Macros, Markets and Munis

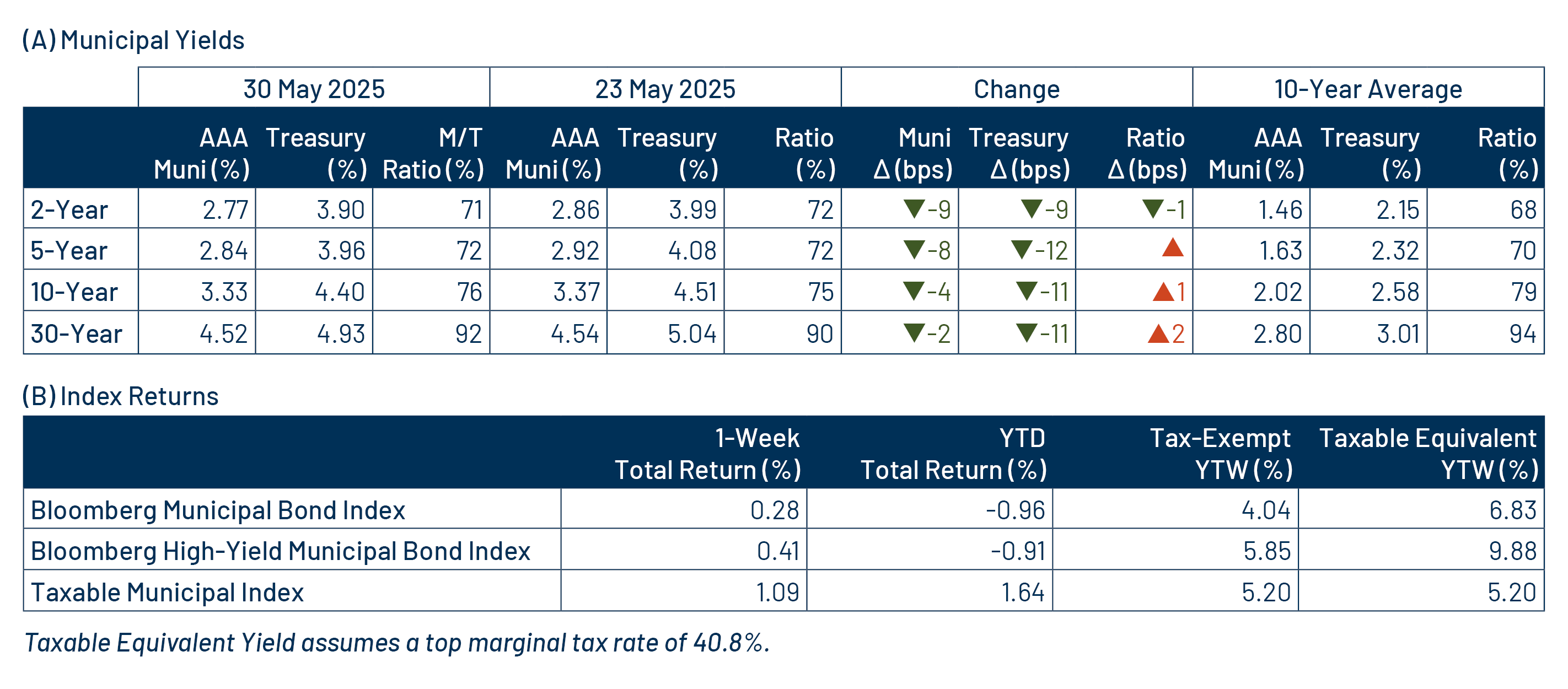

Municipals posted positive returns last week as Treasury yields ultimately moved 9-11 basis points (bps) lower across the curve. Munis moved lower in sympathy with rates but generally underperformed amid inflows and elevated supply conditions. Market volatility abated last week as President Trump delayed the recently announced 50% tariff on Europe and a judge blocked the majority of new tariffs. From an economic data perspective, consumer confidence came in above expectations, while initial jobless claims also exceeded expectations and inflation, as measured by the core Personal Consumption Expenditures (PCE) Index, slowed to a 2.5% annualized rate. This week we highlight the 2025 muni market’s underperformance, which has contributed to what we view as attractive relative valuations.

Muni Funds Record Inflows Amid a Building New Issue Calendar

Fund Flows (up $526 million): During the week ending May 28, weekly reporting municipal mutual funds recorded $526 million of net inflows, according to Lipper. Long-term funds recorded $203 million of inflows, intermediate funds recorded $79 million of inflows and high-yield funds recorded $150 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $6 billion.

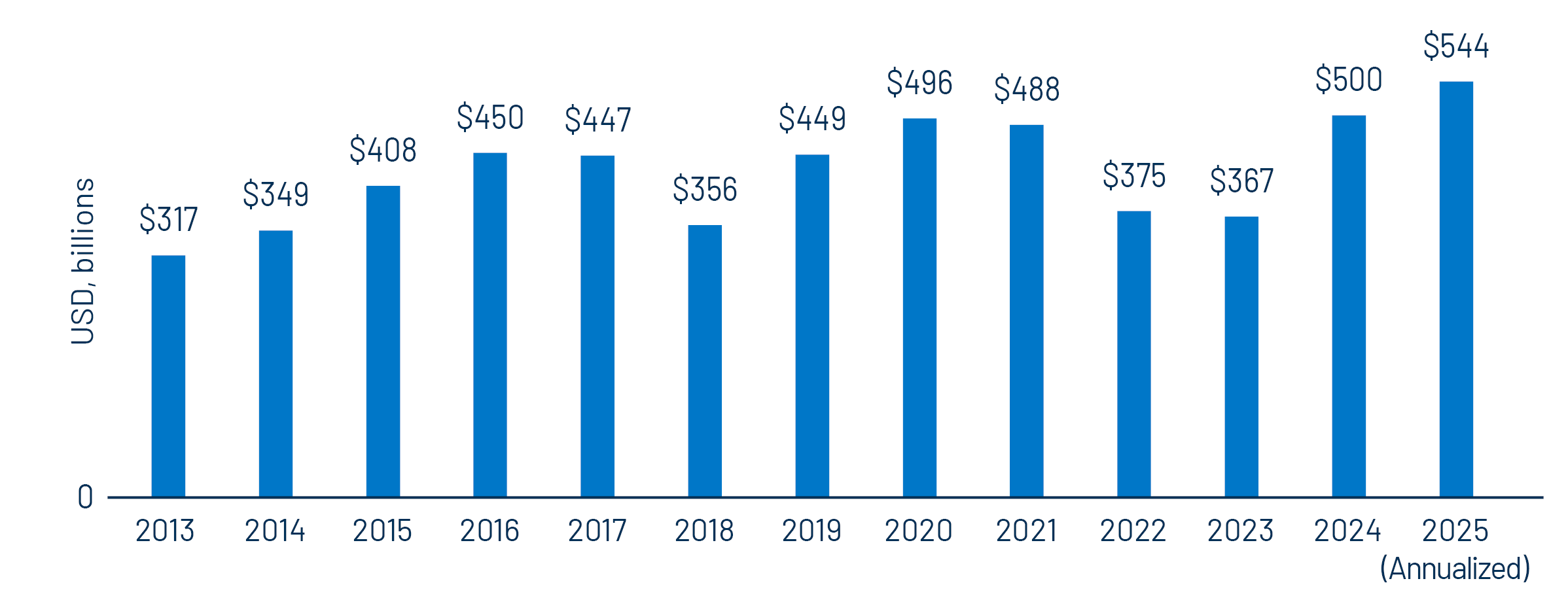

Supply (YTD supply of $227 billion; up 18% YoY): The muni market recorded $12 billion of new-issue supply last week, down 8% from the prior week. YTD, the muni market has recorded $227 billion of new issuance, up 18% year-over-year (YoY). Tax-exempt and taxable issuance are up 20% and 17%, respectively, though tax-exempt issuance has comprised the vast majority (93%) of YTD supply. This week’s calendar is expected to increase to $18 billion, which would mark the highest weekly issuance level in five years. The largest deals include $2.1 billion Dormitory Authority of the State of New York (NYU) and $1.1 billion New Jersey Turnpike Authority transactions.

This Week in Munis: Underperformance Underscores Opportunity

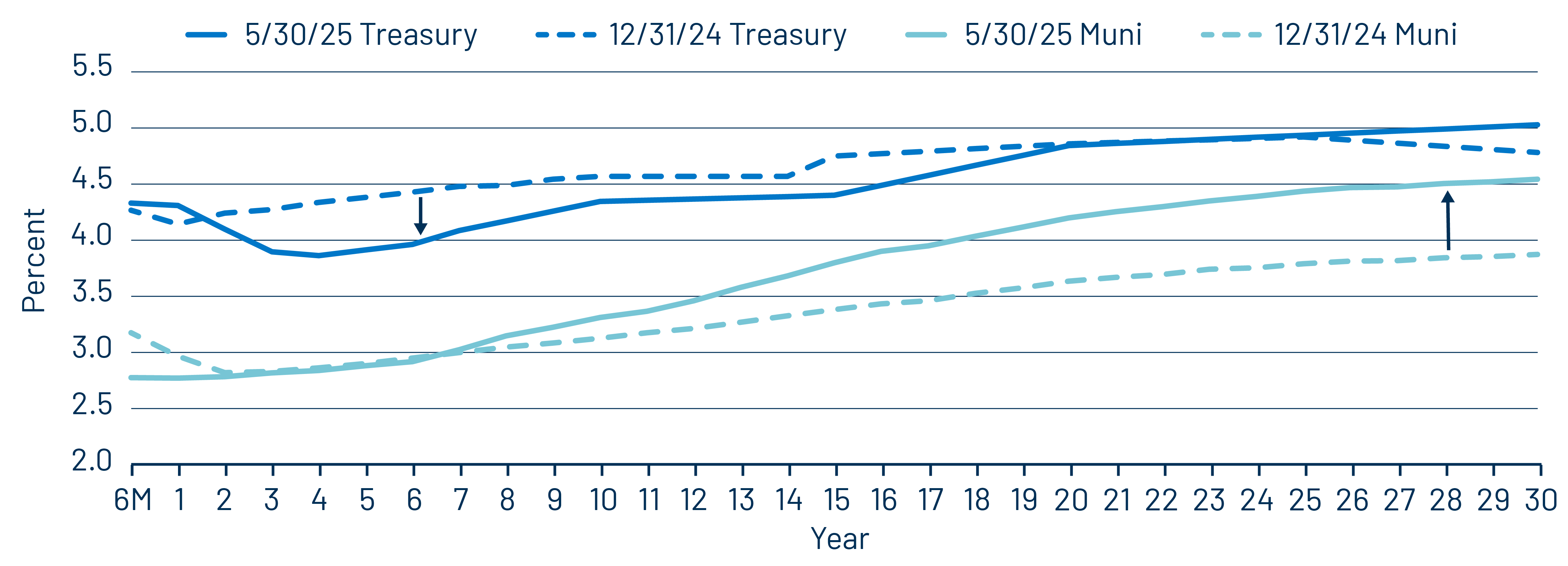

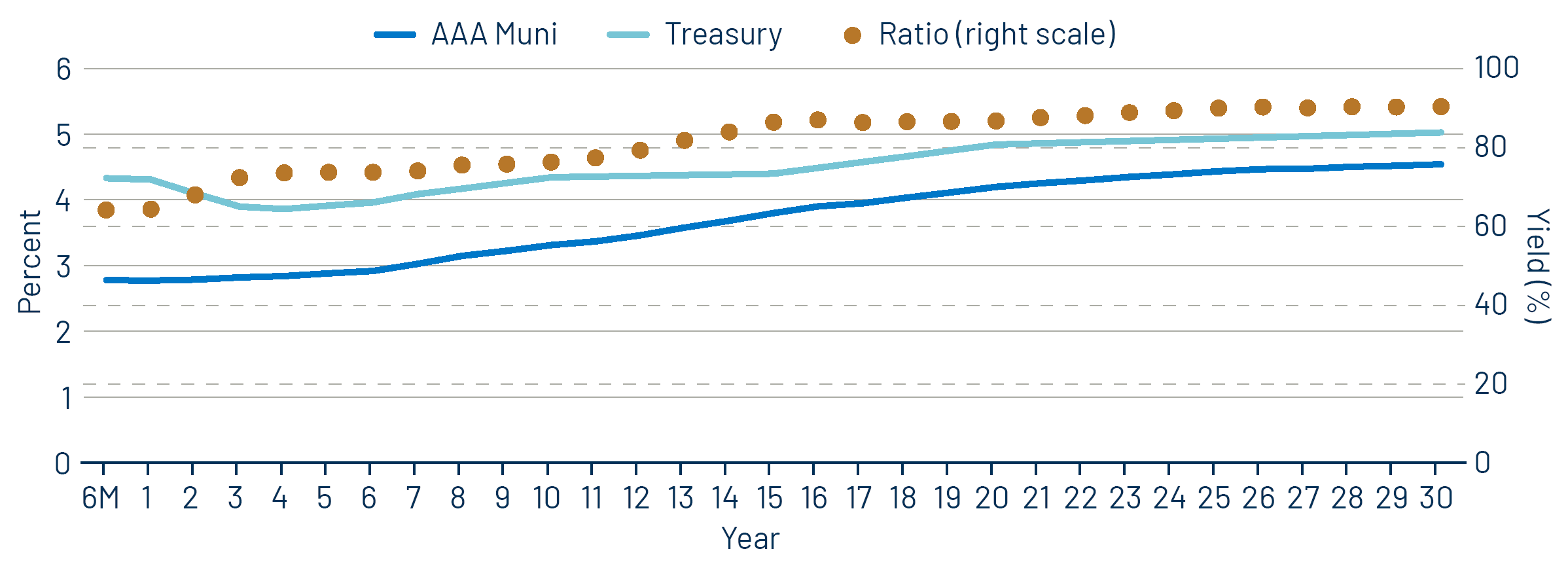

Through the end of May, the Bloomberg Municipal Bond Index returned -0.96% YTD, underperforming both the Bloomberg Treasury Index and the US Corporate Index, which posted positive returns of 2.51% and 2.26%, respectively. While the Treasury curve generally moved lower across most maturities this year, the highest-grade muni curve (AAA municipal market data) generally moved higher by as much as 62 bps.

This year’s underperformance has been largely attributable to challenged supply and demand technicals. YTD new-issue supply of $223 billion has exceeded prior-year record levels by 20%. Meanwhile, from a demand perspective, muni mutual funds have recorded modest inflows of $6 billion, down from prior-year levels and not sufficient to absorb the record supply levels. Demand remains hampered by individual investors anchoring high-quality allocations to cash equivalents (e.g., money market funds), and more recently by seasonal tax-related weakness that has been exacerbated by overall market volatility.

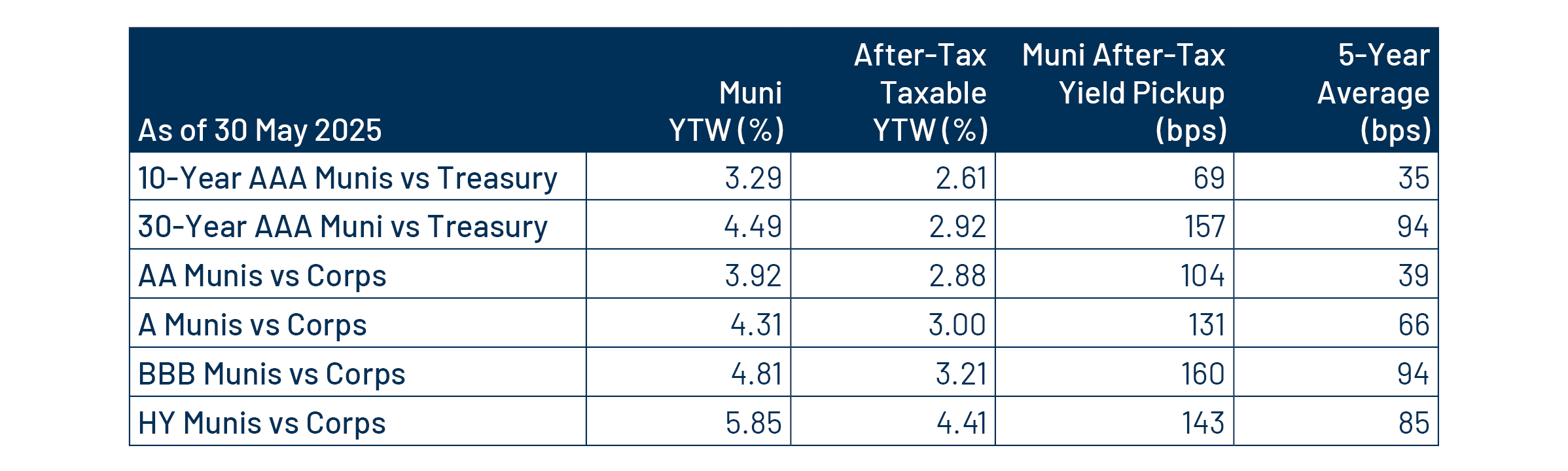

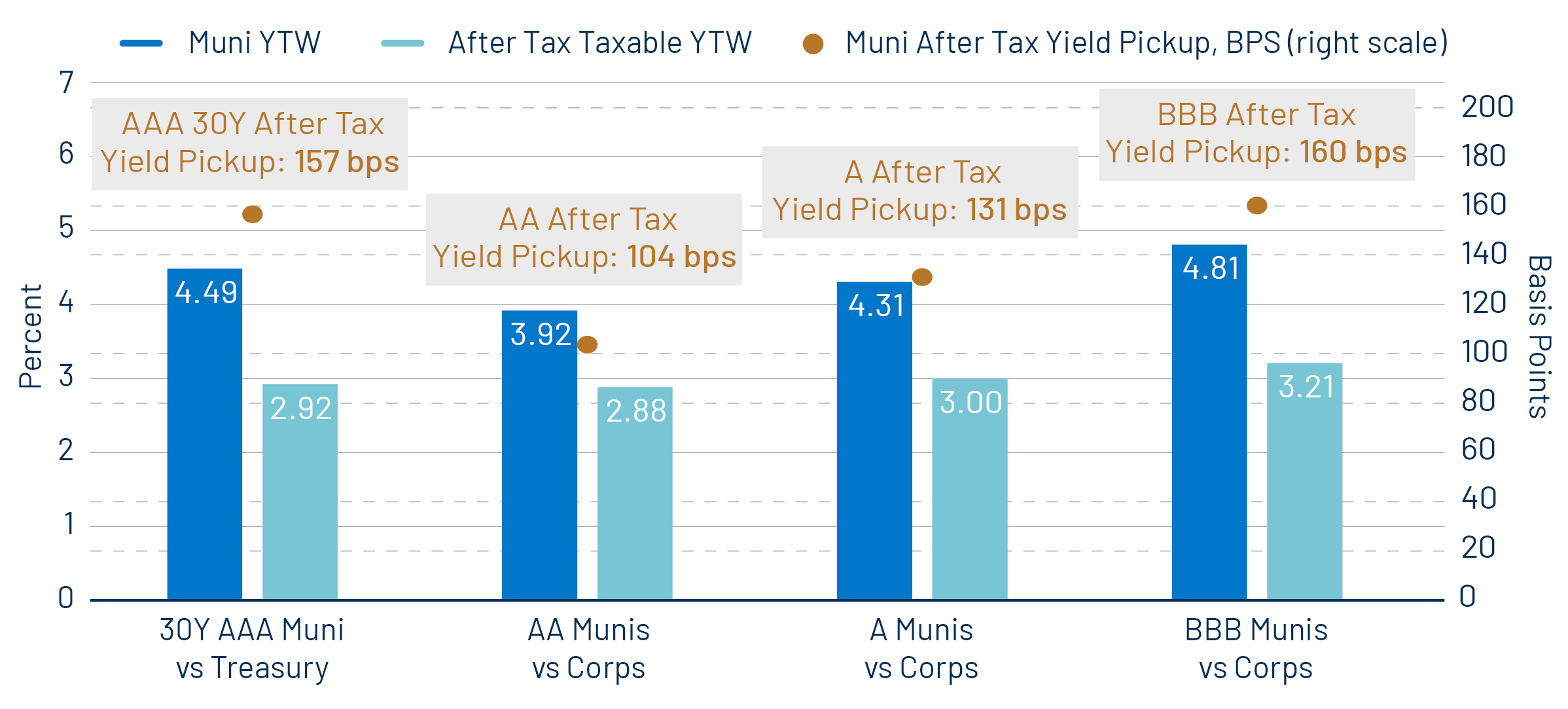

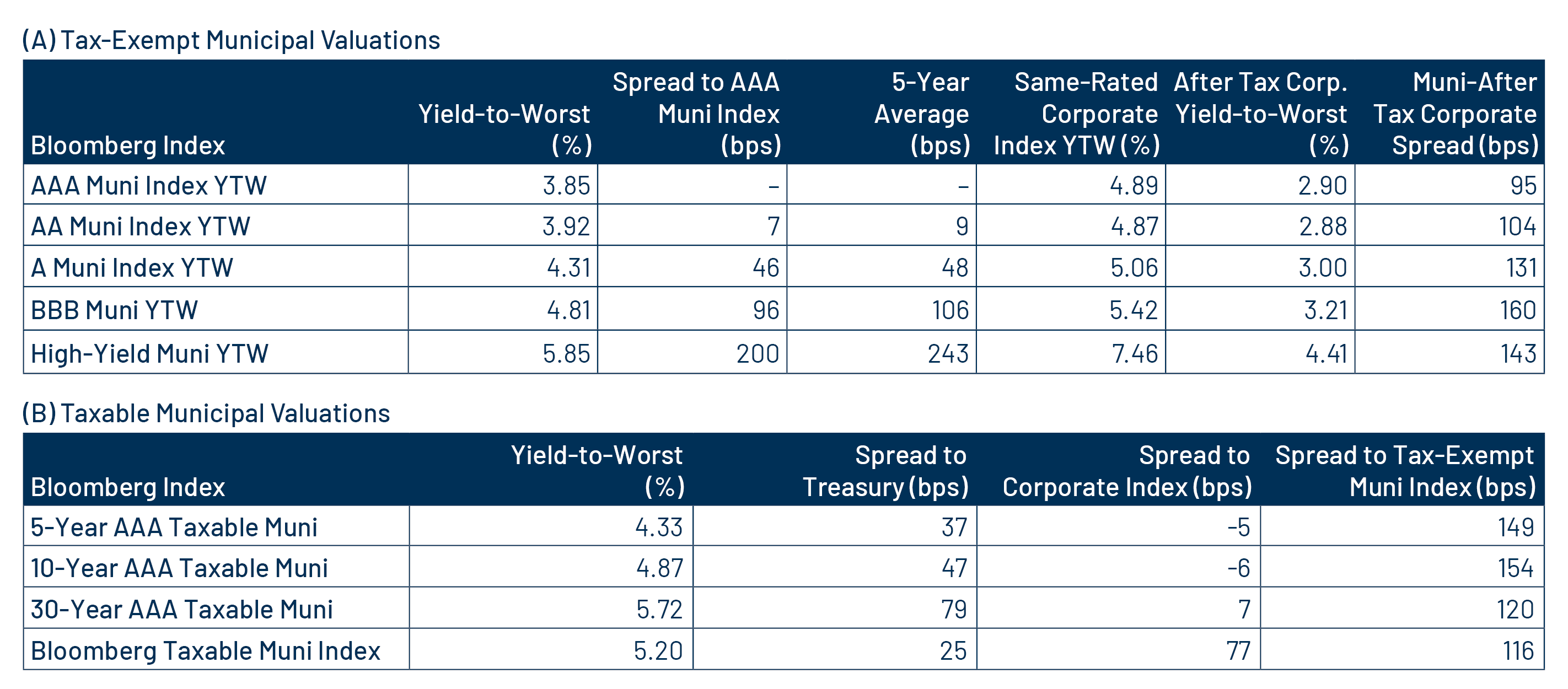

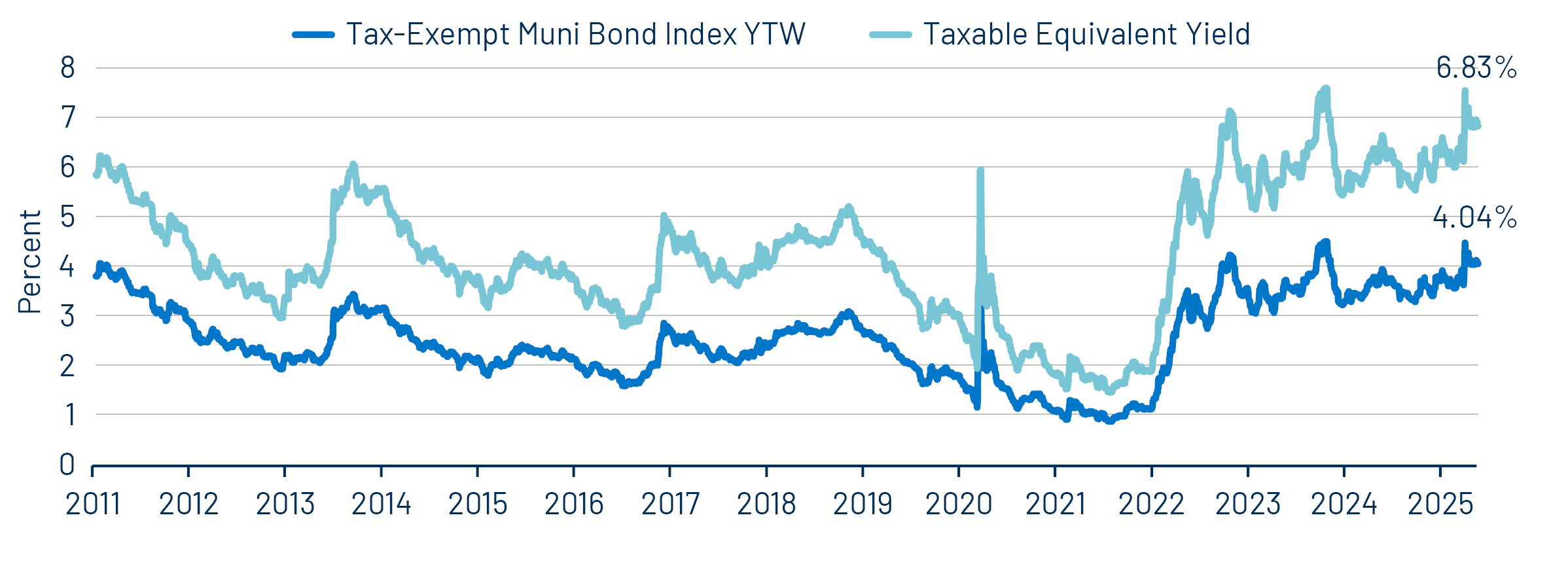

The underperformance, despite generally favorable credit fundamentals, contributes to the value we recognize in the municipal asset class. The Bloomberg Municipal Bond Index has recorded only five negative calendar year returns over the past 40 years, and we anticipate that strengthening technicals in the mid to latter parts of the year can be supportive of sector performance. For investors subject to the highest tax bracket, the majority of the muni market offers over 100 bps of after-tax yield pickup versus comparable taxable counterparts. This pickup, along with expected Federal Reserve rate cuts pushing front-end rates lower, can support demand.

Municipal Credit Curves and Relative Value

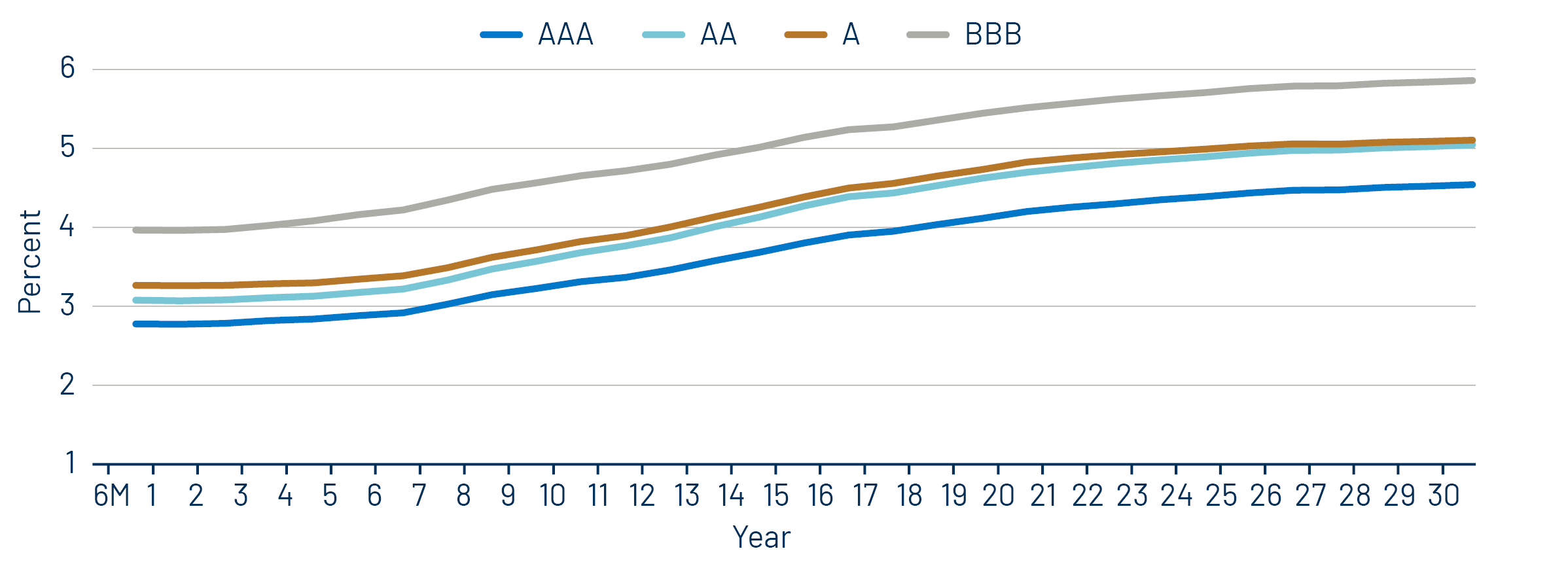

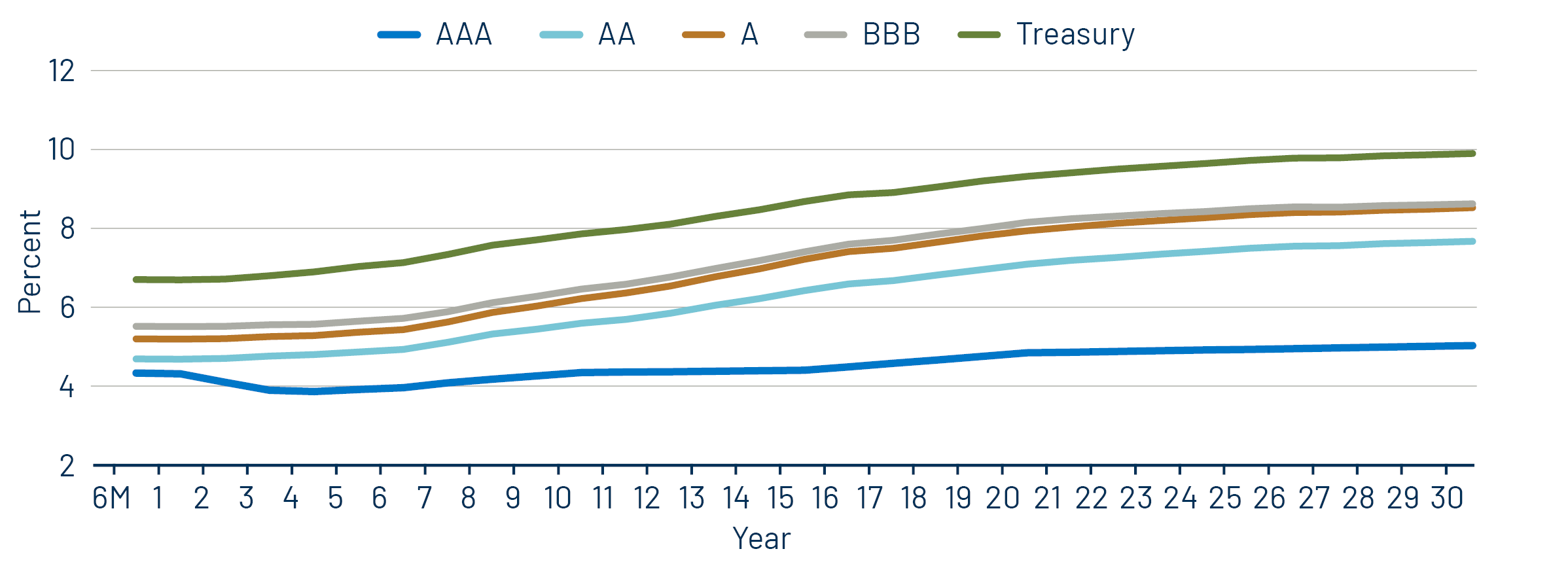

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

Theme #2: The muni curve has steepened, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.