Macros, Markets and Munis

Municipals generally posted negative returns last week, in line with the performance of most US fixed-income sectors as markets were focused on the Federal Reserve (Fed) rate cut. While the Federal Open Market Committee’s decision to reduce the fed funds rate by 25 basis points was not a surprise, the number of dissents as well as the forward-looking dot plot signaled greater uncertainty ahead. While moving lower in the front end, Treasuries generally moved higher in intermediate and long maturities. Municipals outperformed, with yields moving higher in longer maturities to a lesser magnitude. This week we touch on the steady demand for munis, which has mostly rebounded from the prior outflow cycle.

Supply Remained Elevated Along with Persistent Demand

Fund Flows ($16 million of net inflows): During the week ending December 10, weekly reporting municipal mutual funds recorded $16 million of net inflows, according to Lipper. Long-term funds recorded $158 million of outflows, while intermediate funds recorded $5 million of inflows and the short-term and short/intermediate categories recorded $169 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $50 billion.

Supply (YTD supply of $564 billion; up 17% YoY): The muni market recorded $13 billion of new-issue supply last week, down 23% from the prior week’s level. YTD new-issue supply of $565 billion is 17% higher than the prior year, with tax-exempt issuance up 19% year-over-year (YoY) and taxable issuance in line with the prior year’s level. This week’s calendar is expected to decline to $4 billion. The largest deals include $2.0 billion New York Transitional Finance Authority and $750 million Kentucky Public Energy (Morgan Stanley Gas Prepay) transactions.

This Week in Munis: Demand Rebounds, with Positive Prospects Ahead

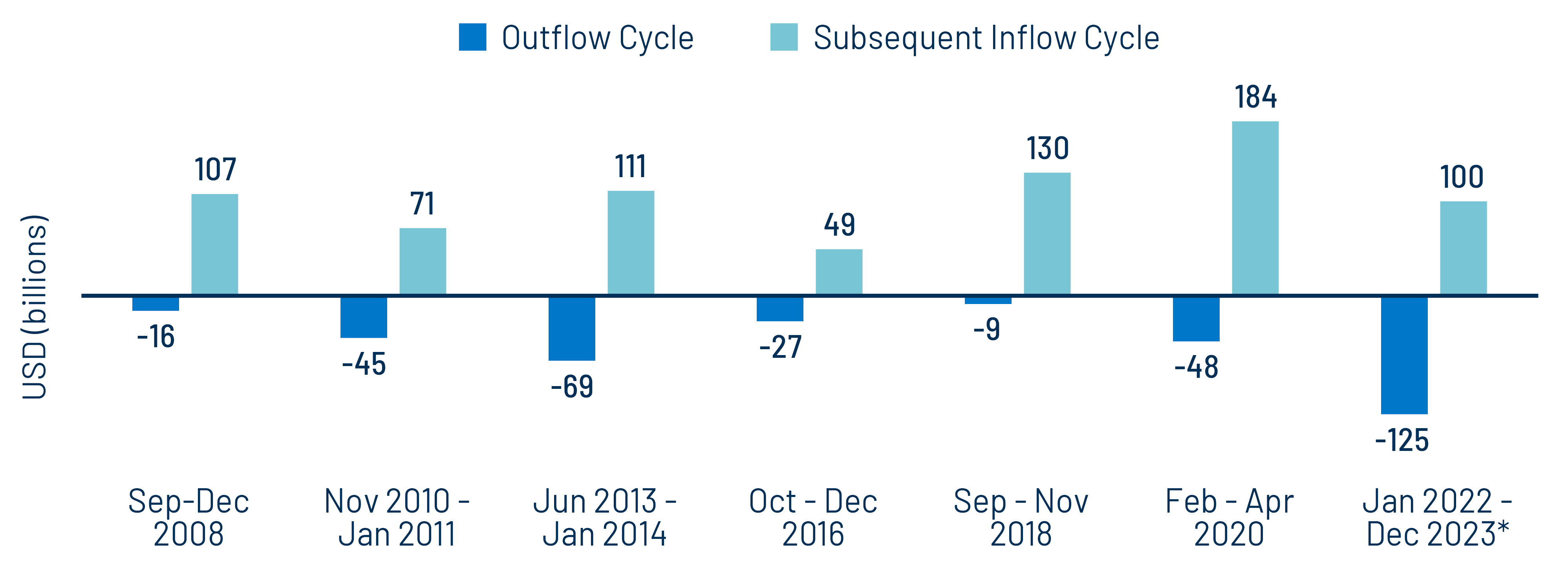

Muni mutual funds weathered a record outflow cycle in 2022 through 2023 as the Fed increased interest rates, with over $125 billion of cash divested from muni funds according to ICI. In 2024, demand slowly returned to the muni asset class, as funds recorded $46 billion of net inflows last year with the conclusion of the hiking cycle. This positive demand has extended into 2025, with muni funds recording $50 billion of net inflows YTD. The inflows recorded this year extend the net inflow streak to $100 billion, which still falls approximately 20% short of the outflows that left muni funds in 2022 and 2023. During the six prior muni fund outflow cycles since the global financial crisis, subsequent inflow cycles traditionally exceeded prior outflow cycles by an average of $73 billion. The fact that the current two-year inflow cycle has not yet surpassed the record outflow cycle observed in 2022-2023 is a positive signal for potential future demand.

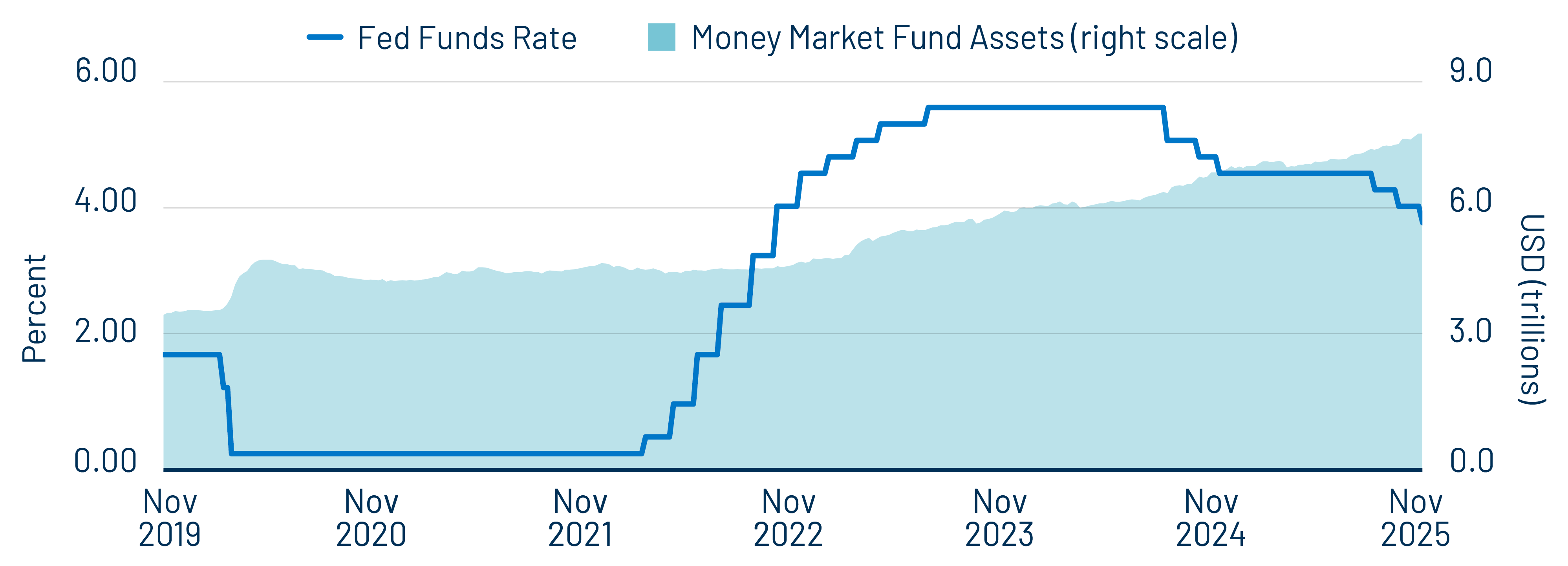

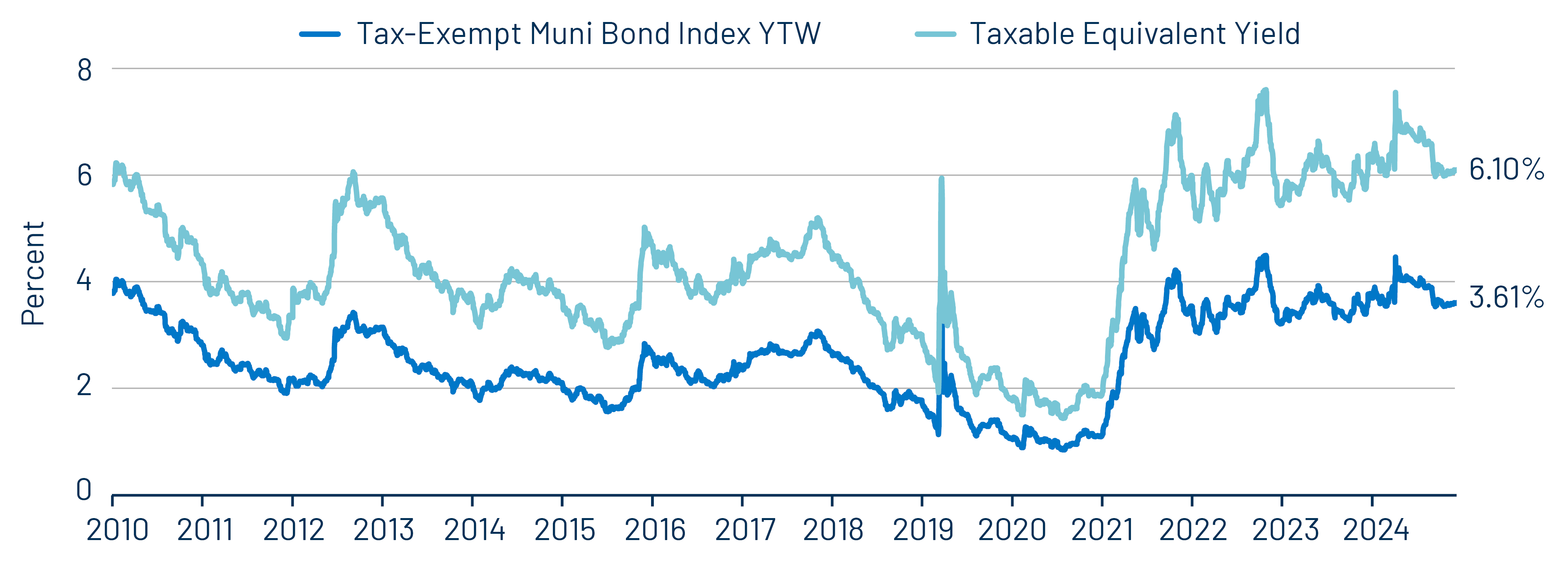

Looking ahead, we expect demand to remain supported by the Fed’s expectations that short-end rates will decline further. Money market assets have increased by $3.1 trillion to $7.7 trillion since the start of the Fed’s hiking cycle. Should those allocations reverse—or even slow—as front-end rates decline, Western Asset believes investors could seek higher income opportunities in other fixed-income asset classes. At current valuations, the after-tax income opportunities offered by the muni market are well positioned to attract such demand, which we expect would contribute to municipal market performance ahead.

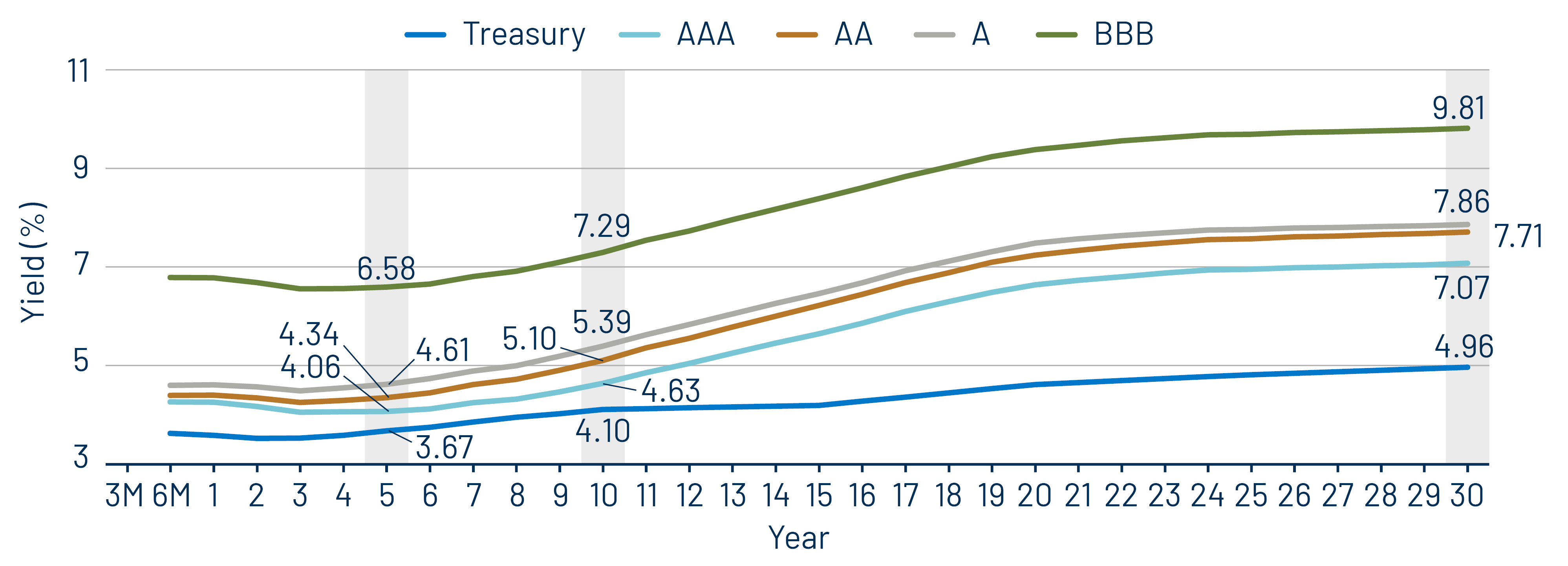

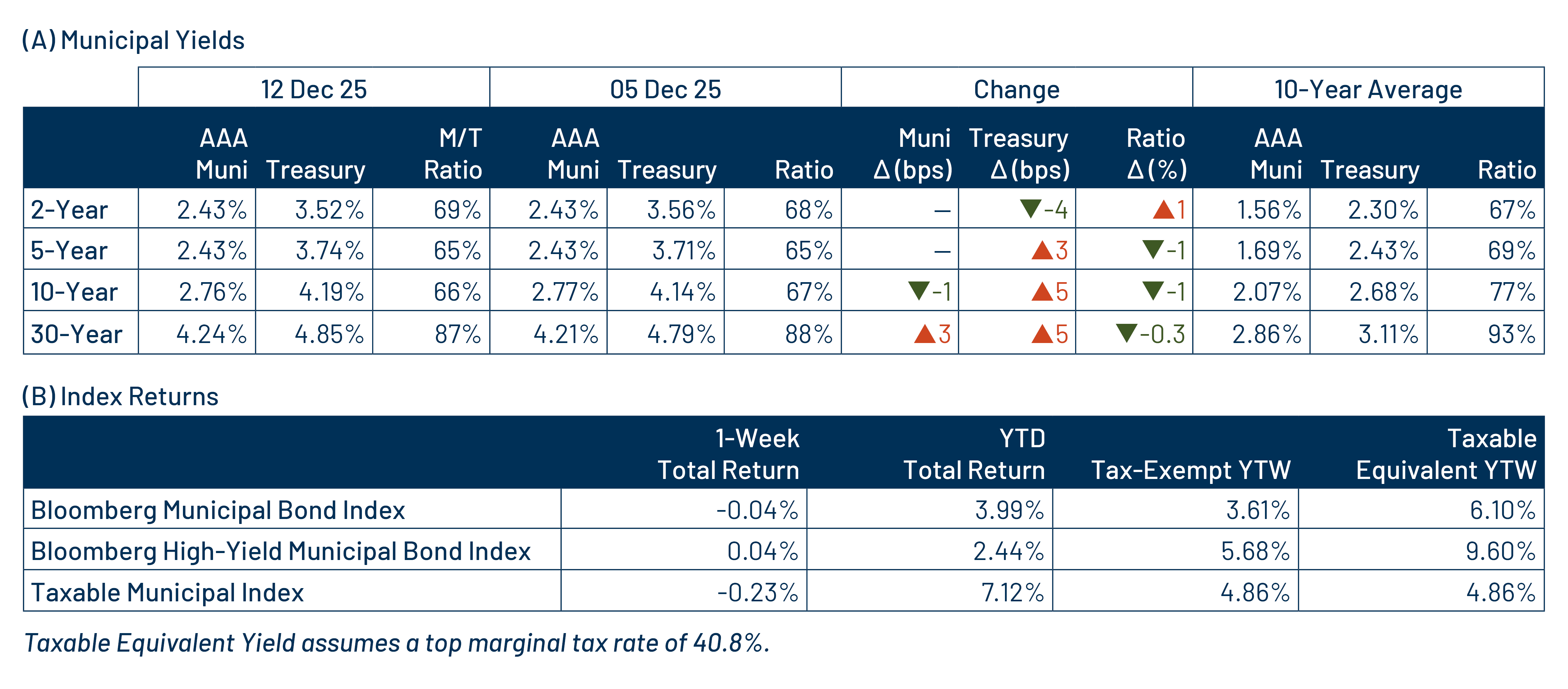

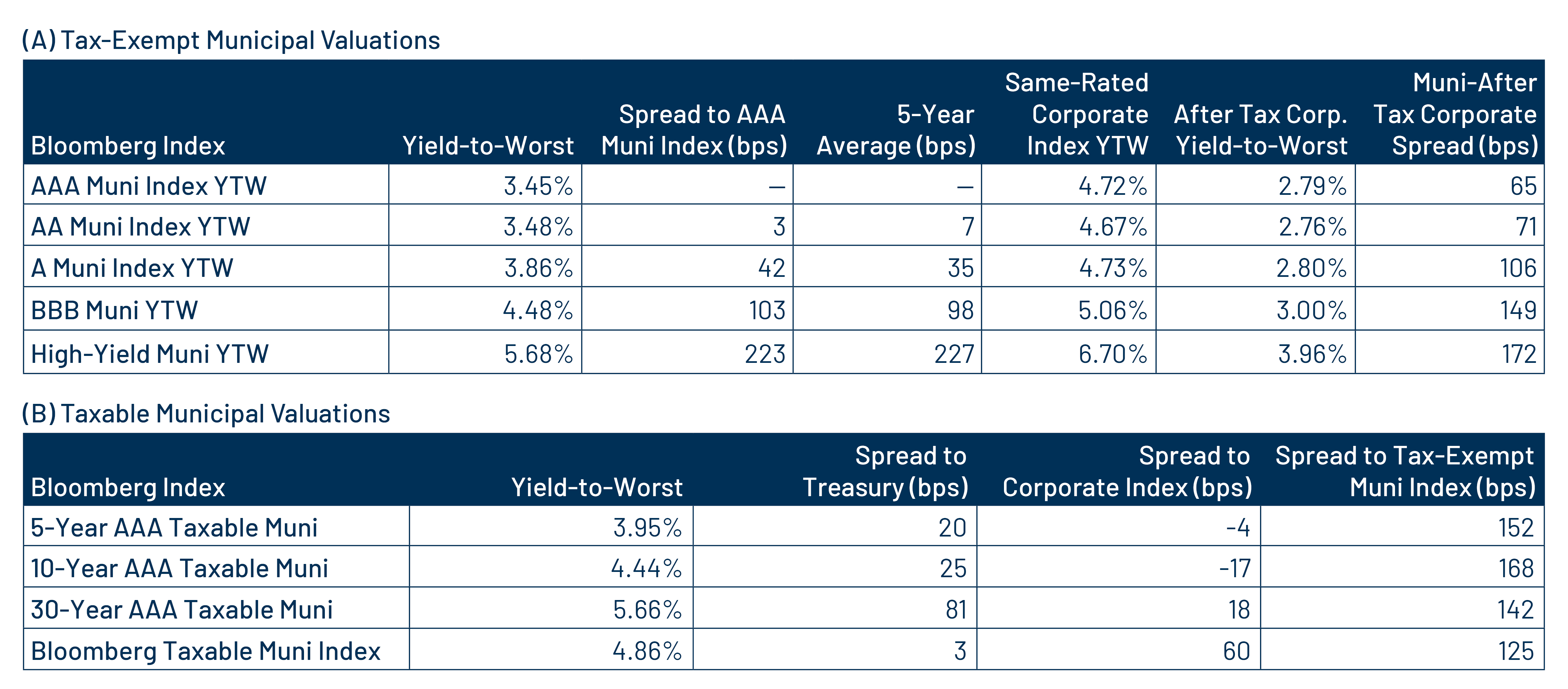

Municipal Credit Curves and Relative Value

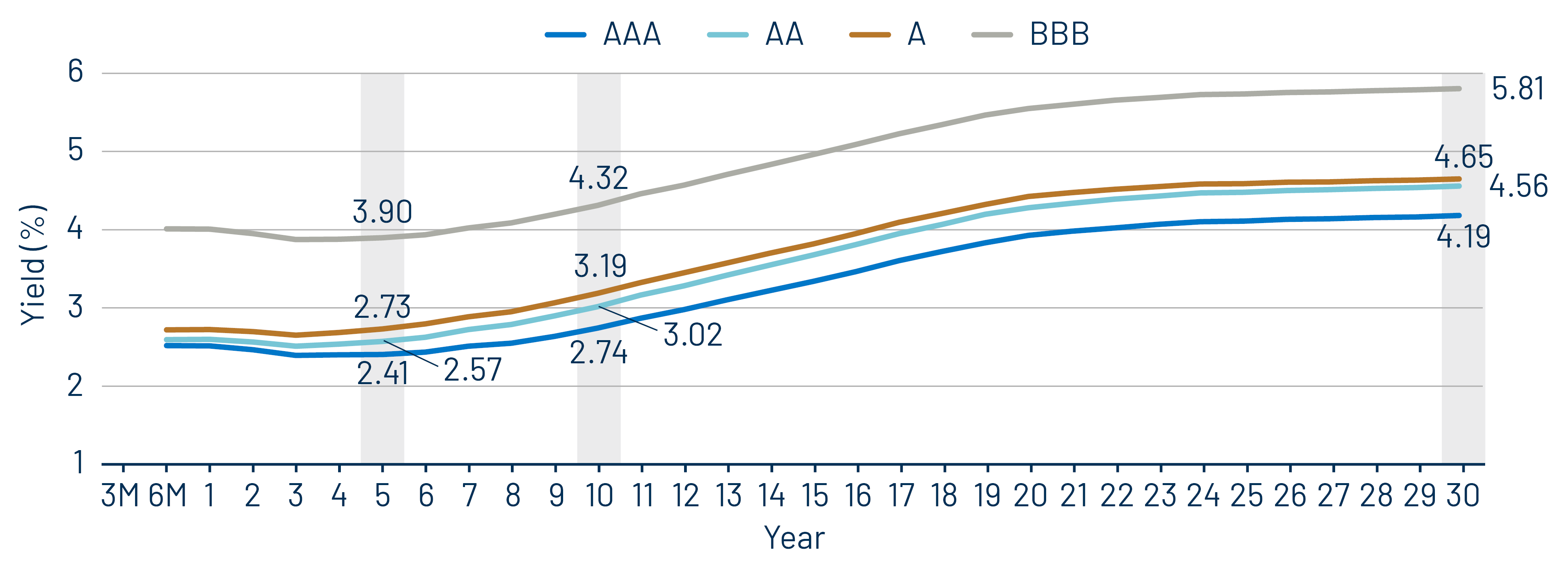

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

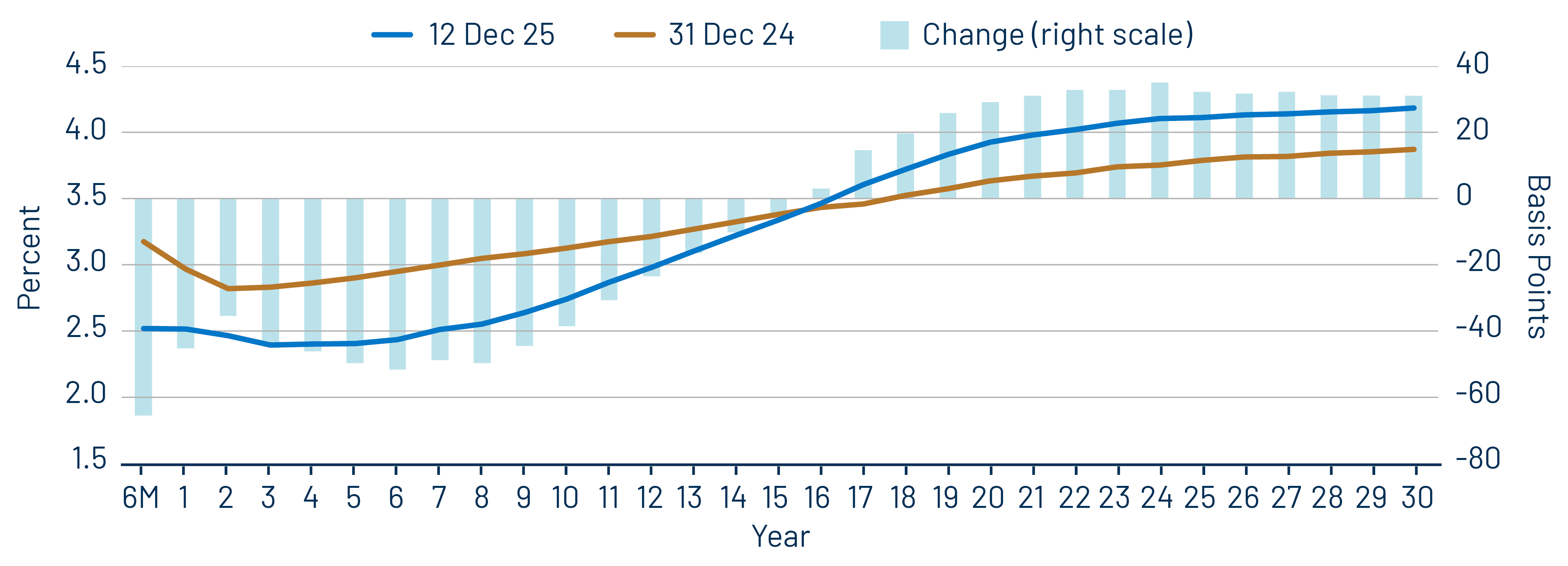

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

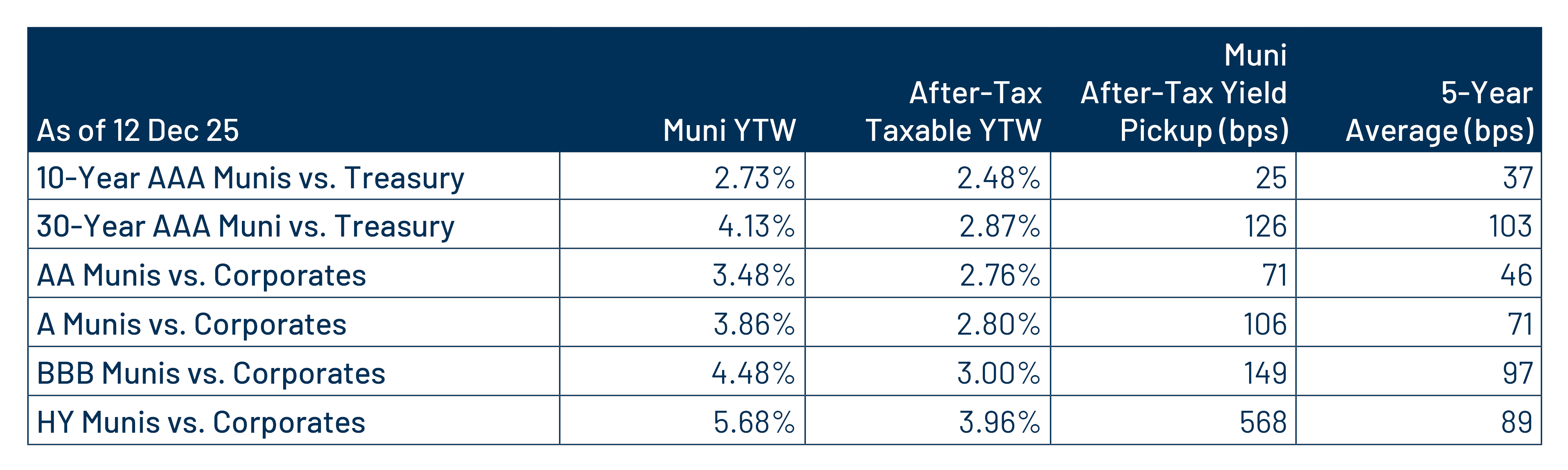

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.