Municipal Yields Trailed Treasuries Higher

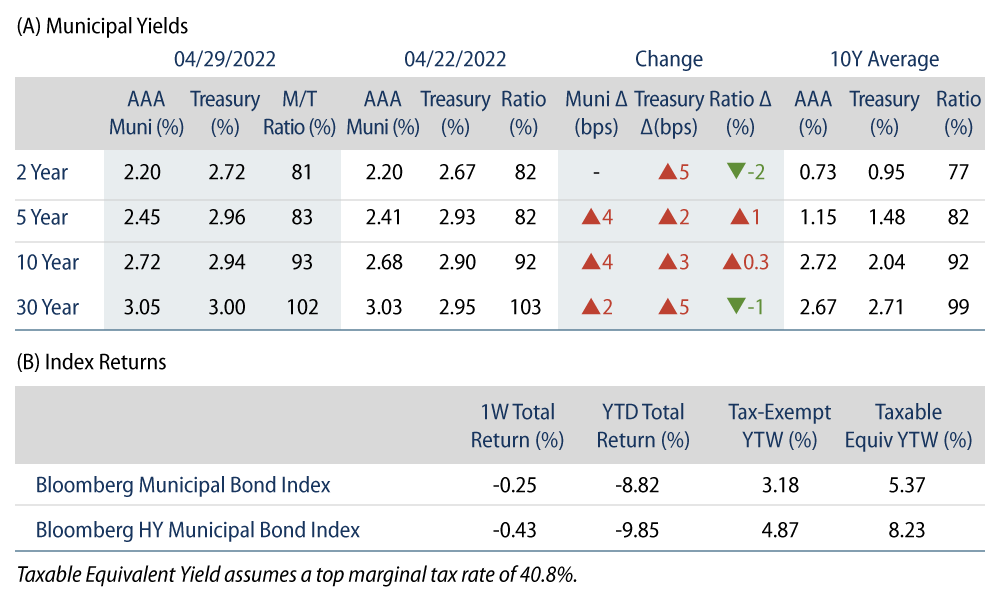

Municipals posted negative returns, as high-grade muni yields moved 2-4 bps higher across the curve. Munis underperformed Treasuries in intermediate maturities last week, but outperformed in short and long maturities. Meanwhile, municipal fund outflows continued. The Bloomberg Municipal Index returned -0.25%, while the HY Muni Index returned -0.43%. This week we highlight the state of Illinois budget and recent upgrade.

Technicals Remain Weak Amid Continued Fund Outflows

Fund Flows: During the week ending April 27, weekly reporting municipal mutual funds recorded $2.9 billion of outflows, according to Lipper. Long-term funds recorded $2.2 billion of outflows, high-yield funds recorded $729 million of outflows and intermediate funds recorded $352 million of outflows. The week’s fund outflows extend the current outflow streak to 16 consecutive weeks, and contribute to $42 billion of year to date (YTD) net outflows.

Supply: The muni market recorded $15 billion of new-issue volume, nearly three times higher than the prior week. Total YTD issuance of $138 billion is 2% higher than last year’s levels, with tax-exempt issuance trending 13% higher year-over-year (YoY) and taxable issuance trending 31% lower YoY. This week’s new-issue calendar is expected to decline to $4.8 billion. Largest deals include $945 million Triborough Bridge and Tunnel Authority and $450 million County of Santa Clara transactions.

This Week in Munis: Illinois Budget Underscores Credit Improvement

Last week we highlighted upgrade momentum within the municipal market. This trend is arguably most exemplified by the state of Illinois, which last month was upgraded for the third time in a year with Moody’s taking its rating to Baa1. The upgrade came on the passage and signing of the $46.5 billion fiscal 2023 budget signed last month, reflecting the state’s revenue growth, continued fiscal discipline, paying down the bills backlog and increased pension funding.

From an economic perspective, the state’s economic condition continues to improve alongside the nation. Illinois unemployment rate grinded lower to 4.7%, down from a record high of 17.4% in April 2020. Illinois estimates real GDP growth of 5.2% in 2021, above recent growth levels but shy of the 5.7% national growth rate.

Improving economic conditions have supported better than anticipated fiscal 2022 (ending June 30) revenues of $46.4 billion, which are coming in 0.3% higher than prior estimates. These higher than anticipated tax collections are expected to lead to a $1.7 billion end-of-year surplus that will be utilized to pay down short term liabilities and Federal Reserve Municipal Liquidity Facility borrowing.

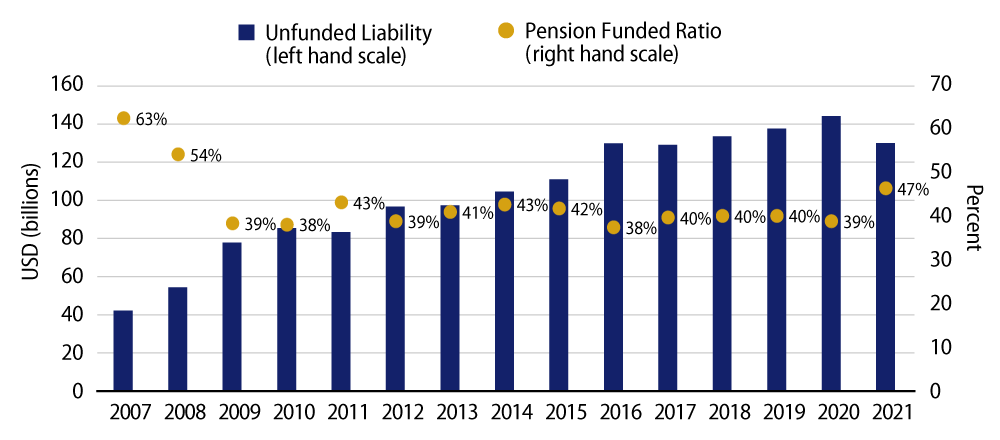

Within the $46.5 billion fiscal 2023 budget, expenditures are expected to decline 2% from fiscal 2022 levels. Major budget highlights include additional K-12 and higher education spending, continued investments in public health and human services, and additional public safety spending. The state has also enacted one-time tax-relief measures for its residents, such as direct rebate checks, property tax rebates and a suspension of the grocery tax for one year. Illinois plans to contribute $1 billion to the Budget Stabilization Fund, which should improve budgetary flexibility. The state also will add $500 million to the Pension Stabilization Fund, on top of a record high pension contribution of $9.6 billion.

While these positive budget trends in our view justify the credit rating improvement, Illinois still faces challenges ahead. The state projects a slowdown in growth in 2022 and 2023, continues to see population outmigration, and its unemployment rate exceeds the nation. While the state has improved the funding status of its pension system, pension liabilities remain elevated and annual contributions still fall short of the Actuarily Required Contribution.

Overall, Western Asset remains a positive credit outlook on the State of Illinois and its related agencies. The state has come a long way from its budget impasse in 2015-2017, a record bills backlog, and a deteriorating pension situation. While Illinois still has challenges that lie ahead, it certainly appears that it has rounded a corner and is now on improved financial and operational footing. Recent spread-widening, along with planned debt issuance later this quarter, could offer an attractive entry point for municipal investors in the upcoming months.