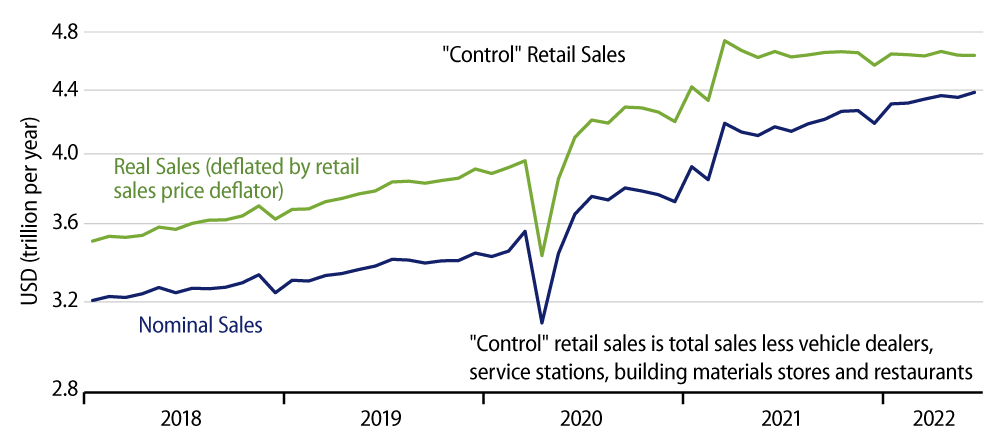

Headline retail sales rose by 1.0% in June, with the May sales estimate revised upward by 0.1%. The more widely watched control sales measure (sales excluding motor vehicle dealers, service stations, building material stores and restaurants) rose 0.8% in June, with a -0.1% revision to May’s estimate. With goods prices up 2.0% in June and goods prices excluding food and energy up 0.8%, it is clear that essentially all of the June sales rise reflects higher prices rather than any increase in actual sales volume.

Indeed, real “control” sales have been slowly but steadily declining for the last 15 months, so the June declines are nothing new. The June declines—net of inflation—were actually somewhat milder than we had seen over the last six months, but this might merely reflect the fact that May’s declines were especially sharp. Actual retail prices through May are reflected in the chart, with June prices estimated from the Consumer Price Index (CPI) release.

In terms of various store types, the largest sales gains were at gas stations, with nominal (dollar) sales up 3.6%, but that, of course, was where prices rose most sharply, with gasoline prices up 11.2%. The fact that gasoline sales fell so sharply net of inflation, even in the first month of the summer driving season, indicates that consumers are beginning to adjust to higher prices by changing their lifestyles. True, this reflects the pain of higher prices, but it also is part of the economic process by which market forces will eventually redirect economic resources and work to lower gas prices.

The other area where nominal sales gains were notable was non-store merchants, reflecting mostly the online behemoths. There, we reckon that real (inflation-adjusted) sales were up 1.3% in June. However, that follows a -1.5% real drop in May, so even there, the recent trend is flat or falling in real terms.

Elsewhere, sales were generally down further in June when price changes were allowed for. The exceptions were slight likely real gains for books and sporting goods stores, furniture stores, and for restaurants. Among these, only restaurants have shown any ongoing gains net of inflation in recent months. Those gains reflect further post-Covid reopenings and are more than offset by declining real sales at grocery stores.