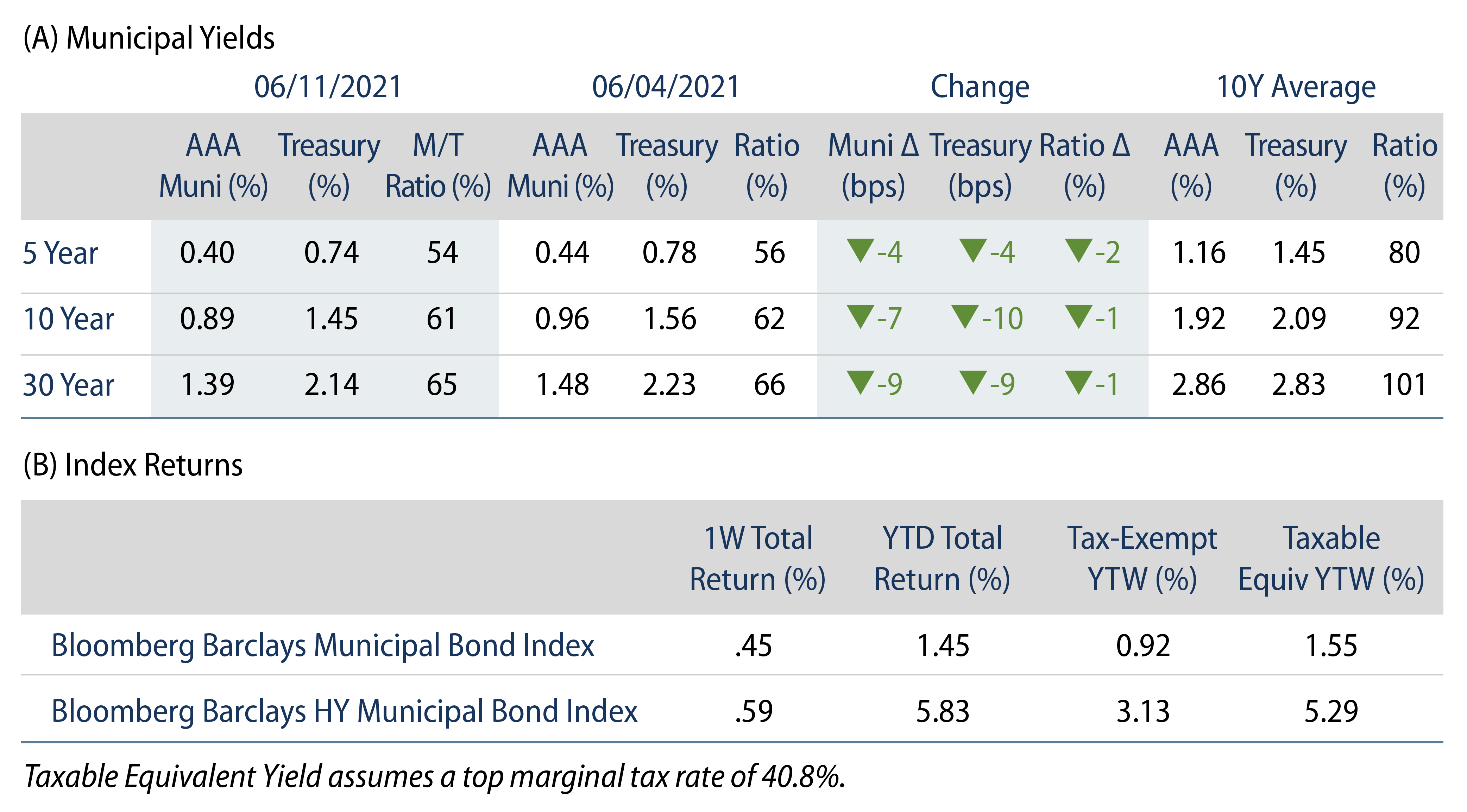

Municipal Yields Moved Lower with Treasuries

US municipal yields moved lower with Treasuries during the week. AAA municipal yields mover 4-9 bps lower across the curve, generally in line with Treasuries. The Bloomberg Barclays Municipal Index returned 0.21%, while the HY Muni Index returned 0.40%. Municipal mutual fund flows maintain a record pace. This week, following the May payroll release, we evaluate implications of lagging payroll trends in the state and local government sector.

Municipal Mutual Fund Flows Maintain Record Pace

Fund Flows: During the week ending June 9, municipal mutual funds recorded $2.5 billion of net inflows. Long-term funds recorded $1.8 billion of inflows, high-yield funds recorded $816 million of inflows and intermediate funds recorded $281 million of inflows. Municipal mutual funds have now recorded inflows 55 of the last 56 weeks totaling $115 billion, with net inflows year-to-date (YTD) maintaining a record pace at $54 billion.

Supply: The muni market recorded $11.7 billion of new-issue volume during the week. Total issuance YTD of $193 billion is 19% higher from last year’s levels, with tax-exempt issuance trending 20% higher year-over-year and taxable issuance 16% higher. This week’s new-issue calendar is expected to remain relatively steady at $12.3 billion of new issuance. The largest deals include $1.8 billion taxable New York Dormitory Authority (personal income tax) and $811 million Port of Seattle transactions.

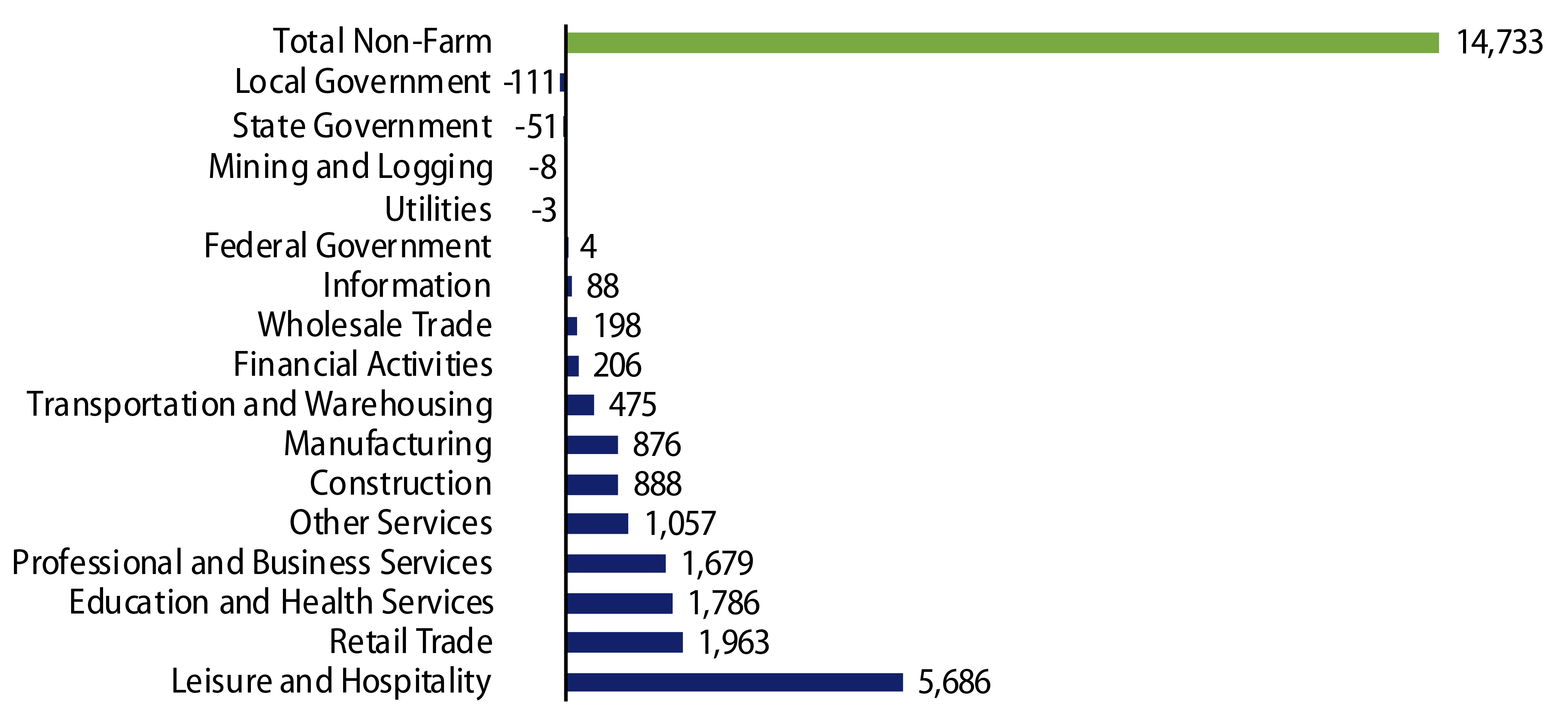

This Week in Munis: Muni Payrolls Continue to Lag, Despite Stimulus

The state and local government sector is among the nation’s largest employment drivers, comprising 13.0% of total nonfarm payrolls. The nonfarm payroll figure released this month highlighted a gain of 559,000 new jobs (+0.4%) during May, while state and local payrolls were generally unchanged over the month. While the nation’s total nonfarm payrolls have increased 14.7 million (+11.3%) from the trough of the pandemic in April 2020, total payrolls remain 4% below February 2020 highs. Although the pandemic-driven state and local payroll decline followed the national trend, state and local payrolls diverged over the recent recovery period, declining 162,000 (-0.8%) from April 2020 to May 2021.

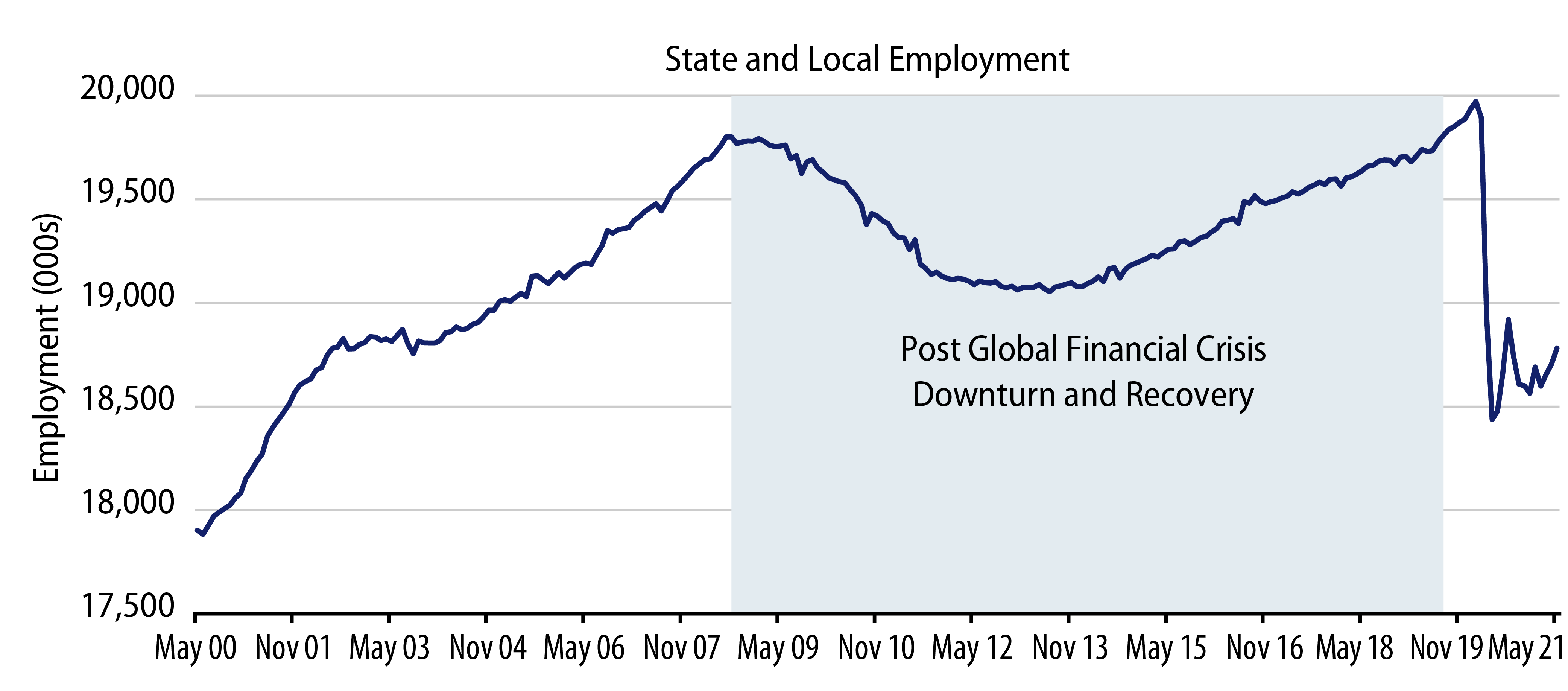

State and local employment has declined by 1.2 million workers (-6.0%) since the high levels observed in February 2020. During this period, local payrolls declined 921,000 (-6.3%), while state employment declined by 176,000 workers (-3.4%). The majority of state and local reductions were associated with the education sector, with local governments suspending 556,400 education positions (-6.9%) and states shelving 244,000 education positions (-9.4%). Local non-education positions declined 354,600 (-5.3%) and state non-education positions declined 35,500 (-1.3%). The largest non-education sector includes local administration (police, fire, and social services), and while it is down just 4% from pre-Covid levels, it has not shown any growth in 2021.

The state and local employment decline was a key issue highlighted to rationalize the $350 billion direct state and local aid package within Biden’s American Rescue Plan. However, since its passage, we have not observed a material rebound in state and local hiring. As schools reopen and federal aid is disbursed we expect state and local employment will increase, but a full state and local government job recovery could take longer than some expect. It took over 10 years for state and local government employment to retrace a relatively lower degree of job losses following the global financial crisis (GFC), when subsequent austerity measures led to 800,000 state and local job losses before fully recovering to the 19.8 million high watermark seen in August 2008. While states and localities are undoubtedly in a better fiscal position than they were following the GFC, the demand for non-education workers could remain challenged, particularly as certain states and locals grapple with elevated fixed costs such as pension payments.

While lower levels of employment should provide additional budget relief and be broadly supportive of state and local issuer credit, higher unemployment levels could serve as a longer-term drag on regional growth trends, and have a larger impact on issuers with higher socioeconomic dependence on the sector. We remain cautious on issuers and regions with limited economic diversity in evaluating opportunities in the sector, particularly considering the strong technicals in the market that have led to limited spread differentiation of such risk.