Municipal Rallied Last Week

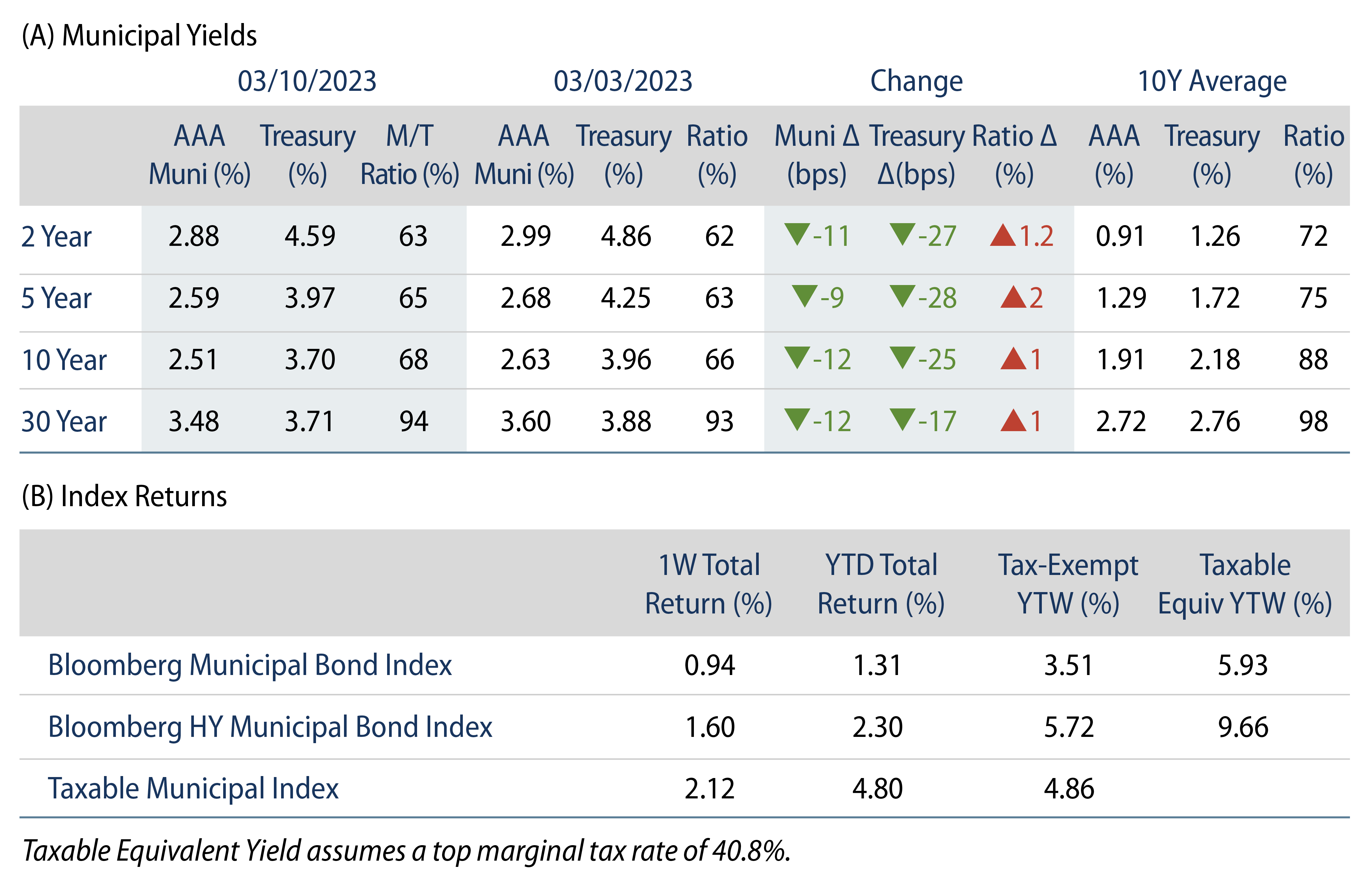

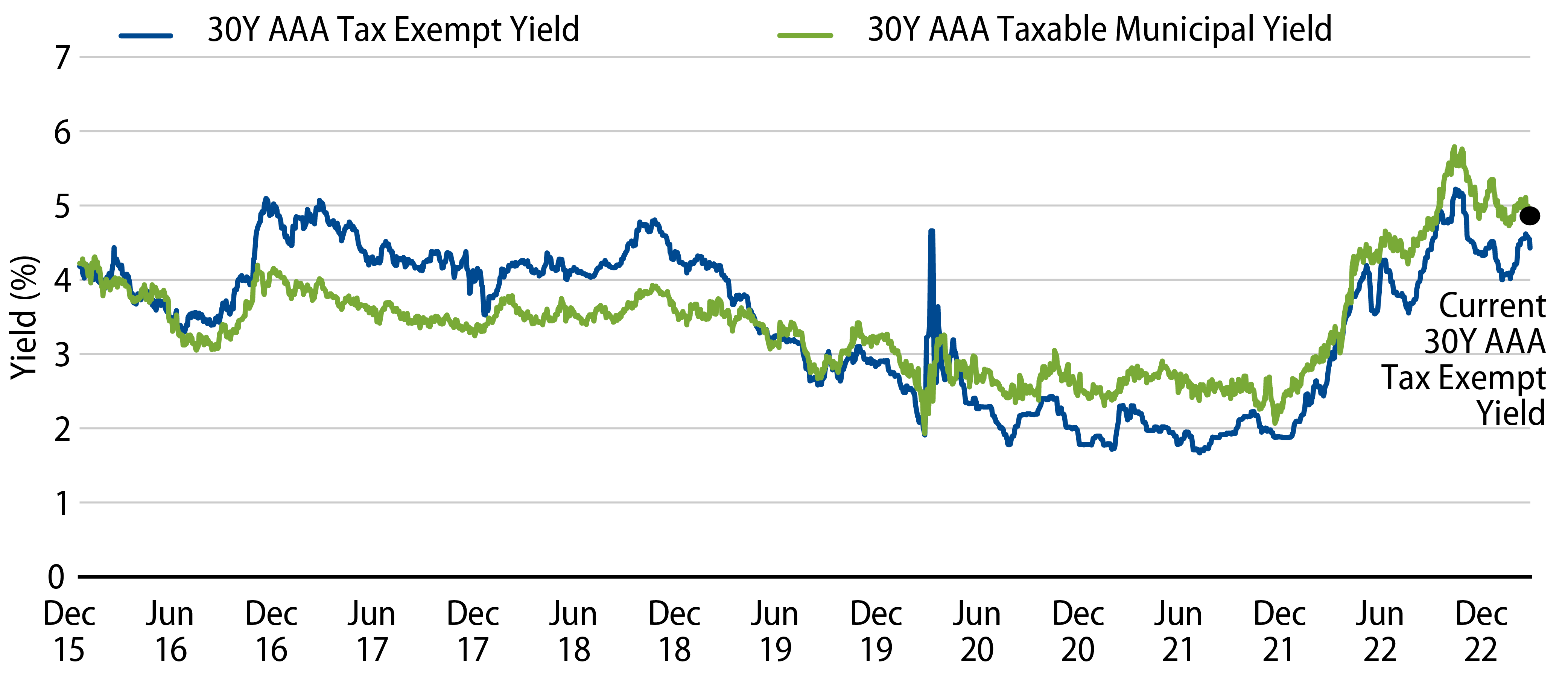

Municipals rallied last week, with high-grade muni yields moving 9-12 bps lower across the curve. Weaker muni technicals contributed to underperformance versus Treasuries, which reacted relatively sharply to an increase in jobless claims on Thursday, then more aggressively to the risk-off sentiment associated with the bank failure news on Friday. The Bloomberg Municipal Index returned 0.94% during the week, the HY Muni Index returned 1.60% and the Taxable Muni Index returned 2.12%. This week we highlight implications around proposed tax increases associated with President Biden’s budget proposal released last week.

Muni Technicals Weakened Amid Fund Outflows and Higher Supply

Fund Flows: During the week ending March 8, weekly reporting municipal mutual funds recorded $308 million of net outflows, according to Lipper. Long-term funds recorded $207 million of inflows, high-yield funds recorded $15 million of outflows and intermediate funds recorded $105 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to $650 million.

Supply: The muni market recorded $13 billion of new-issue volume last week, approximately double the prior week’s level. YTD issuance of $60 billion is down 6% year-over year (YoY), with tax-exempt issuance down 5% YoY and taxable issuance down 13% YoY. This week’s calendar is expected to decline to $7 billion. Large transactions include $1.25 billion NYC Transitional Finance Authority and $850 million Energy Southeast transactions.

This Week in Munis: Biden’s Tax Proposal Bolsters Muni Appeal

Last week President Biden released a $6.8 trillion 2024 budget proposal that included a variety of tax increases to fund spending initiatives:

- The top individual marginal tax rate would increase to 39.6% (from 37%)

- The corporate income tax rate would increase to 28% (from 21%)

- The capital gains rate would increase to 39.6% (from 20%)

- A 25% minimum tax would be established on households with more than $100 million (top 0.01% of earners)

- The Medicare surtax would increase to 5.0% (from 3.8%)

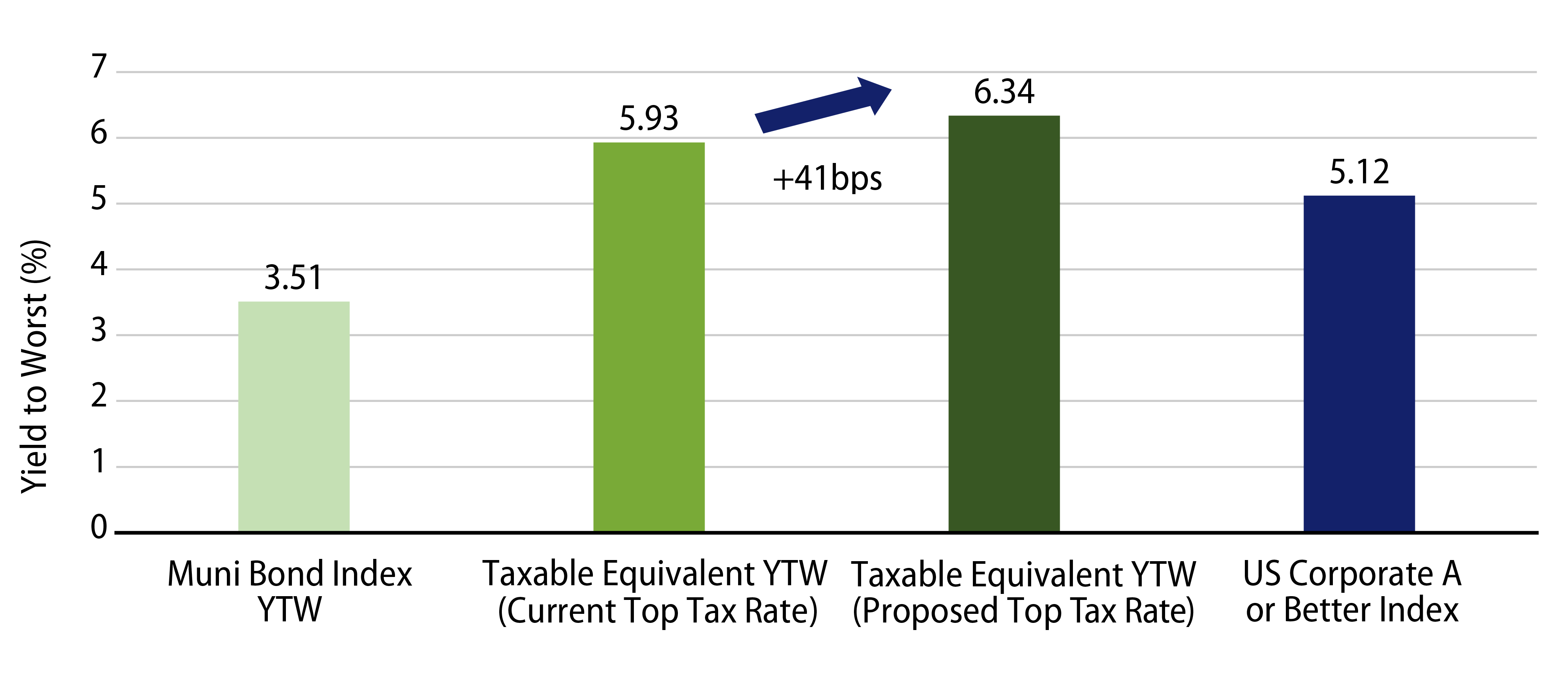

The tax proposal would significantly improve the appeal of the municipal tax-exemption, if enacted. As of Friday, the Bloomberg Municipal Index yield of 3.51% was equal to 5.93% on a taxable-equivalent basis when assuming the current top federal marginal tax rate of 40.8%. Under the budget proposal, the top individual federal marginal tax rate would increase to 44.60% and improve the Bloomberg Muni Bond Index taxable equivalent yield by 41 bps to 6.34%, well above the U.S. Corporate (A or Better) Index yield of 5.12%.

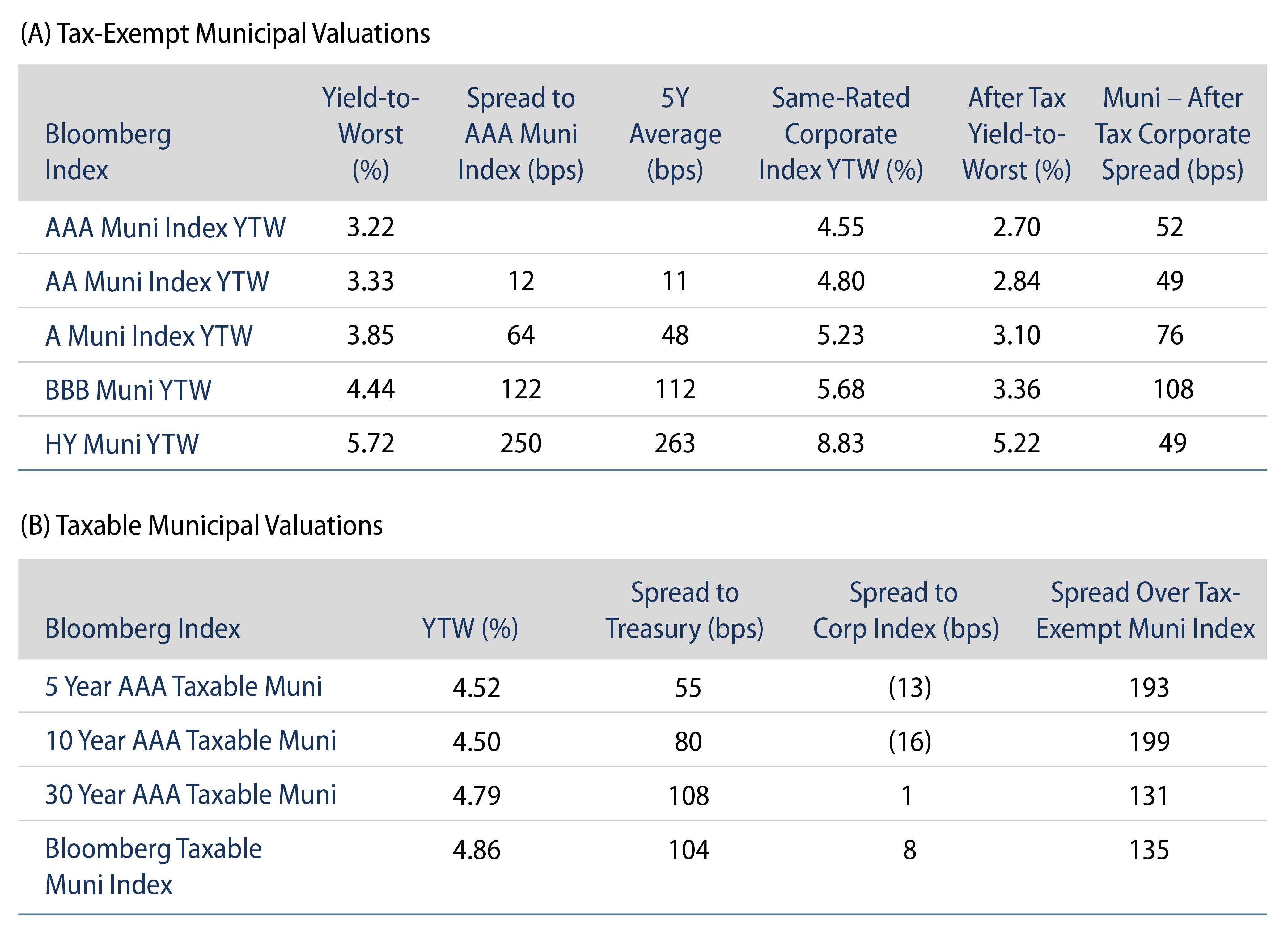

In addition to an improved municipal value proposition for individuals, the tax-exempt municipal market would likely welcome additional interest from institutions. When corporate tax rates fell to 21% from 35% in 2018 following the implementation of the Tax Cuts and Jobs Act, corporations found better after-tax value in taxable muni securities rather than tax-exempts. We would expect any proposal that increases the corporate tax rate to 28% to offer more frequent tax-exempt value opportunities for institutions such as US insurance companies, potentially improving demand for tax-exempts.

Corporations Would See Greater Parity Between Tax-Exempt and After-Tax Taxable Muni Valuations

Considering the divided Congress, with Democrats maintaining just a slight majority in the Senate and Republicans holding the majority of the House of Representatives, Western Asset does not expect these efforts to garner meaningful traction as tax increases are often unpopular and difficult to pass. However, we do expect this proposal to set the stage for a more prolonged discourse around tax policy ahead of the midterm election cycle. While unlikely to pass in the current form, heightened tax rhetoric is often sufficient to bolster municipal demand sentiment, which can further help the muni market emerge from the record fund outflow cycle observed last year.