The current decline in economic activity suggests that there may be a material uptick in corporate issuer downgrades. In light of the pandemic-induced economic slowdown and market volatility, we take a moment here to examine the potential impact on regulatory capital charges under the current and proposed frameworks for corporate bonds held by US insurers.

Background

The National Association of Insurance Commissioners (NAIC) has in recent years been considering updating its schedule of risk-based capital (RBC) charges for fixed-income investments. Charges currently in effect were put into place in the early 1990s (with some changes since then) based on historical data from the 1970s and 1980s1. One reason an update may now be warranted is that economic and market conditions have changed markedly since then, as have credit ratings methodologies. Another reason is simply to better align RBC charges to actual risks, and to this end, the proposed RBC Life factors of the American Academy of Actuaries1 are based on an increase in granularity. Though this blog post is focused on Life insurance, similar considerations and conclusions would hold for the Property & Casualty (P&C) sector, with one key difference: implementation of new Life factors appears to be a higher priority than implementation of new P&C factors since investment risk tends to consume a larger percentage of the total capital charge for Life insurers than for P&C insurers.

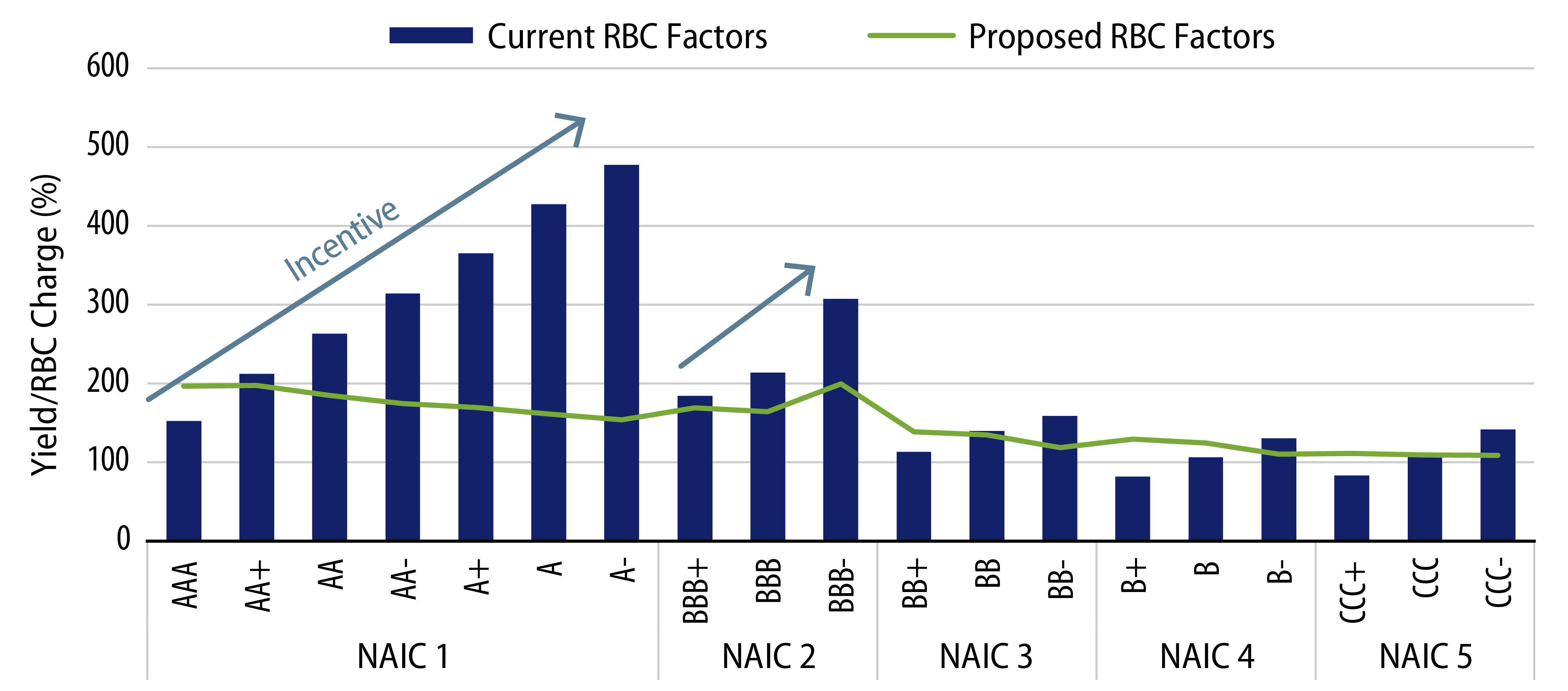

Whereas the current factors depend upon a bond’s NAIC rating (from NAIC 1 through NAIC 6), the proposed factors depend upon a bond’s credit rating (from AAA through D). Under the current factors, an investor seeking a return on capital2 is incentivized to go down-in-credit within each NAIC rating bucket in order to pick up yield without increasing capital charge, whereas under the proposed factors, that incentive goes away (Exhibit 1).

Implementation Timeline

The NAIC had been targeting implementation of the proposed Life factors by year-end 20191, but realistically, it may more likely occur in late 2020 or even 2021. At least, that was the pre-pandemic thinking.

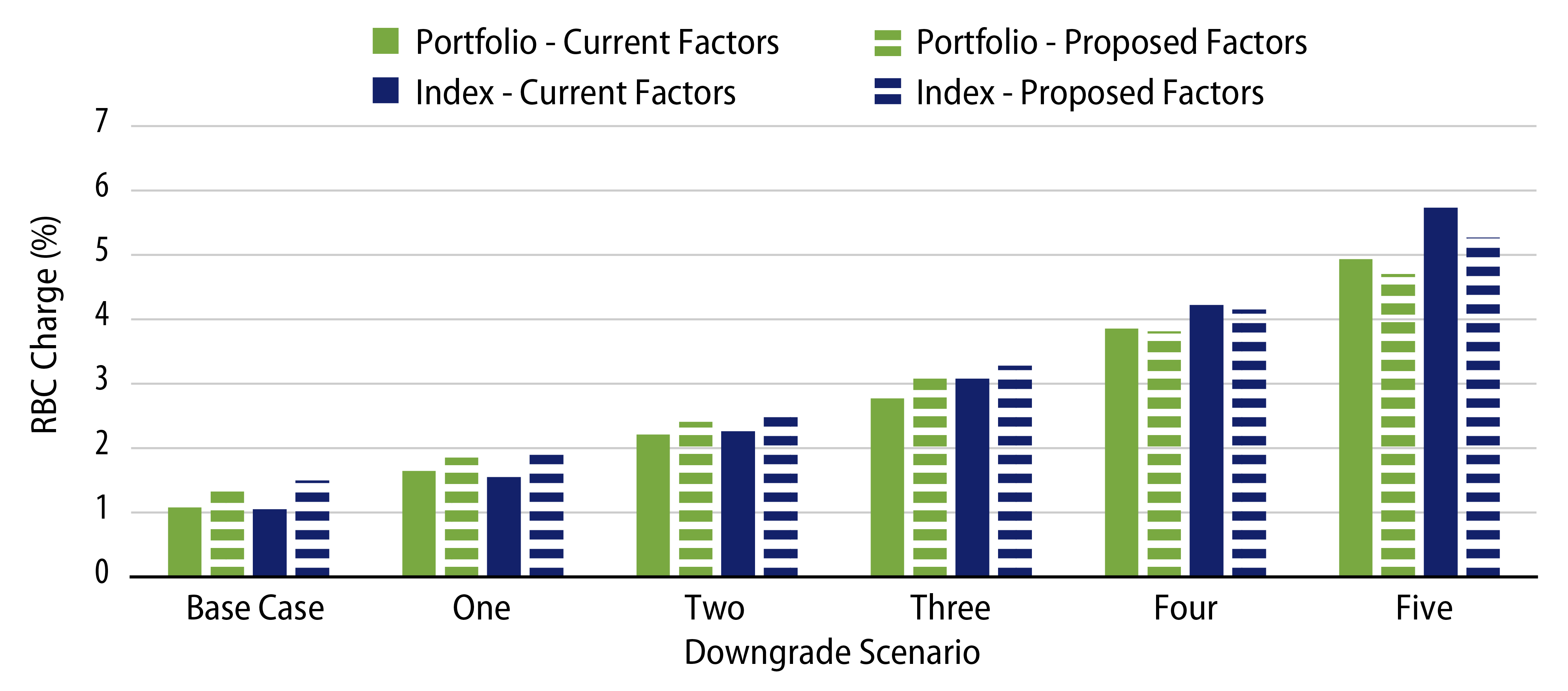

To better understand how the current and proposed RBC factors would behave in the event of credit rating downgrades, we have created several downgrade scenarios.

Credit Ratings Downgrade Scenarios

We considered five credit rating downgrade scenarios in order of increasing severity. In each scenario, we assume that 10% of the portfolio is downgraded by one or more notches pro rata across all ratings. Scenario One assumes a one-notch downgrade (for example from A- to BBB+). Scenario Two assumes a two-notch downgrade (for example from A- to BBB), and so on through Scenario Five. We have taken a multiple downgrade scenario into account, as the cadence of downgrades in credit has picked up in March 2020. According to Moody’s Analytics, 12-month rating drift (represented as follows)…

(notches upgrades – notches downgrades) / (number of rated issuers)

….doubled from -5.7% in February to -13.6% in March due to downgrade activity.

US Life Industry Composite Fixed-Income Portfolio

We consider US Life insurer general account assets in aggregate as of December 31, 20193. Because of data granularity limitations, the simplifying assumption is made that, within each NAIC rating bucket, the allocation is spread out equally among different credit ratings4. Thus, for example, within NAIC 1 the allocation is assumed to be spread equally among AAA through A-. Similarly, within NAIC 2 the allocation is assumed to be spread equally among BBB+ through BBB-, and so on. With over 50% of US Life insurer general account assets in corporate bonds, according to Cerulli5, we focus our attention on US investment-grade credit corporates. Thus, as a comparison benchmark, we consider Bloomberg Barclays US Corporate Bond Index.

Capital Charge Impacts

We examine the downgrade scenarios’ impact on the portfolio’s capital charge:

Note that capital charges are higher using the proposed versus current factors for scenarios of one to three downgrades. This is true under the less severe scenarios, while the reverse is true under the more severe scenarios. This is as expected, reflecting the fact that in recent decades, credit losses have increased for investment-grade bonds and decreased for high-yield bonds1.

Managing Downgrade Risk

Regardless of the implementation timeline for the new factors, managers of general account assets may be able to position their portfolios to better withstand potential downgrades. For example, issuers that are more likely to withstand the downturn may be identified through fundamental credit research. Finally, as noted above, downgrades that do occur would not impact a portfolio’s RBC profile under the current NAIC regime unless there is a crossover into a new NAIC bucket (for example A- to BBB+).

Conclusion

The proposed factors appear to better align to actual risks by removing the unintended incentive to go down-in-credit within each NAIC rating bucket (to pick up yield while holding the capital charge constant). Moreover, they behave as expected under hypothetical credit rating downgrade scenarios. These considerations support moving forward with implementation per the timeline that had been put into place pre-pandemic, if not sooner. Regardless of the implementation timeline, managers of general account assets may be able to position their portfolios to better withstand potential downgrades.

1[CIPR23] Risk-Based Capital Requirements on Fixed Income Assets to Change, CIPR Newsletter, Volume 23 of November 2017, https://www.naic.org/cipr_newsletter_archive/vol23_rbc_requirement.pdf.

2Return on capital is defined as Yield/RBC Charge

3S&P Global Market Intelligence, based on regulatory filings

4US government direct and guaranteed issues, which receive a capital charge of 0%, are separated out and not subject to the credit rating downgrade scenarios.

5Cerulli Associates, U.S. Insurance General Accounts 2018