Headline Consumer Price Index (CPI) inflation bounced to a 0.4% increase in August, which annualizes to a 4.7% rate. The more closely watched core CPI (excluding food and energy) bounced similarly, to a 0.3% increase, which annualizes to a 4.2% rate. With headline inflation slightly above that of core inflation, food and energy prices indeed contributed to the inflation bounce, rising 0.5% and 0.7% respectively. However, higher rates of inflation were registered across the board for major components of the CPI.

Thus, core goods prices rose 0.3%—3.4% annualized—compared to slight declines seen most of last year prior to the imposition of widespread tariffs. Core services prices rose 0.3%—4.3% annualized—similar to what we saw in 2023 and 2024, but up from the very low services inflation readings registered for March through June.

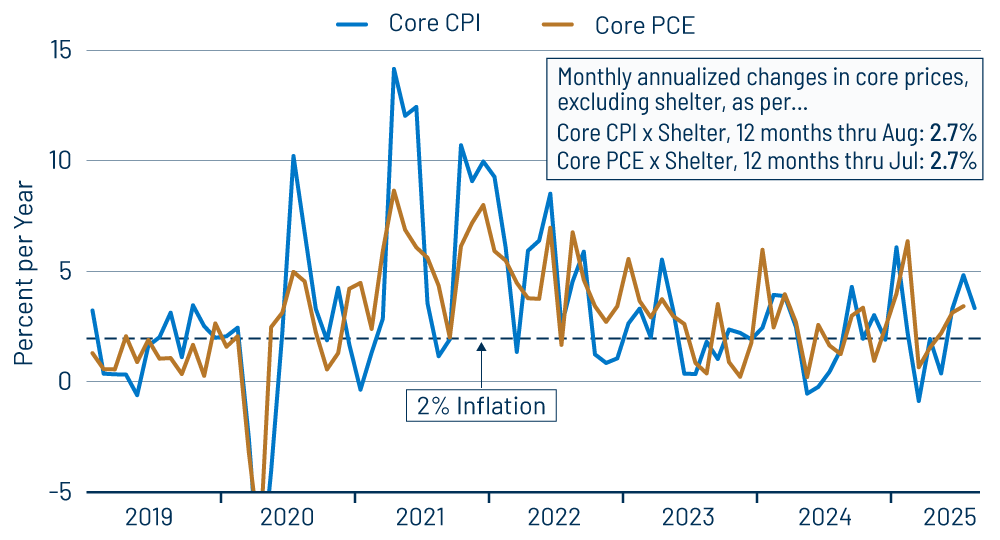

Previously, we had talked a lot about possible overstatements of shelter prices within the CPI and how these had become more moderate over the last year. Well, shelter costs also bounced a bit in August, with both renter and homeowner costs up 0.4%, compared to gains of around 0.3% earlier this year.

The difference between reported shelter cost inflation and inflation for other services is still much smaller than what we saw through early 2024, and we will likely phase out our focus on inflation excluding shelter costs. Still, for the record, August CPI inflation showed a (mild) bounce in shelter costs, as well as similarly elevated gains for other services, core goods, food and energy.

This will no doubt give the Federal Reserve (Fed) some pause in its deliberations concerning rate cuts. The recent inflation numbers are not horrible, but they are elevated from what we saw last year, even in sectors not clearly affected by tariffs. The Fed will pay attention to softening labor markets as well as the bounces in prices, but it is not going to cut rates as aggressively as it might have, thanks to the continued issues with inflation.

Speaking of labor markets, the benchmark revisions announced by the Labor Department earlier this week are in line with the comments in our post last Friday. There, we stated that job gains had generally ceased in sectors other than health care and social services, and a slower growth trend for job growth had been in place since early 2023. This was punctuated, however, by a bounce in job growth in late 2024.

Well, our guess is that much of the -880,000 revision announced for private-sector payroll jobs will work to remove that currently reported late 2024 job growth bulge and indeed leave the resulting trend as slowing steadily since early 2023. Perhaps tellingly about the announced downward revisions, most of them occurred in sectors other than health care and social services. That is, jobs in health care and social services were revised down only very slightly. So, it looks as though when revised data are finally released next February, sectors other than health and social will show near-zero growth from 2023 on, with almost all the job gains since 2023 occurring in health and social—two sectors heavily reliant on government support.