Headline retail sales rose 0.5% in March, with the February sales levels revised upward by 0.7%. The bulk of the March sales gains reflected higher gasoline prices, however, so that the widely watched “control” sales declined very slightly (less than -0.1%). On top of this, goods prices increased a bit in March, though far more slowly than in previous months, so it is likely that real control sales dropped about -0.4%.

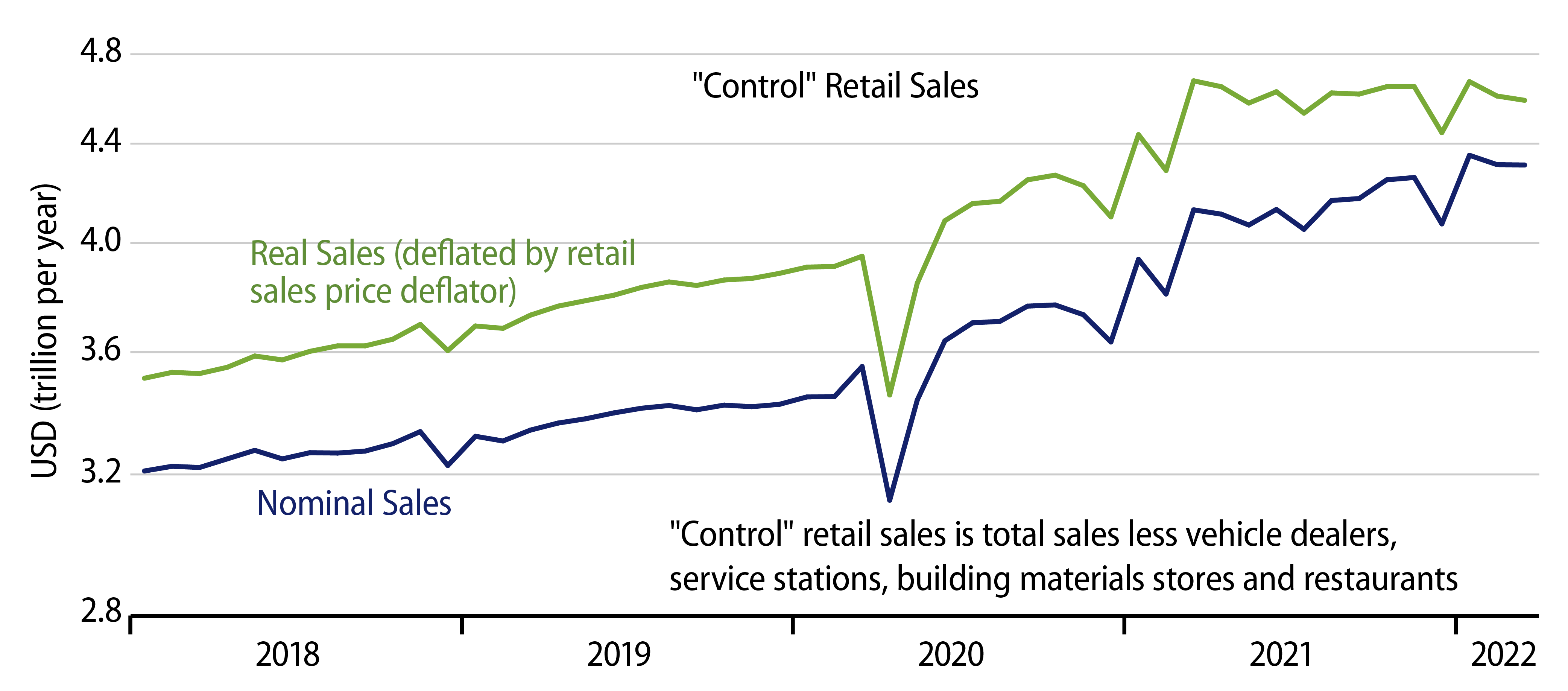

Nominal and real control sales are plotted in the accompanying chart. As you can see there, real sales have generally been treading water for the last 12 months, with their last meaningful increase occurring in March 2021. This appears to be part of a process where consumers are shifting back to newly reopening service sectors after binging on goods in late-2020 and early-2021 when consumer service vendors were still inaccessible due to Covid restrictions.

Total real consumer spending has been following the same trend path it followed prior to the spring 2020 Covid shutdown, with spending neither above nor below that trend, with, again, a shift over the last year from goods into services. The mystery within this trend is just what the heck happened in December 2021, when retail sales dropped so abruptly.

Historically, when such a decline has occurred, it has reflected a disruption of normal shopping patterns, such as a severe blizzard paralyzing the Northeast. During such a disruption, consumers kept on consuming, and household inventories were depleted, so that when the disruption was over, shoppers did double duty to replenish pantries. Sales then show a sawtooth pattern, way below trend during the disruption, way above trend after the disruption, and reverting to trend thereafter.

There was no blizzard or other “natural” disaster to explain the sharp declines last December. At the time, it was plausible to think that shoppers were forced to stay home by Covid restrictions related to the omicron outbreak, in which case, sales would be expected to rebound sharply when restrictions were lifted.

This didn’t happen in January. The average of real sales over December/January was still way below November sales levels. What had been another sharp decline in February was mostly revised away, but no real rebound then—and again, real sales look to have declined a bit further in March.

In sum, the process of consumers shifting from goods to services still looks to be in place. The extraordinarily sharp sales declines of December are still in place and hard to explain.

In terms of specific store types, most retail sectors evince a pattern similar to that of control sales. An exception is department stores, which saw nice gains in March and some move upward in recent months. However, those gains were accompanied by even larger declines in online sales. It is hard to believe, with omicron fears/restrictions so prevalent, that shoppers are shifting back from online merchants to brick-and-mortar department stores. However, that is what the available data suggest.