In today’s low-growth, low-inflation global economy, it has been challenging for retail investors to find income for their portfolios. With approximately 25% of global fixed-income trading with negative yields and US credit spreads nearing cycle lows, traditional bond products no longer offer the yields they once did. As a result, investors are unsettled with the risk/reward tradeoff of owning significant duration risk. Alternatively, private banks offer concentrated portfolios of individual bonds to achieve yield for their clients, but this strategy is often neither diversified nor liquid. In response to this challenge, the market in recent years has been receptive to a new style of open-end fund: the fixed maturity portfolio, or FMP. This post describes the pros and cons of FMPs as well as Western Asset’s approach to the product.

What Is an FMP?

A common format for a fixed maturity portfolio is a mutual fund with a limited initial investment period, final maturity date (typically in the three- to five-year time frame), and an open-ended redemption feature. Structuring the investment in a fund format allows for daily pricing and liquidity, while active portfolio management ensures diversification and credit risk minimization. FMPs are designed to generate income for retail investors with relatively low interest rate risk, therefore common considerations for fixed-income investments such as duration and benchmarks are less of a focus. Consequently, the initial level of income generation as well as the sustainability of the dividend payout are critical in assessing both an FMP fund as well as its investment manager.

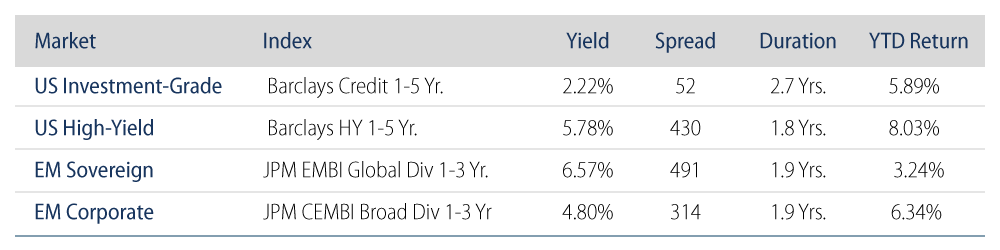

Investment managers typically work with a distributor, often on a proprietary basis, to launch an FMP, with custom specifications that meet their clients’ income needs. Examples of ways by which a fund can be customized include: maturity date, credit quality, asset class allocations (e.g., IG vs. HY vs. EM), country/sector/issuer size limits, and issuer restrictions. In recent quarters, EM-focused FMPs have gained popularity given the potential yield pickup in EM sovereign and corporate debt relative to developed market credit. The table below summarizes the investable universe of short-dated global credit paper available for FMP managers today.

Risks Inherent in FMPs

At Western Asset, we consider credit risk and reinvestment risk to be the two greatest threats to an FMP’s future income, so we focus our efforts on managing both in the context of maintaining an attractive yield. Credit losses obviously put both principal and interest at risk, and thus employing an asset manager with deep credit expertise and a global research footprint is critical. A more subtle problem for FMP investors is reinvestment risk, as coupons and maturities come due and need to be reinvested later in a fund’s life at potentially lower yields. As a result, structuring an FMP to maximize its individual bond maturities while still maintaining adequate portfolio diversification is key.

While the FMP product area has exhibited rapid growth in recent years, particularly in Asia, we would note that liquidity for these daily-priced, short-dated funds is likely to be better than for individual bonds or longer duration funds. Furthermore, growth in the product is not necessarily resulting in an overextension of new credit to the market (e.g., the way CLO issuance has contributed to the growth of the leveraged loan market), but instead is taking advantage of existing securities available for sale in the market. In fact, over time FMPs can benefit from increasing scarcity value of shorter-dated EM and high-yield bonds as issuers continually refinance their maturities, often via attractively priced tenders.

Western Asset's Approach to FMPs

Given the benefits of diversification, we favor taking a global approach to the FMP opportunity set, with developed market and emerging market credits often complementing each other as they have different valuations and business cycles. While Western Asset views FMPs as a “buy and maintain” product that is less focused on generating alpha through trading, the twin goals of preservation of capital and maintenance of income require active management of FMP portfolios to minimize credit and reinvestment risk. Overall, Western Asset considers FMPs to be a yield-enhancing and diversifying element within individual investors’ portfolios.