On November 1, 2021, the President’s Working Group on Financial Markets in conjunction with the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency published a detailed report on the stablecoin market called the PWG Report.1 Stablecoins are one of the latest financial products to join the global digital ecosystem which already includes many buzzword-worthy digital innovations that have dominated the financial and mainstream media headlines in recent years.

Superficially, stablecoins are just another type of digital asset used predominately as a short-term stopgap for investors trading in—or between—other longer-term speculative digital assets, such as cryptocurrencies or non-fungible tokens (NFTs). When comparing the digital-only world with the more traditional investment fund industry, stablecoins are often likened to money market funds. Just like constant net asset value (CNAV) money market funds, stablecoins are designed to maintain a stable value relative to a fiat currency such as the US dollar. This perceived stability offers investors a safe harbor when switching among assets in their digital wallets while earning a small amount of interest.

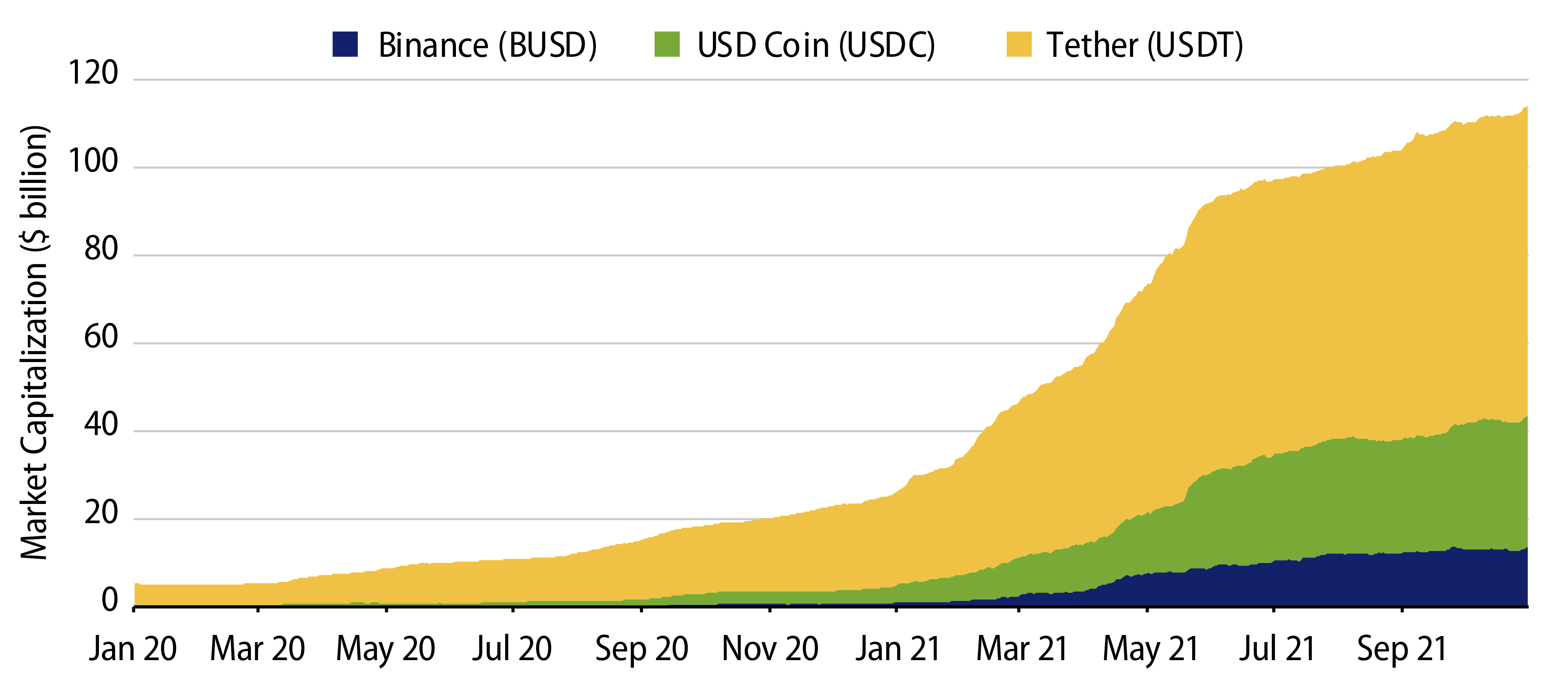

The utilization of the stablecoin market has been swift and widespread. By October 31, 2021, total market capitalization of the top three stablecoins rose to more than $114 billion with the majority of this growth witnessed in the past 12 months (Exhibit 1).

The assumed stability of value is really where the comparison with CNAV money market funds ends. Unlike those types of funds, stablecoins are currently largely unregulated. While sponsors of money market funds must adhere to a variety of strict regulations covering the underlying investment types—NAV accounting practices, portfolio liquidity and stress testing—providers of stablecoins are not bound by such rules and restrictions.

An investment in a CNAV money market fund represents a share of the value of the underlying portfolio, and the fund is managed in such a way that that value is essentially equal to one unit of currency. Conversely, no such relationship exists between the value of the stablecoin token and its underlying portfolio, which can be invested in both low-risk securities permitted for money market funds (e.g., T-bills), as well as in other assets not permitted, such as lower-quality corporate bonds. This funding gap was one of three major risks and regulatory gaps highlighted by the PWG Report:

- Loss of value: Risks to stablecoin users and stablecoin runs

- Payment system risks

- Risks of scale: Risk and concentration of economic power

The potential for a run on a stablecoin is not just a concern for the stablecoin investors, it also creates nervousness for managers of traditional money market funds. If an underlying stablecoin portfolio holds large volumes of money market instruments, such as commercial paper, then a sudden and dramatic liquidation could result in downward price pressure in the broader market. This is something a money market fund manager would be keen to avoid.

The PWG Report makes a number of recommendations to address each of the three concerns we mention, most significantly that issuance of stablecoins be limited to banks only. This would lessen the potential for destabilizing, confidence-driven runs as banks would have access to the various safety nets offered by official institutions, such as the Federal Reserve.

Whatever form stablecoins may end up taking in the future, investors deserve the information they will need to make informed decisions regarding investment risks—and this will undoubtedly be facilitated by the involvement of regulators.

ENDNOTES

1President’s Working Group on Financial Markets, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency: Report on Stablecoins: https://home.treasury.gov/system/files/136/StableCoinReport_Nov1_508.pdf