Municipal Yields Continued to Grind Lower

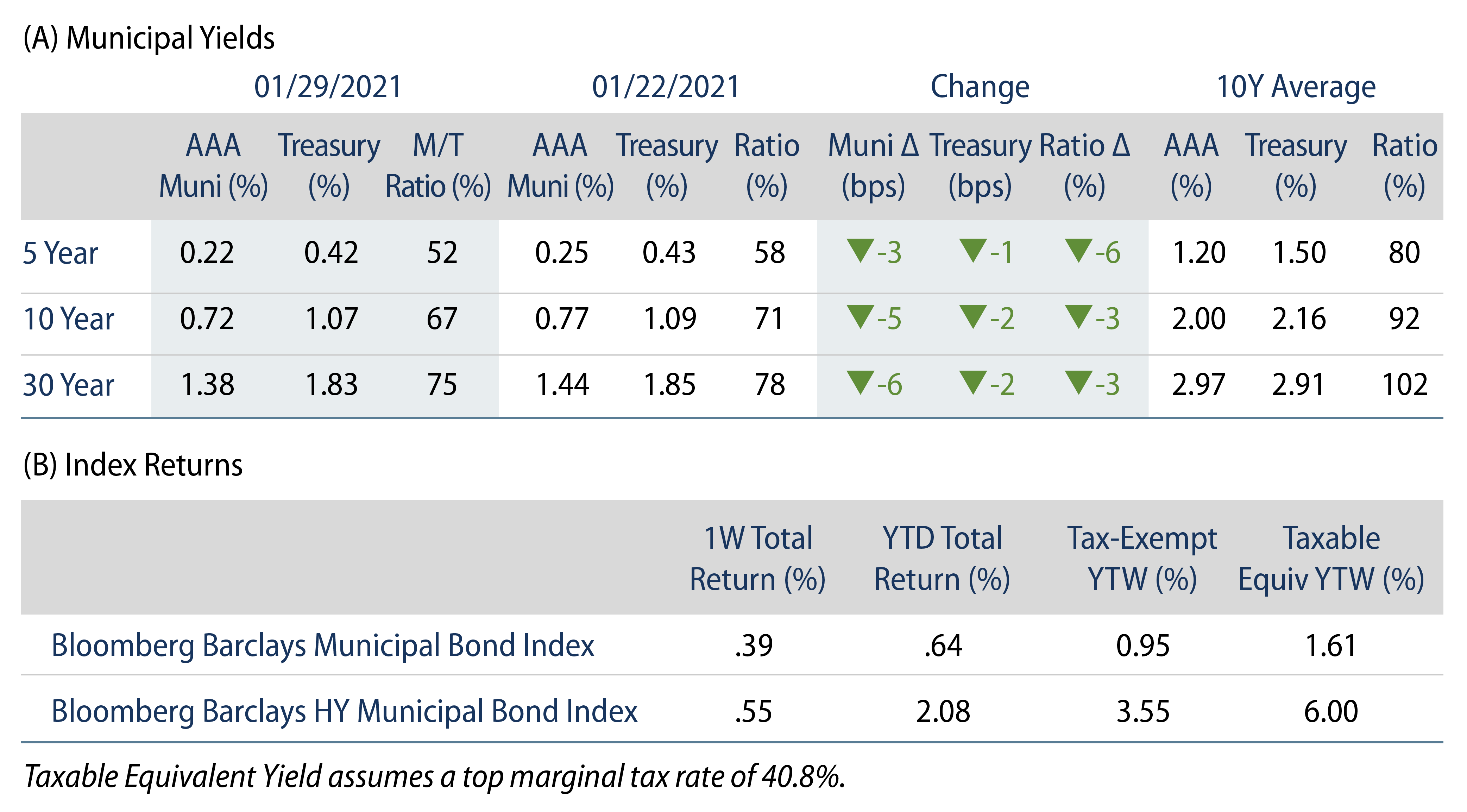

Municipals rallied and outperformed Treasuries during the week. Municipal mutual funds recorded a 12th consecutive week of inflows. AAA municipal yields moved 3-6 bps lower across the curve. Municipals outperformed Treasuries as ratios declined 3%-6%. The Bloomberg Barclays Municipal Index returned 0.39%, while the HY Muni Index returned 0.55%. This week we discuss the prospects of a reversal of the state and local tax (SALT) deduction limitations.

Demand Remains Positive on Near-Record Flows

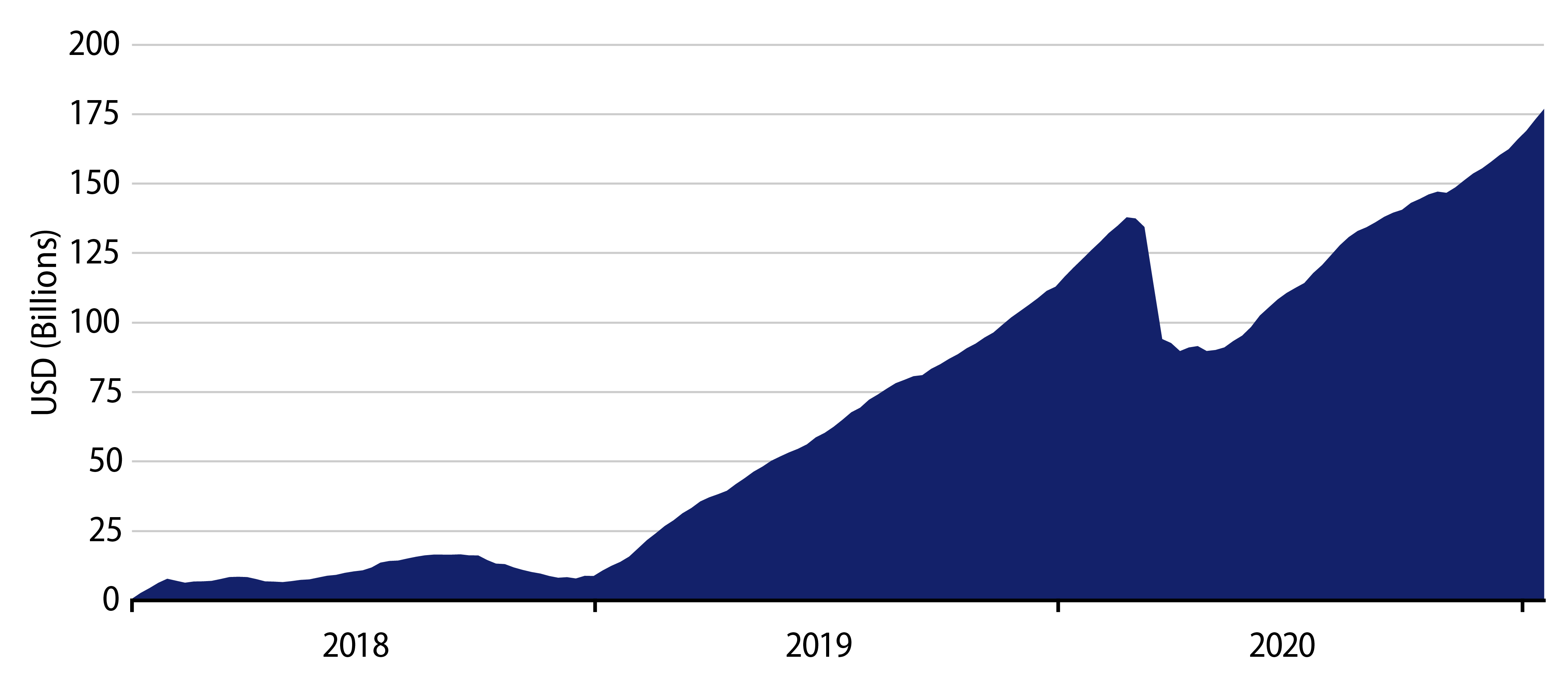

Fund Flows: During the week ending January 27, municipal mutual funds recorded a 12th consecutive week of net inflows, totaling $2.8 billion, which is the second highest weekly inflow on record, according to Lipper. Long-term funds recorded $1.8 billion of inflows, intermediate funds recorded $168 million of inflows and high-yield funds recorded $778 million of inflows. Year-to-date (YTD) net inflows total $13.8 billion.

Supply: The muni market recorded $7.6 billion of new-issue volume during the week, down 11% from the prior week. New issuance YTD of $26.3 billion is up 7% from January 2020 levels. This week’s new-issue calendar is expected to increase to $8.5 billion (+12% week-over-week). The largest deals include $1.2 billion New York City TFA and $1.1 billion Nassau County Interim Financing Authority transactions.

This Week in Munis: SALT Reversal?

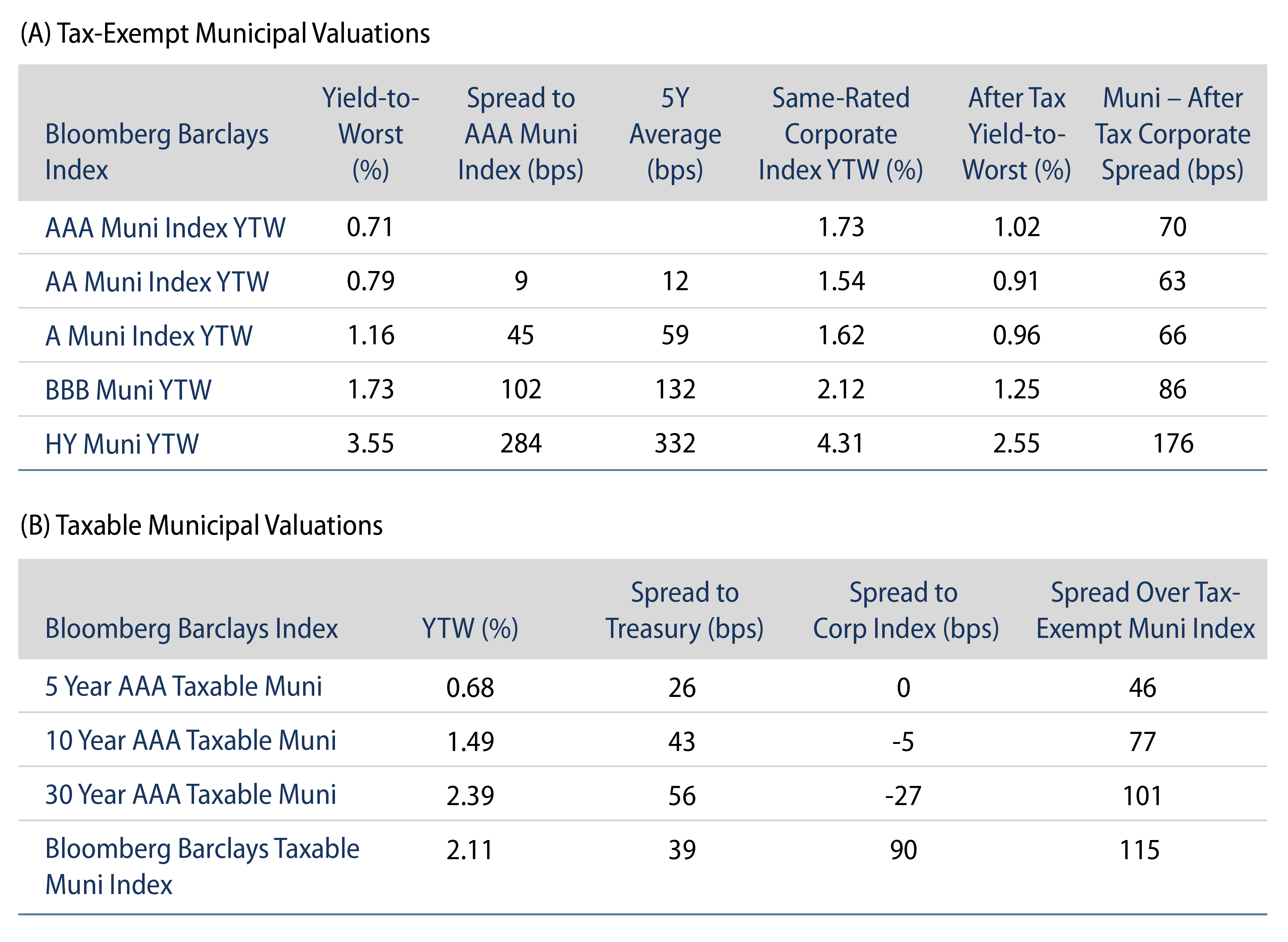

Last week House lawmakers introduced legislation to restore the full SALT deduction, repealing the $10,000 limit enacted by the 2017 Tax Cuts and Jobs Act. The deduction limit has increased tax burdens for individuals in higher tax regions, particularly New York and California, impacting credit profiles and the demand for municipal securities in these states.

From a fundamental credit standpoint, higher tax burdens contributed to outmigration concerns, particularly among individuals who contribute most to state and local coffers. According to the Census estimates, New York and California’s populations declined, -1.1% and -0.2%, respectively, from December 31, 2018 to December 31, 2020, underperforming the national growth rate of +0.8% during the same period.

From a technical standpoint, higher effective tax rates have contributed to increased demand for tax-exempt income. Since the Act’s passage in 2017, municipal mutual funds observed over $175 billion of net inflows into the municipal bond asset class, according to the Investment Company Institute (ICI).

Tax relief offered by a repeal of SALT deduction limits could soften the heavy demand for tax-exempt municipals in these high tax states. However, Western Asset remains constructive on the muni market over the medium term. SALT legislation is still in the early stages and we believe tax reform will remain a challenge in the current economic and political climate. Even if repealed, the potential for higher federal tax rates and infrastructure initiatives should still sustain the value of tax-exempt income-producing assets over the medium term. In addition, a more favorable tax regime could help stem some of the migration headwinds faced by these higher tax states, potentially contributing to credit spread tightening among associated securities.