Municipals Posted the Worst Weekly Return of the Year

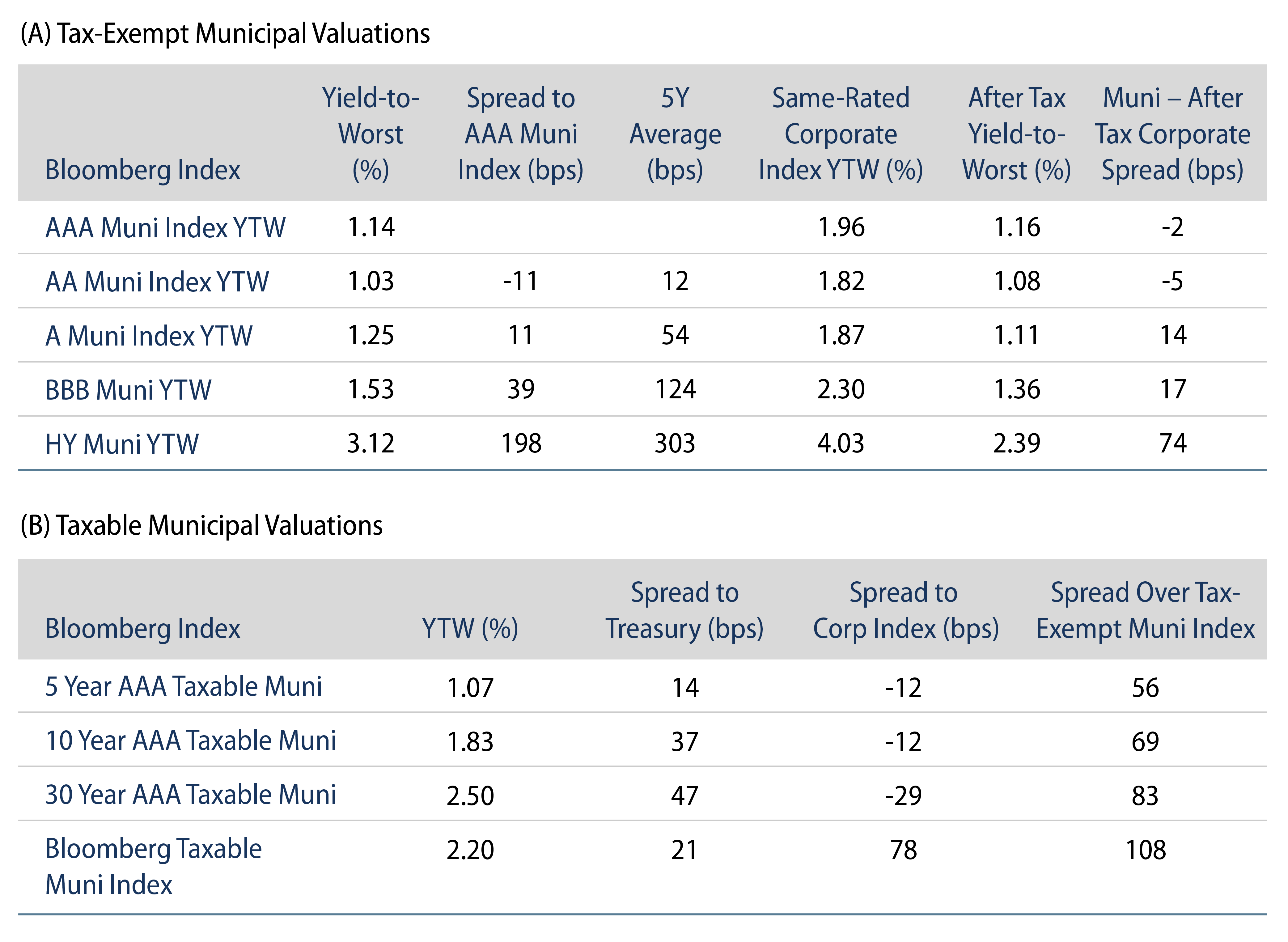

US muni yields increased 7 to 14 bps across the curve. Munis underperformed Treasuries as ratios moved 2% to 9% higher. The Bloomberg Municipal Index returned -0.51%, while the HY Muni Index returned -0.46%. Municipal fund inflows slowed, as high-yield funds experienced outflows. This week we highlight last week’s Golden Tobacco deal and touch on the overall taxable refinancing trend.

High-Yield Fund Flows Turn Negative as Overall Net Inflows Slow

Fund Flows: During the week ending September 29, municipal mutual funds recorded $408 million of net inflows. Long-term funds recorded $78 million of inflows, high-yield funds recorded $103 million of outflows and intermediate funds recorded $106 million of inflows. Municipal mutual funds have now recorded inflows 71 of the last 72 weeks, extending the record inflow cycle to $150 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $89 billion.

Supply: The muni market recorded $12 billion of new-issue volume during the week, up 22% from the prior week. The total issuance YTD of $347 billion is 3% higher from last year’s levels, with tax-exempt issuance trending 13% higher year-over-year (YoY) and taxable issuance trending 17% lower YoY. This week’s new-issue calendar is expected to decline to $8.7 billion of new issuance. The largest deals include $1.5 billion Alabama Federal Aid Highway Finance Authority and $638 million Riverside County Transportation Commission transactions.

This Week in Munis—Golden Tobacco Deal Highlights Taxable Refinancing Trend

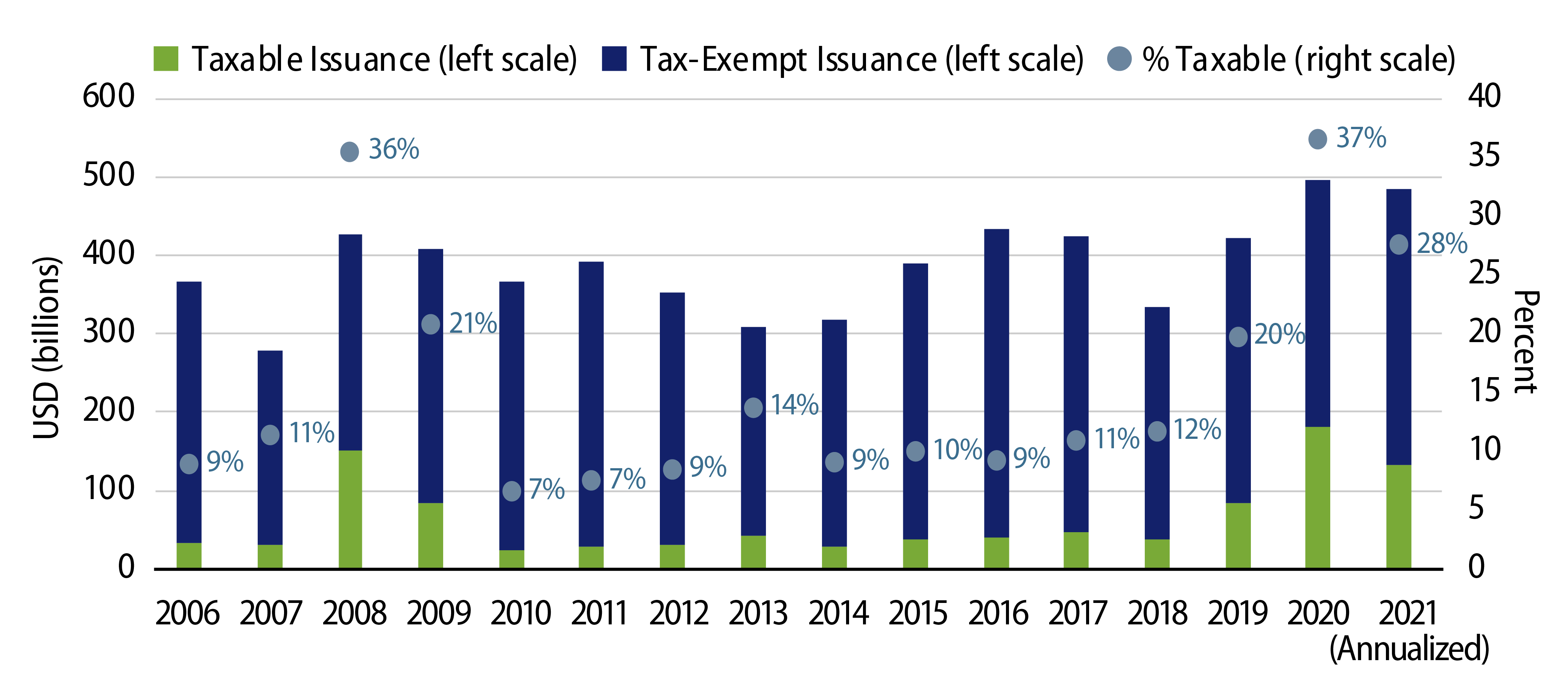

Last week one of the largest tobacco issuers, Golden State Tobacco Securitization Corporation, refunded $1.8 billion of outstanding tax-exempt debt with taxable municipal debt. The deal underscores the continued trend of issuers refinancing outstanding tax-exempt bonds issued in a higher rate environment with taxable debt, shifting the supply landscape and opportunities for municipal investors.

A combination of the 2017 Tax Cuts and Jobs Act’s restriction of tax-exempt advanced refunding with declining global rates have supported the economics for issuers to replace tax-exempt debt with taxable issuance. This means fewer tax-exempt bonds to choose from for those investors seeking tax-exempt debt and more inventory for the growing global taxable municipal buyer base. In 2017, only $39 billion, or 8.7%, of total municipal issuance was taxable, according to Bond Buyer data. From 2018 to annualized 2021 data, an average of $109 billion per year, or 24%, of total municipal issuance has been issued as taxable.

In our view, the sizeable Golden Tobacco transaction will have a moderate impact on municipal index dynamics. We expect the refunding to remove 13% from the Bloomberg Investment Grade Tobacco Index, equivalent to just 0.1% of the Bloomberg Municipal Index. We expect the replacement tobacco taxable tobacco security to double the size of the tobacco exposure within the Bloomberg Taxable Municipal Index, from 0.36% to 0.72%. The refunding will also add cash to many tax-exempt mutual funds, many of which continue to benefit from the record cash inflow cycle.

Forward-looking taxable versus tax-exempt supply dynamics will be shaped by the outcome of the infrastructure and broader spending packages currently being debated in Congress. The $3.5 trillion reconciliation package calls for the revival of tax-exempt refinancing, which could bring back much of the recent taxable issuance back to tax-exempt markets. However, we believe that this measure could easily fall victim to the likely concessions that would be part of any final legislation that would continue not only to limit tax-exempt supply, but also to pull outstanding issuance to taxable markets.