Muni Returns Were Relatively Unchanged During the Week

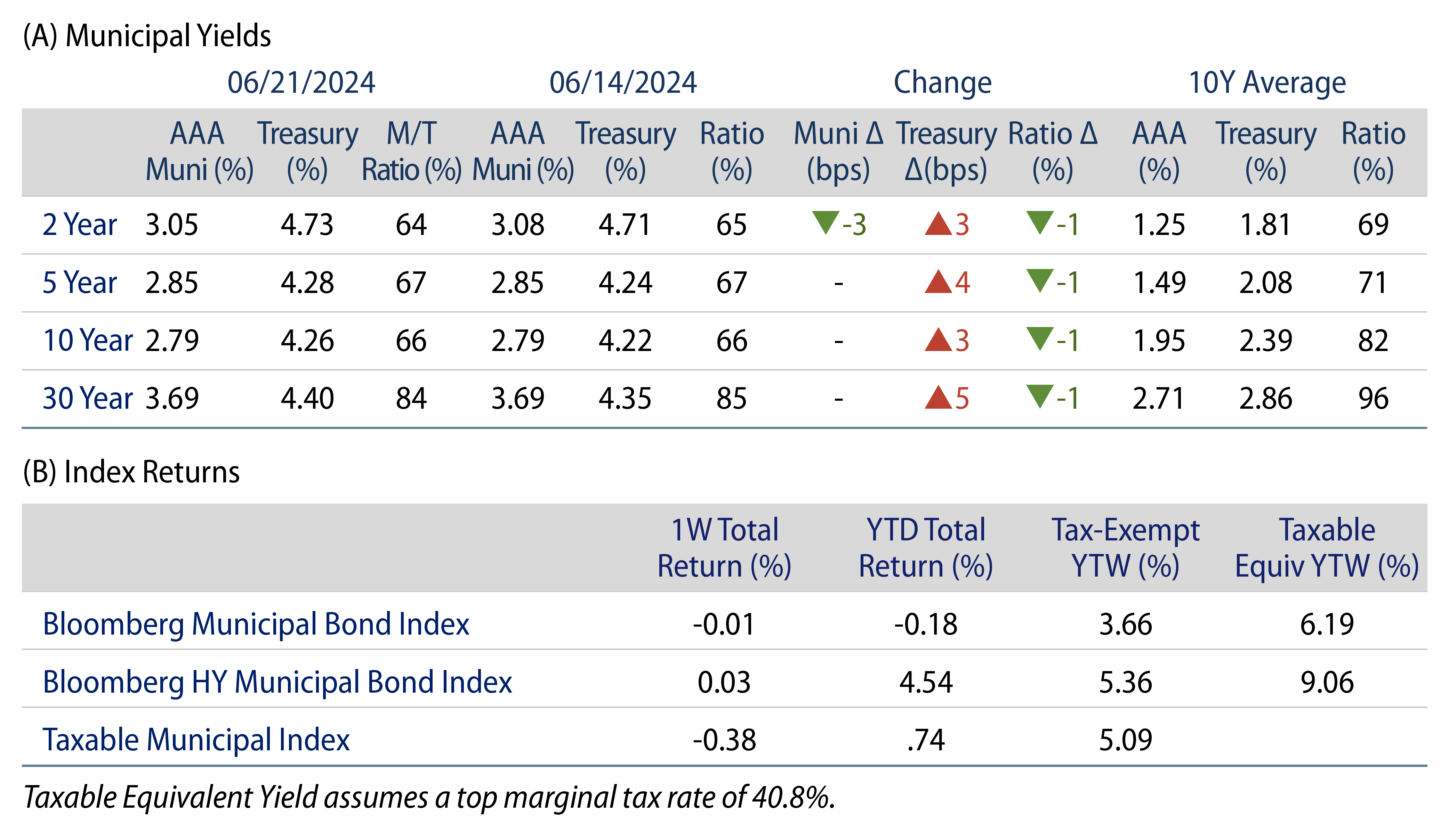

Municipal returns were relatively unchanged but outperformed Treasuries, which moved higher during the week on relatively hawkish Federal Reserve (Fed) dialogue. Supply declined week-over-week but remained near elevated levels. The Bloomberg Municipal Index returned -0.01% during the week, the High Yield Muni Index returned 0.03 % and the Taxable Muni Index returned -0.38%. This week we provide an update on state and local tax collections.

Supply Remained Elevated Amid Modest Fund Inflows

Fund Flows (up $16 million): During the week ending June 19, weekly reporting municipal mutual funds recorded $16 million of net inflows, according to Lipper. Long-term funds recorded $189 million of inflows and high-yield funds recorded $249 million of inflows. Meanwhile, intermediate funds recorded $3 million of outflows and short-term funds recorded $123 million of outflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $11.8 billion.

Supply (YTD supply of $226 billion, up 44% YoY): The muni market recorded $9 billion of new-issue volume last week, up 6% from the prior week. YTD issuance of $226 billion is 44% higher than last year’s level, with tax-exempt issuance 48% higher and taxable issuance 6% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $12 billion. Largest deals include $1.5 billion City of Los Angeles Tax and Revenue Anticipation Notes and $1.0 billion Massachusetts Bay Transportation Authority transactions.

This Week in Munis: State and Local Revenue Growth Remains Resilient

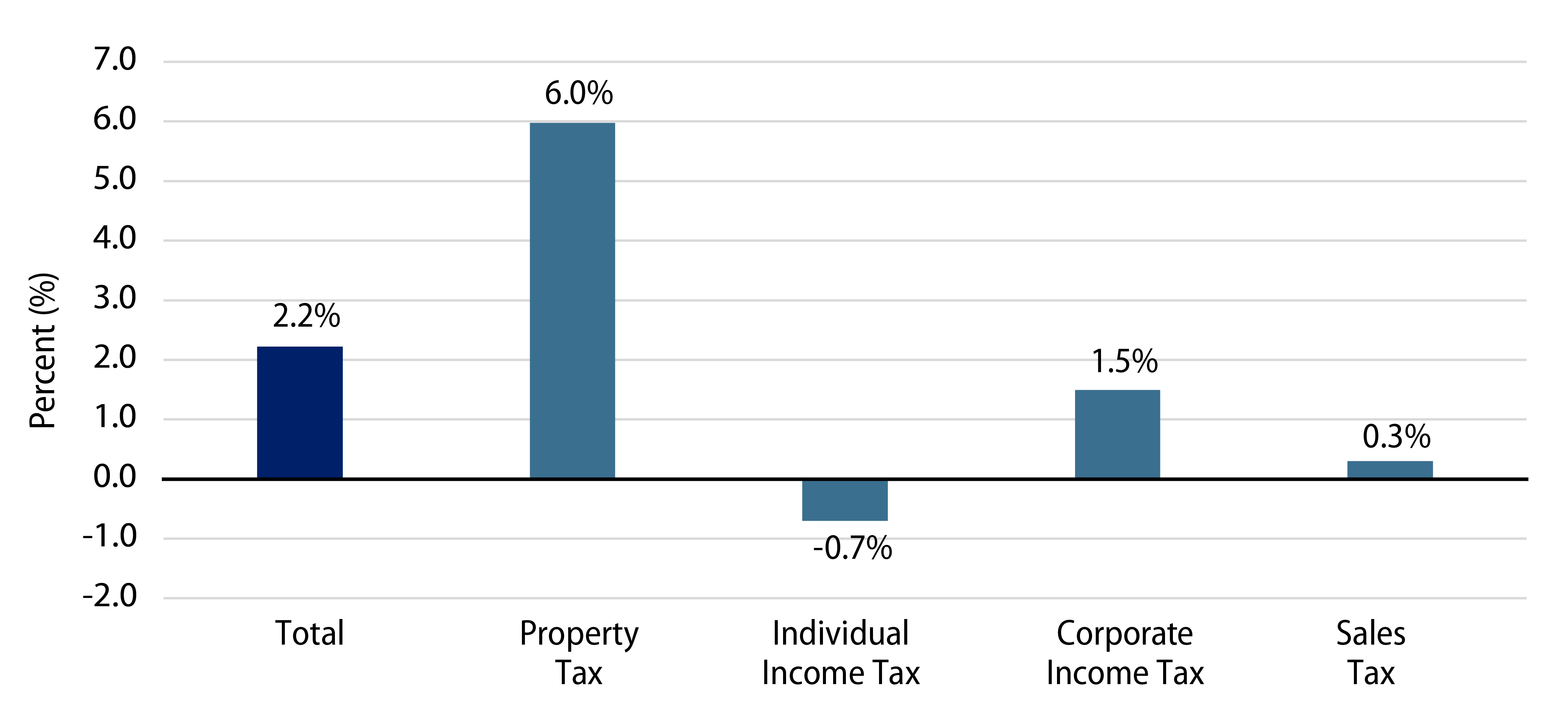

Earlier this month, the Census released 1Q24 state and local revenue estimates, highlighting resiliency in overall state and local tax collections. First quarter major state and local government tax collections grew 2.2% from 1Q23 levels, to $487 billion. Among the major state revenue sources, individual income taxes declined 0.7% YoY, while corporate income and sales tax collections increased 1.5% and 0.3% YoY, respectively. Property tax collections, the primary source of revenues for local governments, increased 6.0% YoY to $195 billion.

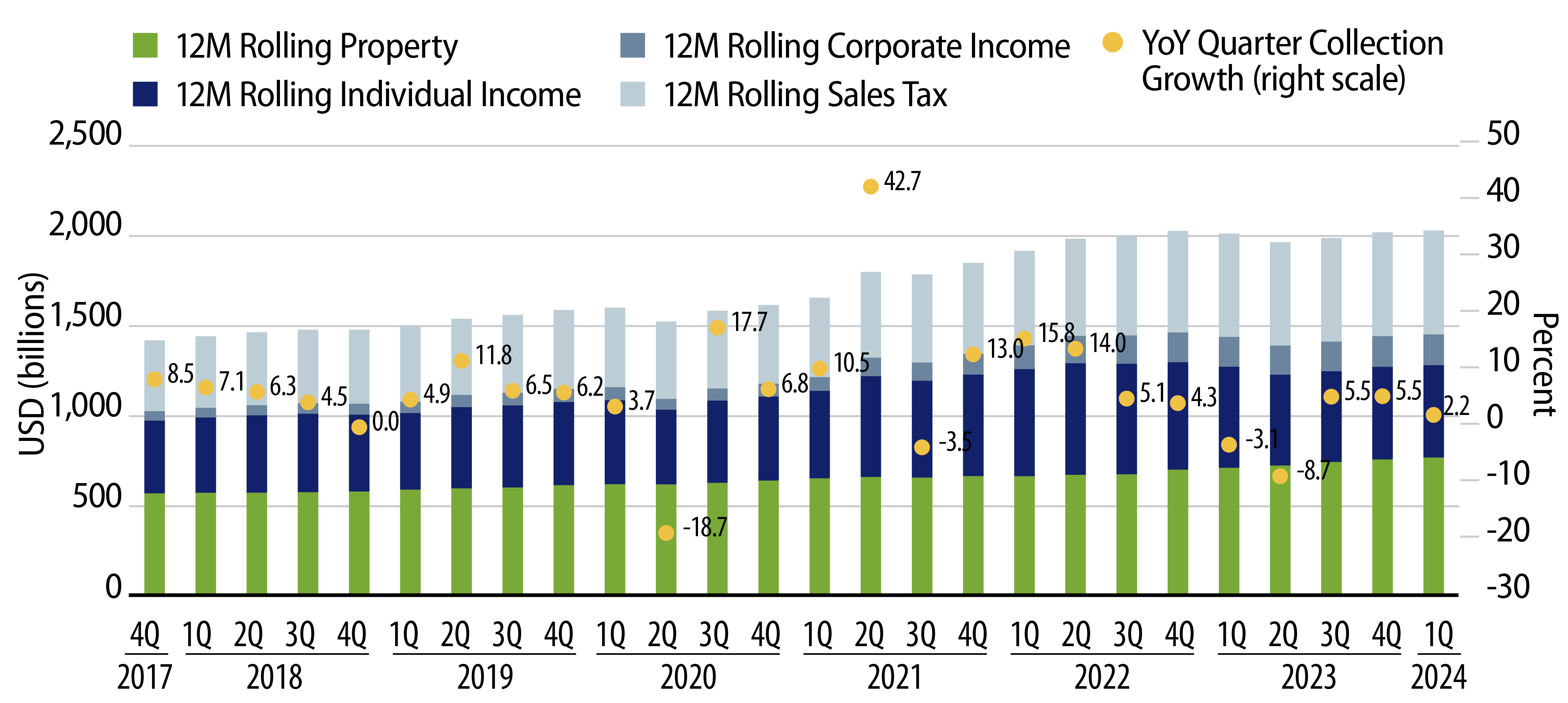

Four-quarter trailing tax collections increased 0.9% YoY to $2.03 trillion. On a 12-month trailing basis, individual income tax collections declined 8.6% YoY, while corporate income tax and sales tax collections increased 3.3% and 0.6%, respectively. Property tax collections also recorded the strongest trend higher, growing 8.0% YoY.

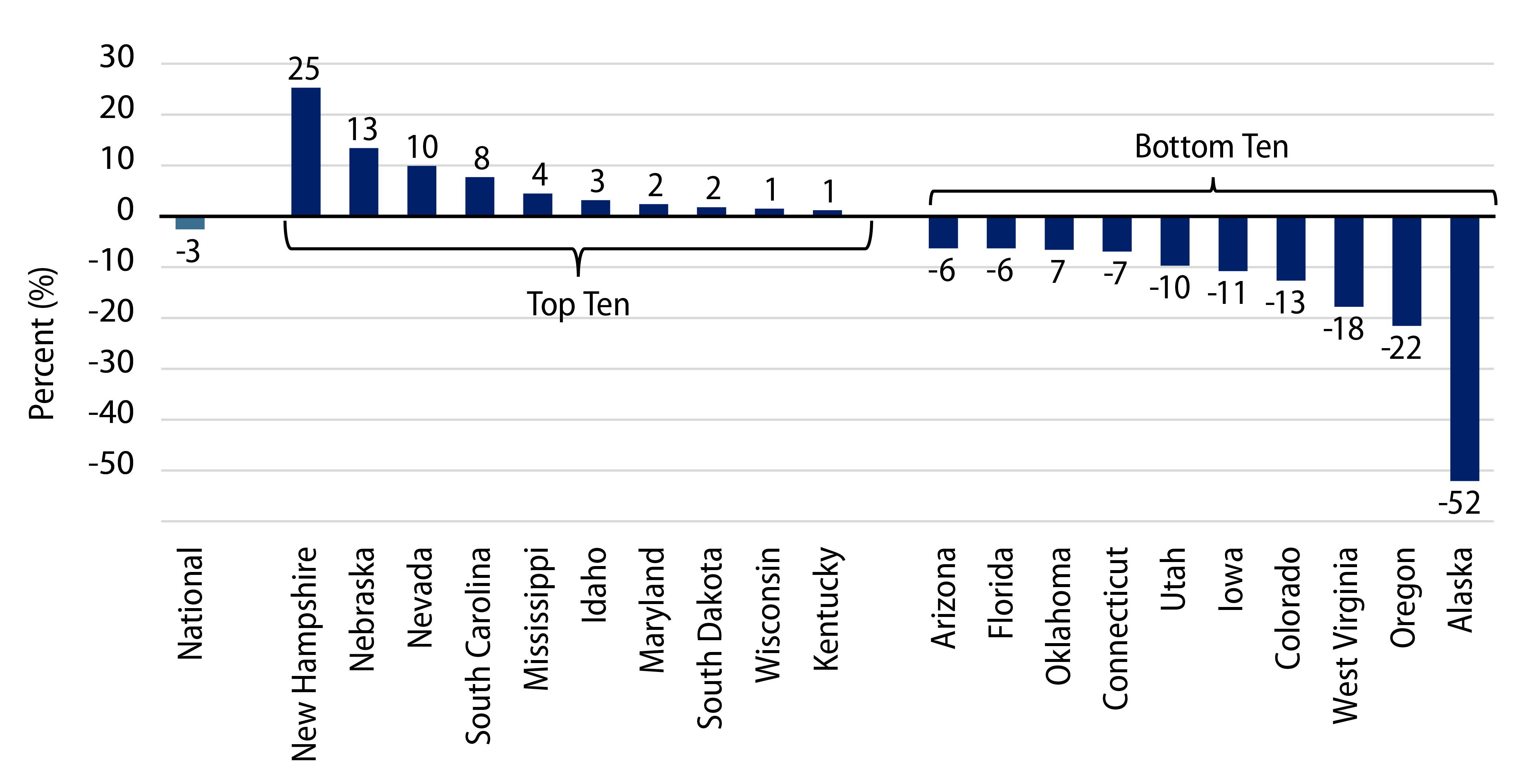

From a state perspective, the Census estimates that the majority of states recorded revenue declines in the four quarters ending March 31, and average state revenues declined 2.6% during the year. On a YoY basis, New Hampshire (+25%), Nebraska (+13%) and Nevada (+10%) recorded the highest growth in estimated tax revenue, while Alaska (-52%), Oregon (-22%) and West Virginia (-18%) recorded the greatest tax collection declines.

The continued growth of tax collections highlights the resiliency of municipal credit, despite signs of slower economic growth. The local government sector remains the largest sector of the municipal market and continues to be supported by a strong real estate market and robust property tax collections. While most states recorded YoY tax revenue declines, a sound labor market and a strong consumer base should be supportive of revenues. We expect elevated cash balances to support municipal credit over the medium term.

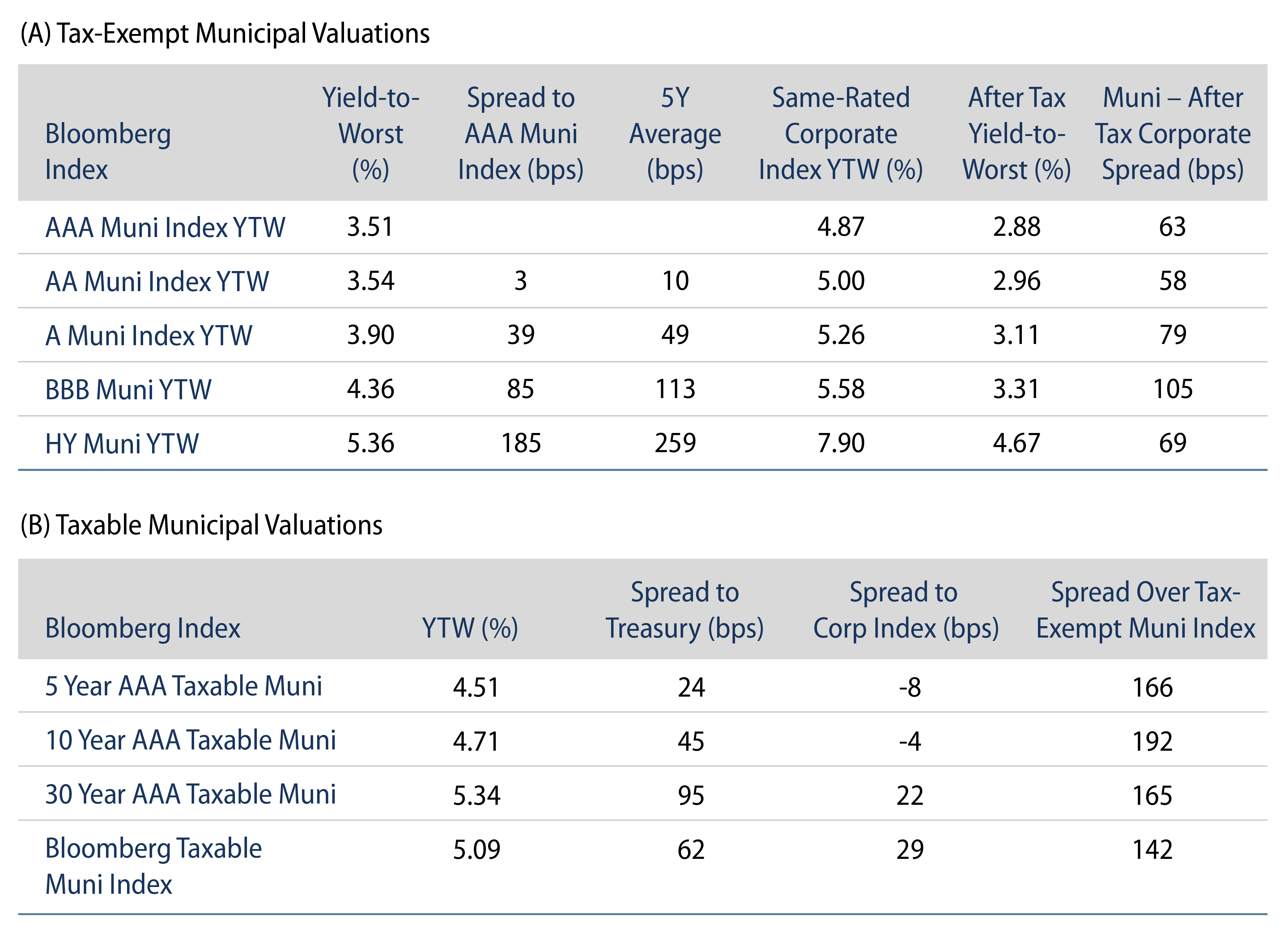

Municipal Credit Curves and Relative Value

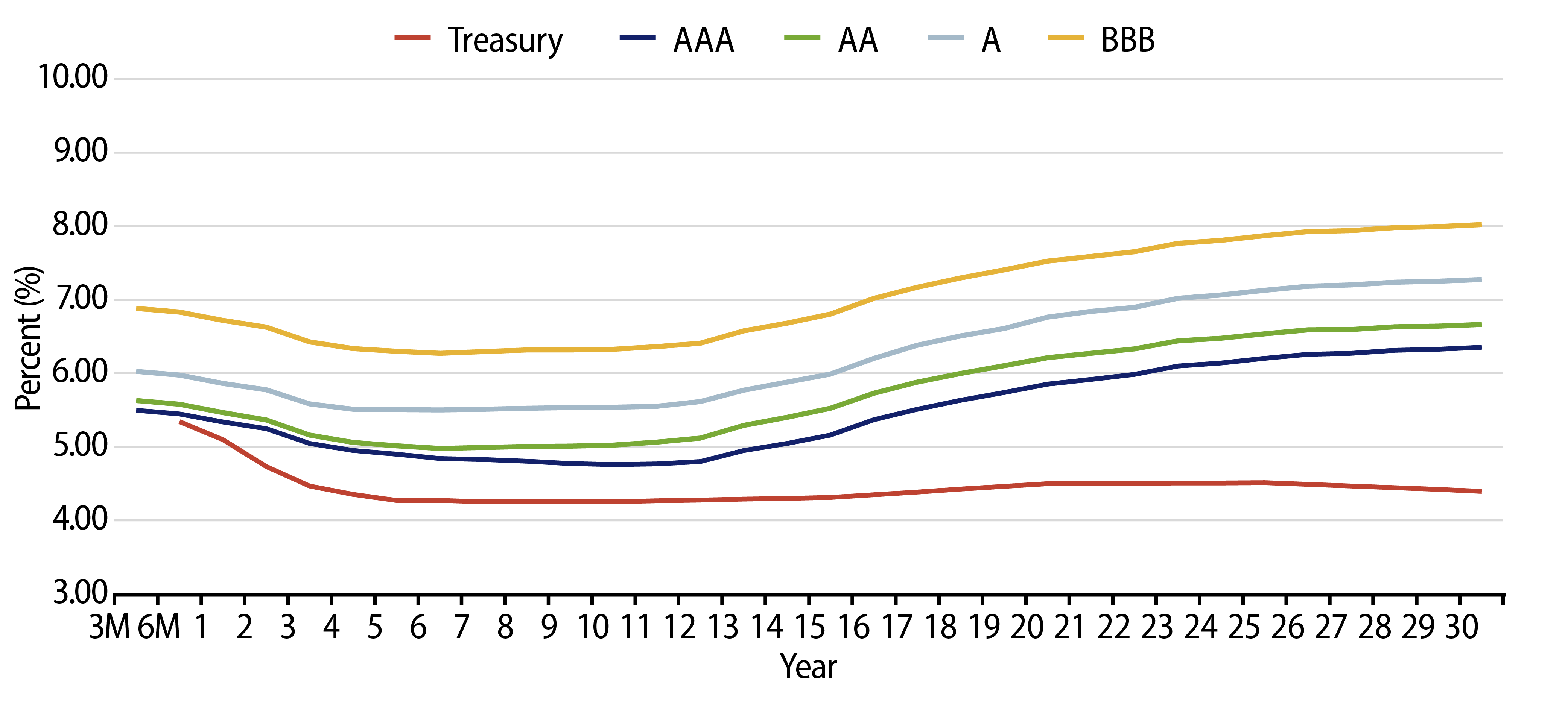

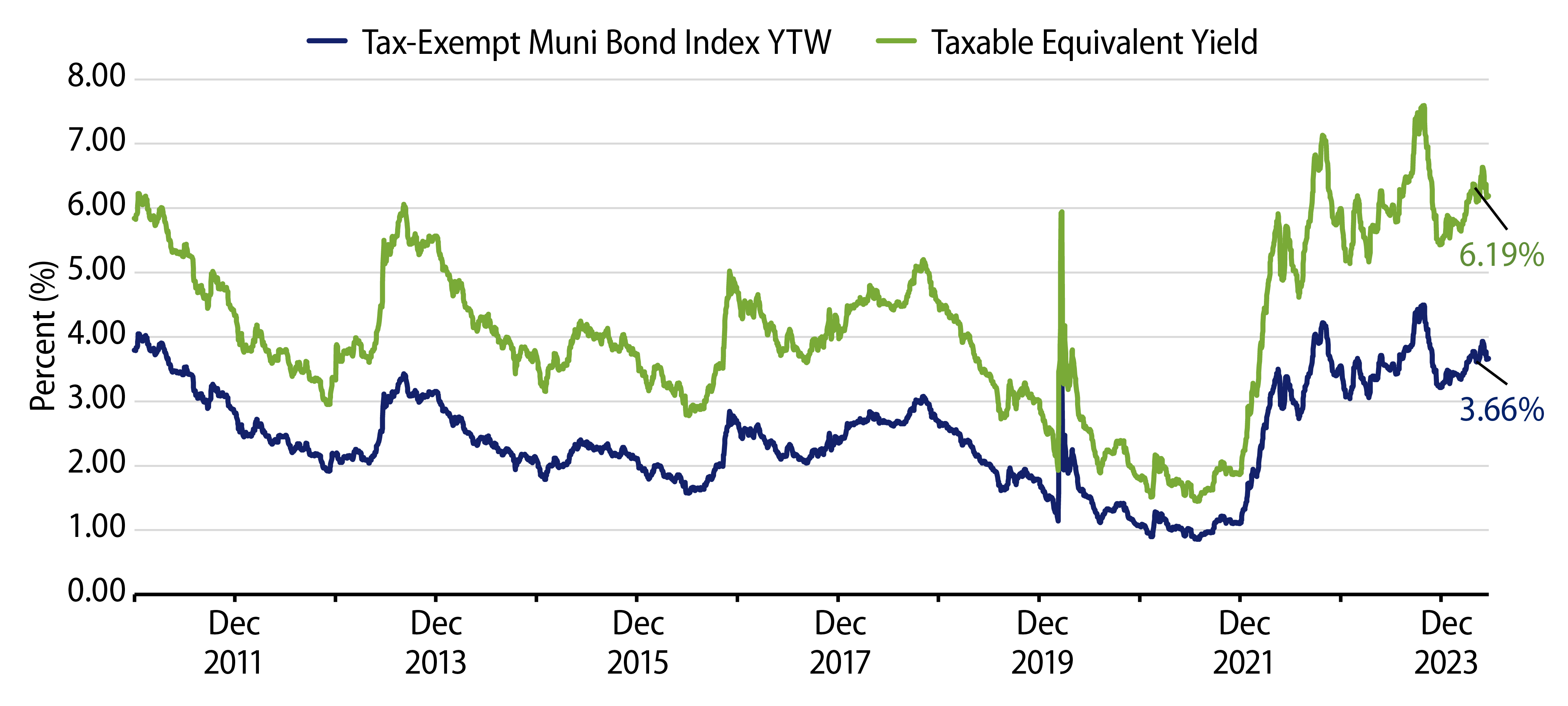

Theme #1: Municipal taxable-equivalent yields are above decade averages.

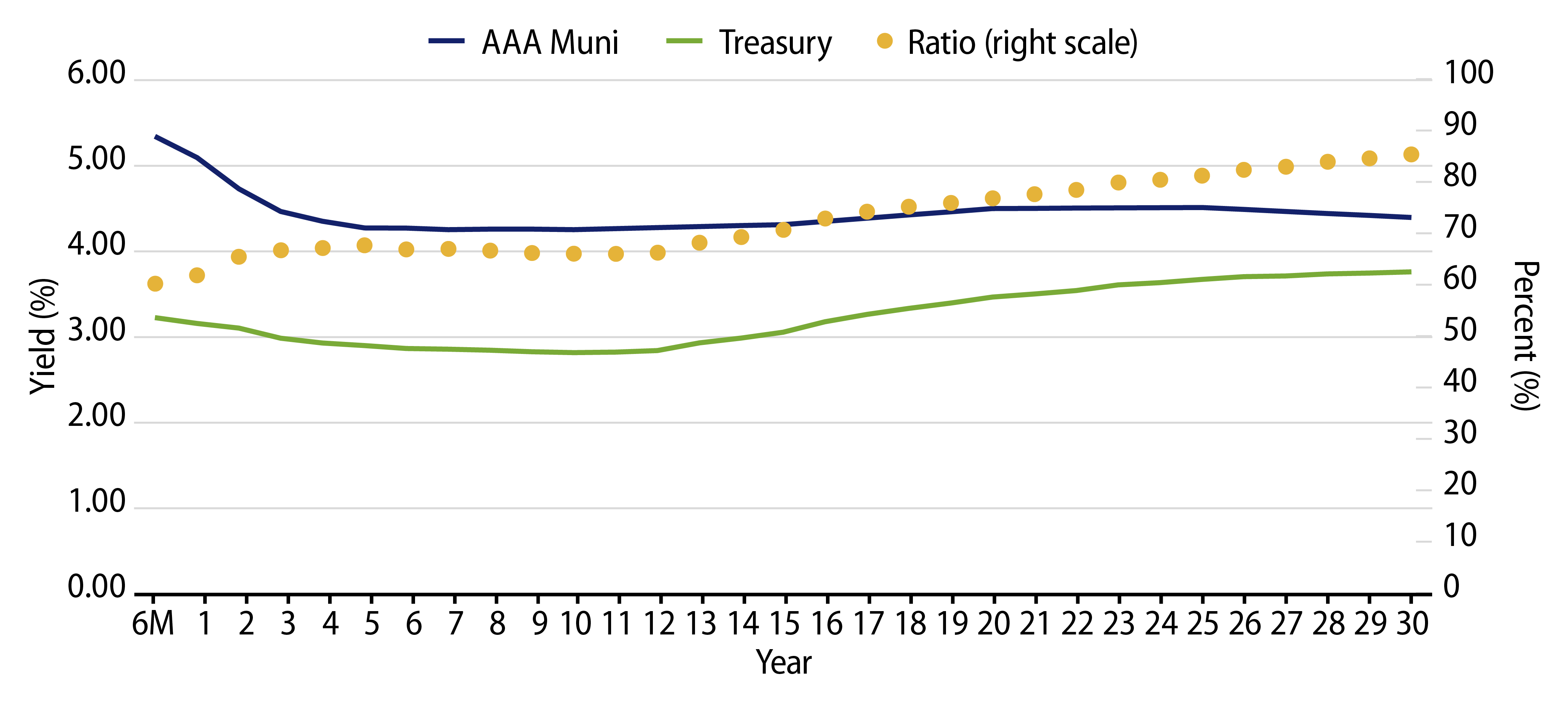

Theme #2: The muni yield curve has disinverted in recent weeks, but bar-belled value remains.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.