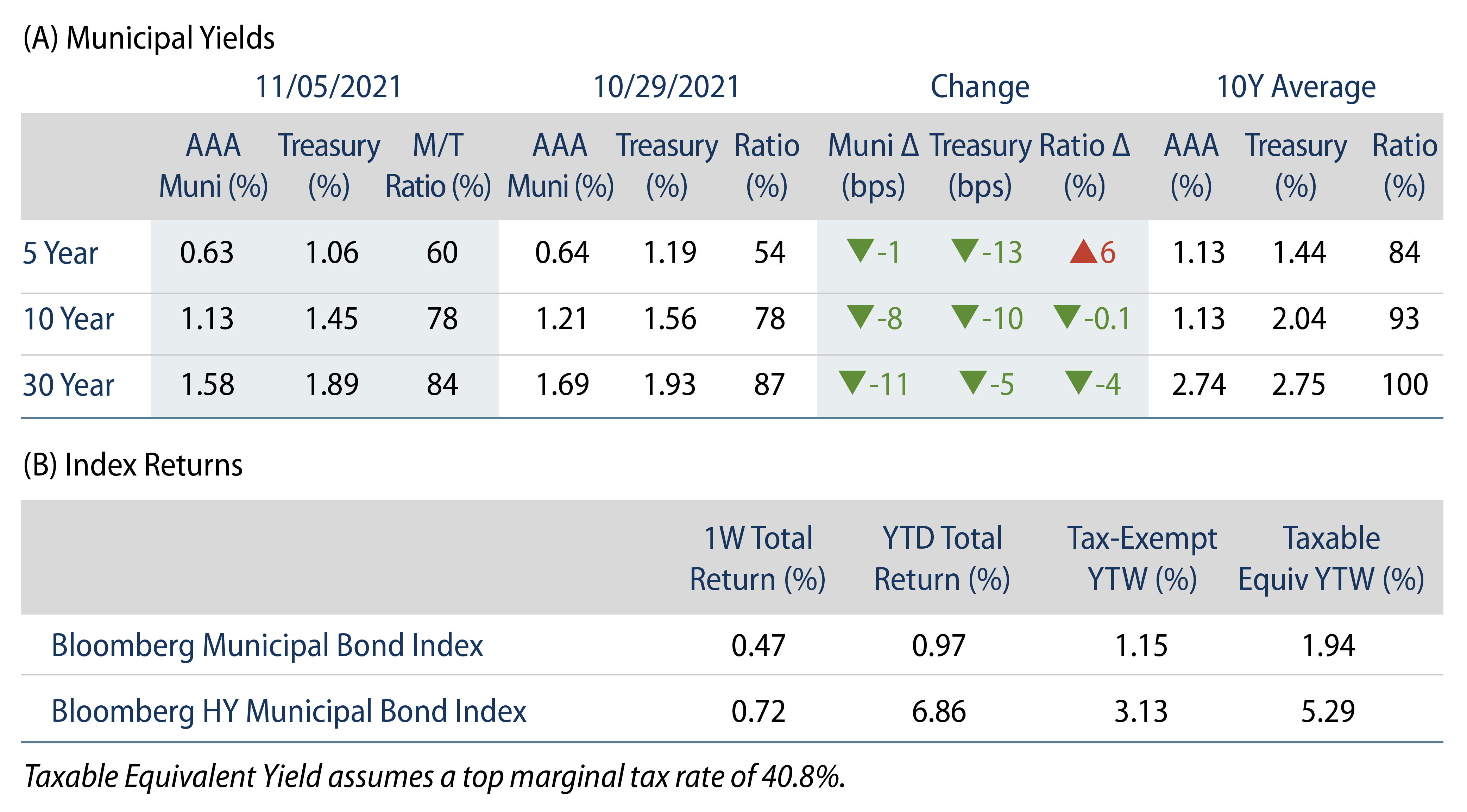

The US muni yield curve moved 1 to 11 bps lower during the week. Municipals underperformed Treasuries in short maturities and outperformed Treasuries in long maturities. Technicals continued to be supported by robust municipal mutual fund flows. The Bloomberg Municipal Index returned 0.47%, while the HY Muni Index returned 0.72%. This week we highlight the outcomes and implications of last week’s election.

Technicals Continue to Be Supported by Robust Municipal Mutual Fund Flows

Fund Flows: During the week ending November 3, municipal mutual funds recorded $603 million of net inflows. Long-term funds recorded $569 million of inflows, high-yield funds recorded $1 million of inflows and intermediate funds recorded $184 million of inflows. Municipal mutual funds have now recorded inflows 76 of the last 77 weeks, extending the record inflow cycle to $154 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $92 billion.

Supply: The muni market recorded $7.6 billion of new-issue volume during the week, down 10% from the prior week. Total issuance YTD of $396 billion is 5% lower from last year’s levels, with tax-exempt issuance trending 4% higher year-over-year (YoY) and taxable issuance trending 25% lower YoY. This week’s new-issue calendar is expected to increase to $8.6 billion of new issuance, despite the holiday-shortened week. The largest deals include $1.2 billion State of California General Obligation and $665 million District of Columbia General Obligation transactions.

This Week in Munis—Election Day

Last week’s elections were relatively quiet for the municipal market in terms of bond measures, but political outcomes in the New Jersey and Virginia state races highlight the changing political landscape that has the potential to influence local policy and progress on federal spending legislation that gained traction earlier this year.

Bond Measures

According to Bloomberg and IHS Market Data, the $27 billion bond measures on ballots were the lowest up for consideration since 2017, and $15 billion were approved by voters. A high concentration of proposed ballot measures were concentrated in funding school facilities in the post-pandemic environment. The subdued amount of bond measures could signal further new-issue supply limitations, which has contributed to net negative supply in recent years.

State Elections

Virginia observed the highest voter turnout since 1997 to elect Republicans across governor, lieutenant governor and attorney general posts. Virginia Democrats are also expected to lose control of the Commonwealth’s House of Delegates as Republicans are projected to win at least 50 seats. Meanwhile, Virginia’s Senate remains under Democratic Party control. Western Asset expects that a divided government would cause more political infighting, which usually means less is done in terms of resolving budgetary issues or pursuing new bonding initiatives.

New Jersey Democratic Governor Phil Murphy was a heavy favorite entering Tuesday’s race, but narrowly survived by just 1.5% of the vote (compared with Biden’s 16% margin of victory a year ago). Notably, Democratic State Senate President Steve Sweeney was voted out of office after holding the role since 2002. Voters in New Jersey expressed sensitivity against Murphy’s higher tax agenda, which could slow any momentum for the state to address its structural challenges, particularly related to elevated pension liabilities.

Federal Policy Implications

This year, Western Asset has anticipated that President Biden’s ambitious spending plans would be challenged by the divided political landscape. We expect federal and local legislators to take notice following Tuesday’s results; this could lead to diminished expectations around the scope of Biden’s agenda and higher taxes, which has bolstered demand for municipal debt this year.