With Western Asset’s outlook for 2020 calling for US growth to remain steady, improving domestic conditions in the eurozone and an acceleration in EM growth, one might expect spread sectors to remain favorable this year. But considering the strong rally across spread sectors in 2019, where can investors look for attractive returns and limited duration exposure in 2020?

Bank loans continue to demonstrate a compelling yield on both a relative and absolute basis. With the S&P LSTA Index currently exhibiting a coupon of 5.3% and an average dollar price of 97.3%, investors have the opportunity to invest at a current yield of 5.5% or a discounted 3-year spread of LIBOR +441 bps. As investors have taken notice of this opportunity, we have seen a strong start to the year for the asset class with loan returns already up 0.81% in the first 24 days of the year. Despite the strong move, investors may not have missed out on the opportunity with further market value upside potential this year as well as significant interest income opportunity relative to other fixed-income options.

In addition to the return profile, another attractive feature of bank loans for investors in the current market environment is the very limited duration profile. Bank loans are floating-rate vehicles in nature and are based on either a 1-month or 3-month underlying LIBOR contract, thus helping to insulate the asset class from rate volatility.

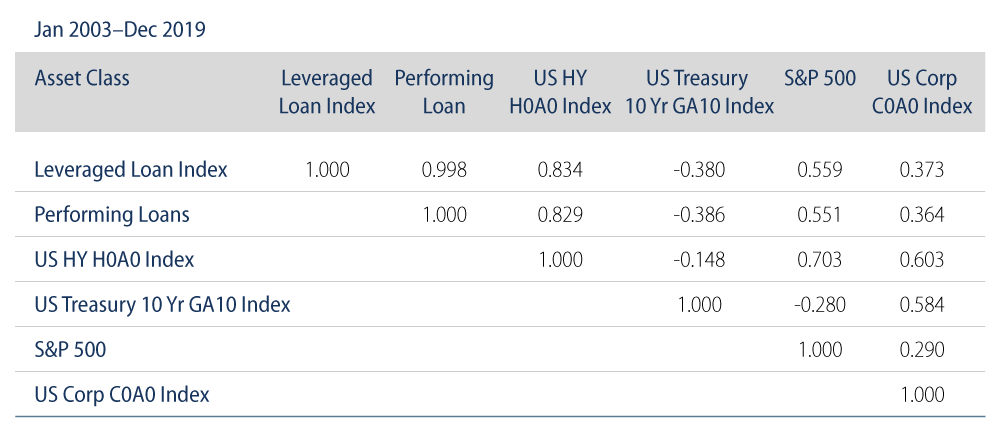

Finally, investors may benefit from bank loans’ potential to provide strong diversification benefits given their relatively muted correlation to equities, investment-grade bonds and Treasuries. Given our outlook for a stable fundamental backdrop in 2020, we believe it’s likely that bank loans will be a stand out performer in fixed-income this year.