Municipals Posted Positive Returns During the Week

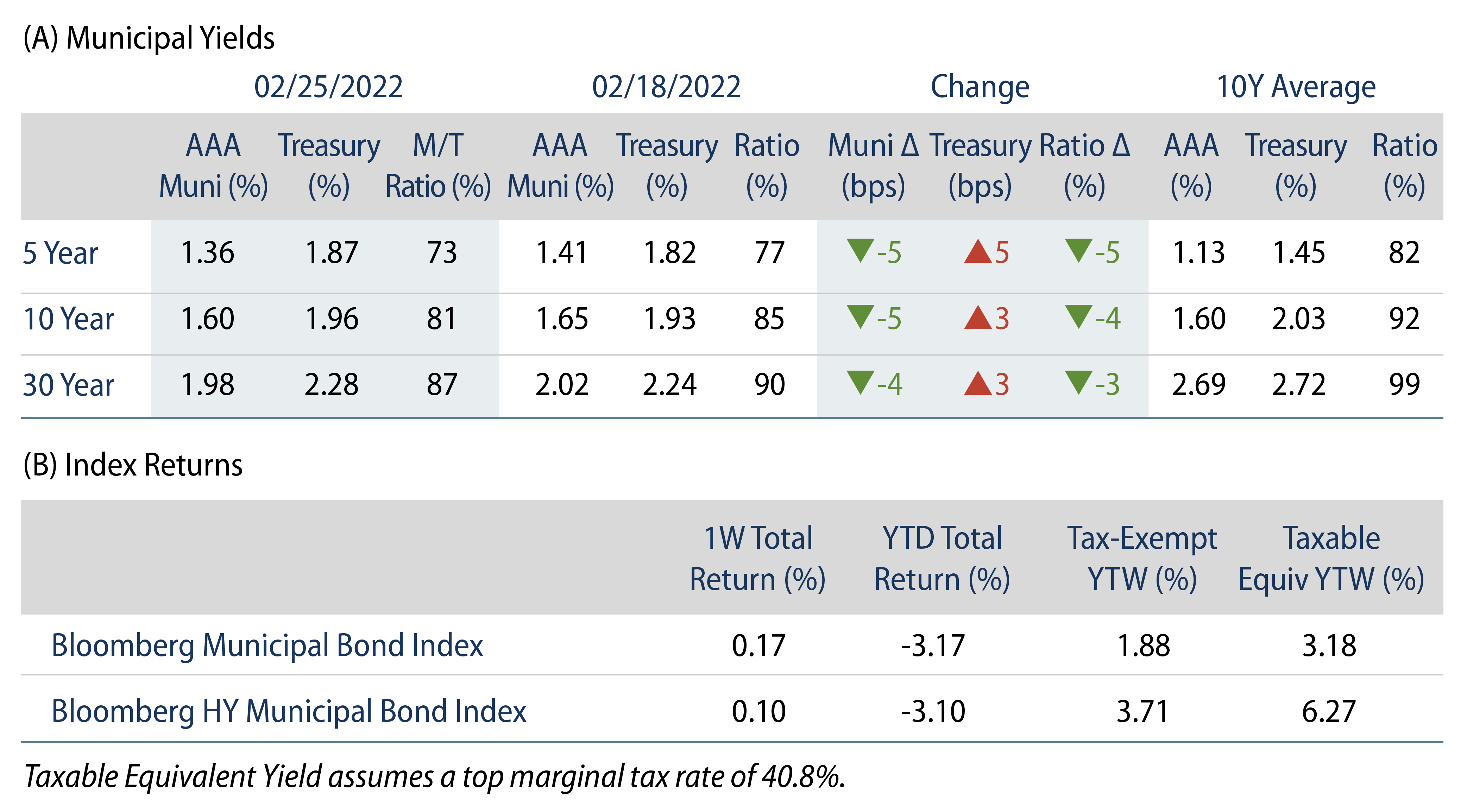

US municipals posted positive returns during the week on a flight-to-quality sentiment as high-grade municipal yields moved 4-5 bps lower across the curve. Municipals outperformed Treasuries as Municipal/Treasury ratios declined. The technical environment remained soft amid continued mutual fund outflows and an uptick in new-issue supply. The Bloomberg Municipal Index returned 0.17%, while the HY Muni Index returned 0.10%. This week we highlight historical municipal performance during Federal Reserve (Fed) hiking cycles.

Municipal Technicals Remained Soft as Municipal Fund Outflows Continued

Fund Flows: During the week ending February 23, weekly reporting municipal mutual funds recorded $1.2 billion of net outflows, according to Lipper. Long-term funds recorded $525 million of outflows, high-yield funds recorded $283 million of outflows and intermediate funds recorded $262 million of outflows. Municipal fund outflows year to date (YTD) extended to $8.3 billion.

Supply: The muni market recorded $10 billion of new-issue volume, over double the prior week’s level. Total YTD issuance of $58 billion is 17% higher from last year’s levels, with tax-exempt issuance trending 48% higher year-over-year (YoY) and taxable issuance trending 50% lower YoY. This week’s new-issue calendar is expected to drop to $4.0 billion. The largest deals include $793 million New York City Municipal Water Authority and $570 million Department of Water and Power of the City of Los Angeles transactions.

This Week in Munis: Munis and Fed Rate Hikes

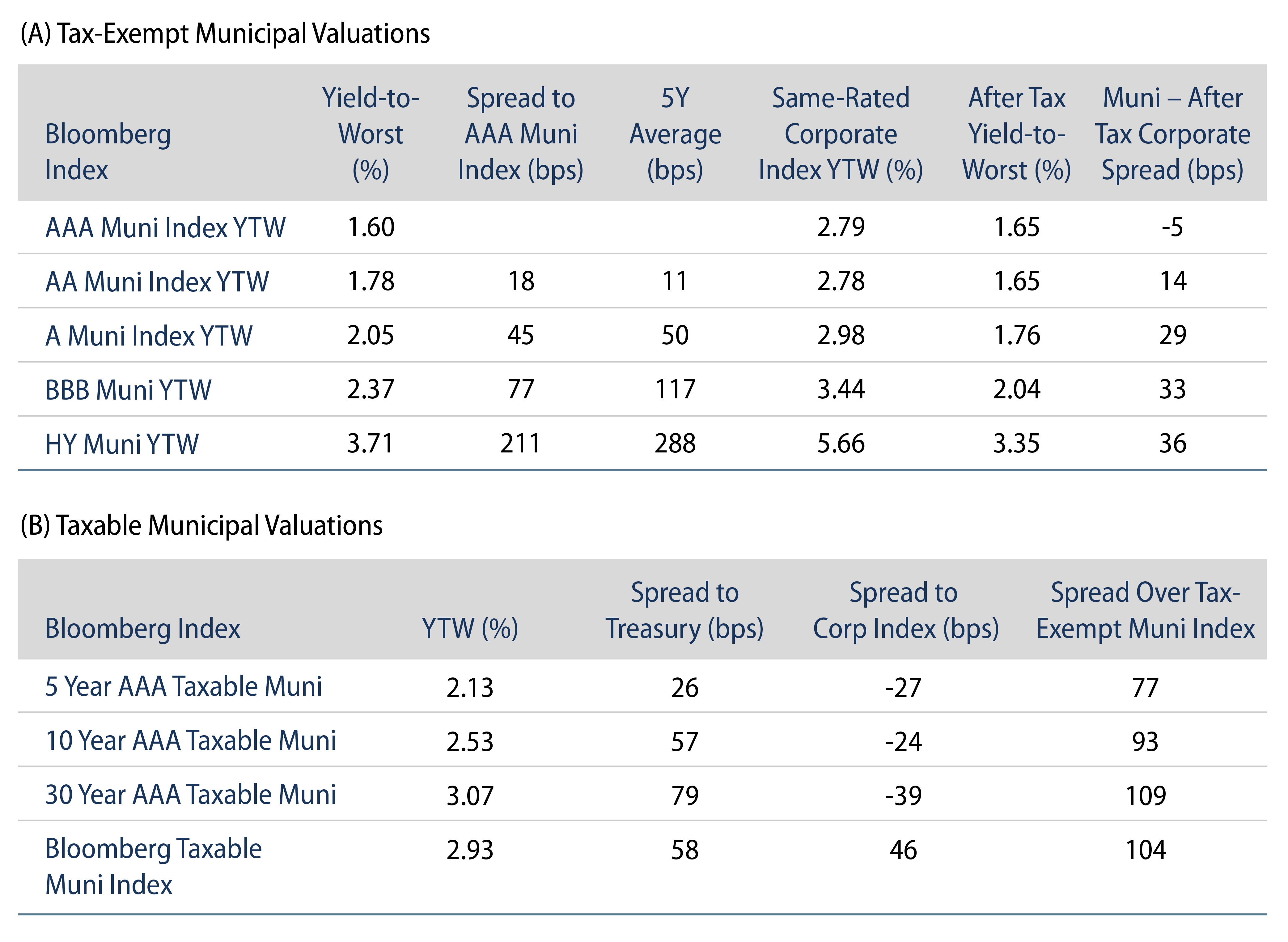

Municipal market volatility observed this year has been driven by inflation and rising-rate concerns. While rising rates can weigh on fixed-income prices, we believe it is important for investors to recognize that the impact of rising rates is often offset by the income component of total returns, and do not automatically translate to negative total returns. In addition, the tax-exemption associated with the municipal asset class offers a unique structural benefit that becomes more valuable as rates increase. For every 100 bps of higher yields in a taxable asset, tax-exempt municipal yields should increase at a lower rate to maintain after-tax income equilibrium, often limiting negative price pressures associated with the muni asset class when rates rise. To further demonstrate these trends, we evaluate muni performance across the past three Fed Funds Rate hiking cycles that took place over the last 25 years, beginning in 1999, 2004 and 2015.

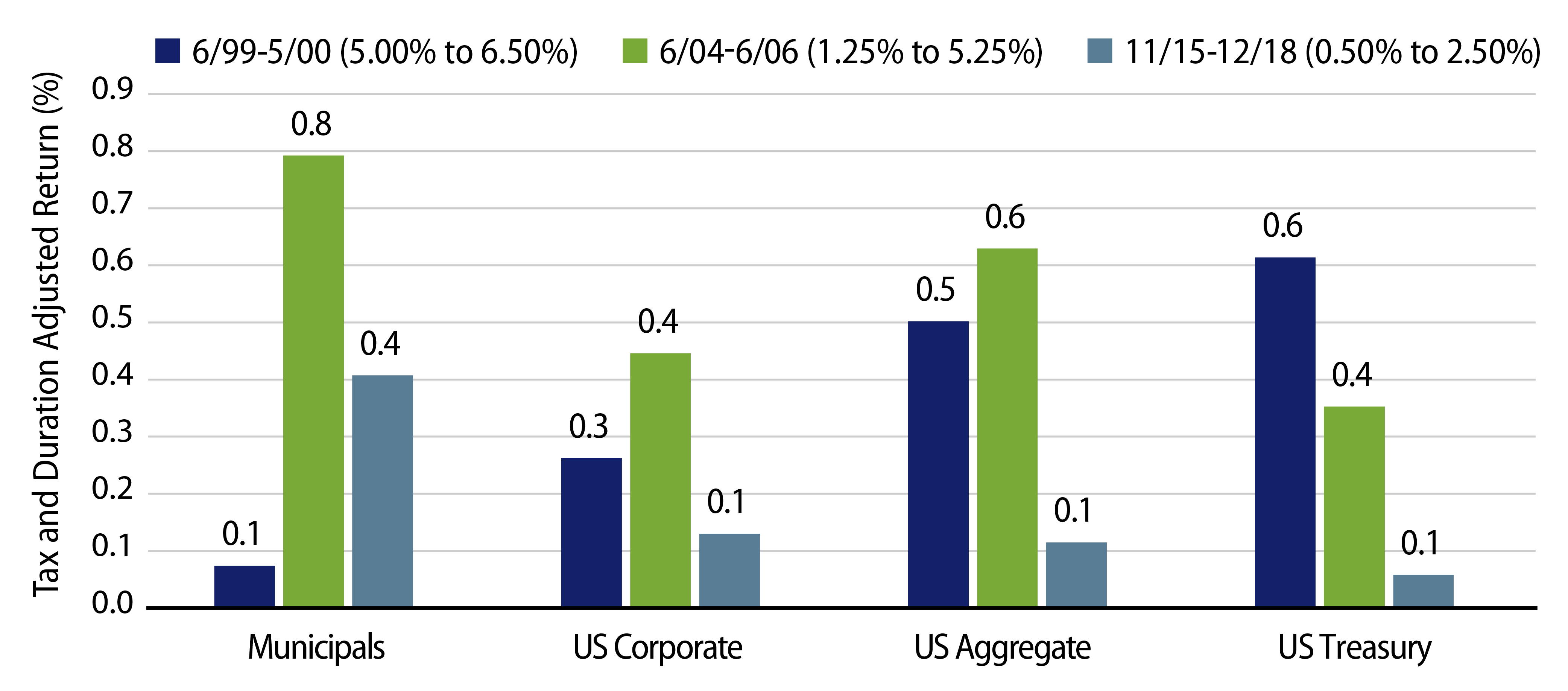

Municipals have outperformed other high quality fixed-income over the past two Fed hiking cycles. Over the past three hiking cycles, US investment-grade fixed-income posted positive total returns as the income component of returns more than offset price pressures associated with rising rates. On a tax-adjusted return per unit of duration basis (assuming a conservative 21% tax rate), municipals outperformed high-grade taxable fixed-income during the last two of these hiking cycles starting in 2004 and 2015.

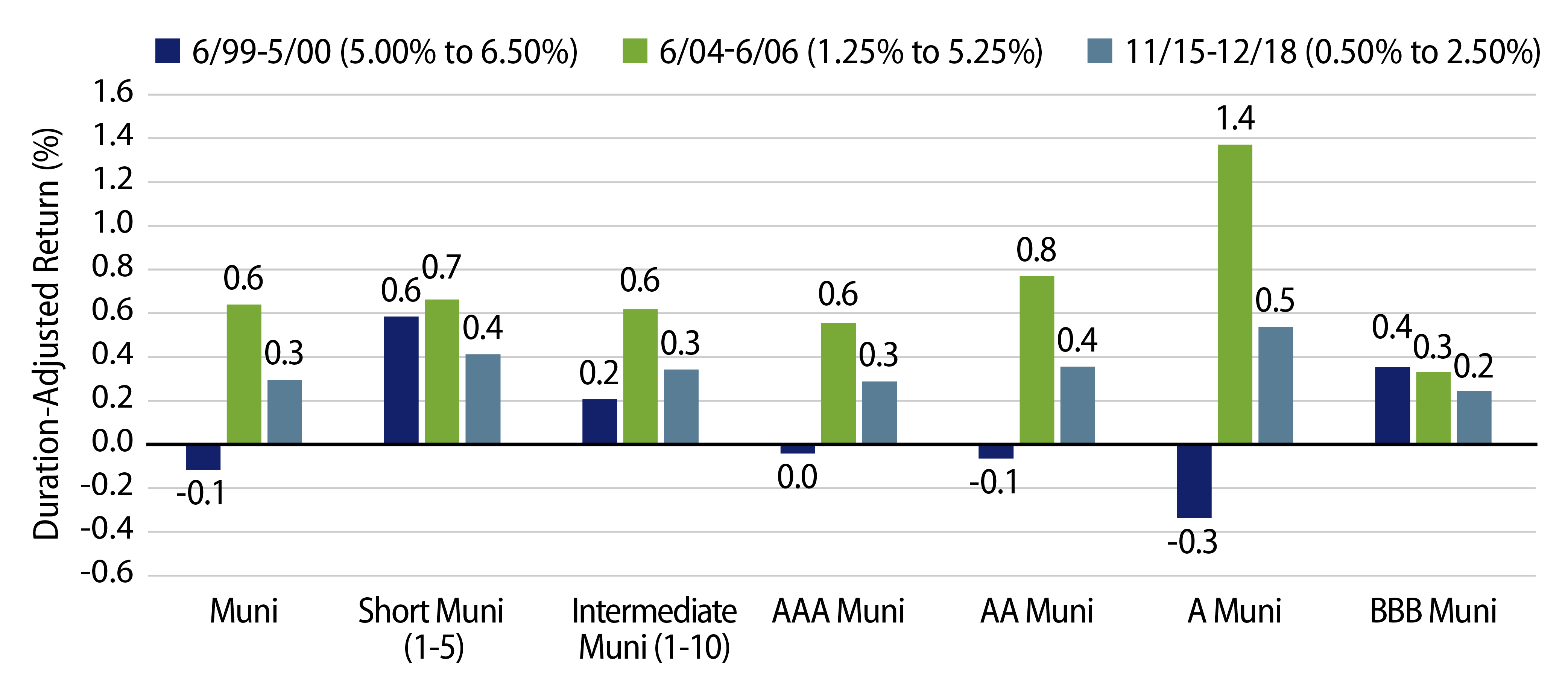

Within the municipal sector during Fed rate hiking cycles, we observe correlated performance trends. From a curve perspective, highest duration-adjusted returns were recorded within the intermediate part of the curve during all three Fed hiking periods. From a credit-quality standpoint, A rated municipals outperformed both higher quality and lower quality counterparts during the two most recent Fed hiking periods beginning in 2004 and 2015.

Considering the currently low Fed Funds Rate (upper target: 0.25%) as a starting point, paired with the potential that above-average inflation could lead to a potentially longer hiking cycle, we believe that the upcoming Fed hiking cycle could exhibit characteristics closer to 2004 and 2015 rather than what was observed in 1999. In this scenario, we could anticipate munis to perform well versus other taxable investment-grade fixed-income sectors, and that intermediate munis within the mid-investment-grade quality cohort could prove particularly resilient. As highlighted in these prior scenarios, we would expect the municipal asset class to serve as ballast of an asset allocation amid potential broader market volatility, and that an active manager can consider these performance trends to deliver value in the upcoming environment.

Note that this information does not constitute investment advice or recommendations with respect to the sectors listed and should not be the sole basis for any investment decision. Past performance is not indicative of future results.