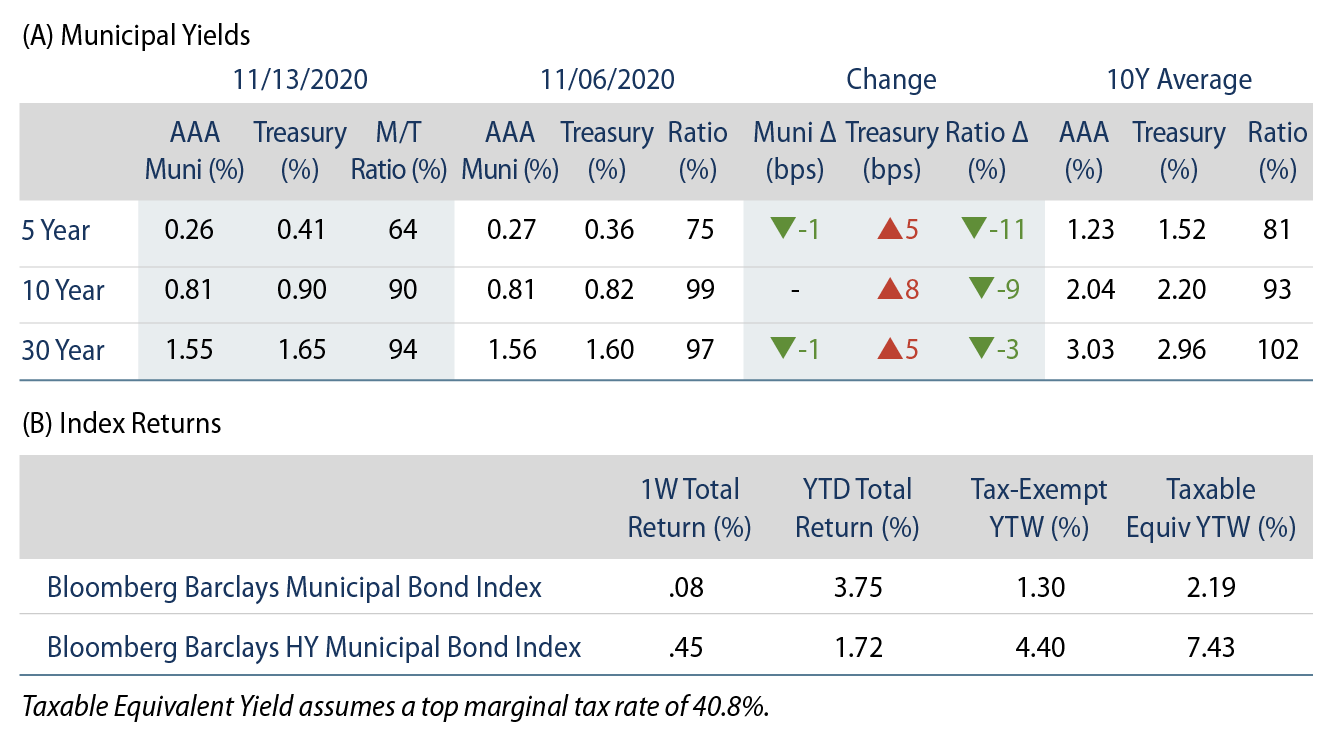

Municipals Yields Were Generally Unchanged

Municipals yields were relatively unchanged, outperforming Treasuries. Strengthening technicals supported high-yield municipal outperformance. Municipal downgrades outpaced upgrades for a second consecutive quarter. AAA municipal yields declined 1 bp in short and long maturities as improved technicals supported the market despite rising Treasury yields. The Bloomberg Barclays Municipal Index returned 0.08%, while the HY Muni Index returned 0.45%

Municipal Technicals Strengthened Due to Positive Flows and Light Supply

Fund Flows: During the week ending November 11, municipal mutual funds recorded $1.2 billion of inflows following outflows observed the prior week, according to Lipper. Long-term funds recorded $912 million of inflows, intermediate funds recorded $73 million of outflows and high-yield funds recorded $526 million of inflows. Municipal mutual fund net inflows YTD total $29.8 billion.

Supply: The muni market recorded $3.9 billion of new-issue volume last week, 3x the prior election week’s levels but well below the YTD average. Issuance YTD of $420 billion was 22% above last year’s pace, mostly driven by higher taxable issuance, which is 150% of last year’s levels. Issuance was expected to reach $8 billion this week. Largest deals include $3.7 billion State of New Jersey COVID-19 Emergency Bonds and $1.4 billion Commonwealth of Massachusetts General Obligation transactions.

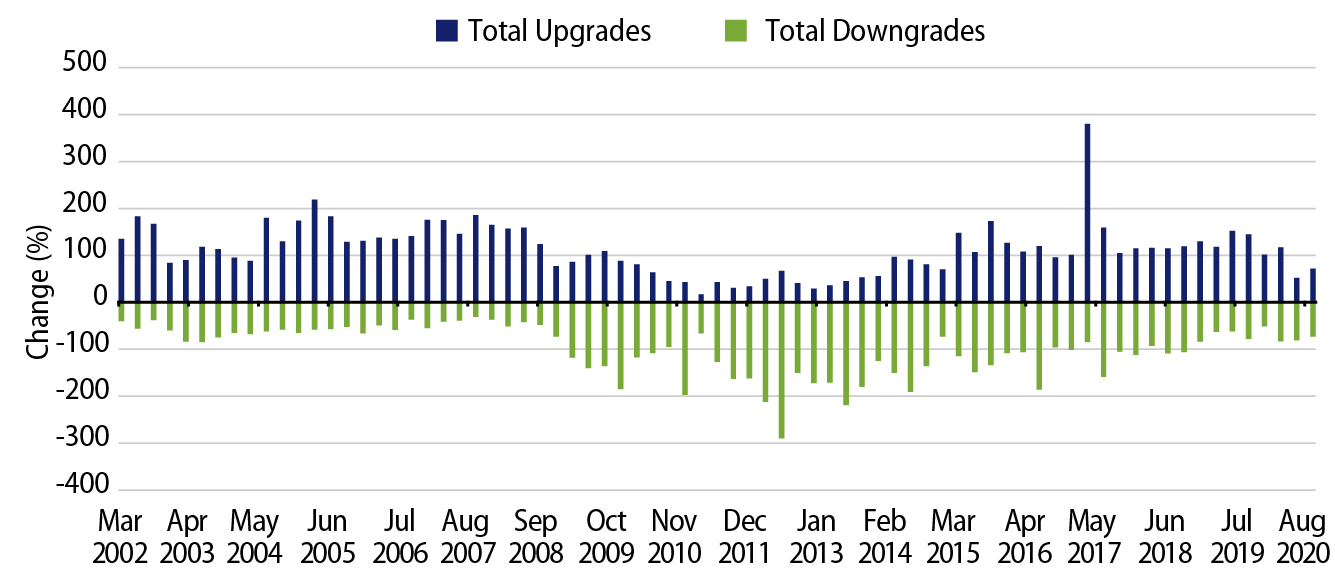

This Week in Munis: Downgrades Outpace Upgrades for a Second Consecutive Quarter

As state and local municipalities continue to grapple with the economic challenges associated with the pandemic, Moody’s reported that rating downgrades exceeded upgrades for the second consecutive quarter in 3Q20. Moody’s lowered ratings on 73 obligors of $43 billion of debt, while upgrading ratings on 72 obligors of $13 billion of debt.

Given the scope of budgetary shortfalls and austerity measures ahead, we anticipate downgrades to outpace upgrades for the foreseeable future. By comparison, during 1Q09 to 4Q14, following the great financial crisis, the rating agency downgraded more issuers than it upgraded for 24 consecutive quarters.

Despite the anticipated downgrade trend, the majority of municipal issuers benefit from substantial budgetary flexibility; as such, we anticipate default rates to remain low versus other asset classes. According to Moody’s, the 10-year cumulative default rate for municipals was 0.16% compared to a 10.17% default rate for corporates. We expect an increase in municipal defaults primarily to be concentrated in select areas of the high-yield market, predominantly in the project finance and senior living sectors. However, even in a stress-scenario where defaults substantially increase for investment-grade municipals, we would expect muni default rates to remain well below corporates and other credit asset classes, which should continue to attract long-term demand from those seeking high quality income.