Private-sector jobs rose by 140,000 in May, though that gain was substantially offset by a -77,000 revision to the April jobs total estimate. This marks the fourth straight month that previous jobs data were revised down substantially, with today’s revisions to April by far the largest.

There are two conflicting aspects of the data and their revisions, which we should point out. First, upon adjusting for the revisions, today’s jobs news was hardly the “strong” report that early financial press releases today made it out to be. The May private-sector employment level is just 63,000 higher than what was announced for April a month ago. Second, and more importantly, job growth looks remarkably steady in recent months. There is no tangible sign of a significant slowing in job growth, tariff and trade war fears notwithstanding.

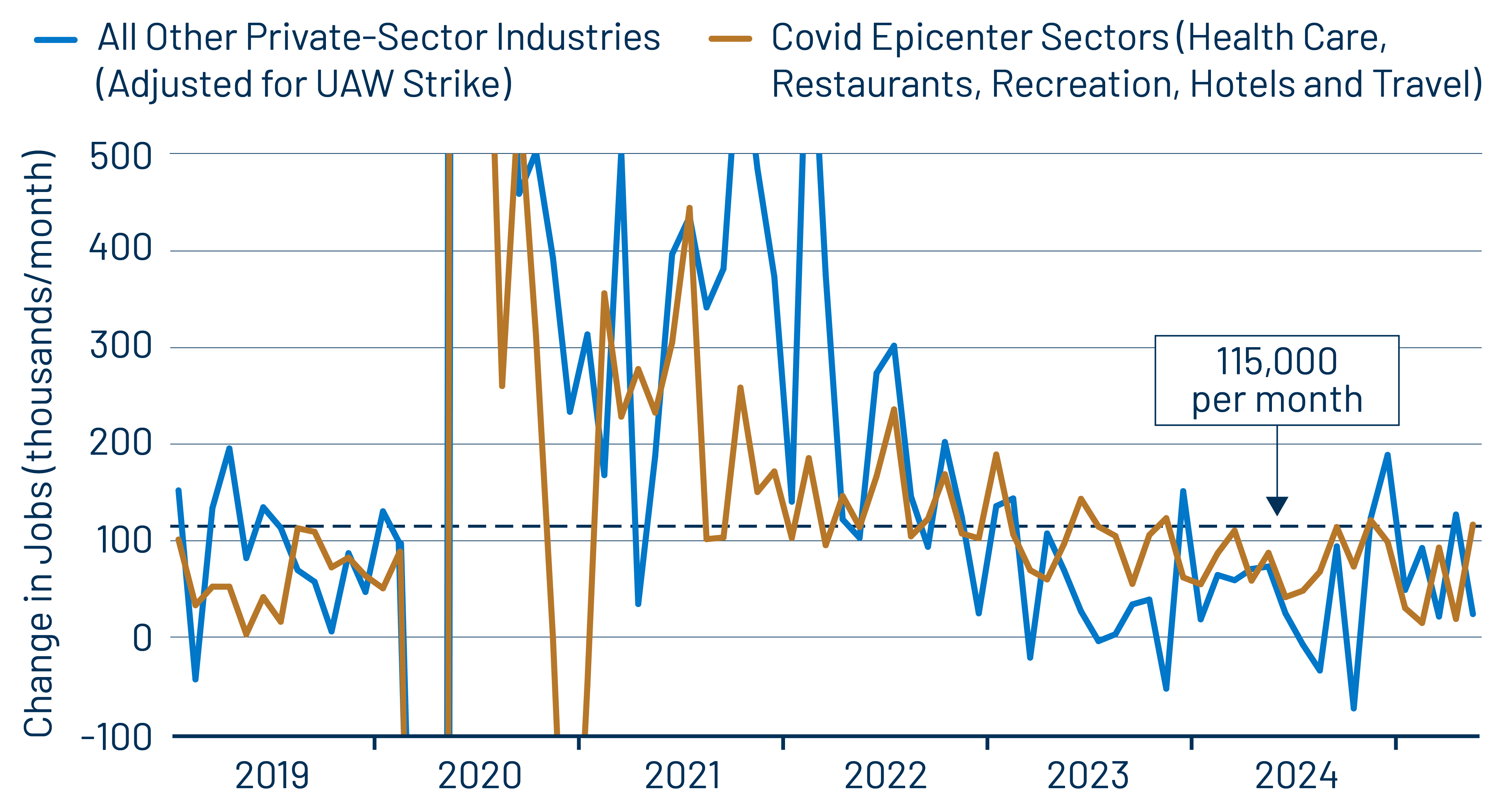

We denigrated the 63,000 “net” gain a few sentences ago, but as you can see in Exhibit 1, the net monthly gains in payroll jobs look to be right in line with what we have seen over the last three years. Similarly, the sectors where one would expect to see early signs of tariff fallout all show steady trends in recent months. The logistics sector has seen a mild downtrend in jobs since late 2021, but there has been no recent intensification of that downtrend. Similarly, retailing jobs continued flat, as they have since early 2023, while passenger travel jobs continue to grow at an average pace of around 5,000 per month.

The only sector to have shown noticeably slower job growth lately is construction, with average job growth of 6,000 per month since September, compared to 18,000 per month in 2023 and early 2024. This slowdown would seem to be due more to overbuilding in the multi-family sector than to anything foreign-trade-related. Meanwhile, manufacturing jobs also are continuing the same flat trend as seen in the last two years.

The gain in total nonfarm jobs was lower than that for private-sector jobs, thanks to another decline in federal government employment. Declines there have totaled 59,000 (-2.0%) since January. The Feds went on a hiring spree of sorts from 2022 through January, adding 156,000 workers over that span. This has started to reverse with the new Administration. (We have focused on private-sector jobs throughout these ups and downs, as we believe these are a better reflector of market forces.)

Elsewhere in the news, workweeks were steady, and hourly wages bounced 0.4% in May, offsetting a soft 0.2% gain in April. Averaging these out, wage growth has been steady at a 3.5% annualized pace over the last six months, fully consistent with the Federal Reserve’s inflation targets.

All in all, a benign employment report showed neither the strong gains touted today in the press nor any weakening redolent of tariff-based recession fears.