Munis Posted Positive Returns Last Week

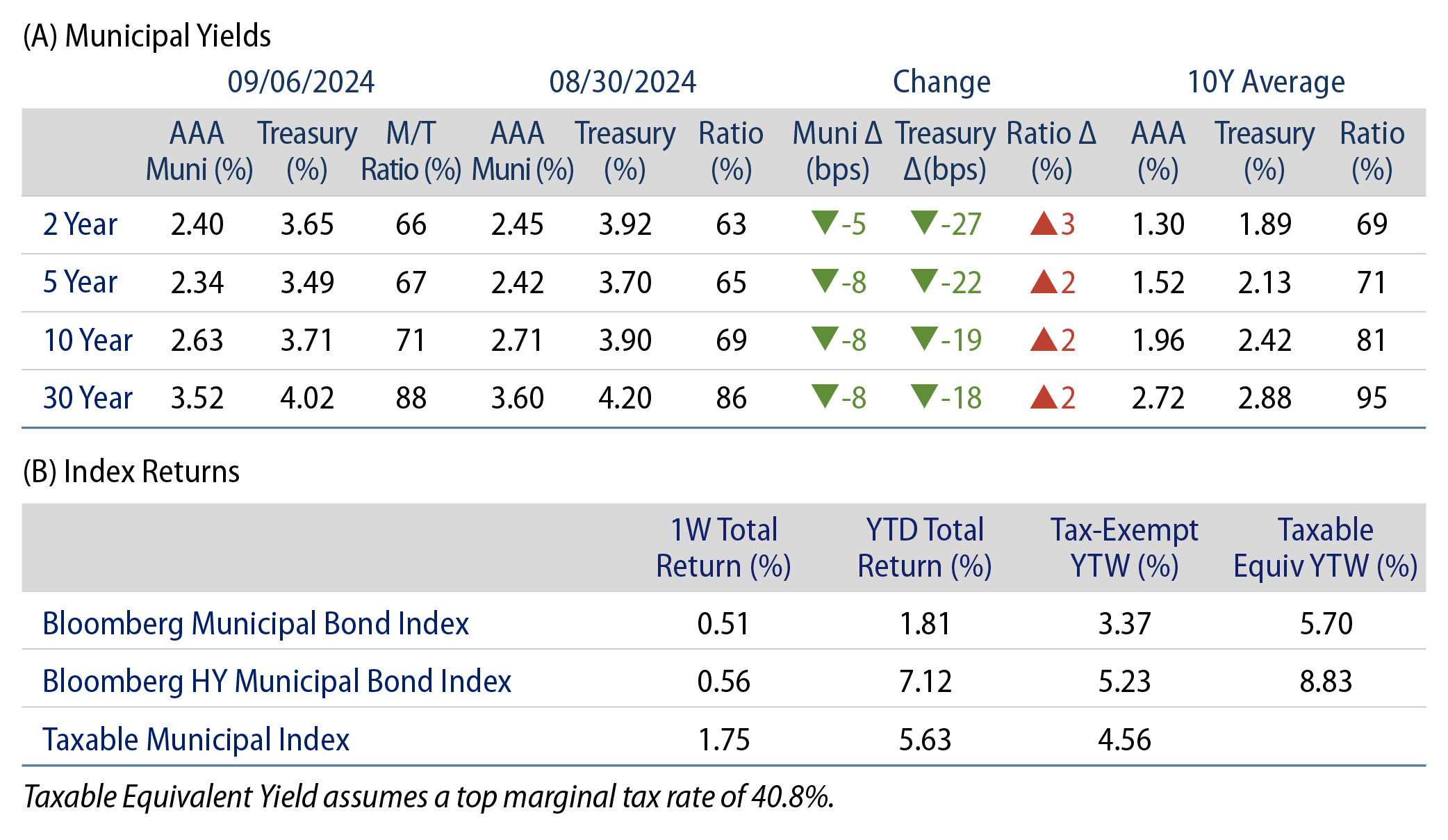

Municipals posted positive returns last week as yields trailed Treasuries lower on weaker-than-anticipated manufacturing and employment data. Meanwhile, high-grade muni yields moved lower across the curve, and muni supply and demand both remained elevated. The Bloomberg Municipal Index returned 0.51% during the week, the High Yield Muni Index returned 0.56% and the Taxable Muni Index returned 1.75%. As muni mutual funds record a 10th consecutive week of inflows, we highlight the implications of an inflow cycle in the muni market.

Technicals Improved During the Holiday

Fund Flows (up $956 million): During the week ending September 4, weekly reporting municipal mutual funds recorded $956 million of net inflows, according to Lipper. Long-term funds recorded $650 million of inflows, high-yield funds recorded $341 million of inflows, intermediate funds recorded $163 million of inflows and short-term funds recorded $159 million of inflows. This week’s inflows represent the 10th consecutive week of inflows and lead estimated year-to-date (YTD) net inflows higher to $22 billion.

Supply (YTD supply of $337 billion, up 41% YoY): The muni market recorded $8 billion of new-issue volume last week, down from the prior week but higher than typical holiday-shortened weeks. YTD issuance of $337 billion is 41% higher than last year’s level, with tax-exempt issuance 45% higher and taxable issuance 5% higher year-over-year (YoY). This week’s issuance is expected to remain elevated at $12 billion. The largest deals include $1.5 billion New York City Transitional Finance Authority and $1.1 billion State of Illinois transactions.

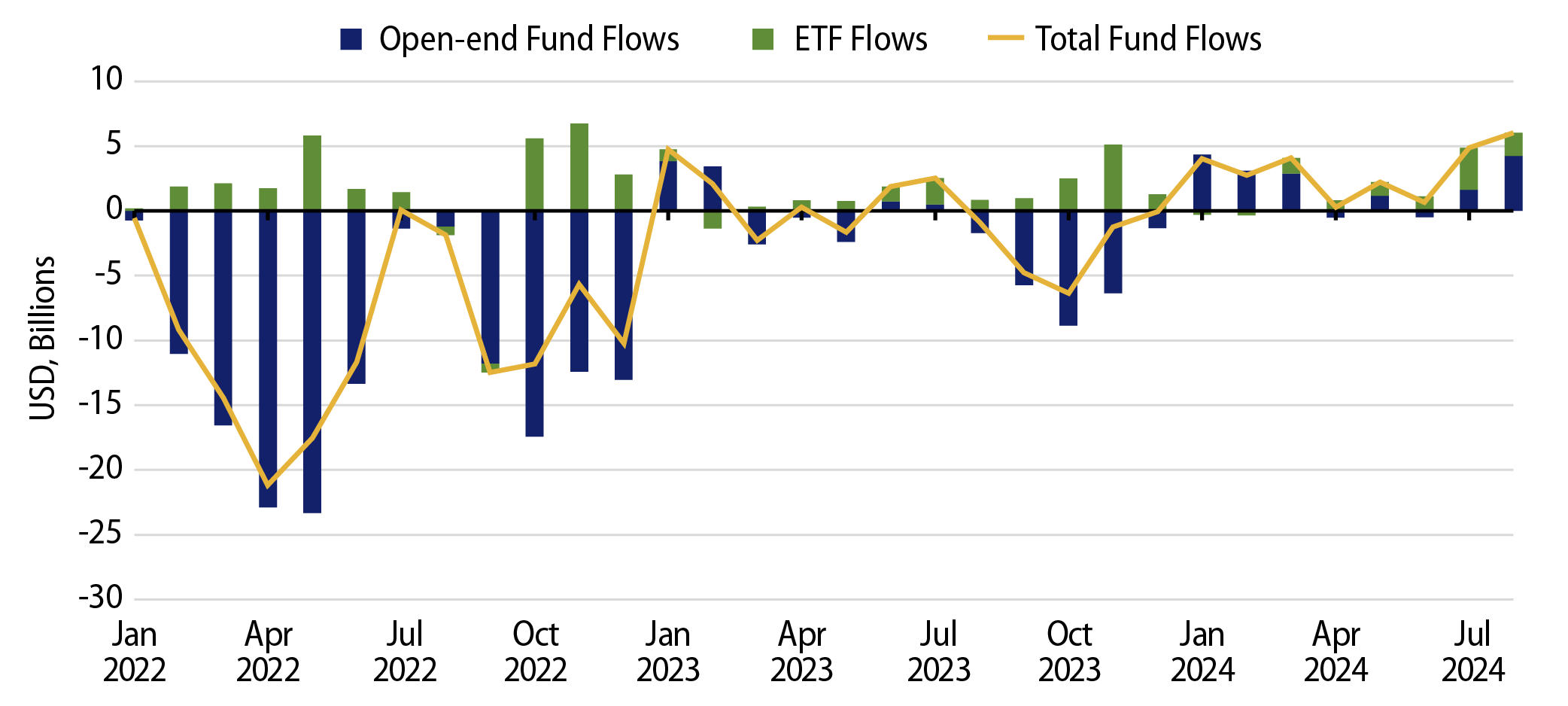

This Week in Munis: Return of the Inflow Cycle

From the start of the Federal Reserve (Fed) hiking cycle in the first quarter of 2022 through the end of 2023, municipal mutual open-end funds and ETFs recorded $122 billion of net outflows, marking the largest and longest period of outflows in the municipal market’s history, according to ICI. So far this year, higher nominal income opportunities have driven flows back to the muni asset class, with municipal mutual funds recording $26 billion of inflows from late December through August 28. According to Lipper, investors signaled appetite for long-duration and high-yield funds, which recorded $24 billion and $11 billion of net inflows through August, respectively.

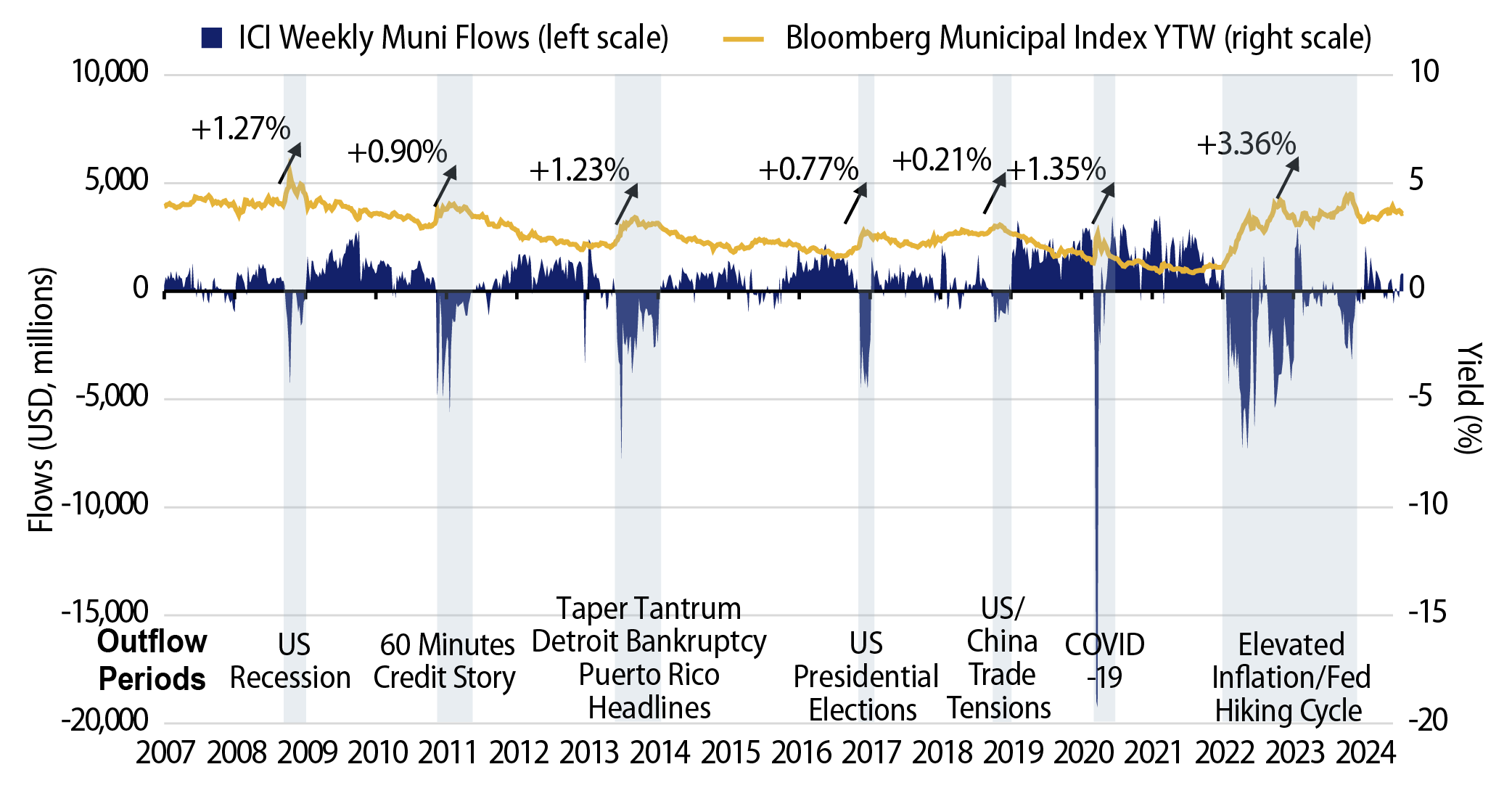

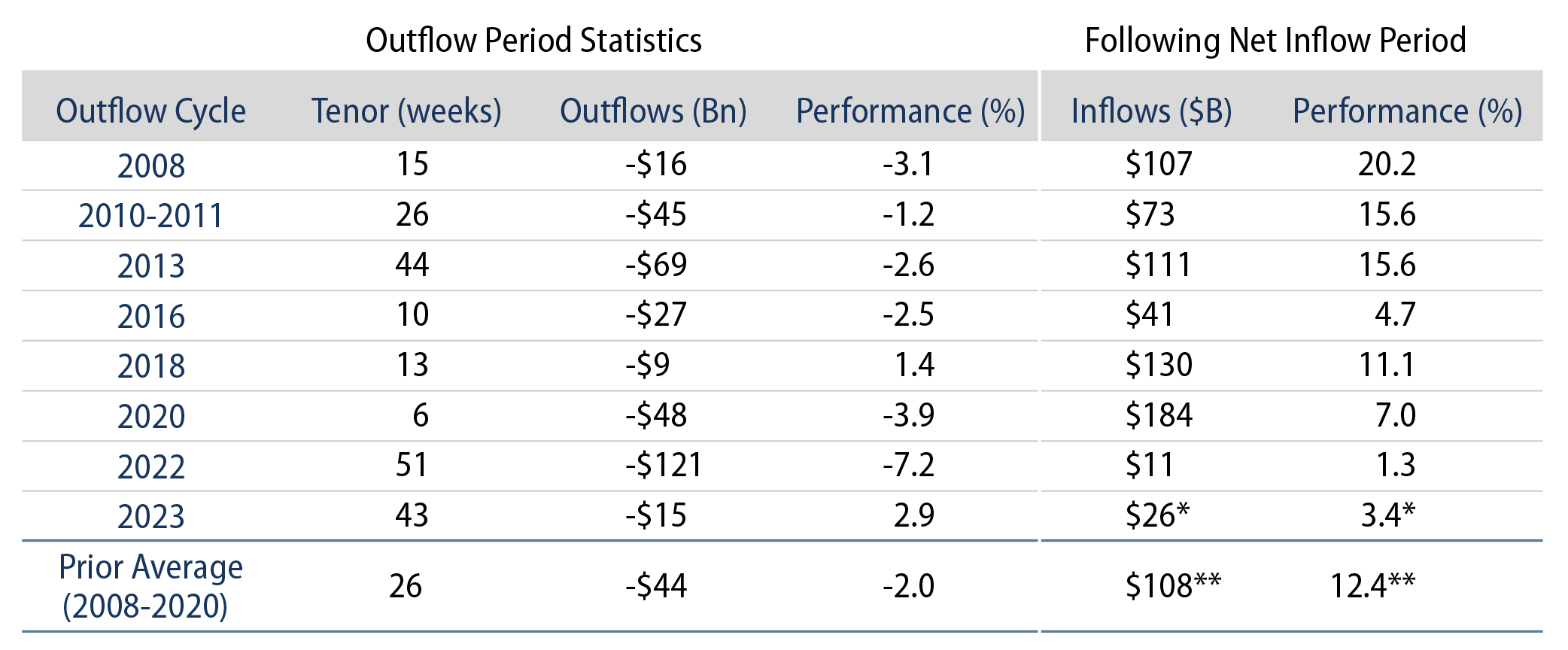

Considering municipal mutual funds comprise a high portion of municipal trading activity, fund flows can contribute to supply and demand imbalances that can impact municipal valuations and opportunities. Over the prior eight outflow cycles, Bloomberg Municipal Bond Index performance averaged -2.0%, and average index yield increases ranged from 0.2% to 3.4%.

As we look at the potential implications of the current inflow cycle, if past serves as precedent, positive demand for the muni asset class could contribute to favorable investor outcomes. Over the last six inflow cycles prior to 2022, the Bloomberg Municipal Bond Index returned an average of 12.4%. The $26 billion of inflows observed this cycle is well below prior inflow averages, and the order of magnitude of the current inflow cycle is well below the $122 billion of outflows collectively observed in 2022 and 2023, suggesting there could be more room to run as the Fed embarks on an expected easing cycle later this month.

Municipal Credit Curves and Relative Value

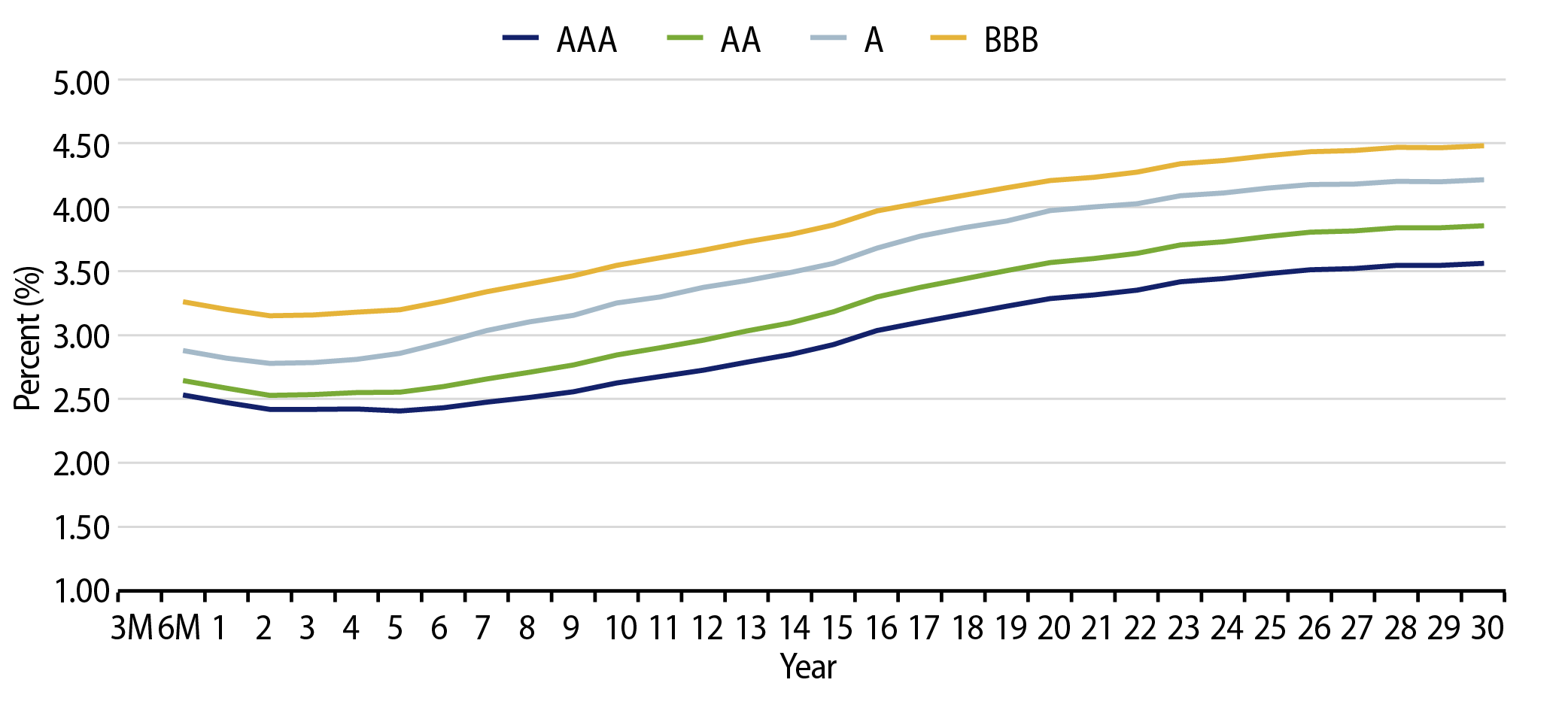

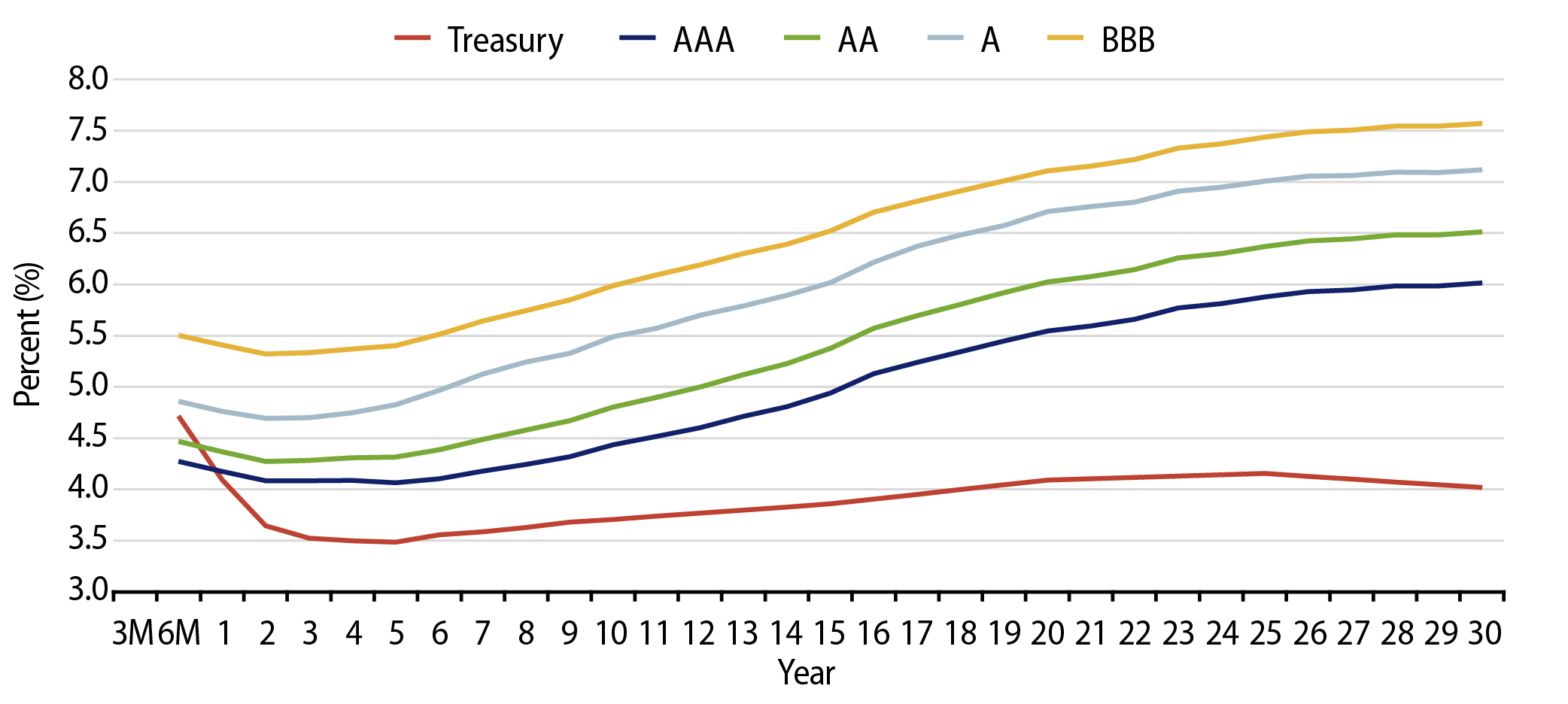

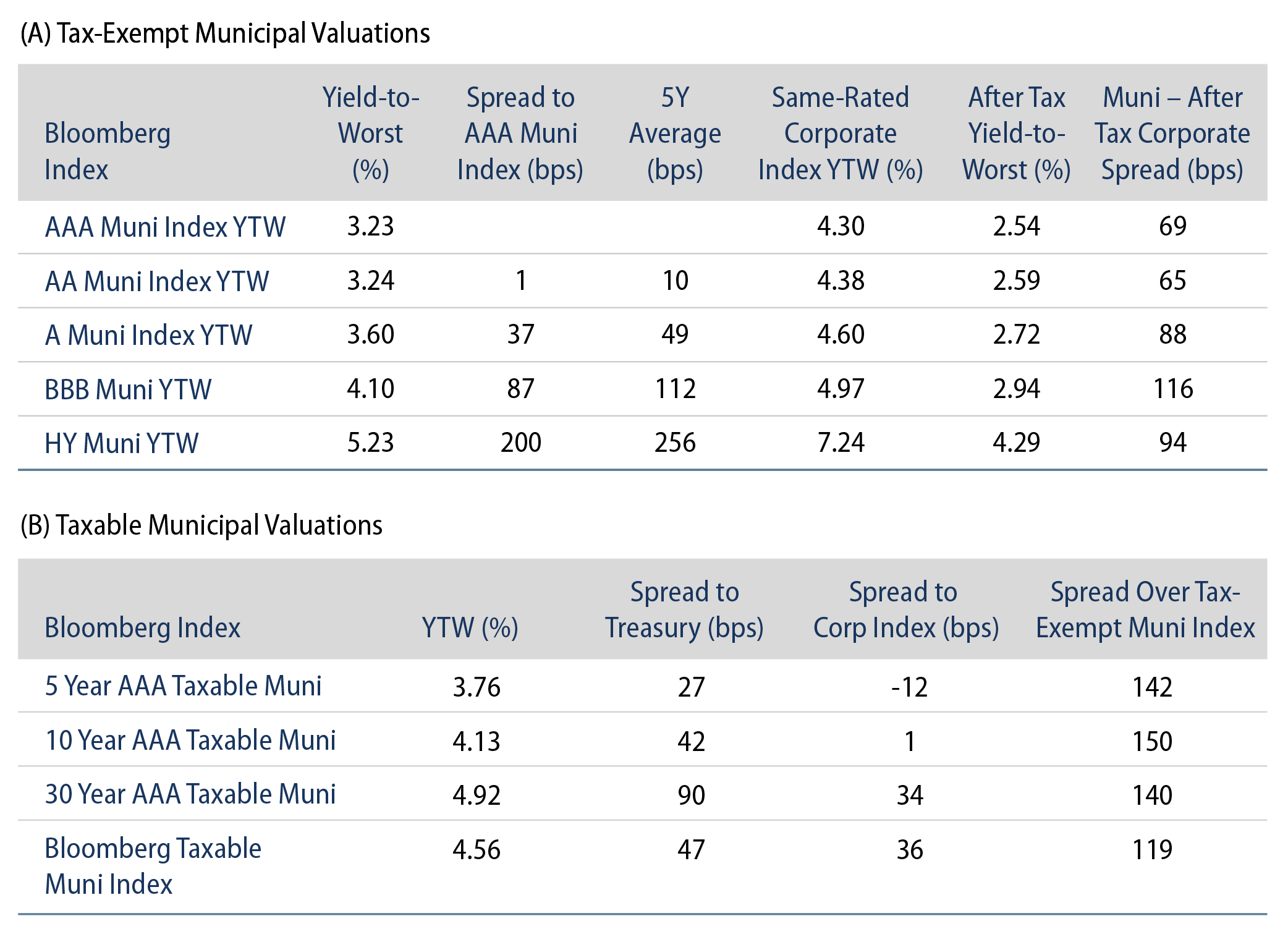

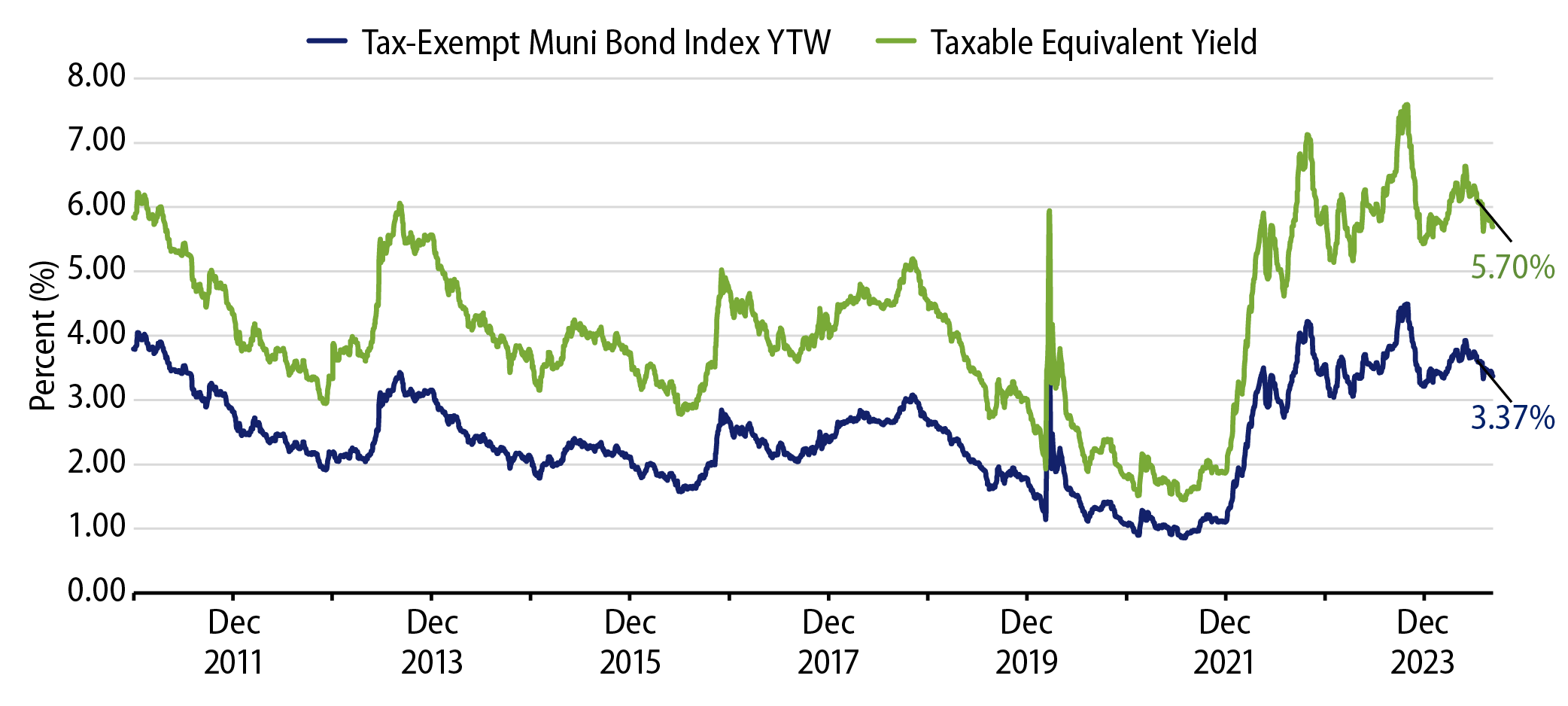

Theme #1: Municipal taxable-equivalent yields and income opportunities are above decade averages.

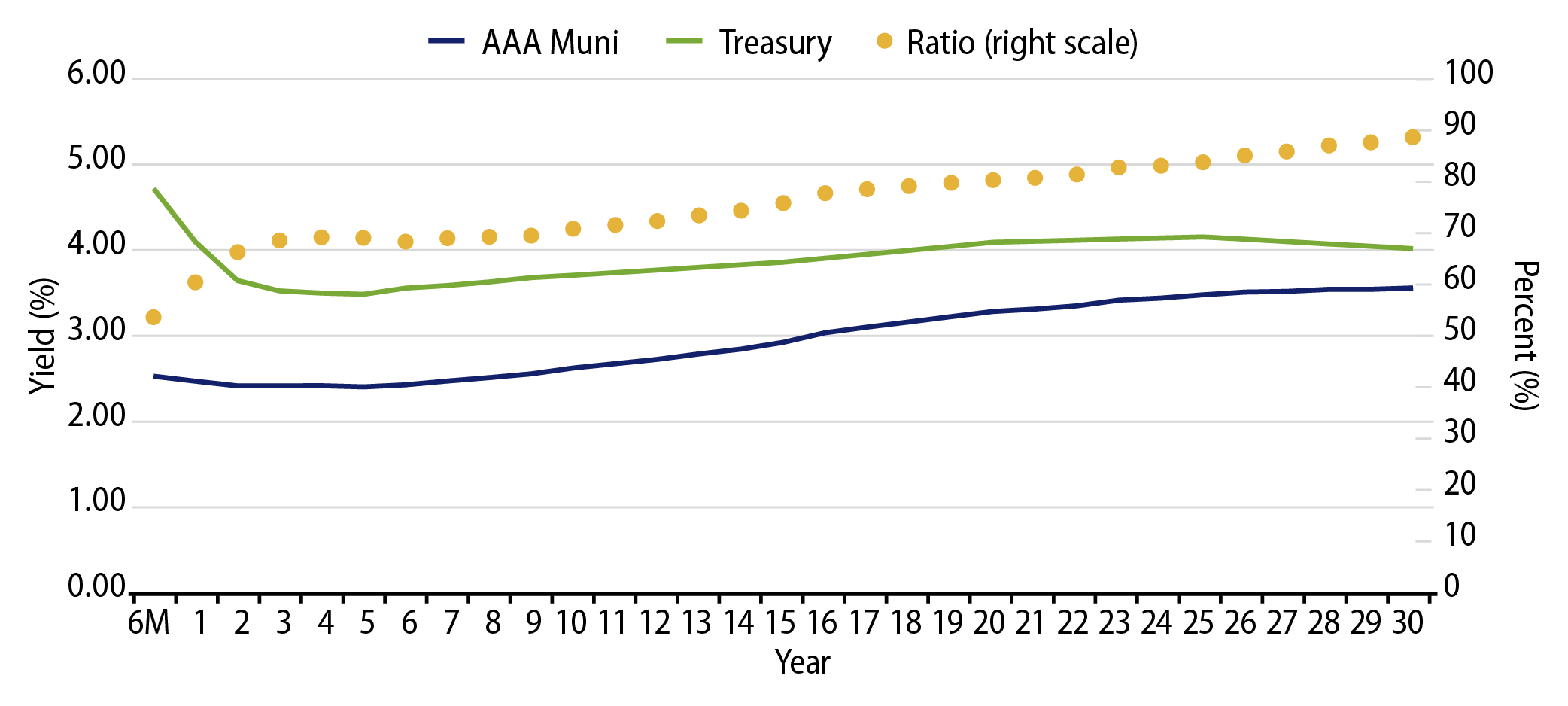

Theme #2: The muni yield curve has largely disinverted, offering potential value in extending maturities.

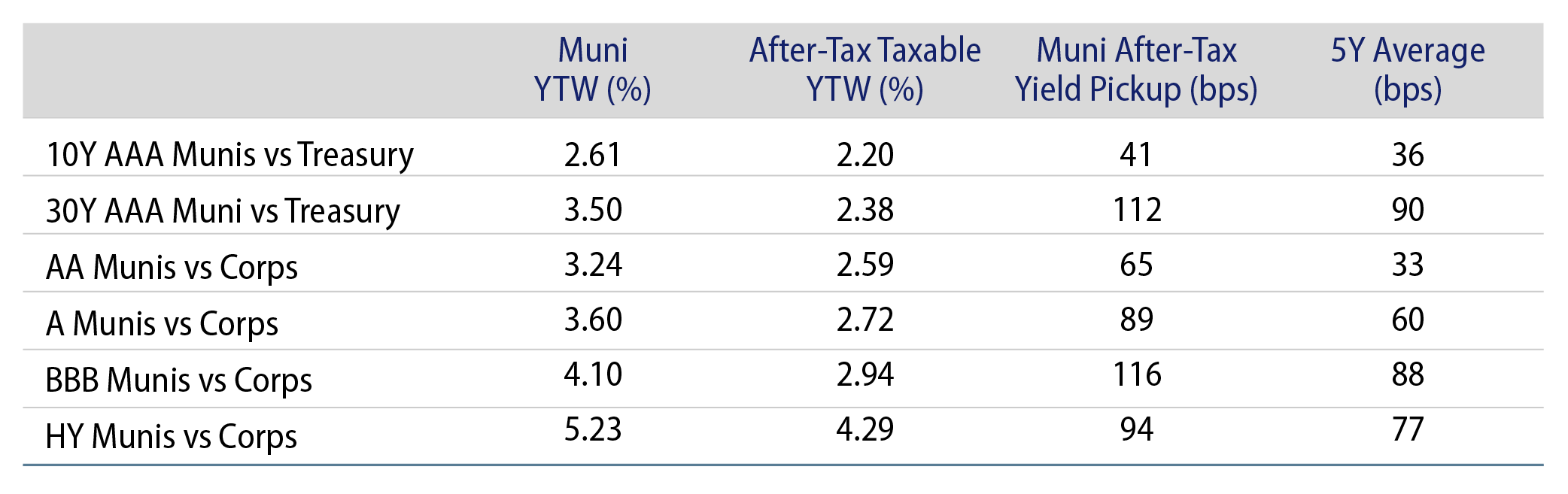

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.