As of this writing, it looks like the election dust storm is clearing and that Joe Biden has been elected the 46th President of the United States. Republicans appear to have retained control of the Senate, subject to the final election results in Georgia and North Carolina. And the Democrats have retained control of the House of Representatives (though the Republicans gained seven seats). In short, the election result at this point could be characterized as Blue (President)/Red (Senate)/Blue (House). But again, there are two Senate seats left to be decided and the outcome from those elections could materially impact the markets. Further, President Trump is contesting the national election results in certain battleground states and the eventual outcome of that effort is still uncertain.

We do have some good news regarding the pandemic. Pfizer and BioNTech recently announced that their coronavirus vaccine was 90% effective in preventing COVID-19 infection in the latest trials. While the vaccine progress is unequivocally positive, market developments will be subject to finalization of the election results, further stimulus packages, other vaccine-related milestones and continued improvement of the economic recovery.

Western Asset’s Election Series explored the potential impact of different election outcomes as described earlier (specifically, Blue/Red/Blue and Blue/Blue/Blue) on the economy, taxes and various headline sectors. As mentioned, the current election outcome points to a Blue/Red/Blue government. But, there are still scenarios—perhaps unlikely—that could result in one of the following: (1) Blue/Blue/Blue, (2) Red/Red/Blue and (3) Red/Blue/Blue governments. The good news is that the markets appear to have largely accepted the Blue/Red/Blue outcome.

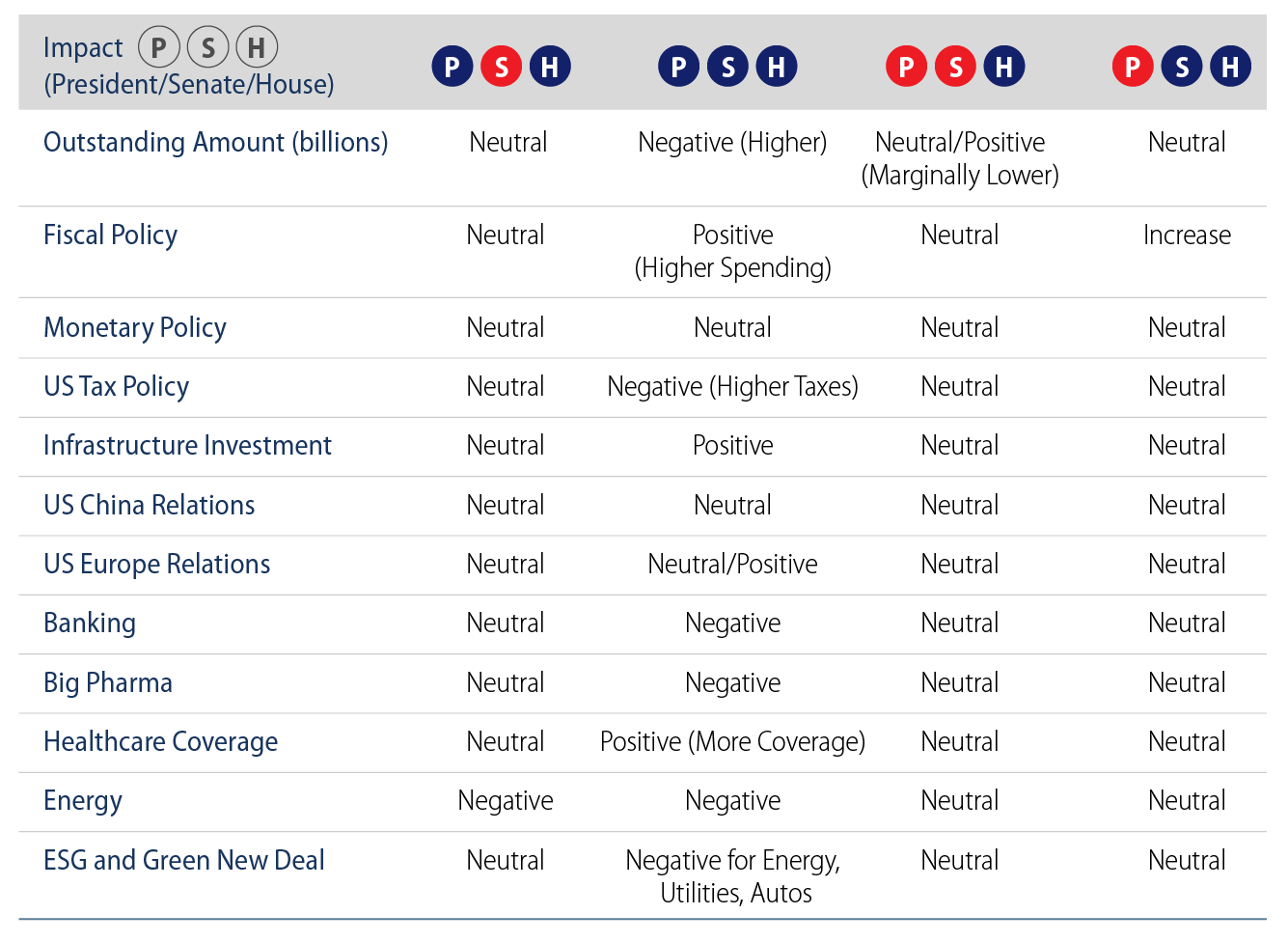

However, if any of the other possible outcomes materialize, the result will certainly impact markets. Exhibit 1 describes the likely directional market reactions once the elections are finalized and control of the presidency and the Senate are established.

As you can see in Exhibit 1, the investment implications are numerous and could impact a number of sectors. As fixed-income investors, the ability to navigate the markets will become critically important. This is why we believe active management will be absolutely essential.

With today’s low-yield environment, the Bloomberg Barclay’s Aggregate index has a 1.27% yield-to-worst (YTW) and 6.13 years of option-adjusted duration (OAD). Further, the government sector represents 39% of the Aggregate Index and the duration contribution is 2.75 years (45% of the overall index duration). The investment-grade credit sector represents 32% of the Aggregate Index and the duration contribution is 2.68 years (44% of the overall index composition). The two sectors (government and credit) represent 5.43 years of OAD (89% of the overall index duration) and 71% of the index composition. These two sectors could be impacted depending on the final election outcomes. The market impact may be immediate or it could take some time to develop as the new president will need to set his near-term agenda. Considering the concentration of the government and credit sectors in the BB Aggregate Index, Western Asset believes that simply “buying” the BB Aggregate Index via an ETF or passive solution poses potential hazards.

The Importance of Active Management in Fixed-Income

The early phase of Covid was a stark reminder that active management in fixed-income investing is important. Investors may recall that the 30-year US Treasury (UST) reached 2.38% on January 9, and dropped to a historical low of 0.99% on March 9. But not many investors realize that the total return of the 30-year UST was 32% during this 60-day period! Passive investors must maintain the index weight (percentage and duration contribution) at all times, so the ability to overweight duration was an invaluable tool during this period. Another Covid-related example was the Federal Reserve’s (Fed) announcement on March 23 regarding the Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF) programs. With corporate bond spreads (both IG and HY) blowing out in early March, the Fed’s announcement was a highly supportive message to the credit markets. Passive managers could not add credit exposure despite (1) extreme valuations (spreads), and (2) a highly supportive announcement from the Fed. An active manager like Western Asset could add selectively to its credit exposure.

While the BB Aggregate includes all investment-grade securities, let’s take a quick look at the US high-yield market. Depending on the eventual election outcome and resulting policy initiatives, sectors such as energy (currently 13% of the index) could be materially impacted over the long term. The ability to position sector exposure and select the right issuers will be imperative—especially in HY. What’s more, passive approaches in HY will face the same potential pitfalls as passively “buying” the Aggregate Index.

In summary, until the election results are finalized, the markets will trend with some level of consternation. Investors will need to decide how to position their fixed-income investments. The eventual results will be known soon enough, and an active manager like Western Asset—with our time-tested and proven active management skills—will be there to take advantage of attractive relative value opportunities and market dislocations as they appear.

Western Asset has been an active fixed-income manager since 1971, and the Firm has navigated many market environments. As investors continue to grapple with the election outcomes, the economy, coronavirus developments, etc., the one certainty is that the ability to navigate the fixed-income markets will be critically important in the coming months—and we view active management as essential.