Private-sector payrolls rose by 83,000 jobs in July, but that was more than offset by a -139,000 revision to the June jobs estimate, according to data released today by the Labor Department. Furthermore, almost all of the July private-sector job gains occurred in health care and social services (+79,000), a category that accounts for only 20% of private-sector jobs but has seen the lion’s share of recent job growth.

Over the last three months, while health care and social services have logged a 201,000 cumulative gain, the rest of the private sector reports a cumulative -46,000 decline. Over the last year, the cumulative changes are +874,000 and +475,000, respectively. There is nothing wrong with job growth at doctors’ and social services offices, but it would be reassuring to see more growth in the other 80% of the economy.

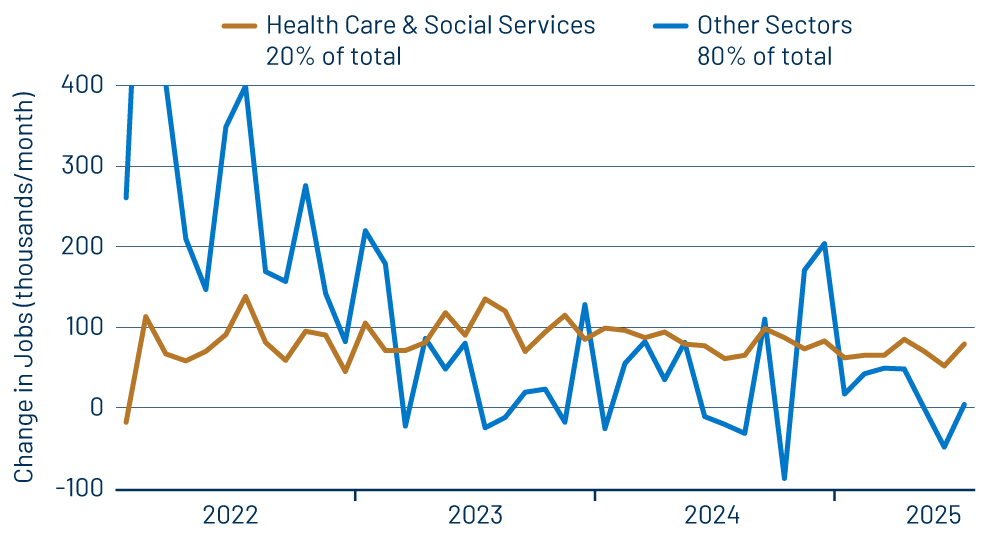

Exhibit 1 breaks down private-sector job growth between the 20% in health care/social services and the other 80% of the economy. As you can see, while health/social has seen steady positive growth, the rest of the economy has been hovering around zero job growth for most of the last three years, punctuated by periodic bursts of big gains, the last of which occurred late last year.

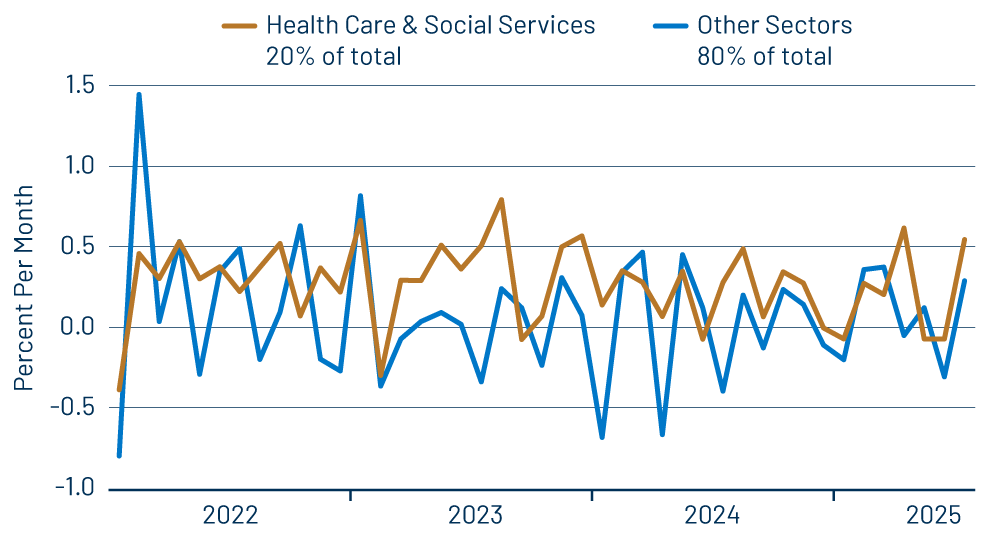

While today’s job growth data were soggy, average workweeks rose sharply, so that total hours worked logged a nice gain. However, this was not the case in preceding months. Growth in total hours worked for health/social versus other sectors is shown in Exhibit 2. Alongside soft job growth, the remaining 80% of the economy outside health/social has shown essentially zero net growth in total hours worked for the last three years.

Last month, we pointed out that the big June gain in total payroll jobs was coming from flukey public school jobs data, thanks to a later-than-usual end to the public school year. We thought that the +63,000 June gain in public school jobs would be reversed in the July data (hence our focus then and now on private-sector jobs). Well, rather than July showing a decline, that 63,000 June gain was revised away, with public school jobs now showing no growth in June and a -12,000 decline in July. This is the same end result as we had expected, but it followed a different route to get there.

Besides the gains in hours worked, average hourly wages also showed a monthly gain of 0.3% in line with preceding months’ experience. The economy does not seem to be shutting down, but the fact remains that there is little labor market activity (growth) outside health care and social services, which are obviously two (private) sectors heavily supported by government activity. This is most obvious in the last few months’ data, but it has actually been the case since the beginning of 2023.