Municipals Posted Positive Returns Last Week

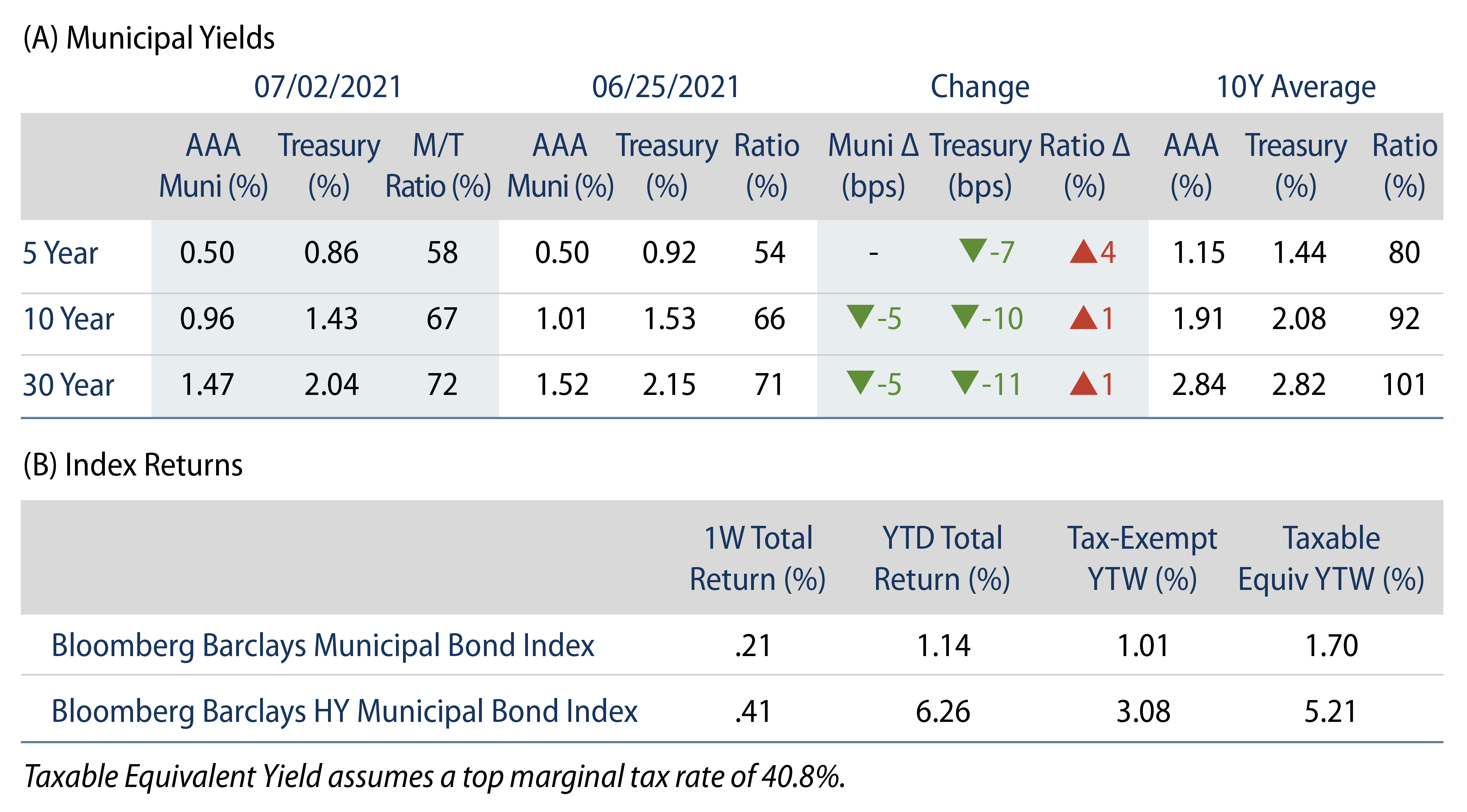

AAA municipal yields moved 5 bps lower in intermediate and long maturities, trailing Treasuries lower. US municipals underperformed Treasuries as Municipal/Treasury ratios moved 1% to 4% higher during the week. The Bloomberg Barclays Municipal Index returned 0.21%, while the HY Muni Index returned 0.41%. Municipal mutual fund flows maintained a record pace as supply declined. Now that we’re halfway through 2021, this week we discuss year-to-date (YTD) performance, technicals and fundamentals in the muni market.

This Week in Munis: Mid-Year Report

Performance

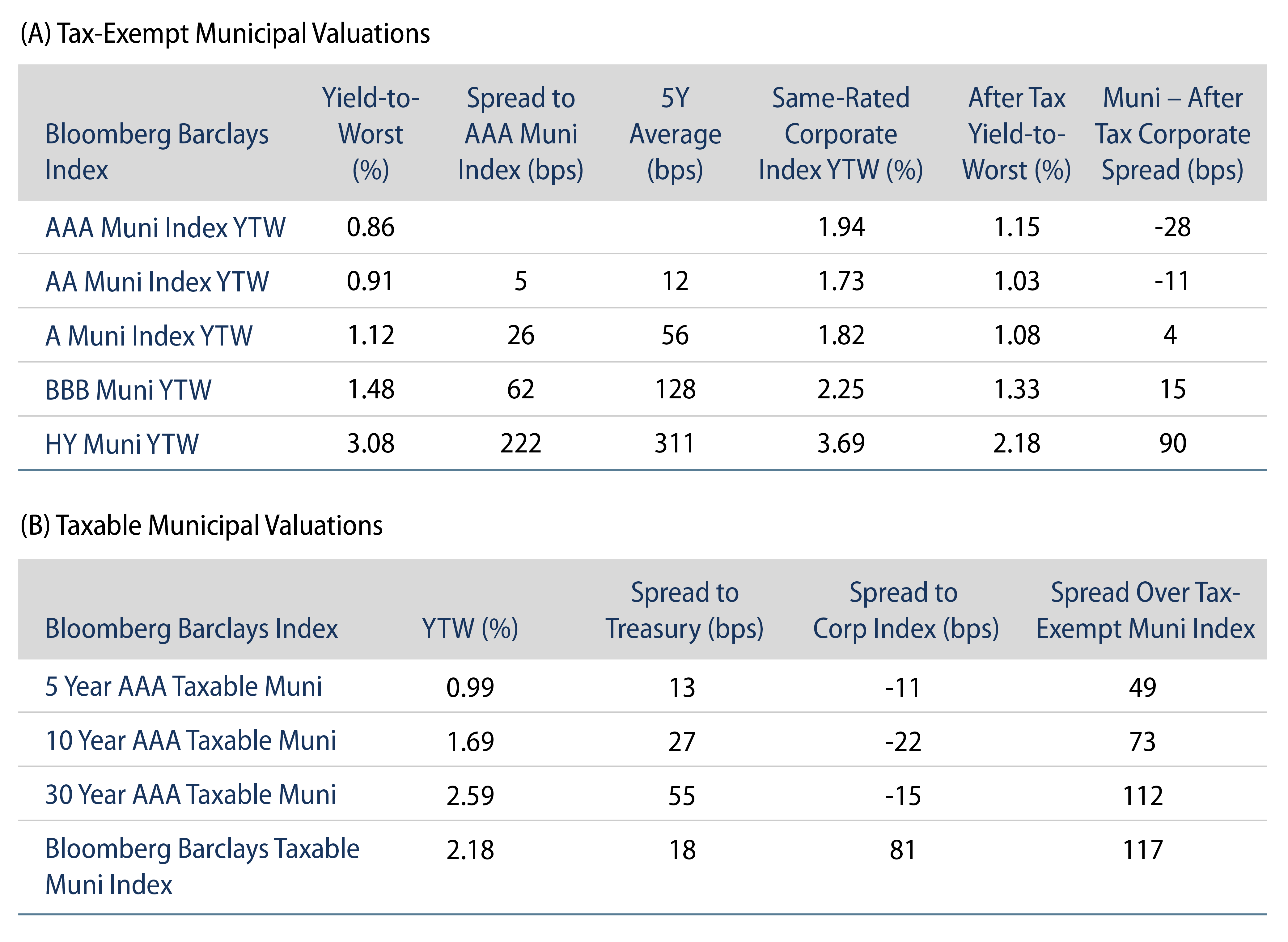

Through the first half of 2021, municipals posted positive performance, shrugging off the negative returns observed in other fixed-income asset classes. The Bloomberg Barclays Municipal Bond Index returned 1.06% and the Bloomberg Barclays Taxable Muni Index returned 0.30% YTD, outperforming the U.S. Aggregate (-1.60%), the U.S. Corporate Index (-1.27%) and the U.S. Treasury Index (-2.58%).

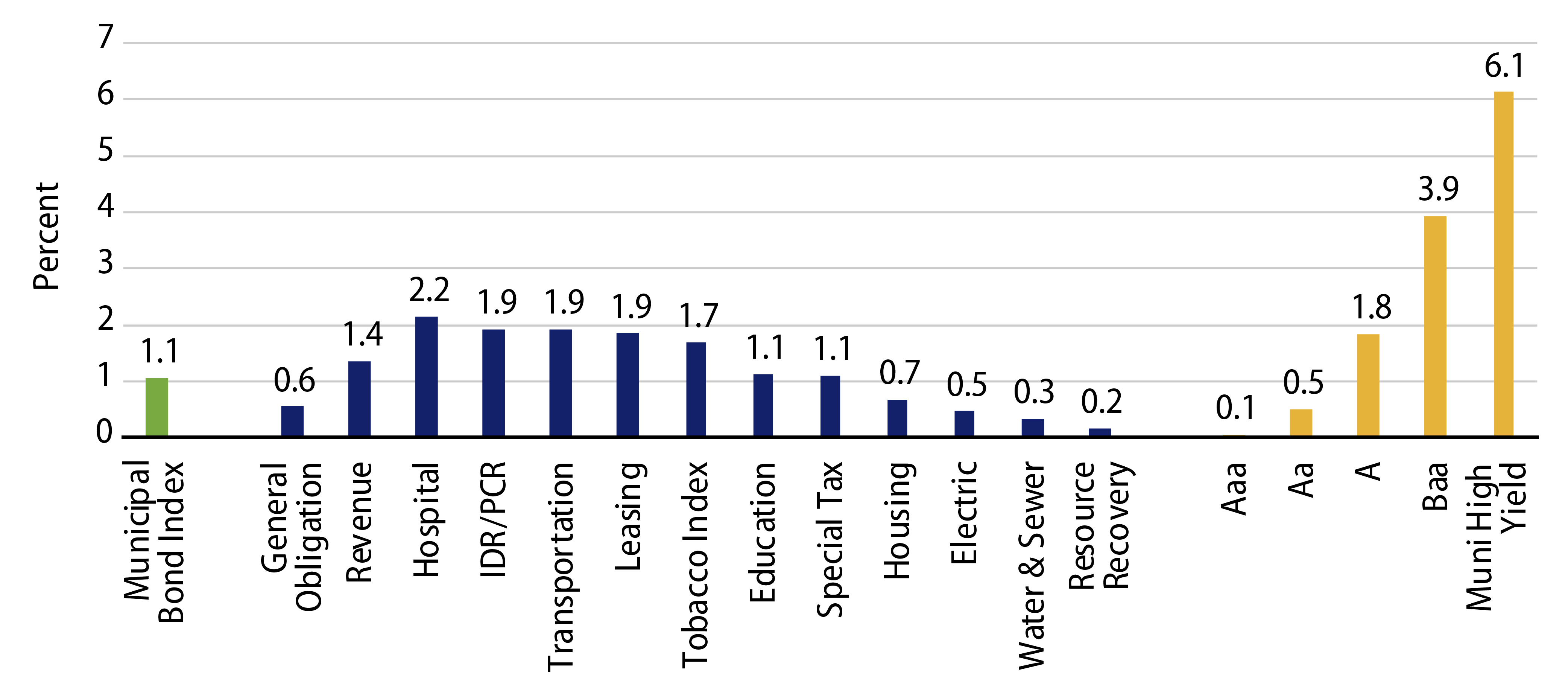

- Curve Returns: Longer-term municipals outperformed through the first half of the year, with the 15-year, 20-year and 22+ year indices returning 1.24%, 1.79% and 2.33%, respectively. The 5-year and 7-year indices underperformed, posting returns of 0.17% and 0.18%, respectively.

- Sector Returns: From a sector perspective, reopening sectors outperformed, with health care and transportation returning 2.15% and 1.93%, respectively. Higher quality water & sewer and electric utility sectors lagged the market, returning 0.34% and 0.47%, respectively.

- Quality Returns: Reversing trends from 1H20, lower-quality municipals were the best performers, with High Yield, BBB and A indices returning 6.13%, 3.91% and 1.75%, respectively. AAA and AA municipal indices underperformed, returning 0.06% and 0.51%, respectively.

Technicals Driving Outperformance

- Higher, Yet Limited Tax-Exempt Supply: Total tax-exempt issuance of $170 billion is trending 21% higher year-over-year (YoY), but is still tracking 18% below the levels observed in 2017 when the Tax Cuts and Jobs Act eliminated tax-exempt advanced refunding.

- Record Tax-Exempt Municipal Demand: Municipal outperformance is largely related to the unrelenting demand for tax-exempt income. Municipal mutual funds recorded inflows at a record pace YTD, at $59.5 billion. Long-term funds recorded $37 billion, high-yield funds recorded $14 billion, and intermediate funds recorded $11 billion of net new capital. Municipal funds observed inflows in 58 of the past 59 weeks, totaling $121 billion. In addition to municipal fund demand, increasing demand from institutional investors, SMA investors and seasonally high coupon reinvestment are supporting a strong bid for the asset class.

- Elevated Taxable Municipal Supply: Taxable municipal supply, including corporate issuance, declined 10% YoY to $66 billion. While rate volatility contributed to modest issuance declines, taxable issuance is still well above longer-term averages at 28% of total municipal issuance as issuers refund outstanding tax-exempt debt through taxable issuance.

- Increasing Taxable Municipal Demand: As taxable issuance has increased, so has the taxable municipal buyer base. According to the Federal Reserve’s flow-of-funds data through 1Q21, primary holders of taxable municipal issuance increased their municipal holdings approximately 7% from 1Q20. Banks increased their holdings 7% to $528 billion, P&C insurance companies increased holdings 5% to $294 billion, life insurers increased muni allocations 8% to $231 billion, non-US investors increased holdings 1% to $104 billion.

Credit Fundamentals and Outlook Improve

Municipal fundamentals continue to improve as economies reopen and ongoing Covid vaccinations progress. According to the Census, major state and local revenues (property, income and sales taxes) were 10% higher in 1Q21 versus 1Q20. Better than expected revenues, combined with direct federal aid measures that will continue to be rolled out, will bolster municipal credit.

The credit improvement is evident in some of the market’s most challenged credits. Just last week, the state of Illinois was upgraded by Moody’s, from Baa3 to Baa2. The upgrade was a stark contrast to the pre-pandemic debate on whether the sixth most populous state would be downgraded to high-yield status.

With valuations retraced fully past pre-pandemic levels, finding relative value in the market is increasingly difficult, and we believe independent credit surveillance is increasingly important. We continue to favor those issuers and sectors that would benefit from a recovery, particularly among transportation, health care and select high-yield issuers. Meanwhile, we believe the market is providing an opportunity to improve portfolio liquidity, providing flexibility in the event of unforeseen market volatility.