Performance Overview

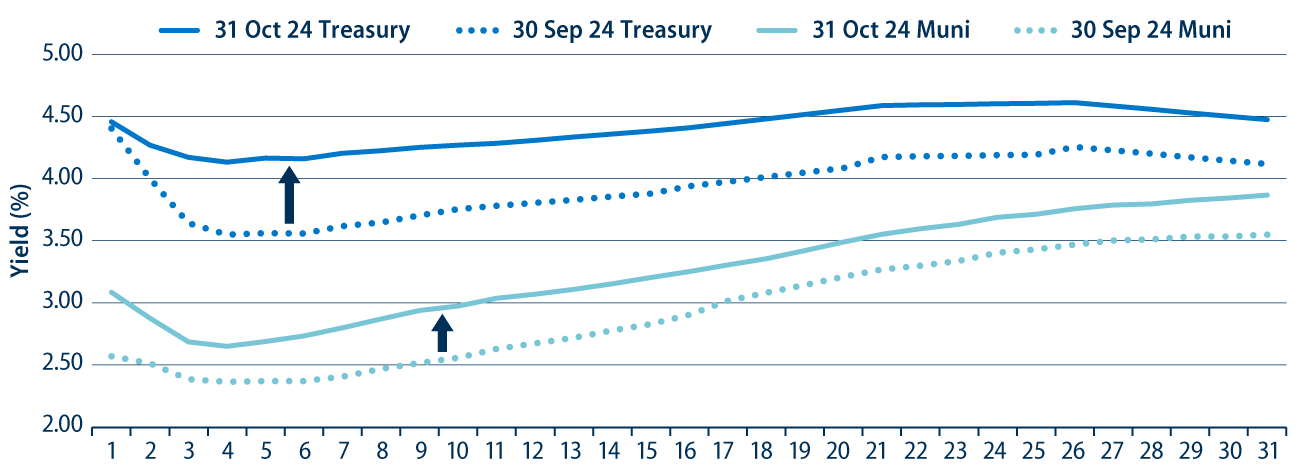

Municipal yields moved higher in sympathy with Treasuries.

Fixed-income markets sold off in October as employment, inflation and consumer sentiment data all came in above expectations and pressured rates higher. The Treasury yield curve moved 30 to 60 basis points (bps) higher across the curve during the month. Muni market yields trailed Treasuries higher but generally outperformed due to relatively strong demand and better valuations following relative underperformance observed earlier in the year. All told, the Bloomberg Municipal Bond Index returned -1.46%. Longer-duration securities underperformed amid the rate selloff, while lower investment-grade securities outperformed as credit spreads continued to contract.

Supply and Demand Technicals

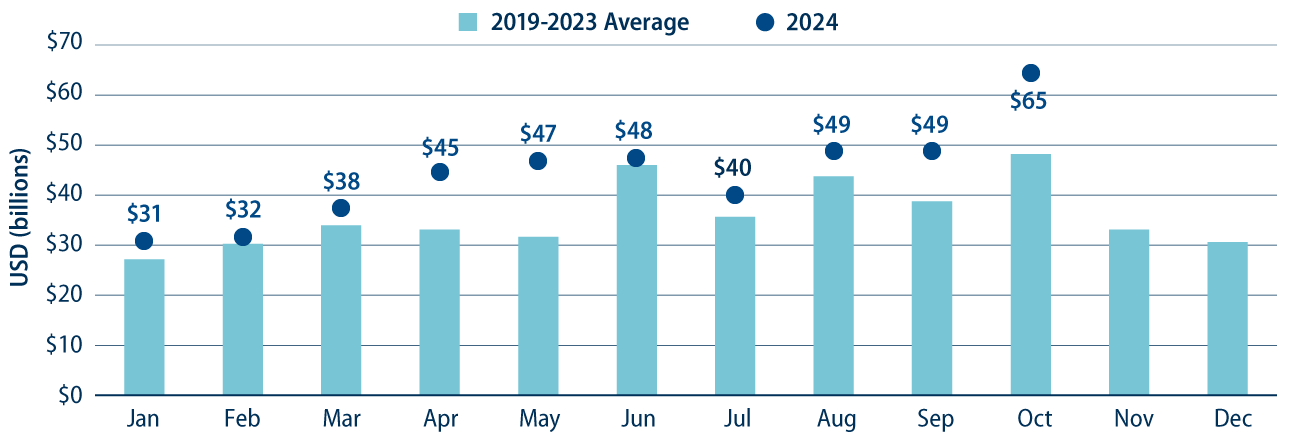

October municipal supply reached the highest level of the year.

Municipal supply continued at a record pace in October. Total new issuance of $65 billion was up 68% from October 2023 levels and marked the highest level of issuance recorded this year. Total year-to-date (YTD) supply of $444 billion is up 44% year-over-year (YoY). Tax-exempt supply comprised 92% of new-issue supply, increasing 48% to $408 billion, while taxable new-issue supply increased 13% to $36 billion.

Demand for municipals increased in October, following the Federal Reserve rate cut the prior month. Municipal mutual funds recorded an estimated $10 billion of net inflows, according to ICI, representing the highest month of inflows this year and extending YTD inflows past $40 billion. Long-term and high-yield category flows recorded the largest proportion of fund flows during the year.

Fundamentals

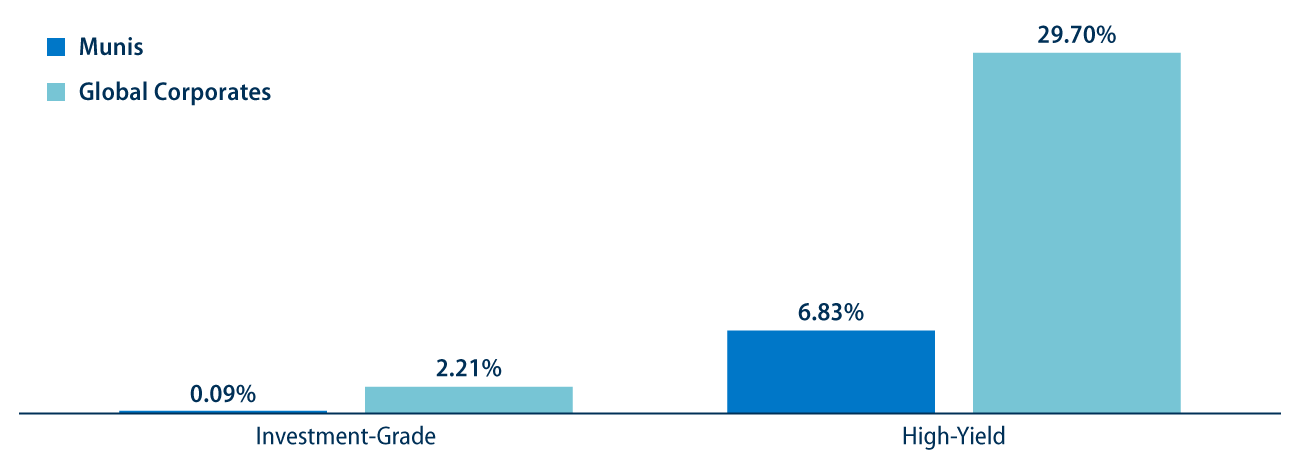

Municipal default rates remain low and below corporates.

Strong economic data reported in the month of October should continue to support municipal revenues and credit fundamentals. Last month, Moody’s published its annual municipal default and recovery study, which highlighted a significant drop-off in Moody’s-rated defaults since Puerto Rico’s defaults in 2016 and 2017. A single Moody’s-rated issuer defaulted in 2023, continuing a trend of relatively low default rates for the municipal asset class versus corporates. While defaults remain low, the report highlights credit challenges of lower growth rates, higher labor costs and a potential reduction of federal aid.

Valuations

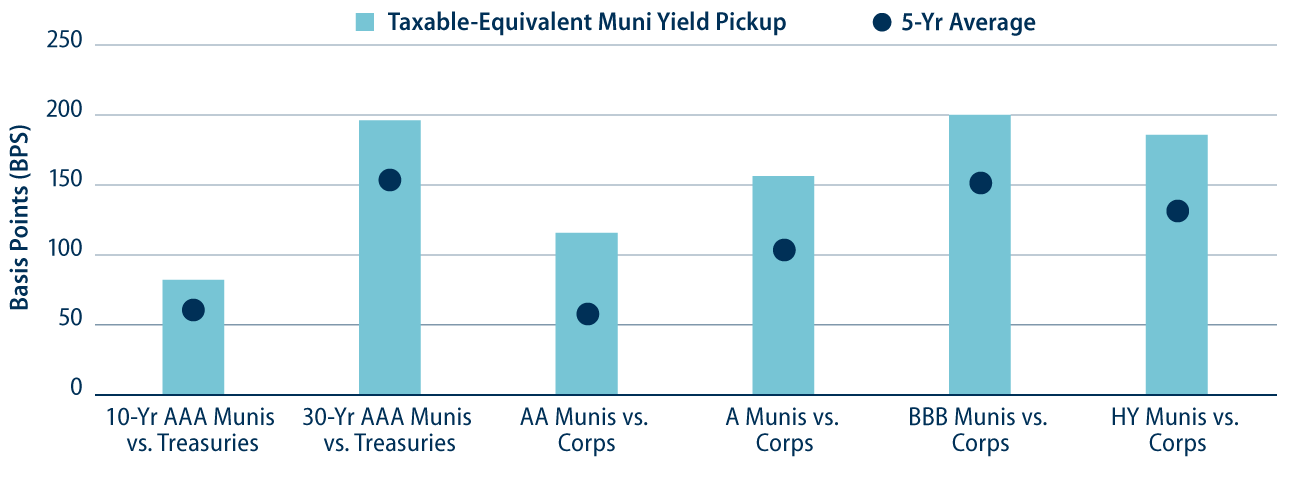

Municipals offer above-average after-tax yield pickup versus taxable counterparts.

Despite the outperformance in October, our view is that municipals continue to offer attractive after-tax income opportunities and a compelling relative value proposition across rating cohorts. The 3.66% average yield-to-worst of the Bloomberg Muni Bond Index remains 44 bps higher than at the start of the year, and equivalent to 6.18% on a taxable-equivalent yield basis for an investor in the highest marginal tax bracket. Comparing municipals to like-rated taxable fixed-income, longer and lower intermediate-grade after-tax spreads remain above five-year averages across most of the yield curve and credit spectrum.