Headline retail sales rose 0.5% in June, on top of a +0.3% revision to the June sales estimate, according to data released today by the Census Bureau. The more closely watched “control” sales measure also rose 0.5% in July with a hefty +0.4% revision to its June sales estimate. (The control measure abstracts from sales at car dealers, service stations, building material stores and restaurants in order to focus on retail sectors catering more to consumer rather than business customers.)

Both motor vehicle sales and prices show substantial month-to-month volatility, which is one reason we and other analysts abstract from them and focus on control sales. In June, vehicle prices declined substantially, but in July, they rose a bit. Apart from these swings, price increases for other retail items were much slower in July than in June.

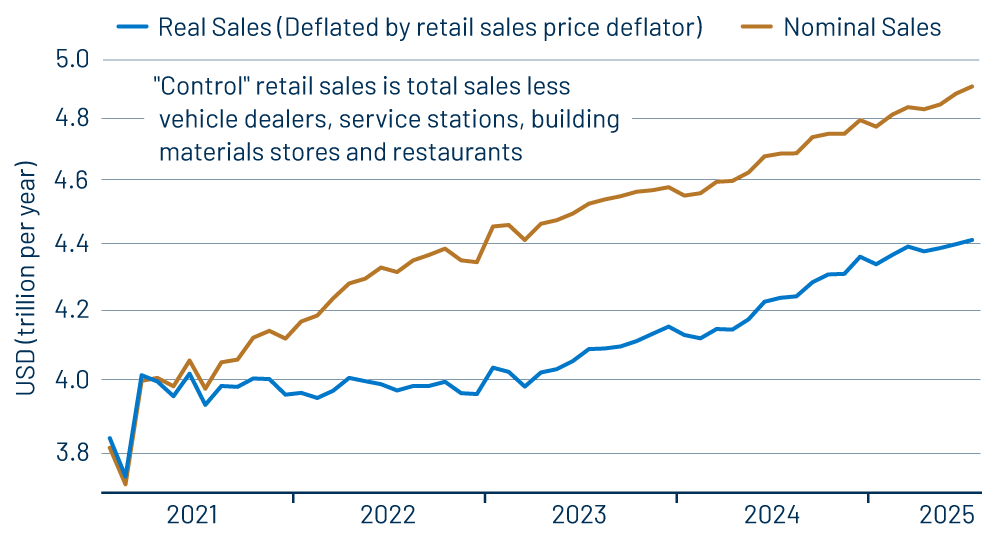

With slower goods price inflation and with both a nice July gain and a substantial upward revision to June, this is a much more favorable retail sales release than what we saw a month ago. It eases concerns about consumer spending we voiced last month (cf. our July 17 post). As you can see in Exhibit 1, real control sales now show some growth from March through July, whereas a month ago they showed no growth from March through June.

These data are also more consistent with economic theory and the effects of tariffs on spending than those of a month ago. As we discussed then, monetary theory would suggest that tariffs have no effect on nominal sales in the long run and instead reduce real sales. However, in the short run, with various “frictions” in place, nominal sales would be expected to rise somewhat and then fall back.

Last month, the data showed steady growth in nominal sales through June and no growth in real sales. This month, with the revisions to May/June and July gains, nominal sales indeed show some recent pickup (relative to preceding trends) and real sales slightly slower growth than in2024. This makes more sense.

A remaining sticking point is spending on services. Services are essentially unaffected by tariffs, and through June services prices decelerated noticeably. Nevertheless, real consumer spending on services started to slow early this year, a few months before merchandise spending slowed (as indicated by real retail sales). This suggested that there was more to the apparent softening in consumer spending than the impact of tariffs alone.

The revisions and July growth paint a better picture of retail sales and, thus, consumer spending on goods. Hopefully, the July services spending data released later this month will echo this more upbeat tone.

Because we are abstracting from momentary vehicle price swings and applying short-term/long-term economic theory concerning tariff effects, this discussion has been more involved than usual. With unprecedented tariff impositions affecting an already complex economic picture, we think these details are worth discussing in order to get to a cogent picture of the data. Thanks for bearing with us.

Beneath all the fur flying, again, we read today’s news as a much more favorable take on consumer spending than the data showed last month. There are still questions to be worked out, but today’s data alleviate many of the concerns we voiced last month.