Frontier markets continue to defy expectations. After a down year for performance in 2022—during which frontier markets broadly tracked other segments of the fixed-income market amid rising interest rates globally—pundits were quick to write off this segment of the emerging market (EM) asset class. A loss of market access for many issuers stoked fears of cascading sovereign defaults and interminable debt restructuring exercises.

Western Asset, however, held a contrarian view that frontier markets, in aggregate, were sufficiently strong to weather a period of limited or no market access, allowing them to storm back from the 2022/2023 lows as global financial conditions eventually loosened. We also believed that frontier market valuations offered investors a margin of relative safety to compensate for a wide range of potential Federal Reserve (Fed) policy paths and global-growth outcomes.

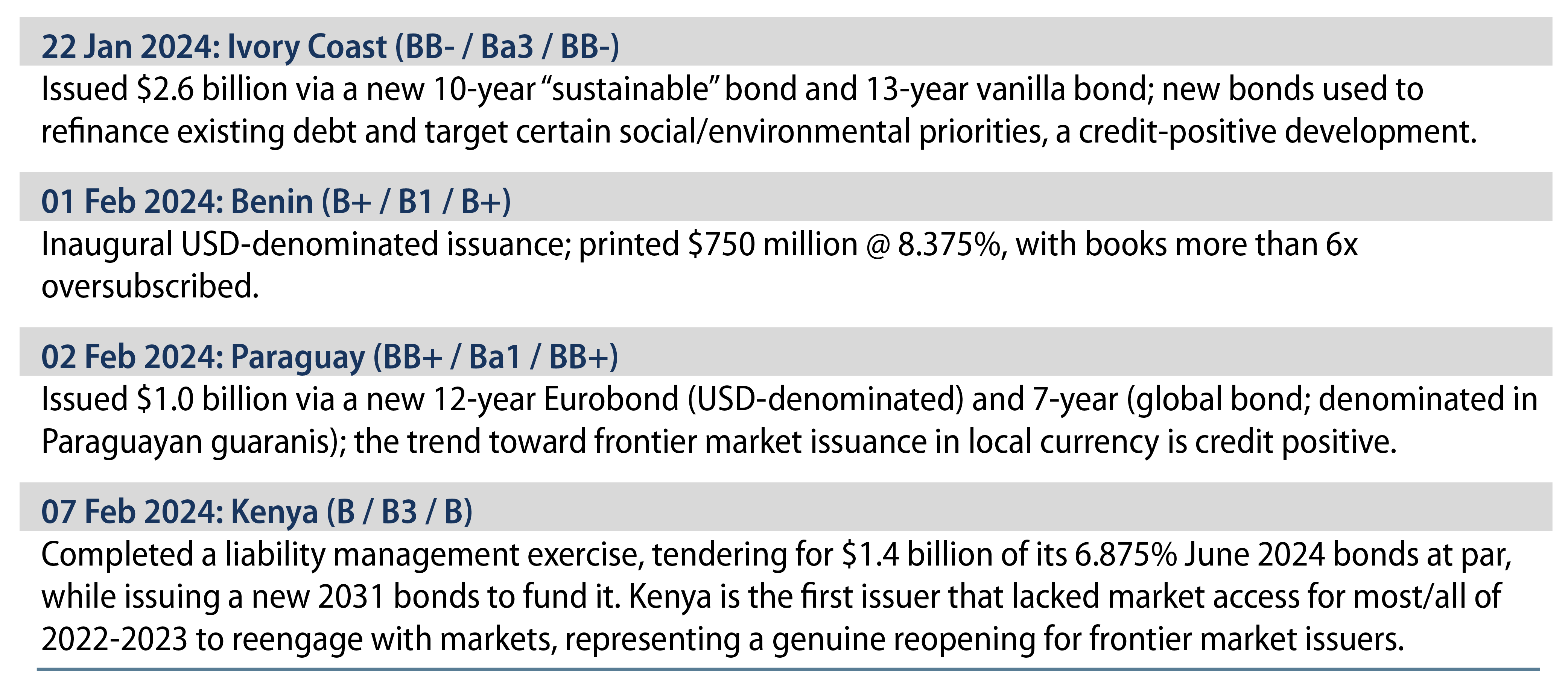

Despite still-brisk macroeconomic headwinds for most of 2023, frontier markets delivered double-digit returns for the full calendar year (21%, according to JPMorgan’s Next Generation Index), in line with our base case. And the new year has started off on a promising note. A number of frontier market issuers have already tapped markets for new external capital (Exhibit 1), and we’re seeing early signals that the primary market is truly beginning to unlock, including (critically) for issuers that lacked market access in 2022/2023. The sea change in frontier market supply/demand dynamics is clearly a healthy development, and likely shifts us into the next stage of the recovery process, which should in turn help cement frontier markets as a viable and potentially rewarding EM fixed-income alternative.

Looking ahead, we believe the market can continue to thaw, even if the Fed doesn’t begin cutting rates until later this year. Frontier market sensitivities tend to be more elevated to the US term premium and broader risk sentiment. In that context, we believe as long as there’s no re-acceleration of US inflation, ensuring that we have indeed reached the peak for US policy rates, frontier markets can continue to perform well, keeping markets open. While the total volume of supply is not overly useful to forecast, we would expect five to 10 additional countries to approach markets if global financial conditions broadly remain stable. This mix will likely include some countries that—like Kenya—lacked access to external capital for most of the 2022-2023 period. While continued market access is by no means the only way that frontier markets can perform strongly this year, it would be a very welcome tailwind.

These “success” stories weren’t obvious in the depths of the summer 2022 selloff (or at many points throughout 2023). Yet, identifying them early has proven a successful investment recipe in the past. Our research process at Western Asset is built to do this work, while experience helps guide the risk-taking process, which seeks to use valuations as a risk-mitigation strategy.