Municipals Posted Negative Returns During the Week

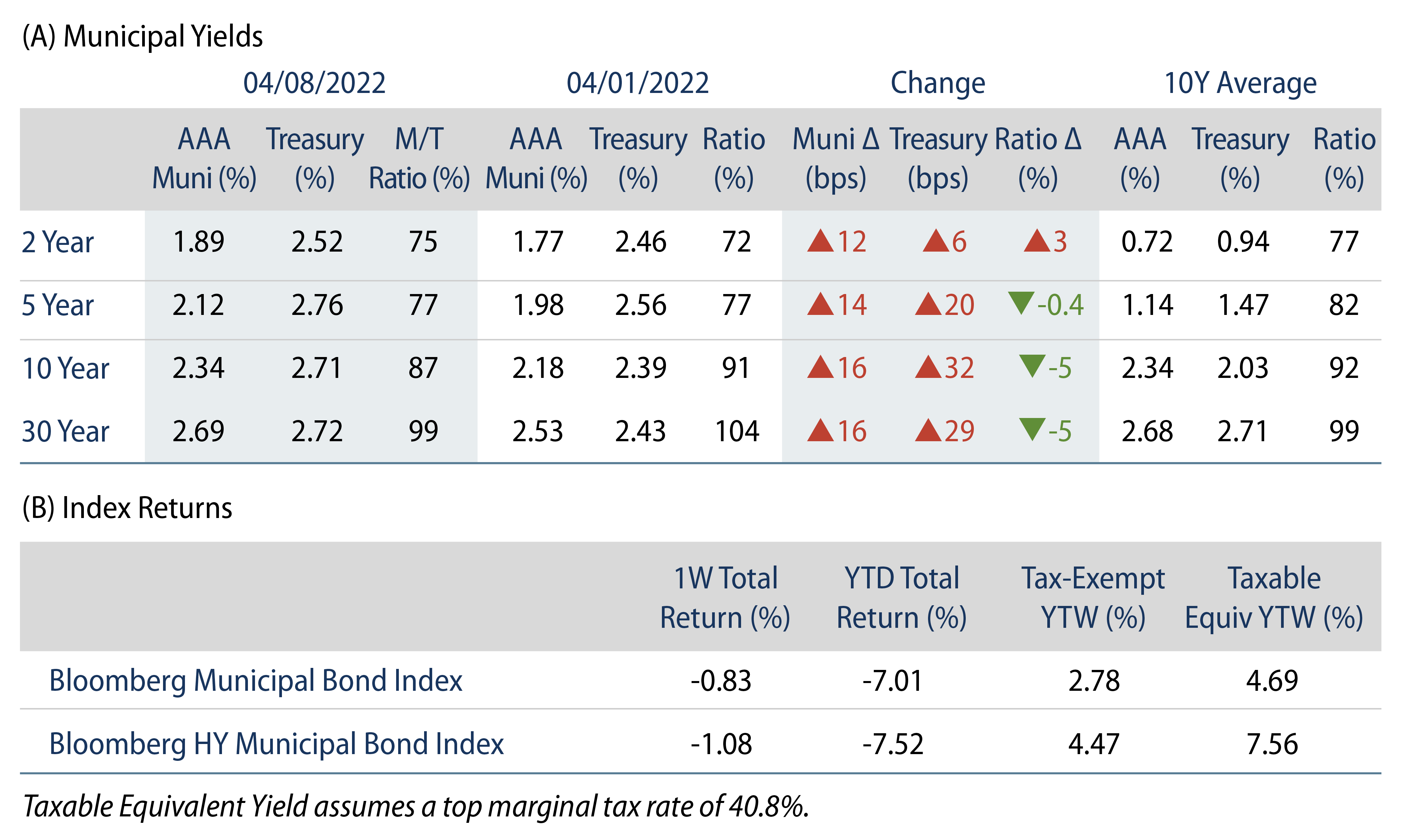

US municipals posted negative returns this week, with high-grade municipal yields moving 12-16 bps higher across the curve. Supply and demand technicals weakened as both fund outflows and supply increased. Munis underperformed Treasuries in short maturities and outperformed in long maturities. The Bloomberg Municipal Index returned -0.83%, while the HY Muni Index returned -1.08%. This week we highlight the seasonal demand weakness associated with tax season.

Market Technicals Remain Weak as Fund Outflows and Supply Increased

Fund Flows: During the week ending April 6, weekly reporting municipal mutual funds recorded $3.2 billion of outflows, according to Lipper. Long-term funds recorded $2.4 billion of outflows, high-yield funds recorded $1 billion of outflows, and intermediate funds recorded $566 million of outflows. The week’s fund outflows extend the current outflow streak to 13 consecutive weeks, contributing to $27 billion of net outflows year to date (YTD).

Supply: The muni market recorded $12.2 billion of new-issue volume, up 23% from the prior week. Total YTD issuance of $114 billion is 7% higher than last year’s levels, with tax-exempt issuance trending 19% higher year-over-year (YoY) and taxable issuance trending 28% lower YoY. This week’s new-issue calendar is expected to decline to $5 billion. Largest deals include $625 million Maryland Economic Development and $500 million President and Fellows Harvard College transactions.

This Week in Munis: Tax Season Demand Technicals in Focus

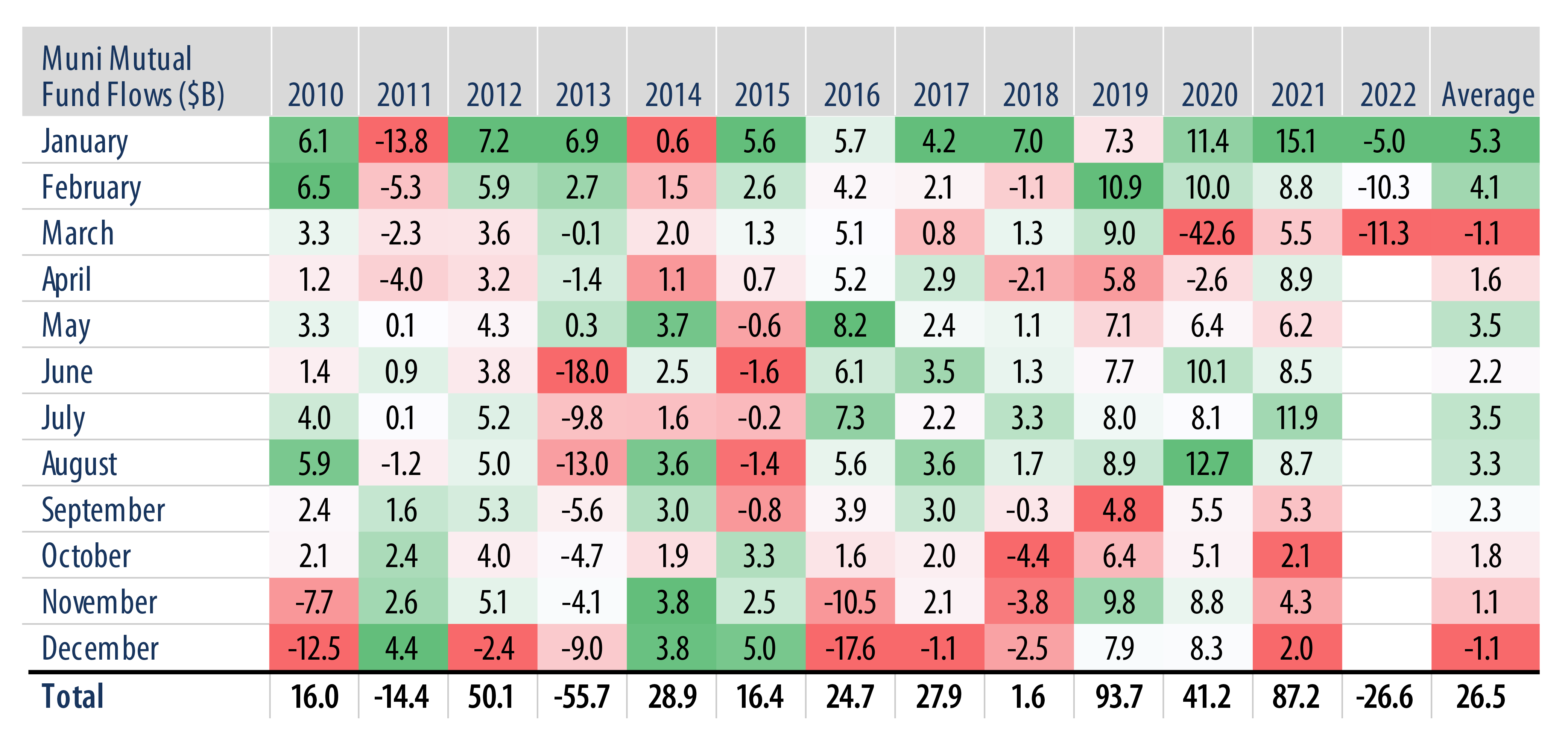

March and April have historically been relatively weaker months for municipal demand—at least partially attributable to seasonal selling associated with many high net worth individuals utilizing their high-quality municipal allocation to fund tax bills.

From 2010 to 2021, the month of March averaged $1.1 billion of municipal mutual fund outflows, compared to average inflows of $2.5 billion in all other months. YTD flows are consistent with this trend, as outflows of $5 billion and $10 billion in January and February, respectively, accelerated to $11 billion in March.

Notably, the prior two tax seasons included tax-related selling that extended into the summer, given the tax deadline extensions that the IRS granted due to the pandemic. However, as we approach this year’s normal April deadline, we anticipate the majority of tax-related municipal selling has already transpired.

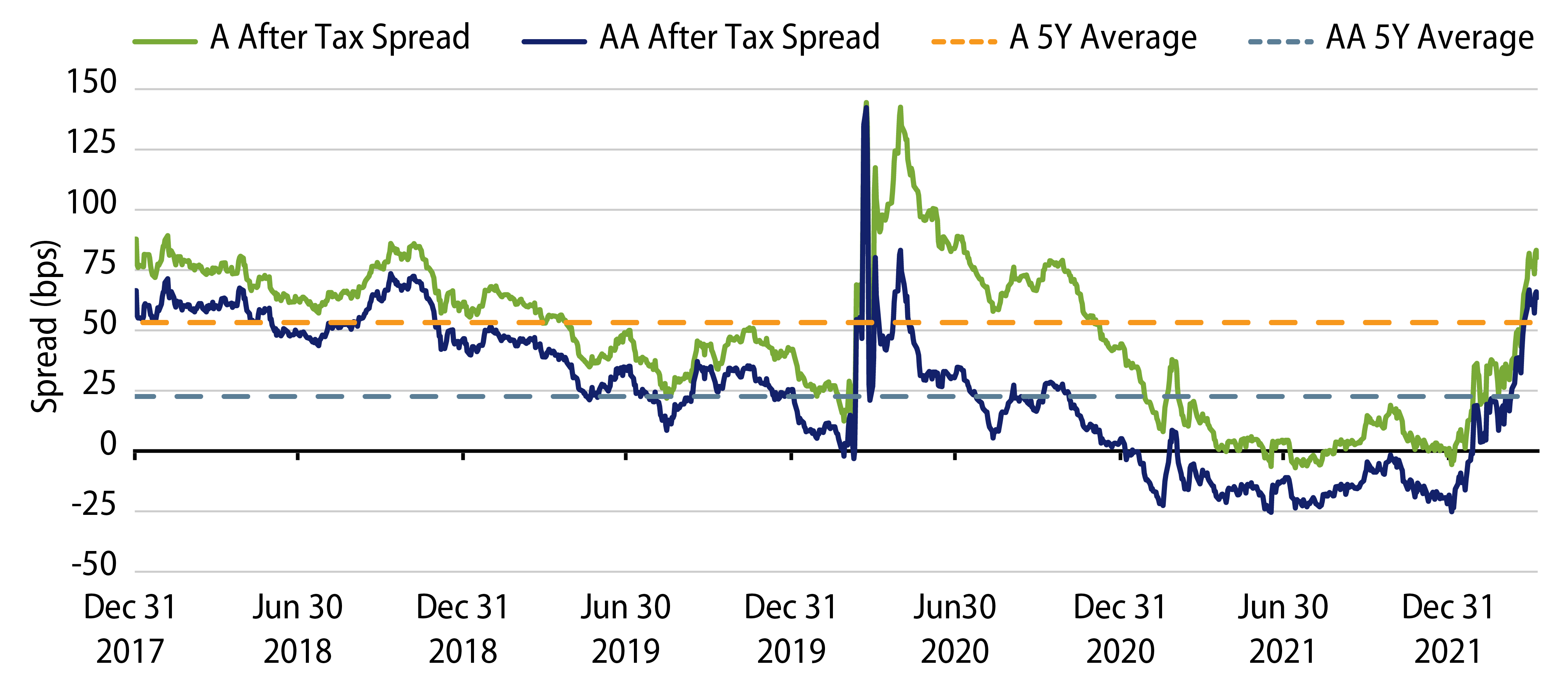

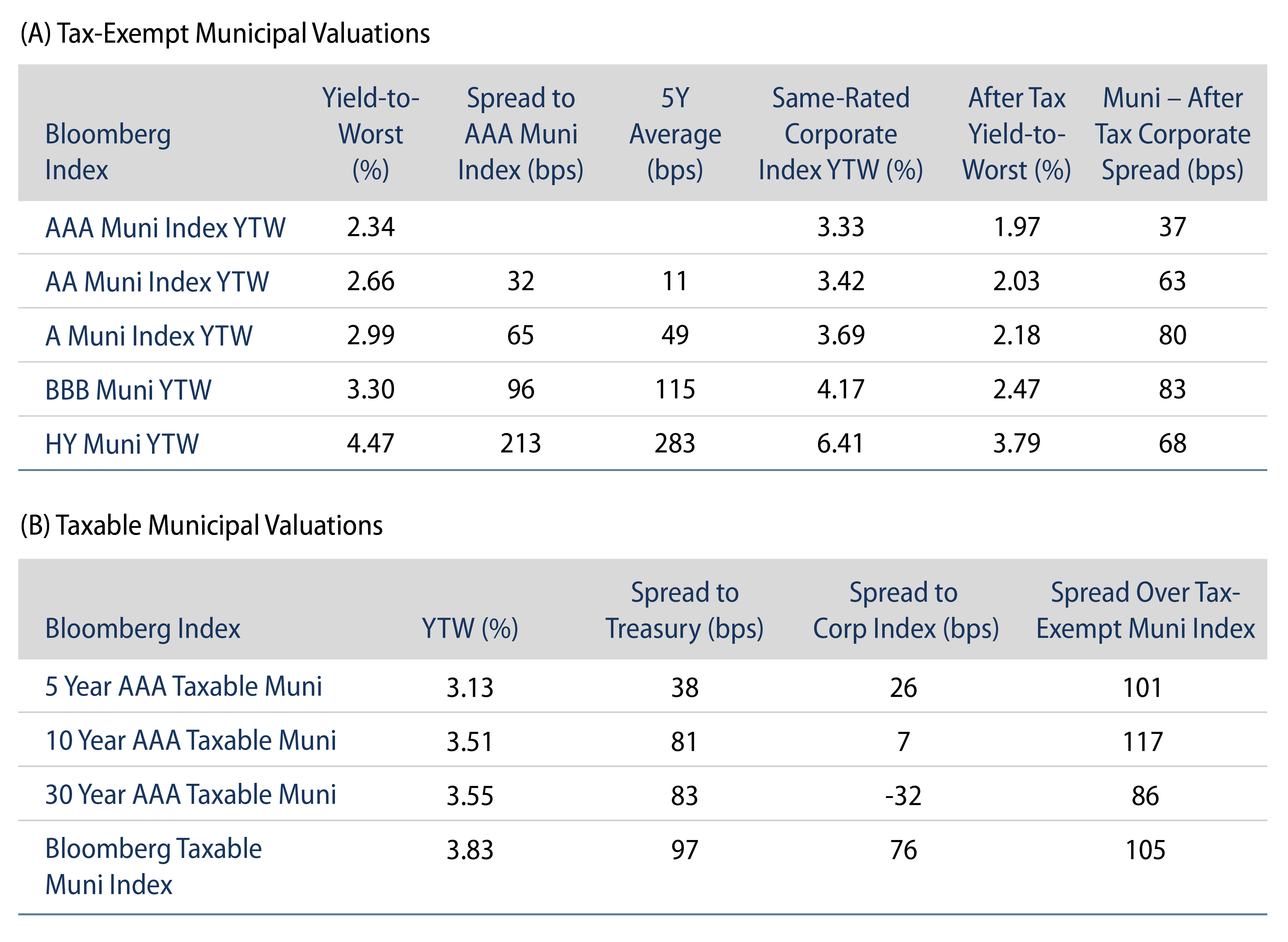

Emerging from tax season, we believe we could see demand return from both retail and institutional buyers as municipals now screen more attractive relative to both Treasuries and investment-grade credit. This relative value proposition could further improve with any developments on the tax-policy front, as President Biden has proposed higher marginal tax rates for both individuals and corporations in his upcoming fiscal 2023 budget. We remain constructive on the long-term value proposition of the tax-exempt asset class and believe these seasonal liquidity-driven conditions have helped contribute to a much better entry point for taxpayers to extract after-tax relative value.