Real (inflation-adjusted) consumer spending was reported as rising 1.1% in January, following declines of -0.3% in both November and December. Real spending on merchandise rose 2.2% in January, following declines of -1.2% and -1.1% in November and December, respectively. Real spending on services rose 0.6% in January, following gains of 0.2% and 0.0% in November and December, respectively.

In commenting on the retail sales data over the past few months, we mentioned seasonal volatility around this time of year and the difficulty government statisticians have in properly adjusting the data for seasonal fluctuations. The resulting data are therefore very volatile and suspect, and you can see oddities in the various aggregates and components.

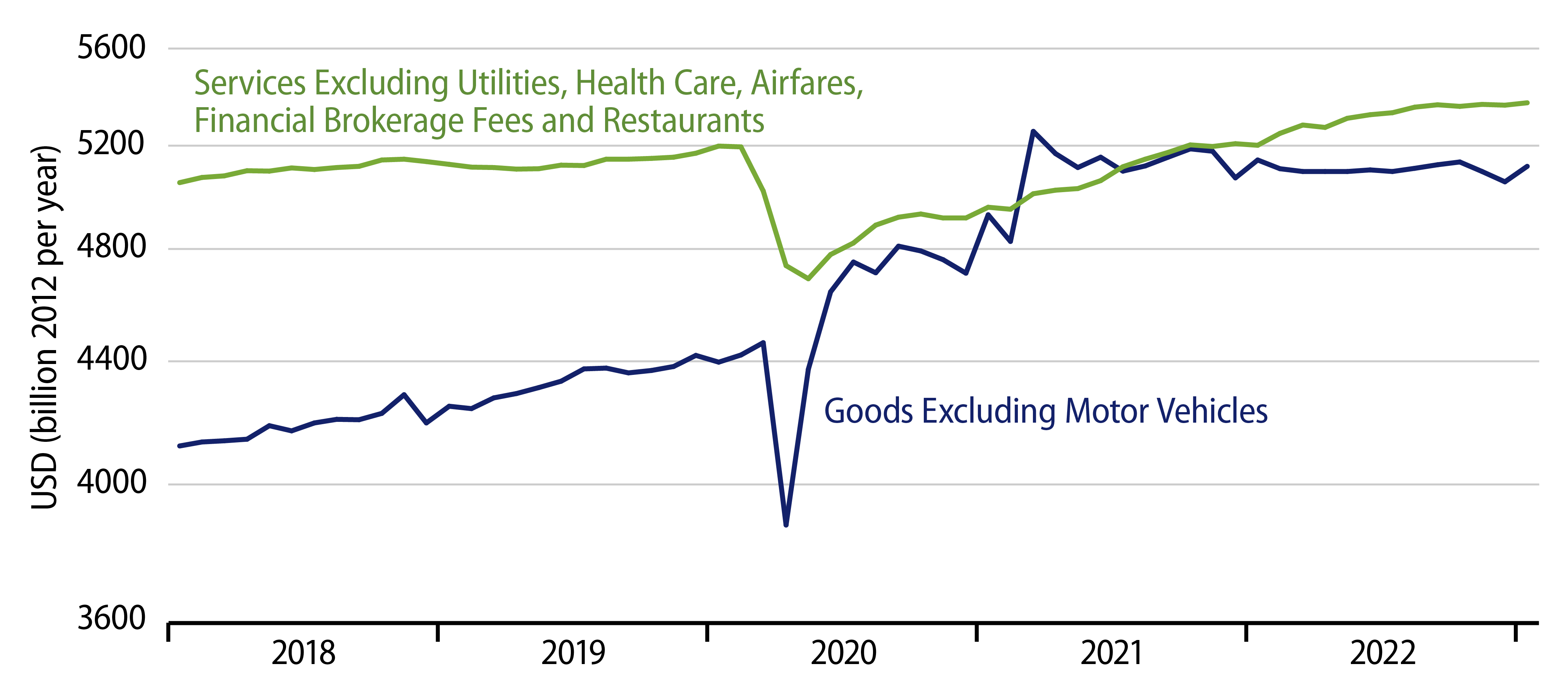

As you can see in the chart, real consumer spending on merchandise other than vehicles has shown sharp bounces in each of the past three Januarys. If anything, the bounce announced for the present January is more modest than the preceding ones. (And, yes, while we have excluded spending on motor vehicles, that component shows even more volatility than—and the same flat trend as—other goods.)

As for services, most of the January gains occurred in health care and food services (restaurants). Granted, health care spending has been growing “healthily” for quite some time. However, this is not discretionary spending, and meanwhile, health care outlays remain well below pre-Covid trajectories, even with the recent increases. As for restaurants, real spending there was down substantially in November and December, only to be reported up sharply in January. This does look to be seasonal noise.

Net of all the noise, goods spending looks to be on the same flat-to-down trend it has followed since March 2021, while services appear to be decelerating. In other words, we disagree vehemently with analysts taking these data as an indication of consumer strength.

Of course, for January at least, a good part of the “softness” we assert comes from an increase in consumer inflation, with the core Personal Consumption Expenditures (PCE) price index rising 0.6% in January after more restrained increases in preceding months. Those folks proclaiming supposed consumer strength in January can also latch onto the above-expectation inflation readings to call for continued Fed rate hikes for quite a while yet.

We could offer a whimper of protest to point out that the three preceding months’ price prints were much more favorable and that January price data could be subject to the same seasonal volatility as are the spending data. However, that rejoinder would not get any traction unless and until upcoming Fed data offset the January readings. In the meantime, financial markets will face tough sledding.