Macros, Markets and Munis

Munis posted positive returns last week as the Treasury curve flattened, moving 1-3 basis points (bps) higher in shorter maturities and 1 bp lower in longer maturities. The high-grade muni curve also flattened, with short-duration yields moving 3-8 bps higher in short maturities and 3-6 bps lower in longer maturities. Market data releases remained limited amid the government shutdown last week, though the September Consumer Price Index (CPI) data was released and came in below expectations at 3.0% year-over-year (YoY). Core CPI printed at 3.0%, also below expectations. Meanwhile, muni demand remained positive amid another elevated supply week. This week we discuss the recent upgrade of Illinois’ credit rating by Moody’s and the overall upgrade trend observed this year.

Supply Increased to Near Record Levels While Demand Remained Positive

Fund Flows ($1.1 billion of net inflows): During the week ending October 22, weekly reporting municipal mutual funds recorded $1.1 billion of net inflows, according to Lipper. Long-term funds recorded $830 million of inflows, intermediate funds recorded $230 million of inflows and the short-term category recorded $29 million of inflows. ETFs recorded the majority of inflows at $862 million. Last week’s inflows led year-to-date (YTD) inflows higher to $37 billion.

Supply (YTD supply of $483 billion; up 17% YoY): The muni market recorded $18 billion of new-issue supply last week, up 62% from the prior week’s level and among the top issuance levels of this record year. Despite the elevated calendar, deals were oversubscribed. YTD new-issue supply of $483 billion is 17% higher than the prior year, with tax-exempt issuance up 18% YoY and taxable issuance up 5% YoY. This week’s calendar is expected to slow to $6 billion. The largest deals include $1.1 billion Chicago Board of Education and $700 million California State general obligation bond transactions.

This Week in Munis: Illinois Upgraded

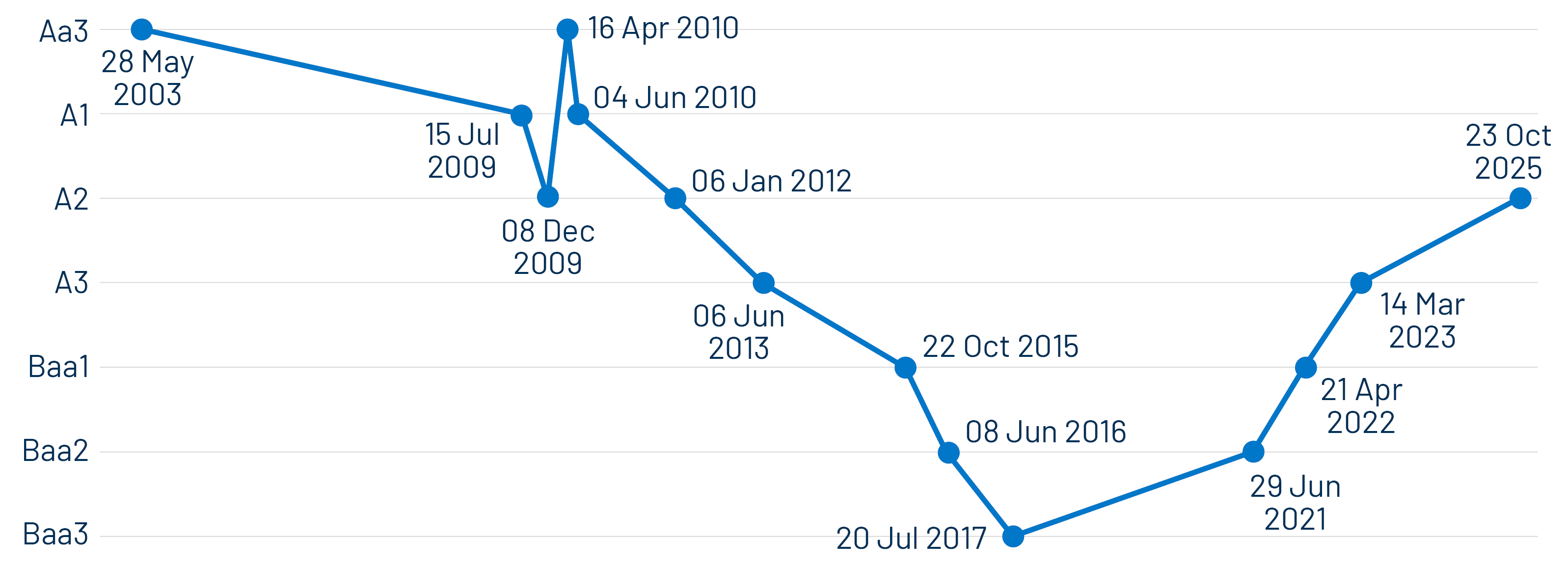

Last Thursday Moody’s upgraded the state of Illinois to A2, up from A3 while maintaining a stable outlook. The state’s upgrade reflects improvement in financial metrics and reserve profile, marks the state’s 13th positive rating action by one of the three major agencies since 2020 and the fourth upgrade by Moody’s over the same period. These positive factors were partially offset by caution around the state’s limited operating flexibility, high debt profile and its fixed cost burden.

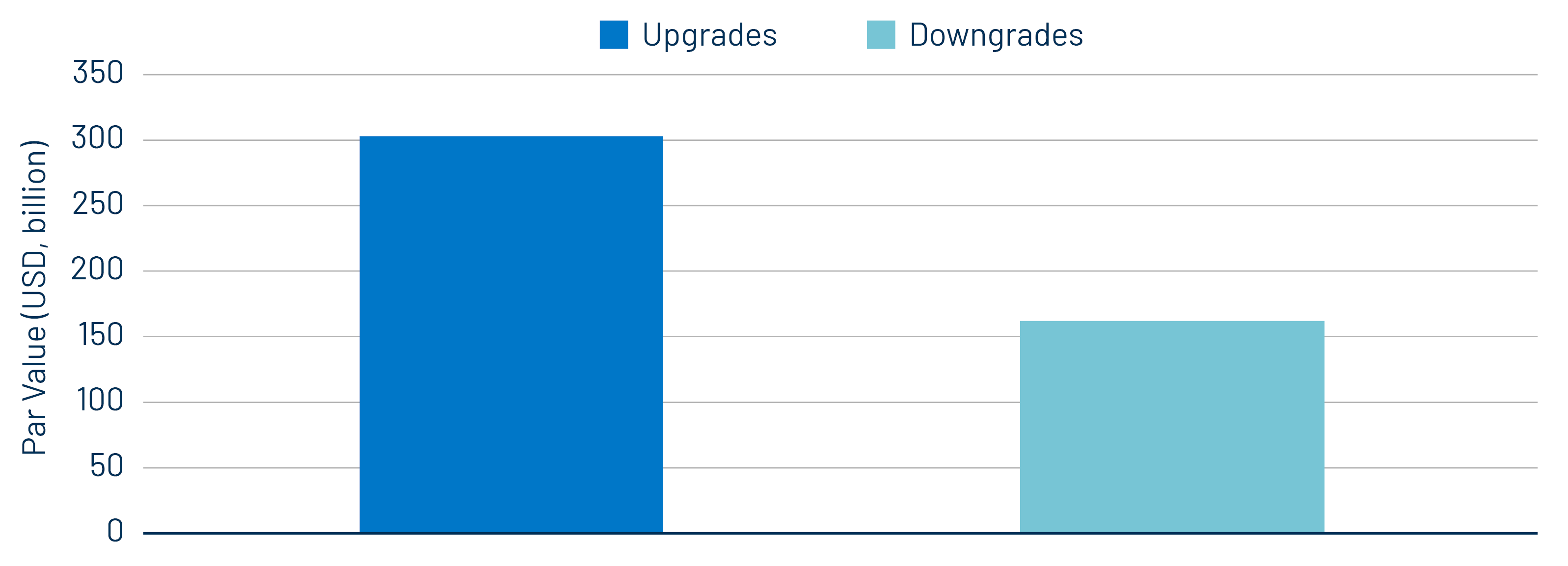

The Moody’s upgrade arrived amid signs of slowing upgrade momentum relative to downgrades. After post-pandemic credit gains that began in 2021, 3Q25 marked the first quarter in which Moody’s downgrades outpaced upgrades. Despite this quarterly slowdown, upgrades from Moody’s, S&P and Fitch have continued to exceed downgrades for the year overall. According to Bloomberg, through October 16, approximately $302 billion in municipal debt has been upgraded, nearly twice the $162 billion downgraded. Reinforcing the positive credit trend observed, first-time payment defaults YTD have totaled $1.3 billion across 37 entities, a 37% decline from the $2.1 billion across 48 entities in 2024 (through October).

Illinois has long epitomized municipal credit vulnerabilities, yet its recent upgrade reflects broader sector resilience driven by post-pandemic recovery and subsequent market stabilization. Still, the state faces persistent demographic challenges and a high debt burden with elevated fixed costs which could contribute to potential future volatility. Western Asset believes the sustained credit improvements in Illinois and the broader municipal market, combined with historically compelling income opportunities and attractive relative value, strengthen the risk-adjusted appeal of the municipal asset class today.

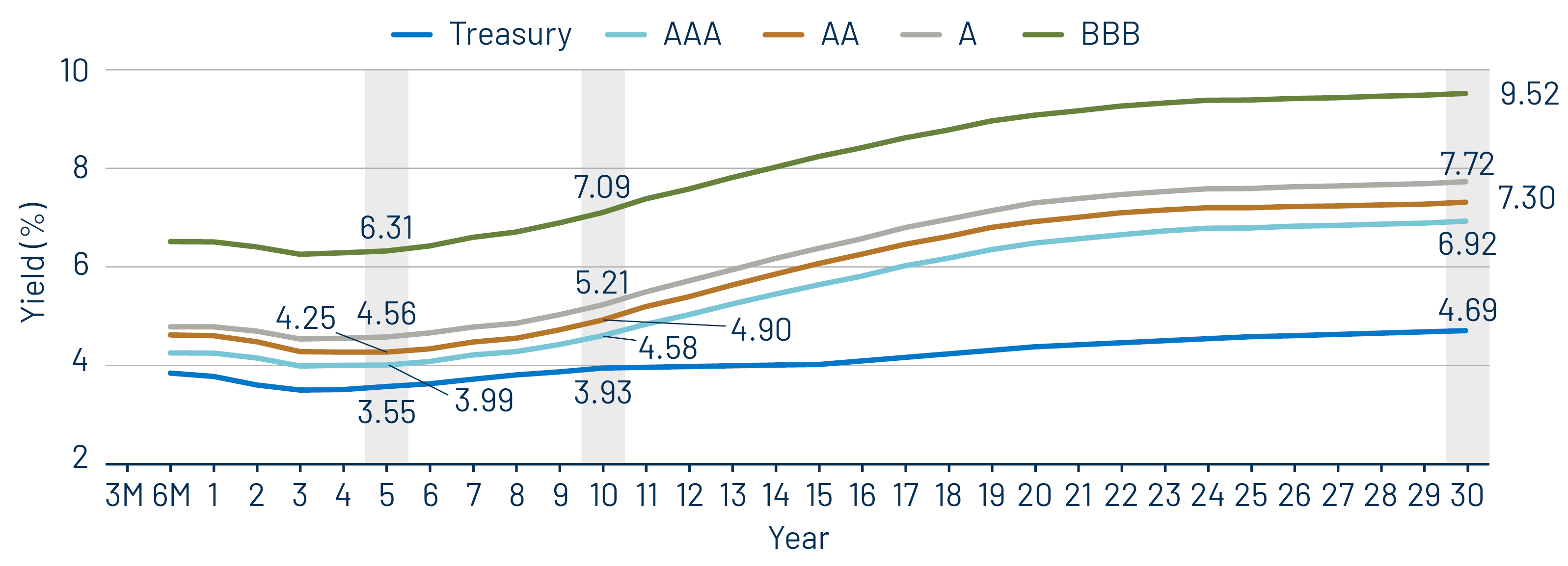

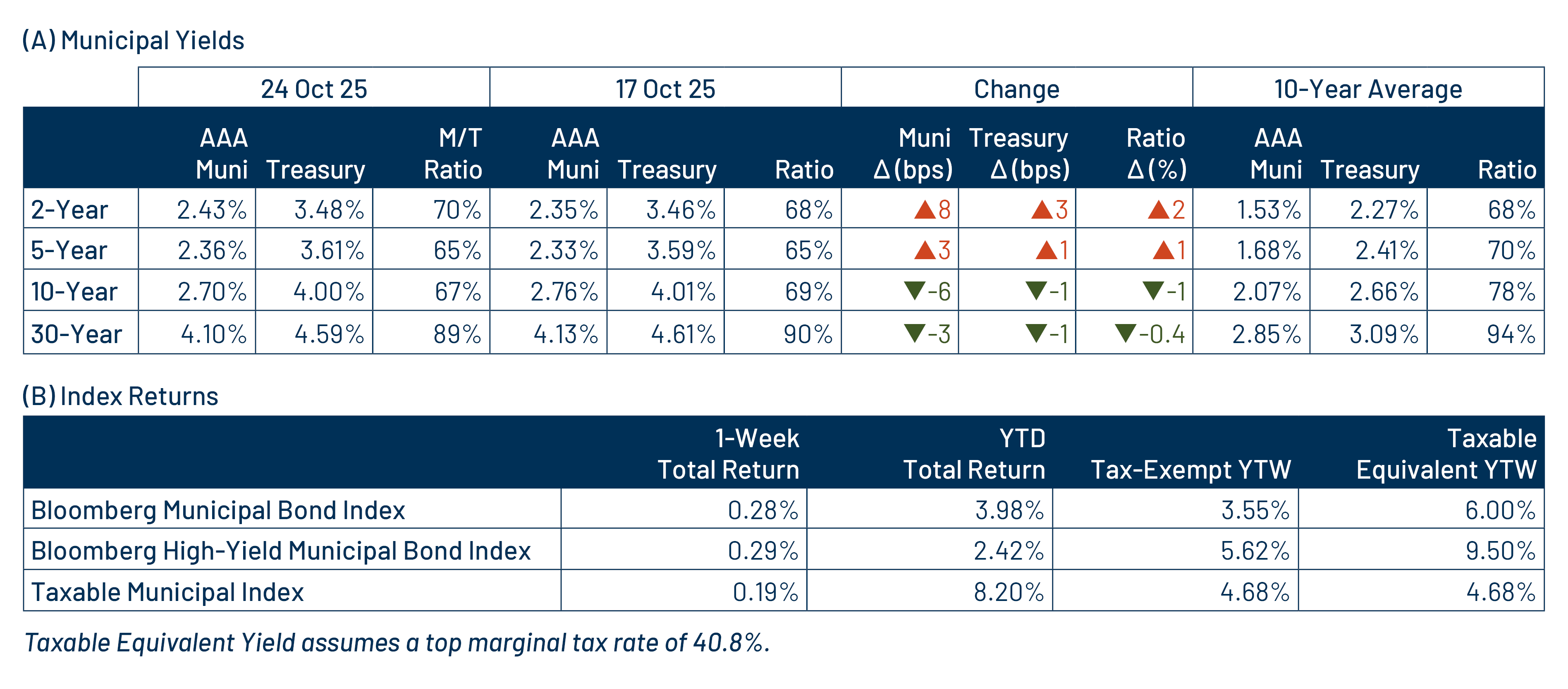

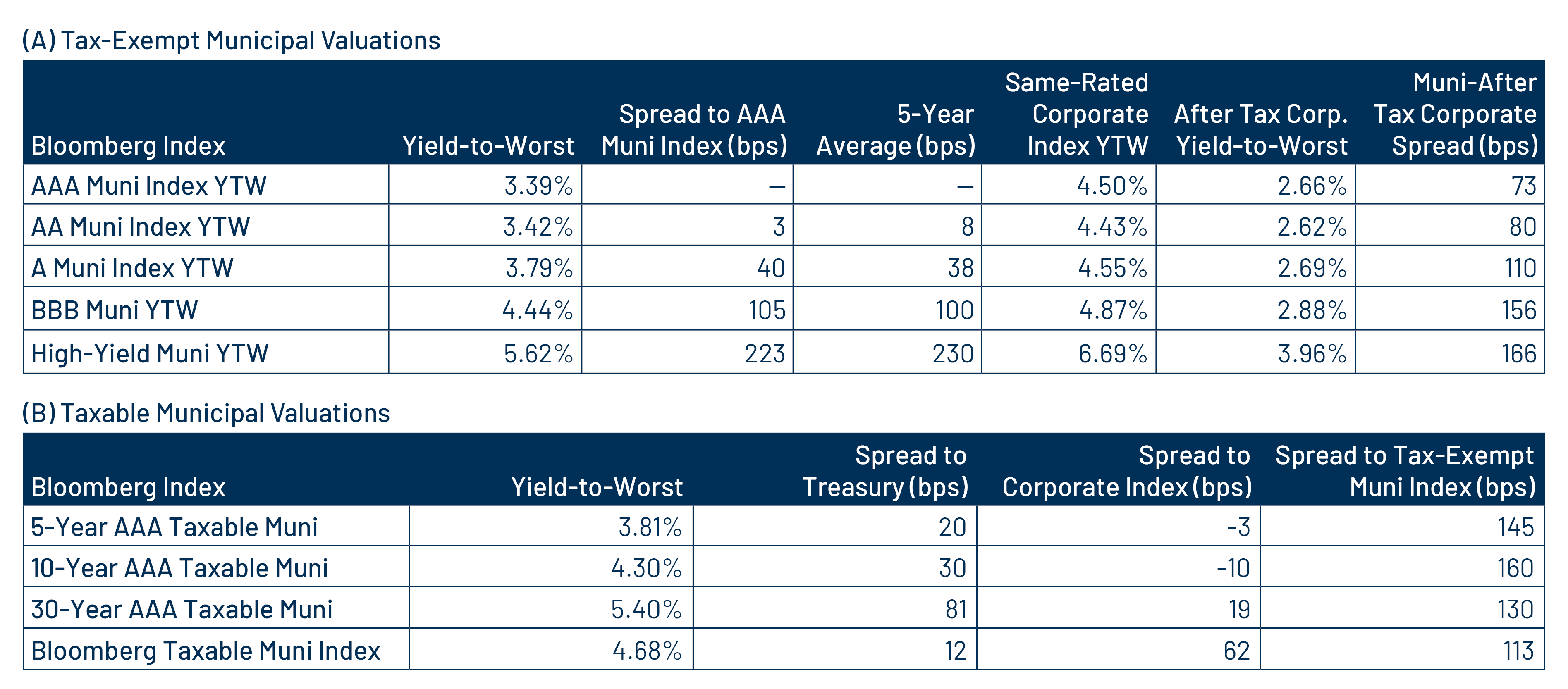

Municipal Credit Curves and Relative Value

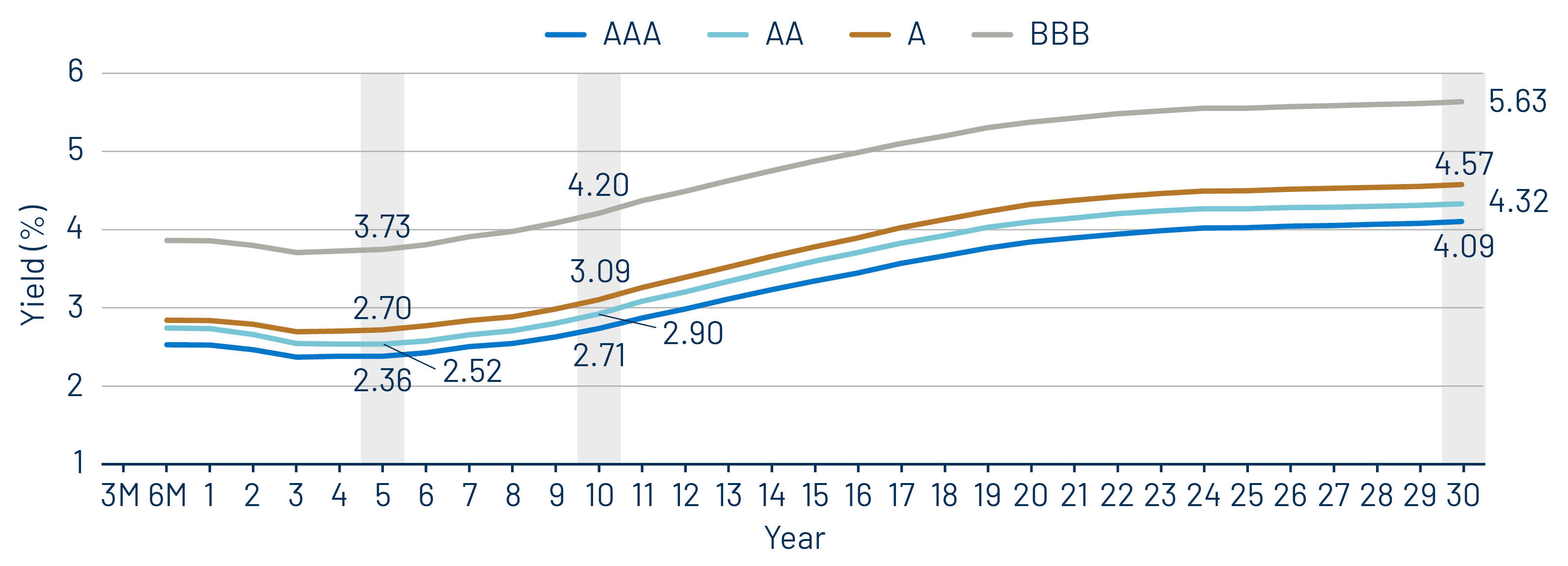

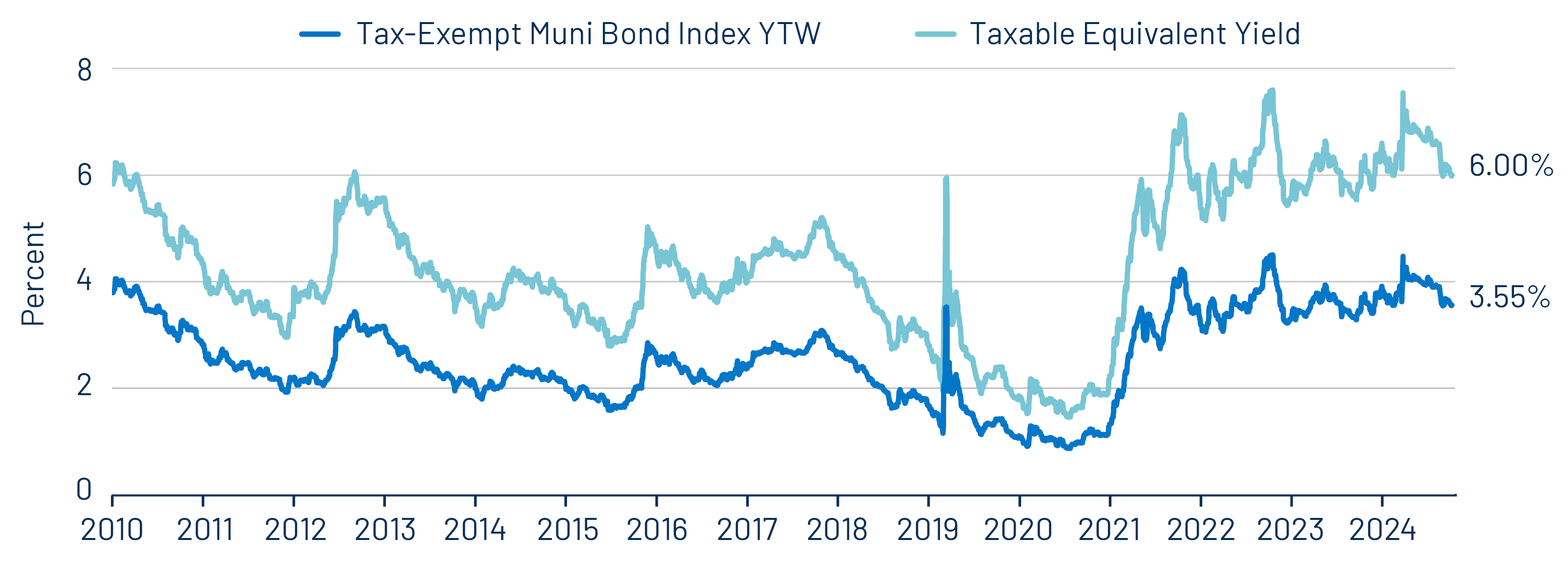

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

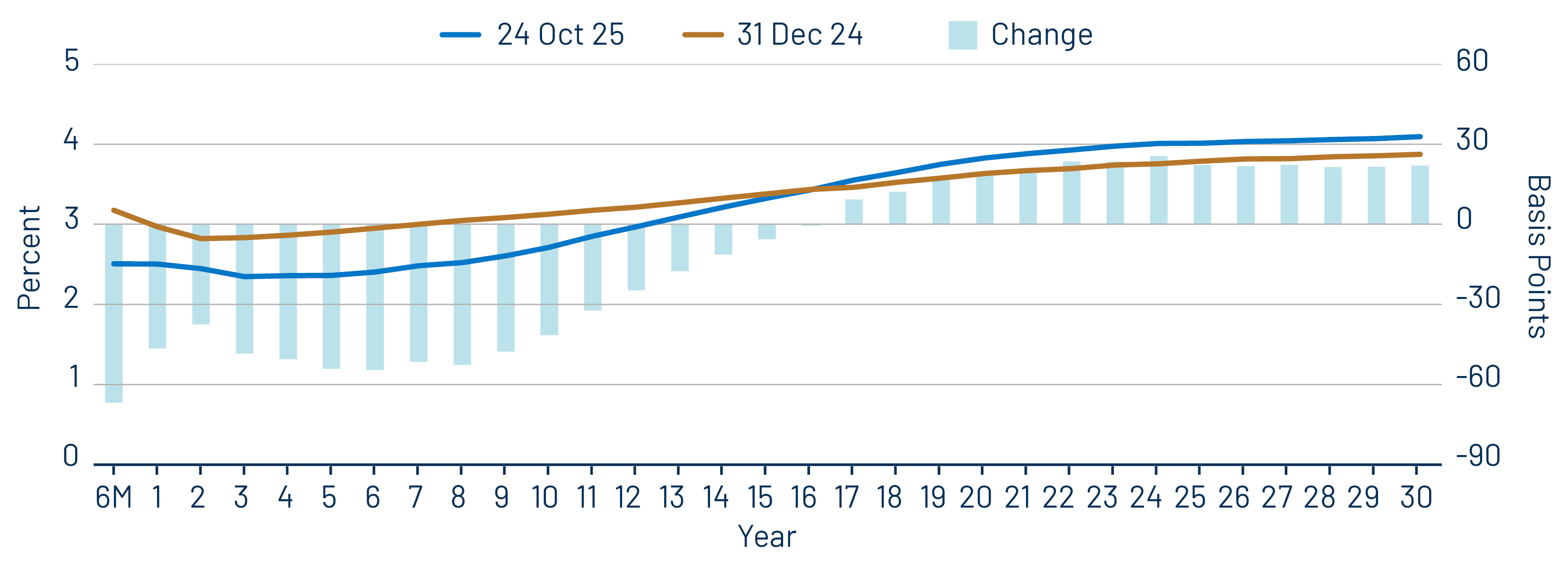

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

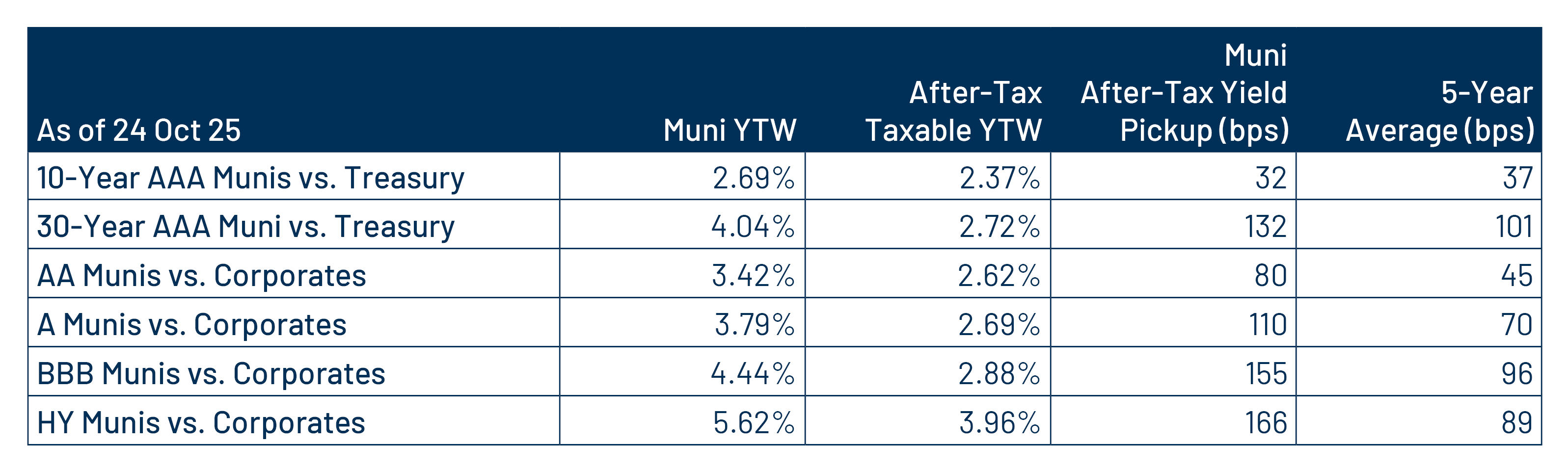

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.