Durable goods order rose a strong 3.4% in January, and even excluding volatile transportation equipment, “core” durables orders were up a nice 1.4%, with both series also seeing substantial revisions to the previously announced December data. Within durables, orders for capital equipment other than aircraft were up 0.5%, with an even larger upward revision to December.

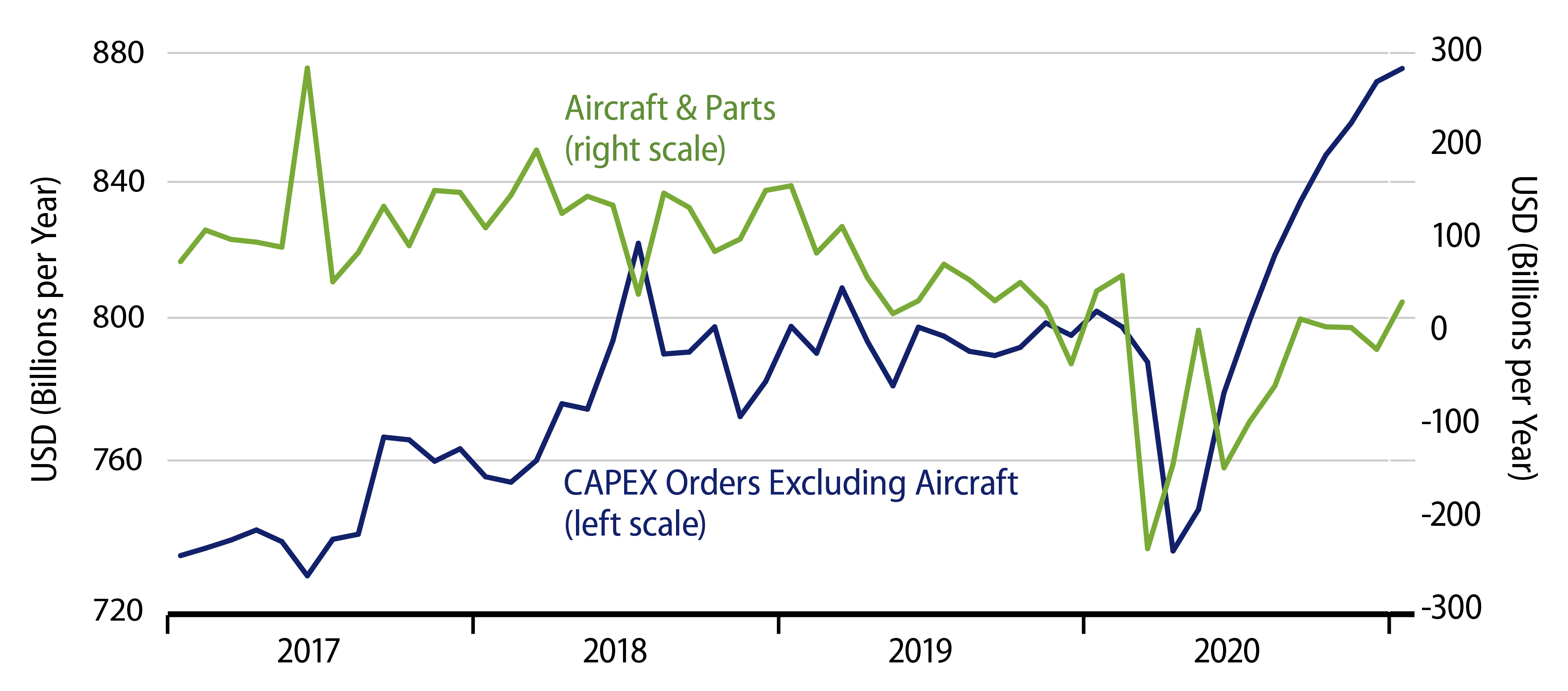

We reported two weeks ago that January retail sales data portrayed a strong consumer. Today’s durables data paint an equally strong manufacturing sector and strong demand for investment. Of the three series mentioned above, the capital goods’ gains might sound the least impressive, but consider Exhibit 1. January CAPEX orders were over 9% above pre-pandemic highs.

One might counter that after the horrendous declines during the March/April shutdown, we need higher levels of capital goods orders to make up for lost time. However, a 12-month average of capital orders is itself 2.2% above pre-pandemic highs—and this for a series that had shown zero growth over 2018-19.

In other words, averaging shutdown recession with reopening recovery, capital goods orders are on net stronger than what we saw prior to Covid. The same can be said of manufacturing in general. Not only has manufacturing activity in general fully rebounded above pre-pandemic highs, it has held sufficiently above those levels long enough to more than make up for output lost during the pandemic shutdown last spring. This is also true for investment demand, consumer spending on merchandise and housing construction.

We think the US economy can grow by as much as 7.5% this year. Such growth would merely offset the losses seen during the shutdown and return GDP to the 2.3% growth trend path it had been on prior to the pandemic. However, ALL that growth is likely to occur in the services sectors, which are still seeing output levels 6% below those prior to the pandemic.

In contrast, recovery is essentially complete in the manufacturing and construction sectors, and little further growth from these can be expected in 2021 without risking overheating. In order to get service sectors recovering at the paces seen within manufacturing and construction, these sectors must first be reopened. That, more than any stimulus from Washington, will be the sine qua non for strong growth in 2021.