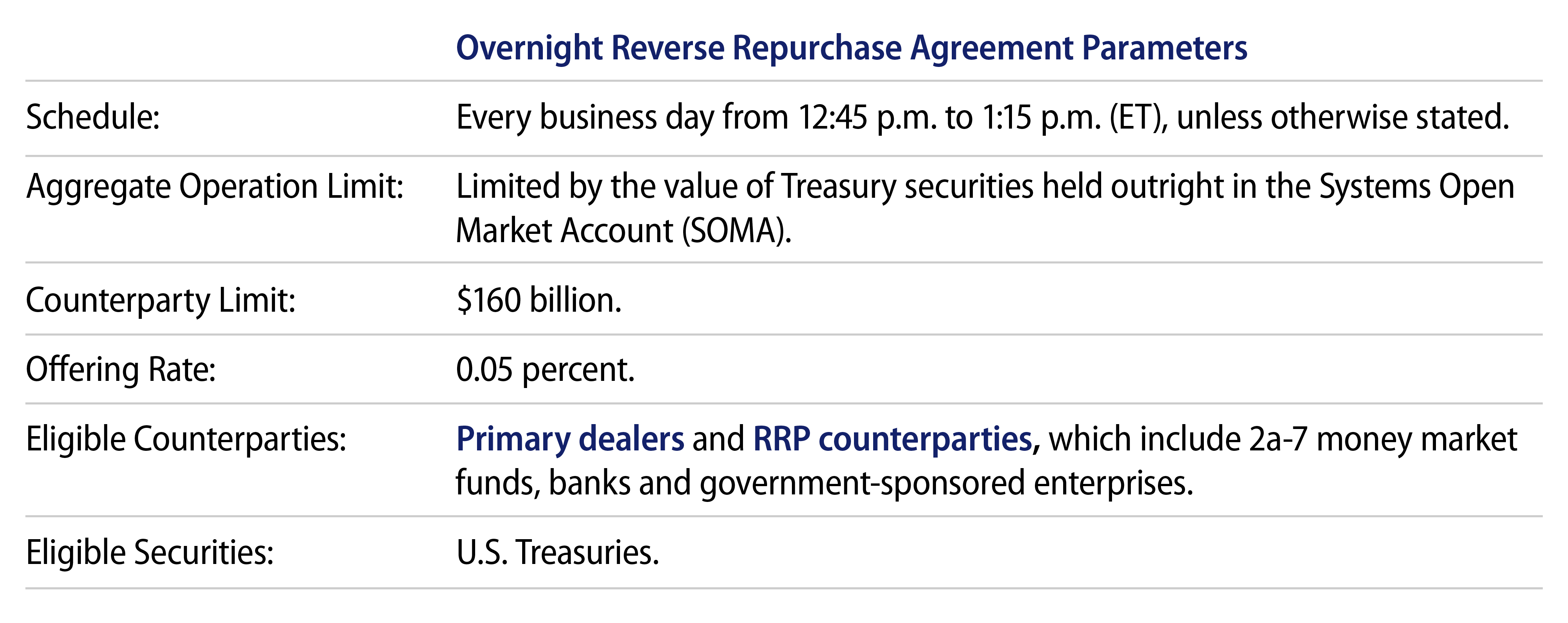

In 2013, the Federal Open Market Committee (FOMC) announced its intention to utilize an overnight reverse repurchase agreement (RRP) facility as a tool to support effective policy implementation by helping to control the fed funds rate. Reverse repo, conducted by the open market trading desk, is a transaction in which the Federal Reserve (Fed) sells a security to an eligible counterparty and simultaneously agrees to repurchase the security the next day at a set price. Eligible counterparties include primary dealers, 2a-7 money market funds, banks and government-sponsored enterprises. The RRP allows the Fed to temporarily reduce the supply of reserve balances in the banking system, and allows investors to place short-term cash in the facility and earn a fixed rate of 5 bps.

The RRP has been a popular investment option for many money market mutual funds in recent months. All domestic 2a-7 funds with assets in excess of $2 billion are eligible to participate in the program. A single fund can invest up to $160 billion per day. Money market funds are accustomed to investing in repurchase agreements as a means to manage their overnight liquidity and provide them with cash on hand to meet redemption requests. US-based money market funds are required to hold at least 10% of their portfolio in overnight investments and 30% in securities that mature within a week. Repurchase agreements help funds adhere to both of these metrics.

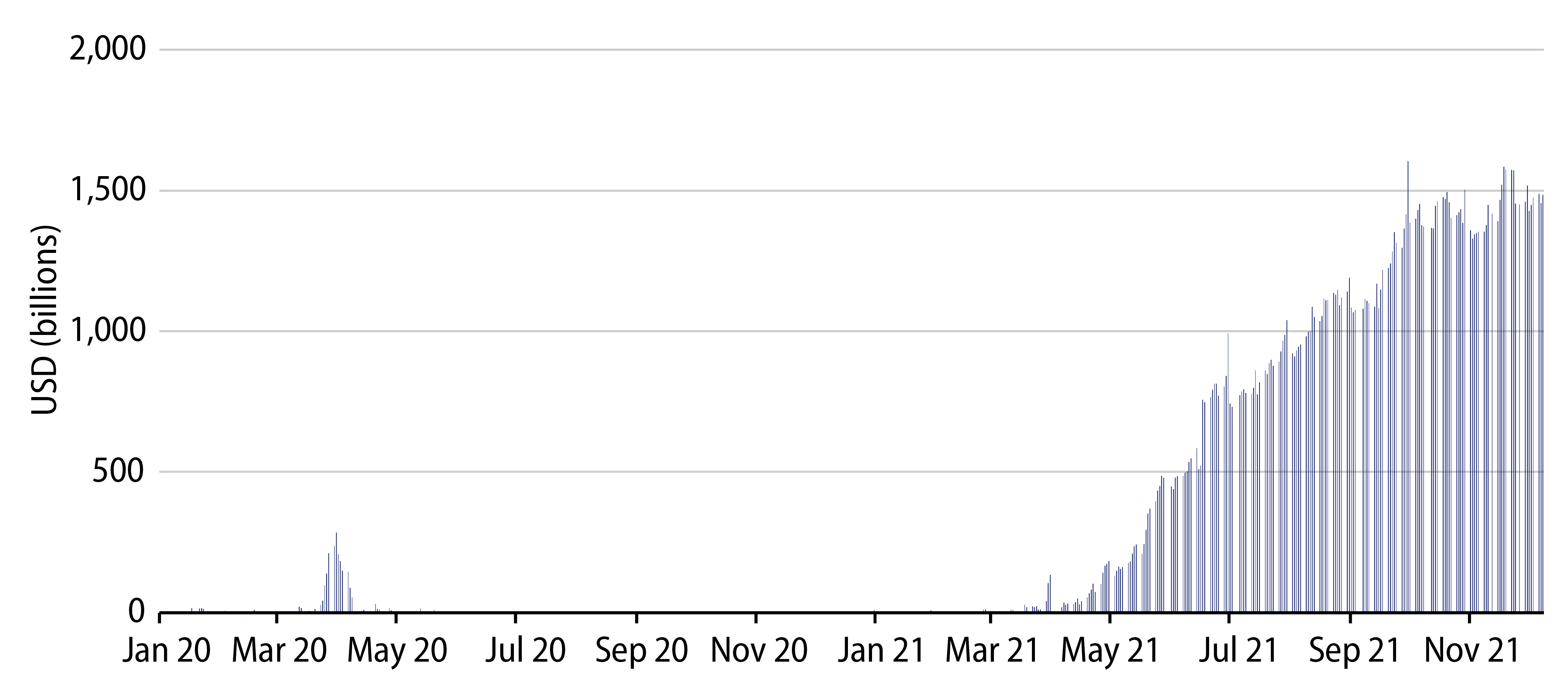

Since the outset of the COVID-19 pandemic, excess cash in the front end of the yield curve has put downward pressure on rates (Exhibit 2). Earning very close to zero on repo transactions became the norm and there was even talk about repo interest rates moving into the negative. As a result, the RRP facility has seen increased usage beginning in March 2021, which sped up when the Fed moved the interest rate to 5 bps on June 16, 2021. This technical adjustment helped drive all repo rates up and avoid negative territory.

The RRP facility hit an all-time high on September 30, 2021 with over $1.6 trillion in total usage. Look out for a potential new high at year-end when dealer balance sheets are tight and investors need to place cash. During the entirety of the last zero interest rate period, RRP usage never surpassed $500 billion due to tighter constraints on the program at that time. There is no reason to believe the Fed will eliminate the RRP facility, especially given its recent success and widespread usage. However, there is always the possibility for the Fed to adjust the parameters as it continuously monitors market conditions.

Money market funds are structurally important to the global financial markets. They are also an important investment option for institutions and individuals all over the globe. The RRP is just one of the programs the Fed has put in place to help ensure smooth functioning of this important segment of the market.

Western Asset manages nearly $60 billion in liquidity assets and is an active participant in the Fed’s RRP. Our eligible money market funds are currently investing 10%-15% of their portfolios in the program. We constantly monitor overnight investment options as they provide the cash we need to meet redemption requests and provide our clients with daily liquidity.