Fannie Mae and Freddie Mac, which are government-sponsored enterprises (GSEs), were created by Congress to provide liquidity for the US housing market by buying mortgage loans from lenders and securitizing agency mortgage-backed securities (MBS). Following the 2008 global financial crisis, GSEs were put into a temporary federal conservatorship measure intended to stabilize the housing market. President Trump focused on the GSE conservatorship during his first term in the White House and is expected to favor GSE reform and an exit from conservatorship during his second term. However, removing the GSEs from the 16-year-old conservatorship is a complex undertaking that requires agreements between the Federal Housing Finance Agency (FHFA), the GSE regulator and the US Treasury. Such an undertaking may possibly involve Congressional approval if the GSE charter is modified and may necessitate additional capital requirements for Fannie Mae and Freddie Mac to operate as mortgage finance companies and issuers of guaranteed agency MBS.

On January 2 of this year, the FHFA released a statement requiring written Treasury consent to terminate the conservatorship and a methodical public input process on the exit strategy that is “intended to minimize disruption to the housing and financial markets.”

On February 6, the newly appointed government officials, Treasury Secretary Scott Bessent and Secretary Scott Turner from the Department of Housing and Urban Development (HUD), were interviewed about GSE reform. While Turner, a former NFL player, said he would act as a “quarterback” in the process to remove the GSEs from conservatorship, Bessent was more explicit in his comments:

“The most important metric I am looking at is any study or hint that mortgage rates would go up. So anything that is done around a safe and sound release is going to hinge on the effect on long-term mortgage rates.”

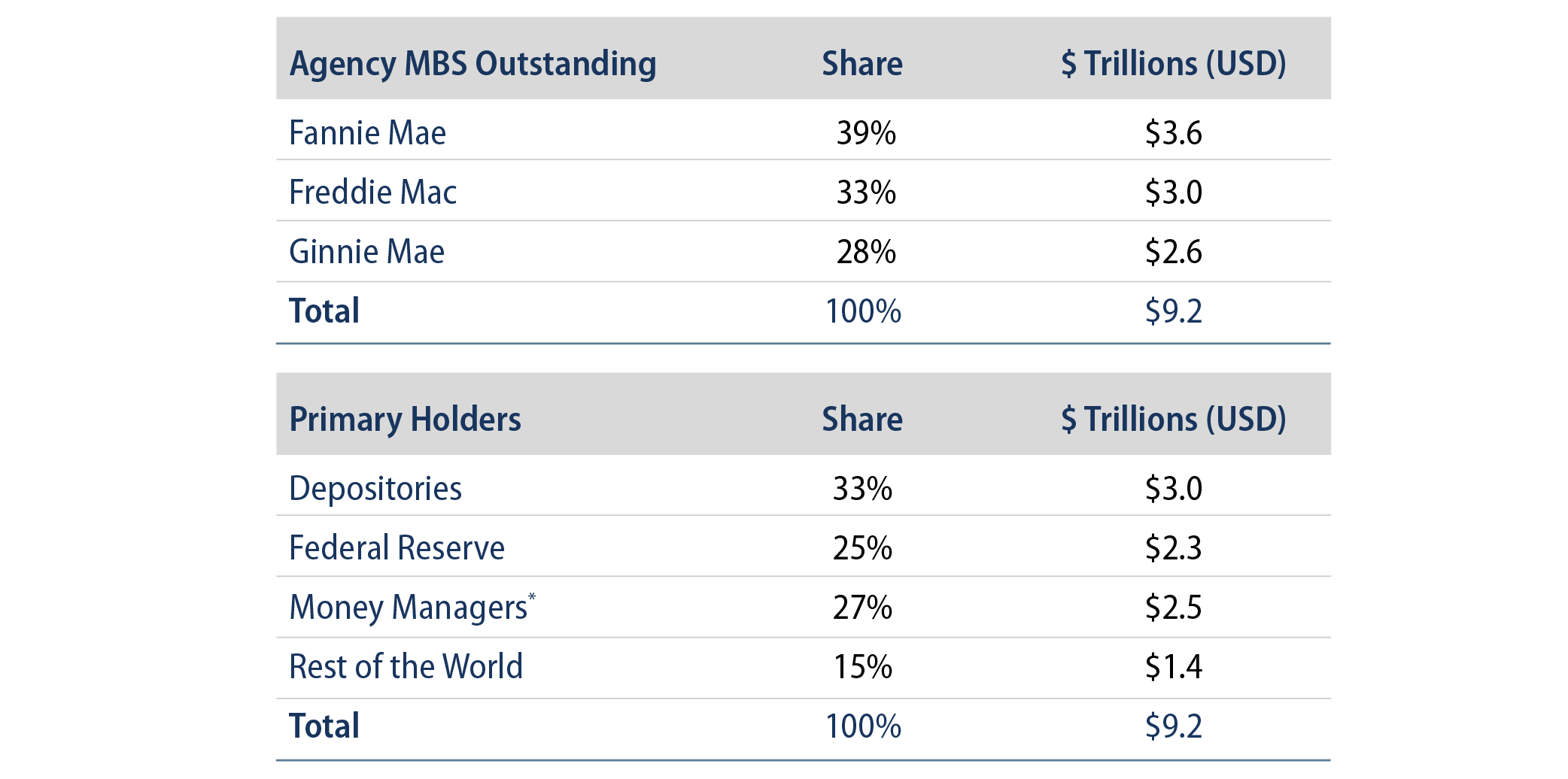

In our view, while GSE reform is possible with this backdrop, hurdles to privatization remain, beginning with the preservation of housing finance markets and mortgage affordability as required by Congress and recognized by both the FHFA and the US Treasury. The government backing feature, the capital treatment of GSE-issued agency MBS and the functioning of the To-Be-Announced (TBA) market are all vital to maintaining safe and sound mortgage finance markets. Agency MBS issued by Fannie Mae and Freddie Mac account for almost 75% of all outstanding agency MBS and are broadly held by US depositories, the Federal Reserve and investors worldwide. Market liquidity is supported by the TBA market and the Uniform MBS (UMBS) single security, which standardizes Fannie Mae and Freddie Mac MBS into one shelf with trading volumes exceeding $280 billion per day on average.

Under federal conservatorship, the implicit government backing was ring-fenced by the US Treasury Preferred Stock Purchase Agreement (PSPA), which consisted of lines of credit to the Treasury in exchange for senior preferred shares with 10% dividends and warrants on 80% of the GSE’s common stock struck at zero. As of 3Q24, the Treasury’s PSPA stake stood at around $340 billion; $193 billion of which is senior preferred stock, and $147 billion of dividend accruals. Going forward, the Treasury has options to wipe out the senior preferred stake. Within the Congressional Budget Office framework, the budget projections should not be impacted by a write-down of the senior preferred stake since the outlay for the draws has already occurred. Additionally, the Treasury can exercise its warrants on the common stock before expiration on September 7, 2028, or convert the Treasury senior preferred stock into common equity.

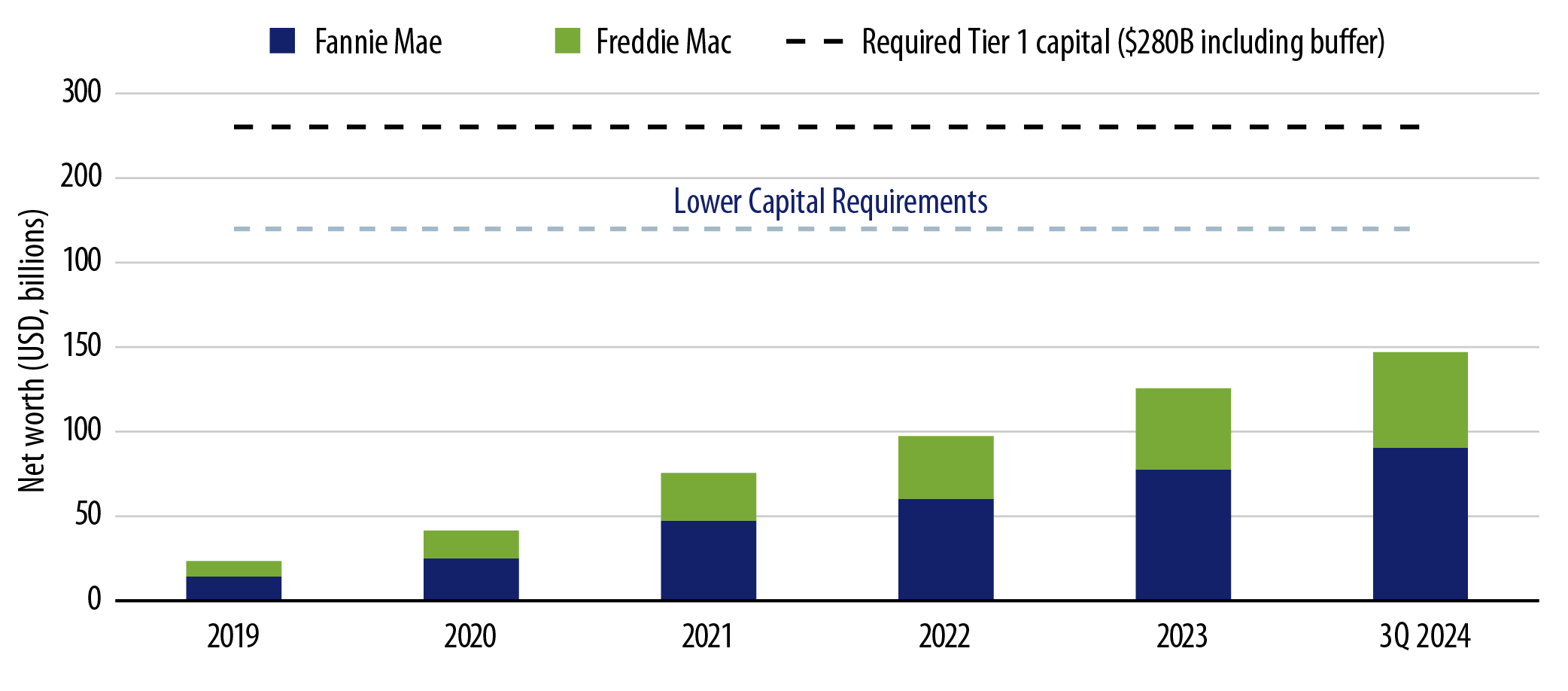

There are significant capital requirements to release the GSEs as private entities. Based on the FHFA 2020 capital framework (under President Biden), Tier 1 capital requirements and additional capital buffers were estimated at around $280 billion, compared to $150 billion in combined net worth as of 3Q24, and $20 billion to $25 billion earnings per year. This implies a timeframe of five to seven years to organically build the required capital, or an $80 billion to $90 billion IPO after two years of organic capital build. However, capital requirements could also be revised down to about 2.5%-3.0% (similar to an insurer model versus a global systemically important bank), which potentially shortens the timeline and IPO size. Meanwhile, a marginally higher guarantee fee can increase GSE earnings and pay for the Treasury’s lines of credit.

Exiting the conservatorship and dissolving the PSPA has additional implications beyond the Treasury’s lines of credit, specifically related to constraints around the retained portfolio business of the GSEs. If the portfolio caps are removed, it is possible for Fannie and Freddie to become stabilizing forces in the mortgage market via portfolio purchases.

In summary, we believe that GSE privatization is a complex but achievable undertaking if these hurdles are overcome. The goal is to preserve housing finance markets and mortgage affordability for future generations. Maintaining the government backing feature of agency MBS, preserving the status quo with respect to regulatory and capital treatment of GSE-issued MBS, and ensuring the liquidity advantage of the UMBS TBA are key pillars to a safe and sound release from conservatorship without negative market and trading implications for mortgage investors.