Macros, Markets and Munis

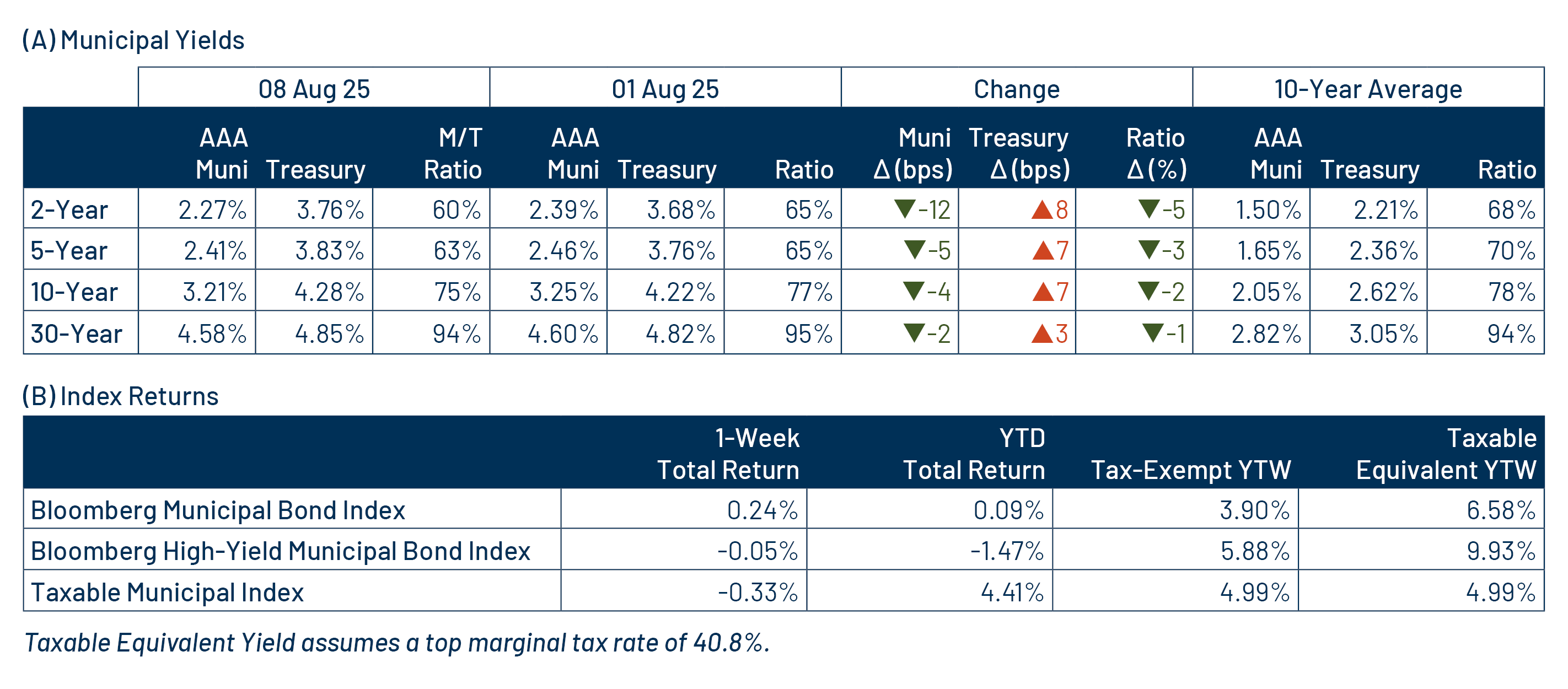

Investment-grade munis posted positive returns and outperformed Treasuries last week. Amid a quiet week of economic data, strong equity market performance and improving sentiment, Treasury yields moved higher across the curve. High-grade municipal yields fell across the curve, outperforming Treasuries as demand improved during the week. Meanwhile, strong fund flows contributed to positive market sentiment, despite near-record supply. This week we touch on muni spread tightening amid headlines about the ability of select high-yield muni borrowers to sustain debt service.

Muni Funds Post Inflows Amid Near Record Supply Conditions

Fund Flows (up $1.7 billion): During the week ending August 6, weekly reporting municipal mutual funds recorded $1.7 billion of net inflows, according to Lipper. Intermediate funds recorded $365 million, short and short/intermediate funds recorded $716 million, long-term funds recorded $574 million and high-yield funds recorded $224 million of net inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $21 billion.

Supply (YTD supply of $360 billion; up 24% YoY): The muni market recorded $22 billion of new-issue supply last week, a near record level and the largest weekly level of issuance this year. YTD new-issue supply of $360 billion is 24% higher than the prior year, with tax-exempt issuance up 25% year-over-year (YoY) and taxable issuance up 6%, respectively. This week’s calendar is expected to remain elevated at $11 billion. The largest deals include $1.1 billion Port Authority of NY/NJ and $450 million Miami-Dade School District transactions.

This Week in Munis: Spread Tightening and High-Yield Headlines Underscore Selection

Fixed-income markets have experienced credit spread tightening this year, and the municipal market has followed suit. The yield differential between the Bloomberg High Yield Municipal Bond Index and the Bloomberg AAA Municipal Bond Index has narrowed significantly over the past decade, dropping from 502 basis points (bps) in December 2015 to a low of 178 bps in April 2025 and averaging 204 bps this year. This tightening reflects resilient US credit fundamentals and strong investor demand, supported by $4 billion in net inflows into high-yield municipal funds during the first half of 2025 (22% of total municipal fund inflows) following a robust $14 billion in net inflows (31% of inflows) in 2024.

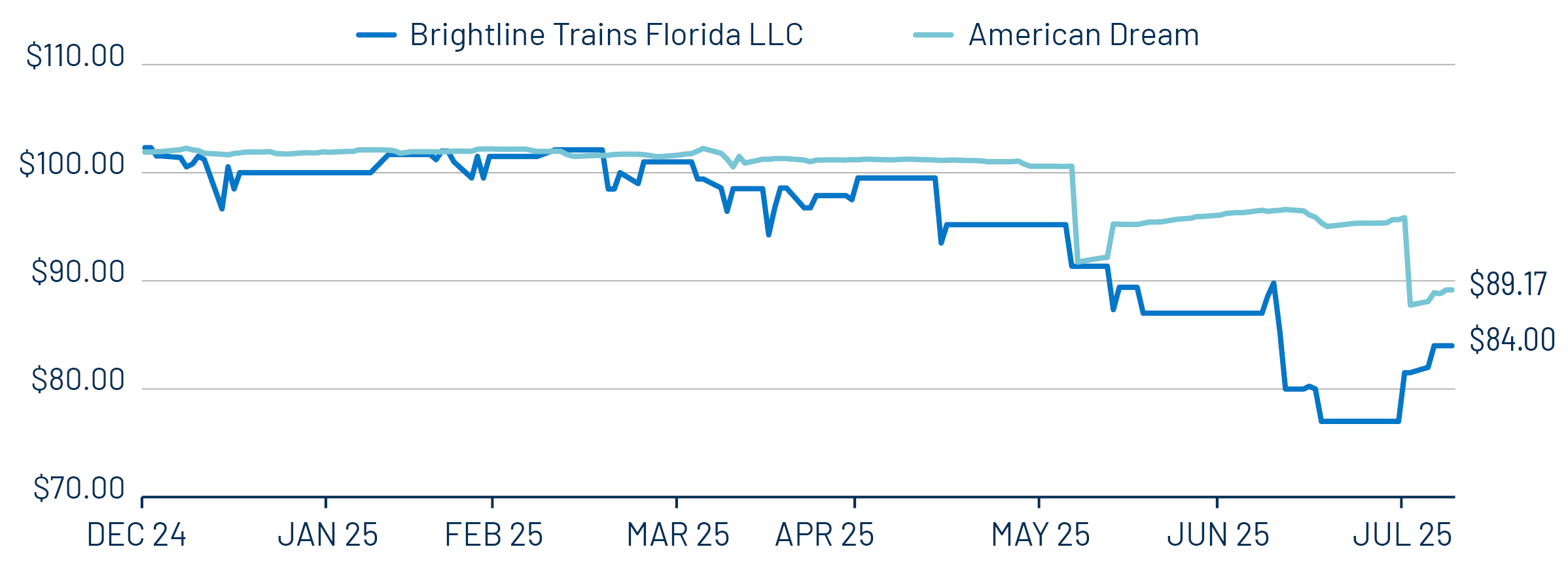

High-yield muni fund flow strength has persisted despite increasing credit headlines in the high-yield muni market. Two of the top 20 issuers in the High Yield Municipal Index, Brightline Trains (Florida) and American Dream Mall (New Jersey), have been in the headlines this year over concerns around the ability to sustain debt service. Brightline’s senior operating lien bonds, initially issued in 2024 with a BBB- rating by Fitch, were downgraded to B by the agency on July 30 as Brightline’s lower-than-anticipated ridership and fares contributed to revenue concerns. S&P followed suit with a two-notch downgrade to BB- last week. Meanwhile American Dream’s tax-backed bonds, initially backed by an assessed value of $3.3 billion, have had its assessment cut to $1.65 billion and affirmed by a judge on July 31.

These concerns have contributed to significant price drawdowns for securities issued by these obligors this year. According to Bloomberg, a representative Brightline security (5.5%, 2053) has dropped 17.5% YTD to $84.00, while a representative American Dream (7.0%, 2050) security has fallen 12.5% to $89.17, each significantly underperforming the Bloomberg High Yield Municipal Index return of -1.41% YTD. The volatility and relative illiquidity of these issuers, which account for 0.5%-1.5% of the index but can represent a larger share of certain municipal portfolios, highlight the need for thorough credit research when navigating the high-yield municipal market, particularly at these tighter spread levels where investors could be less compensated for such risk.

Municipal Credit Curves and Relative Value

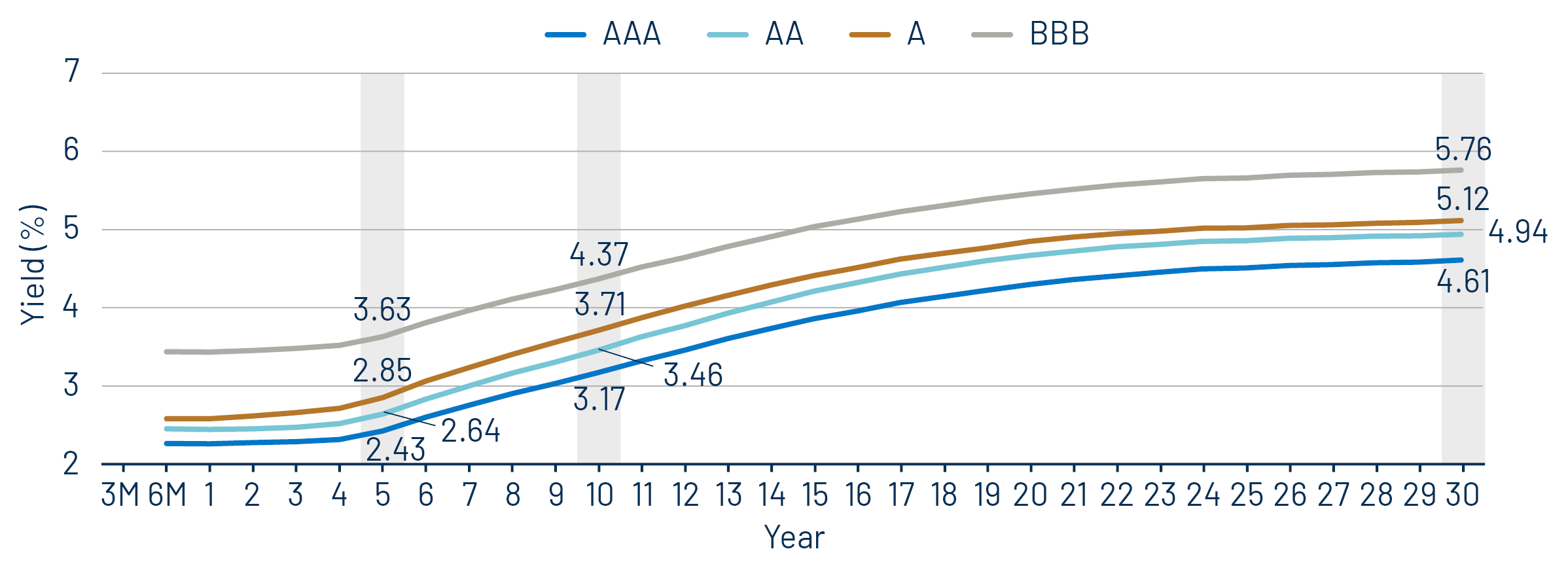

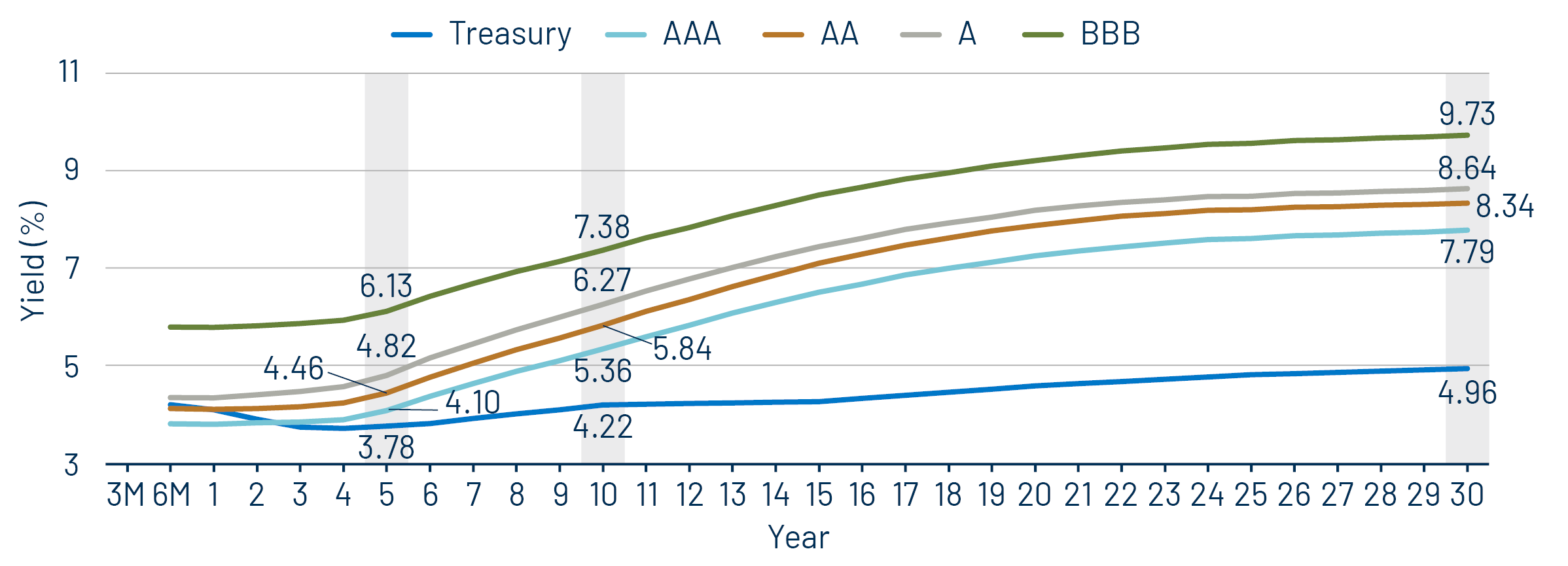

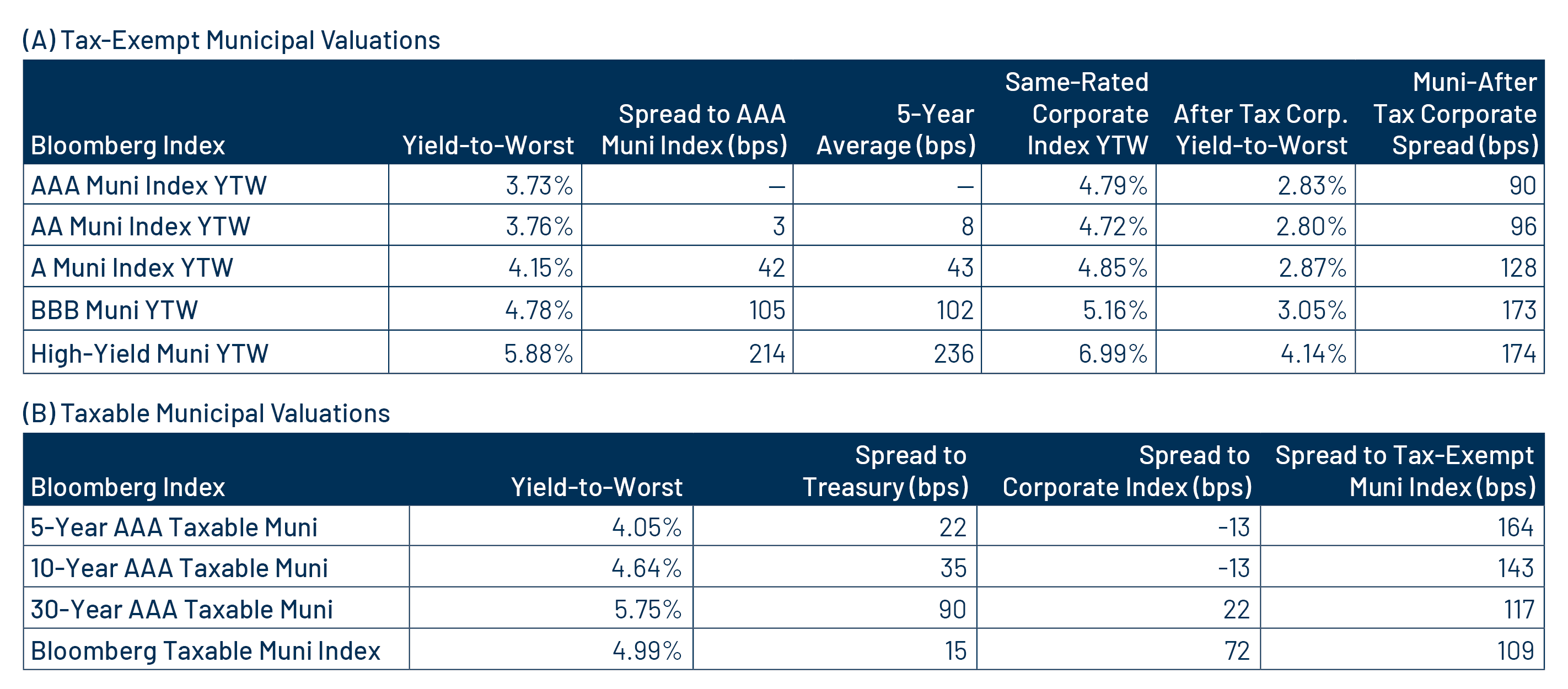

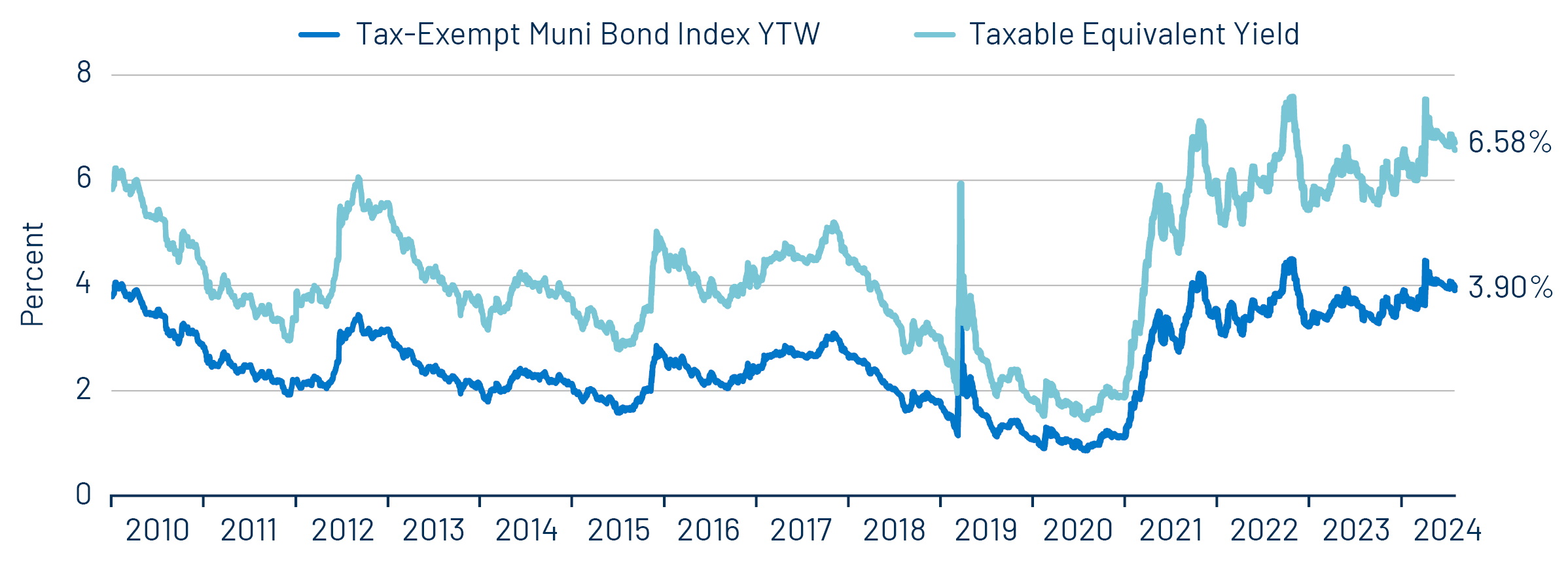

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

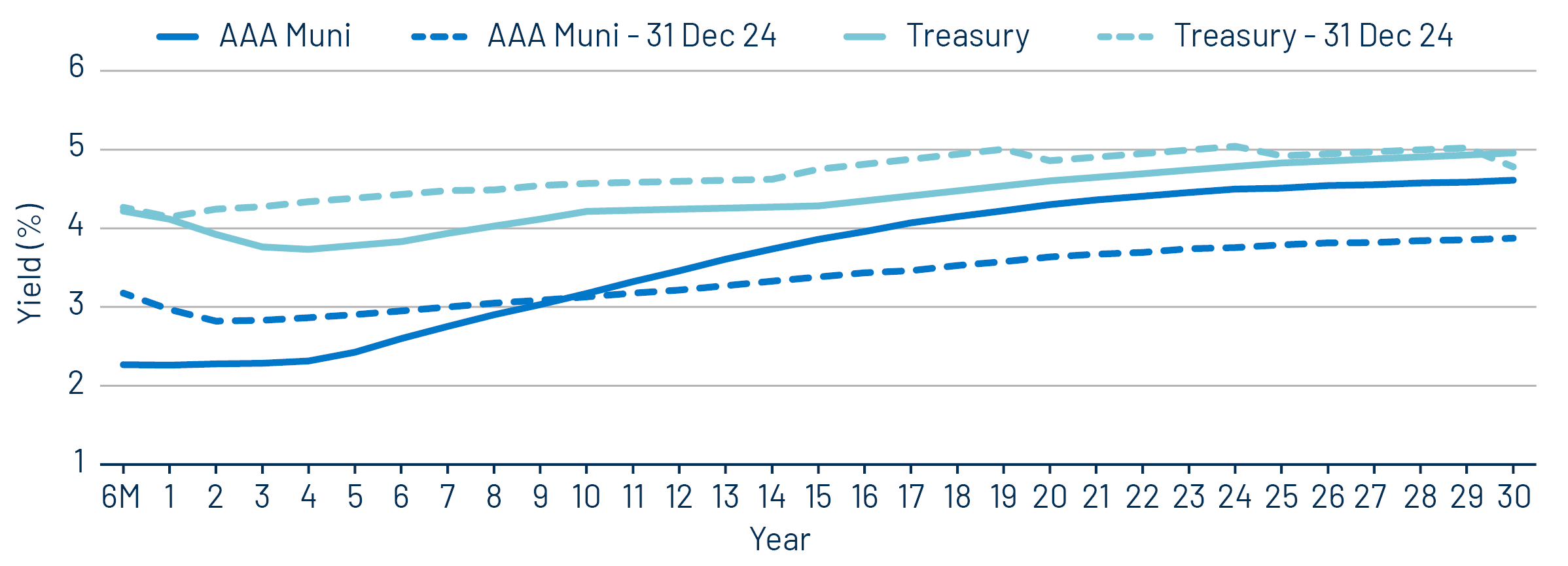

Theme #2: The AAA muni curve has steepened, offering better value in intermediate and longer maturities.

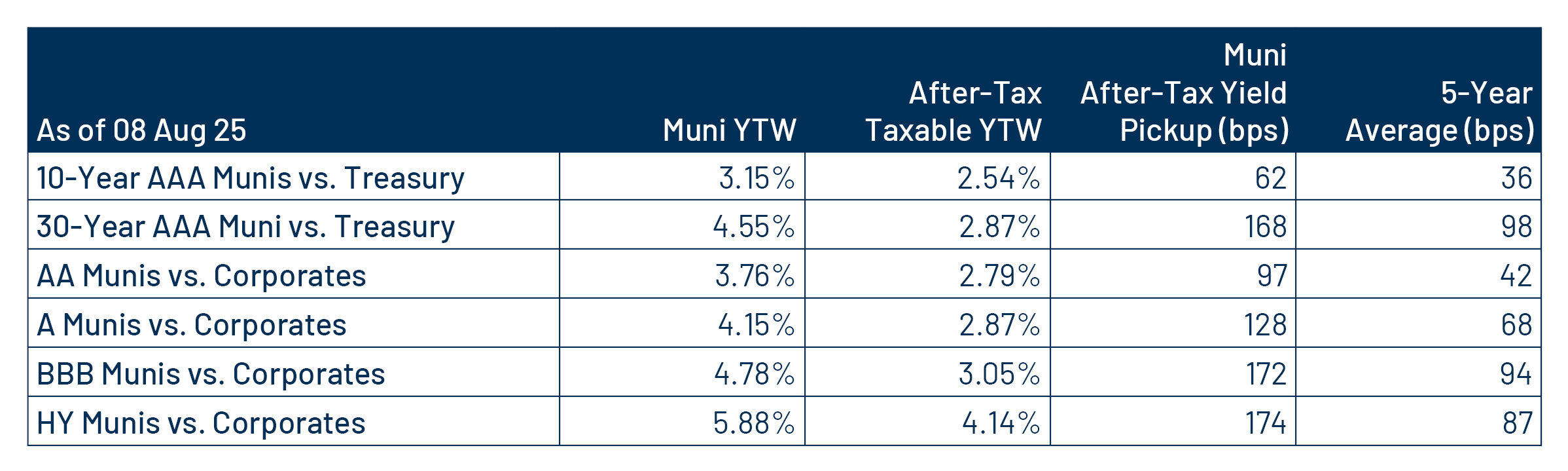

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.