Municipals Posted Positive Returns Last Week

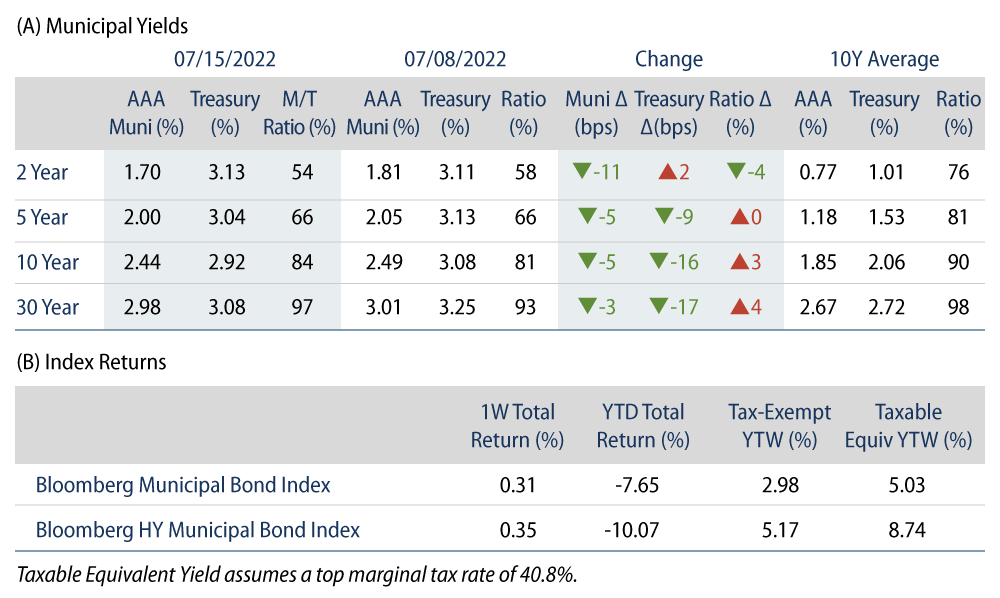

Munis posted positive returns last week and underperformed Treasuries across most maturities. High-grade municipal yields moved 3-11 bps lower across the curve while weekly reporting municipal mutual fund flows turned positive. The Bloomberg Municipal Index returned 0.31% and the HY Muni Index returned 0.35%. This week we evaluate potential price implications of a significant Fed hike later this month.

Municipal Mutual Funds Record Inflows

Fund Flows: During the week ending July 13, weekly reporting municipal mutual funds recorded $206 million of net inflows, according to Lipper. Long-term funds recorded $141 million of outflows, high-yield funds recorded $177 million of inflows and intermediate funds recorded $1 million of outflows. Year to date (YTD) outflows stand at -$80.2 billion.

Supply: The muni market recorded $11 billion of new-issue volume, up over 2x from the prior week. Total YTD issuance of $222 billion is 4% lower than last year’s levels, with tax-exempt issuance trending 7% higher year-over-year (YoY) and taxable issuance trending 39% lower YoY. This week’s new-issue calendar is expected to decline to $7 billion. Large deals include $709 million Main Street Natural Gas and $599 million Central Plains Energy transactions.

This Week in Munis: Short-Term Focus—Impact of an Expected Fed Hike

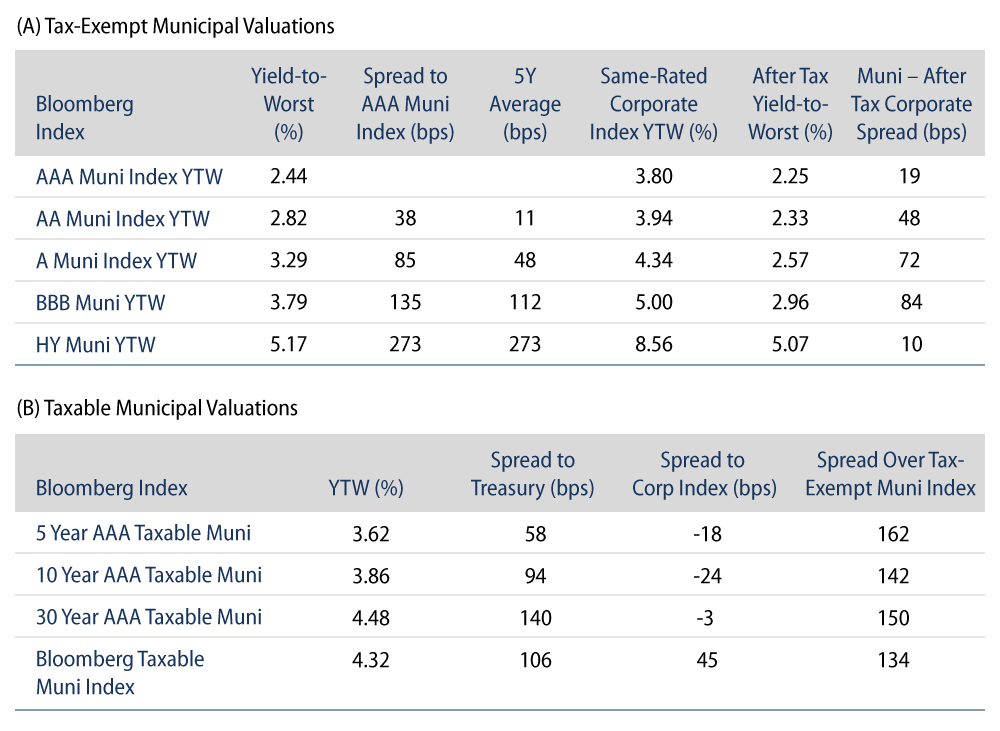

In recent weeks municipal investors have been concerned about adding capital into the muni market during a rising-rate environment. There has been particular focus on the implications at the short end of the curve which could be more directly influenced by the Federal Reserve, widely expected to increase the target rate by as much as 100 bps later this month.

While the rate volatility observed this year has undoubtedly weighed on municipal returns, we believe investors considering adding muni allocations should consider the interest rate volatility already priced into current valuations, as well as the tax-exempt coupon income and reinvestment that can be generated to offset negative price impact associated with the rate increases.

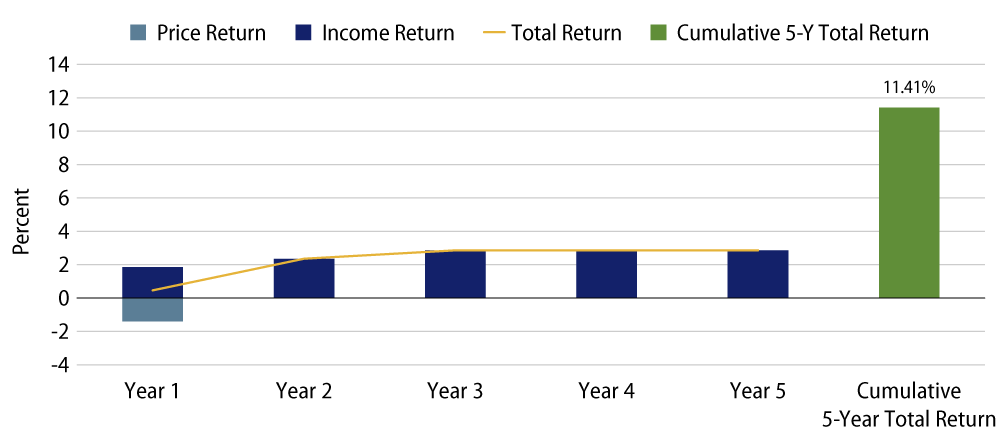

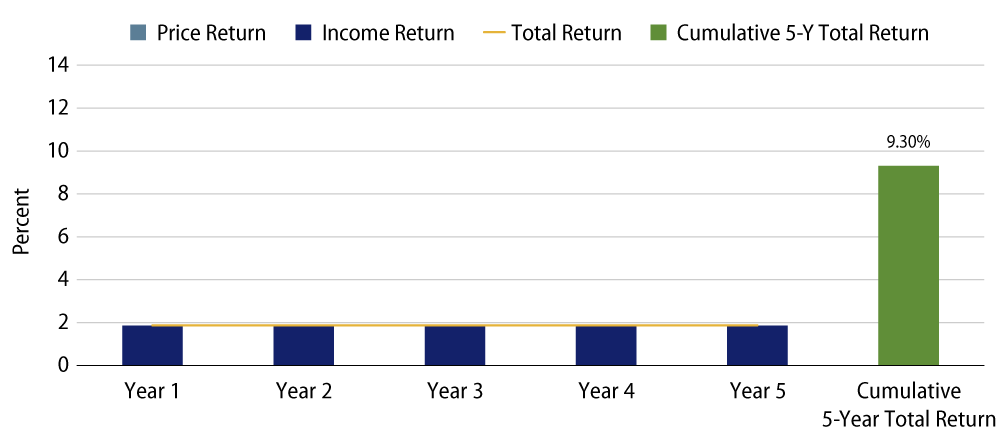

Consider a hypothetical short-term portfolio invested in the Bloomberg 1-Year Municipal Bond Index (1-2 years) right ahead of a 100-bp rate hike by the Fed. Because of the index’s 1.39-year duration, if the municipal yield curve moved 100 bps higher in sympathy with the Fed’s hike, we would expect an initial price decline of roughly -1.39%. However, over the first year from initial investment, the short duration portfolio could potentially earn 1.86% in tax-exempt income (2.35% on a taxable-equivalent basis), likely offsetting the negative price impact associated with the rate increase. In addition to the income earned over the initial year, the portfolio could also benefit from faster reinvestment of coupon proceeds into a higher-rate environment. All else equal, over a five-year period, this hypothetical higher reinvestment could lead to a 11.41% cumulative return, 2.11% higher than the 9.30% return in a no-hike scenario.

As highlighted in a blog post earlier this year, municipal bonds tend to outperform taxable fixed-income over the full course of rising rate cycles. When considering the fact that the municipal tax-exemption becomes more valuable at higher nominal interest rates, it is not surprising that municipal yields, over time, typically move higher at a slower pace than taxable bond counterparts. In this hypothetical scenario, the -1.39% price decline reflects a full 100-bp tax-exempt yield increase in sympathy with a 100-bp Fed move. However, if taxable yields increase 100 bps, it would not be unreasonable to expect the municipal yield to move higher at a lower rate to maintain after-tax equilibrium, which would limit the initial price decline of the municipal portfolio. Moreover, favorable short-term muni technicals of lower YoY short-term supply, as well as lower broker/dealer inventories, could keep short yields relatively anchored, potentially further limiting the price impacts associated with higher rates.

With the Bloomberg 1-year Municipal Index Yield of 1.86% offering more than double the yield of a year ago, we believe this may be an attractive entry point for taxable muni investors looking to step out of cash for high-quality tax-exempt income.