Private-sector payroll jobs rose by 194,000 in November, and there was a +56,000 revision to the October estimate. As we discussed last week, the August-October payroll data had likely been depressed by hurricane-related job disruptions. The gains and revisions announced today offset part of that weakness, but only part. Furthermore, while job counts for September and October were revised higher, average workweeks for those months were revised sharply lower, leaving estimated total production hours worked lower on net.

Recall that hurricanes affected the Southeastern economy in each of the three months from August through October, and, presumably, work conditions got back to normal in November. Over those four months, private-sector job gains averaged only 113,000 per month, well below the pace of previous months. It is also worth noting that most of the recent job gains that have occurred were in health care and other sectors heavily dependent on government subsidies, that is, private education and social services.

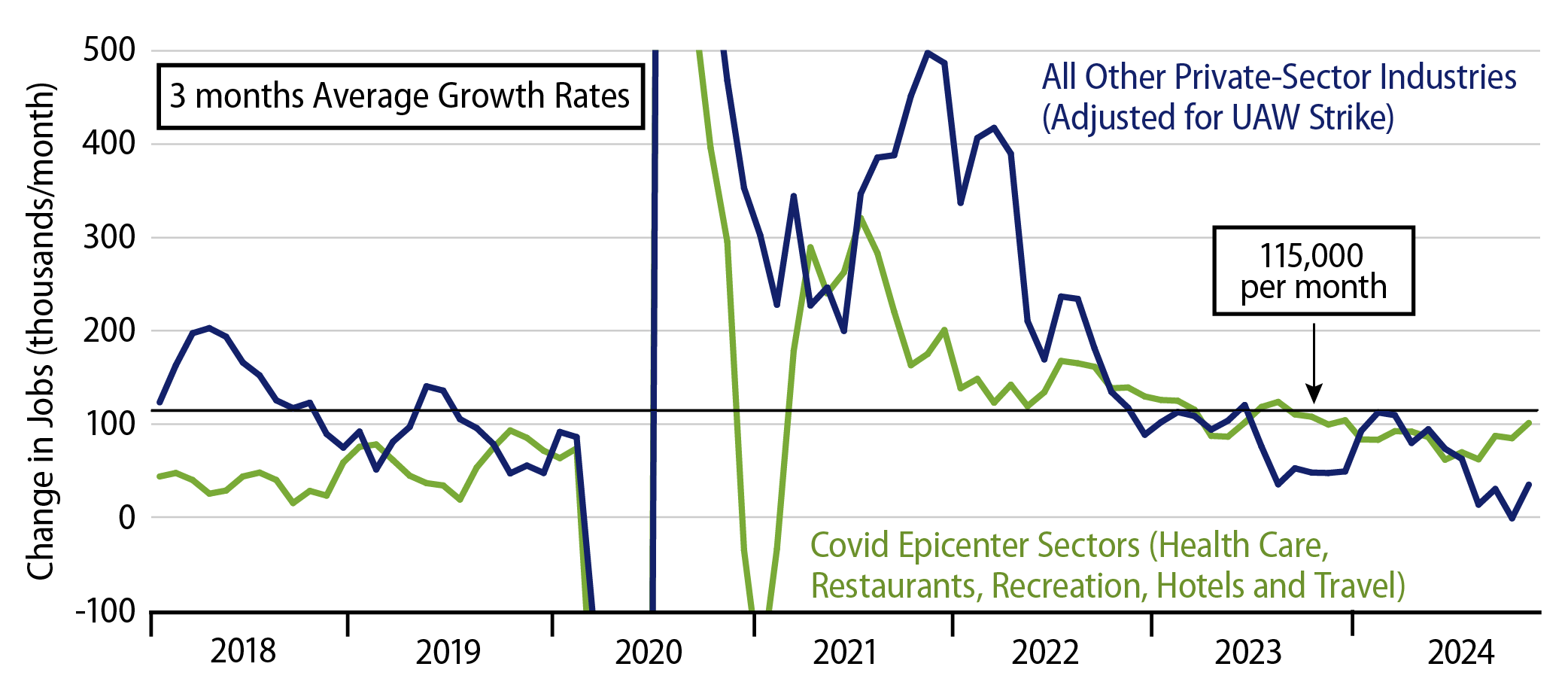

Exhibit 1 shows 3-month growth rates for private-sector jobs, split between what we call the ''Covid Epicenter'' sectors and the rest of the economy. Yes, the Covid Epicenter includes health care. While Covid-related sector job growth has held up well recently, thanks largely to health care gains, job growth elsewhere has trended steadily lower and averaged only 36,000 per month over September-November (22,000 per month over August-November).

One might argue that recovery from the hurricanes was still not complete by November, and that there will be further hurricane-recovery gains in December and January. While this may be the case, the fact that job growth has steadily trended lower since March 2024 suggests more is going on than merely hurricanes.

Keep in mind also that the Labor Department has already announced forthcoming revisions to the payroll data through March 2023, resulting in a -819,000 revision to private-sector job growth over the period April 2023 through March 2024. And that downward revision was net of a +87,000 revision to jobs in health care, private-education and social services. So, if you subtract 906,000 from the count for the blue line in the chart through March 2024 and then merely continued the softer job growth trend since then, the slowing for sectors outside health care looks even more ominous.

The forthcoming revisions reported by the Bureau of Labor Statistics lump health care, private education and social services together (NAICS Code 65 for you data wonks). That sector accounts for 19% of private-sector jobs, but it accounted for 81% of job growth over April 2023 to March 2024 (in revised data) and 65% of job growth since March (in current data). Our point is that job growth is quite slow and slowing further for goods and services that individuals and businesses actually have to pay for out of pocket.

Meanwhile, we haven’t even mentioned that household employment counts came in at -385,000 in November. Now, monthly household job counts are extremely volatile. For example, the November decline was preceded by a +632,000 October gain. Still, taking the last 12 months together, to abstract from short-term swings, household employment shows a cumulative decline of -405,000. (Actually, this change is adjusted for discontinuities that occur each January in the Labor Department’s estimates within the household survey of civilian population, labor force and employment. The official data show November 2024 household employment lower than November 2023 employment by -725,000 jobs, but that is overstated by discontinuities due to a lower estimate of the population as of January 2024.)

In sum, payroll employment data (including pre-announced revisions) show little growth in jobs outside the health care industry over the last two years and an apparent, steady downtrend in growth there, while the household employment data show declines over the past year. To say that the 194,000 post-hurricane gain in jobs reported today overstates the strength of the economy quite understates the realities.