Municipal Yields Moved Higher Last Week

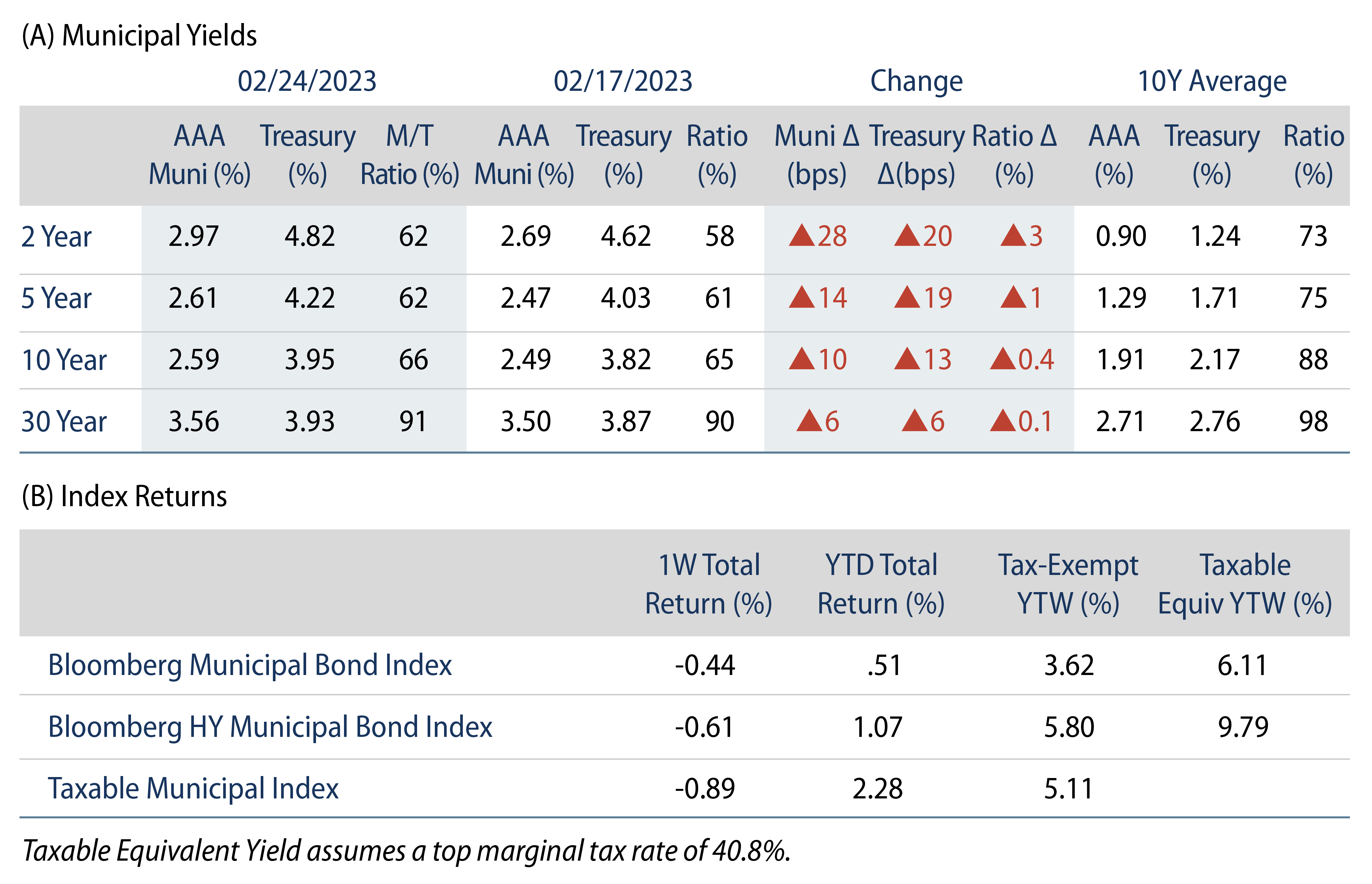

Municipals underperformed Treasuries last week, with rates broadly moving up on higher than expected personal spending and inflation data as core inflation moved 0.6% higher in January and rose 4.7% year-over-year (YoY). Meanwhile, high-grade muni yields moved 6-28 bps higher across the curve and weaker market technicals were driven by fund outflows. The Bloomberg Municipal Index returned -0.44% during the week, the HY Muni Index returned -0.61% and the Taxable Muni Index returned -0.89%. This week we highlight the recently released Illinois budget, which included themes that helped the state earn an upgrade by Standard & Poor’s (S&P) last week.

Technicals Weakened as Funds Recorded Outflows

Fund Flows: During the week ending February 22, Lipper weekly reporting municipal mutual funds recorded $1.7 billion of net outflows. Long-term funds recorded $1.1 billion of outflows, high-yield funds recorded $870 million of outflows and intermediate funds recorded $5 million of inflows. This week’s outflows reverse year-to-date (YTD) net flows to $1.1 billion of outflows.

Supply: The muni market recorded $3.8 billion of new-issue volume last week, down 46% from the prior week. YTD issuance of $41 billion is down 15% YoY, with tax-exempt issuance down 10% YoY and taxable issuance down 52% YoY. This week’s calendar is expected to increase to $5.3 billion. Large transactions include $650 million Southeast Energy Authority and $583 million The Port of Portland (Oregon) transactions.

This Week in Munis: Illinois Earns Upgrade

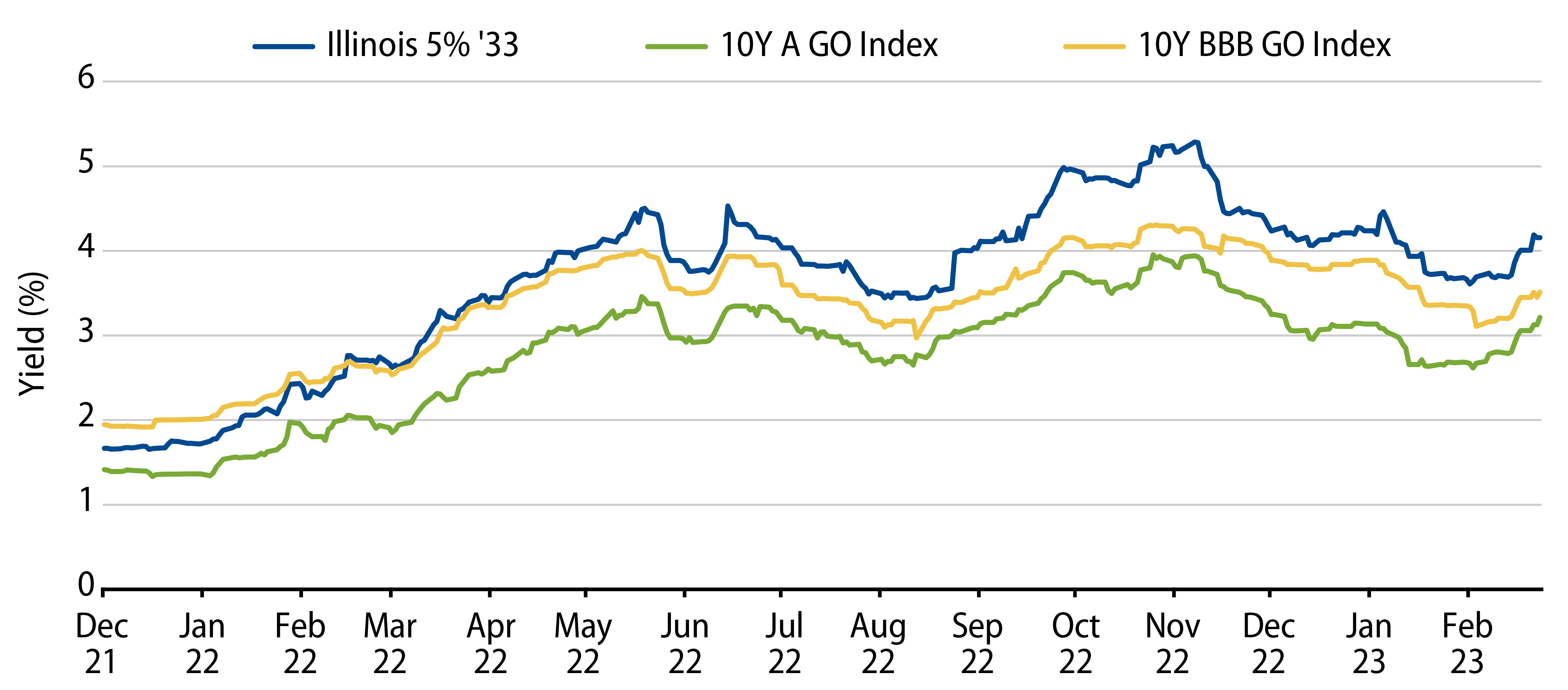

Last Thursday, S&P upgraded the rating on the State of Illinois General Obligation (GO) lien to “A-” from “BBB+,” the fourth rating agency upgrade over the last 12 months. S&P attributed the upgrade to improved budgetary flexibility, an accelerated repayment of liabilities and a stronger liquidity profile following Governor Pritzker’s fiscal-year (FY) 2024 budget proposal released earlier in the month. The state of Illinois, which is now rated A-, Baa1 and BBB+ by S&P, Moody’s, and Fitch, respectively, is no longer the only state without an A- or higher rating by the major rating agencies.

Illinois’ budget proposal for the upcoming fiscal year called for relatively conservative revenue collections, with the state anticipating a 2.8% YoY revenue decline to $49.9 billion. Meanwhile the $49.6 billion budget represented a 0.7% YoY cut to general fund expenditures. The budget included increased funding for education, while also funding incremental increases in public safety, health care and human services expenditures. The proposal also outlined a commitment to pay down liabilities, including a continued paydown of a short-term bill backlog as well as increasing pension contributions by $200 million as scheduled. Last, the budget added to the state’s liquidity profile by contributing $138 million to the Budget Stabilization Fund using the moderate expected surplus.

While credit headwinds remain for the state, Western Asset continues to be constructive on Illinois’ progress to address structural issues over the last decade. The last time Illinois was rated A- by S&P (2014-2015), the state was challenged with a $7 billion general fund budget deficit, compared to a $1.7 billion general fund surplus in FY23. In addition, the state’s short-term bills backlog was over $4 billion versus ~$1 billion outlined in the FY24 budget proposal, and the state did not have an outlined plan to address its large pension obligation. Illinois will likely enjoy improved debt service savings associated with upcoming refunding issuance. Plus, the upgrade could serve as a positive feedback loop to the state legislature to continue making progress toward pensions/debt. Despite the upgrade, municipal investors could potentially still find value in the fact that certain Illinois securities continue to trade at higher yields than other BBB rated issues.