Municipals Posted a Fifth Consecutive Week of Positive Returns

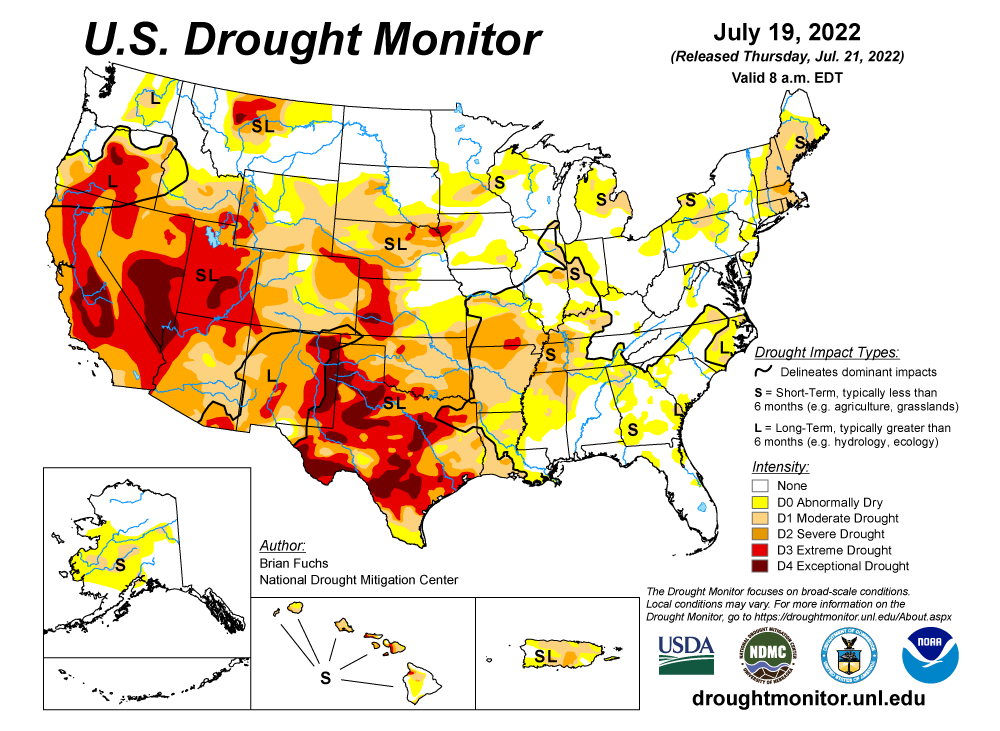

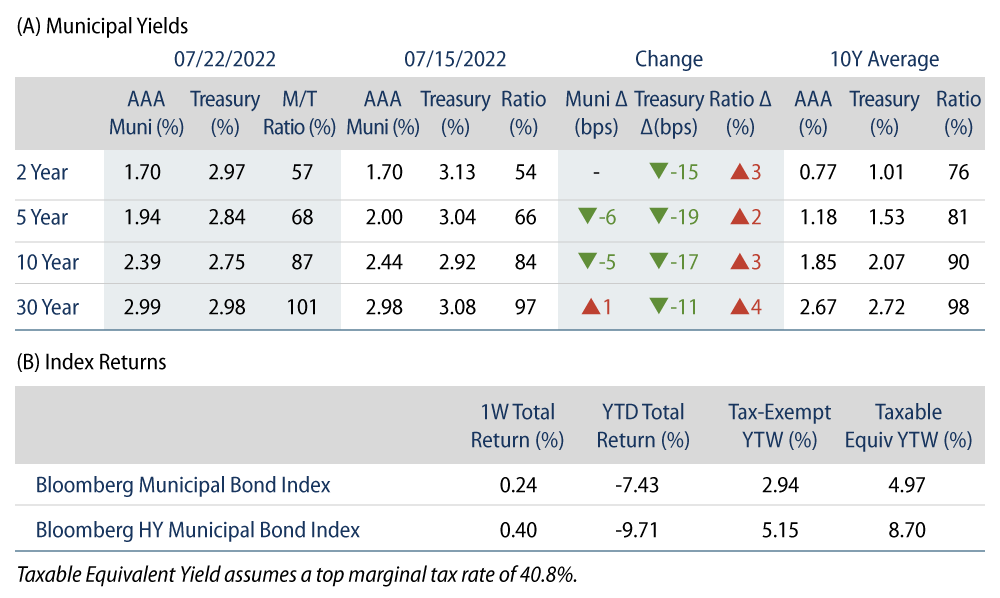

Munis posted positive returns for a fifth consecutive week and underperformed Treasuries across most maturities. High-grade municipal yields moved 3-11 bps lower across the curve. Meanwhile, technicals waned as mutual funds recorded outflows. The Bloomberg Municipal Index returned 0.24% while the HY Muni Index returned 0.40%. Amid record heat across the country this summer, this week we explore drought implications on the municipal market.

Municipal Mutual Funds Record Outflows

Fund Flows: During the week ending July 20, weekly reporting municipal mutual funds recorded $699 million of net outflows, according to Lipper. Long-term funds recorded $280 million of inflows, high-yield funds recorded $65 million of inflows, and intermediate funds recorded $267 million of outflows. Year-to-date outflows stand at -$80.9 billion.

Supply: The muni market recorded $8.6 billion of new-issue volume, down 20% from the prior week. Total YTD issuance of $230 billion is 5% lower from last year’s levels, with tax-exempt issuance trending 7% higher year-over-year (YoY) and taxable issuance trending 42% lower YoY. This week’s new-issue calendar is expected to decline to $3 billion.

This Week in Munis: Drought Implications

When drought is mentioned most people think of the impact on California’s water supply, especially Southern California. But other states in the southwest are also affected with extreme to exceptional water shortages ranging from California, to Oregon, Arizona, Nevada, Utah, New Mexico and Texas, according to the University of Nebraska.

California, and in particular Southern California through the Metropolitan Water District (MWD), derives a significant portion of its water supply from the State Water Project (SWP), which brings water from the north of the state to the south. In addition to MWD, 29 other entities including agricultural users in the San Joaquin Valley rely on the SWP. With 2020 and 2021 the driest years ever recorded in California, the State enacted conservation regulations in May, reducing MWD’s allotment of the SWP to just 5% of its original allocation.

In addition to employing conservation measures and water storage programs to help offset SWP reductions, MWD relies on the 240-mile Colorado River Aqueduct to bring it much needed additional supply. MWD built the Aqueduct in 1928, and to this day operates it in accordance with a pact with Arizona, and Nevada. When supplies drop, Arizona and Nevada absorb the first reductions, not California. In fact, Arizona’s supply was cut for the first time ever in 2022, and the pact can change further after 2026 when the rules governing management of water supply shortages are set to be renegotiated.

The Colorado River Aqueduct relies upon the Federal Bureau of Reclamation owned and operated Lake Mead (associated with the Hoover Dam) and Lake Powell (associated with Glen Canyon Dam) as its primary supply sources. Each is a major storage site in the river’s lower basin that also feeds the Central Arizona Project serving the Phoenix and Tucson areas, as well as 90% of the Southern Nevada Water Authority’s needs for Las Vegas. Today overall storage is at 34% of capacity and Lake Powell is at its second-lowest level in 60 years.

Faced with potential water shortages, California, Arizona and Nevada agreed to a drought contingency plan limiting withdrawals and ensuring Lake Mead remains at a certain level. A $200 million project will increase capacity in 2022 and 2023, with the federal government absorbing $100 million of project costs, Arizona contributing $60 million, and Southern Nevada Water Authority and MWD each contributing $20 million. Over the long-term, this supply increase will not be enough to offset the Colorado River’s overallocation. Western Asset expects to see groundwater resource development and conservation efforts increase. Arizona’s Water infrastructure Authority will be in charge of the state’s $1 billion appropriation targeting increased resources including a possible desalination plant. Water rate hikes will likely be necessary to fund these improvements. As these municipal issuers embark on these capital projects and increase debt loads, we will focus on effects these efforts have on affordability against population trends in what has been a fast-growing region.