In response to the sudden deposit flight from Silicon Valley Bank (SVB) and Signature Bank (SBNY)—and what became the second and third largest bank failures in US history, respectively—money market funds (MMFs) experienced record inflows.

In this post, we highlight some of the reasons why Government MMFs may now look attractive to both institutional and retail investors. These include MMFs’ regulatory framework, ability to offer competitive yields, convenient product features for institutional and retail cash investors, and some of the types of securities and counterparties held in MMF portfolios.

We also briefly review Government MMFs’ use of tri-party repurchase (repo) agreements, including the Federal Reserve’s (Fed) reverse repo facility (RRP).

Recent Inflows to Government MMFs

From March 8 to March 15 the US MMF industry saw its fifth largest week of inflows ever.

In its March 16 weekly release, the Investment Company Institute (ICI) reported a net increase in MMF assets in the US of around $120 billion, driven by nearly $145 billion of inflows to Government MMFs, partially offset by outflows from Prime and Tax-Exempt MMFs.

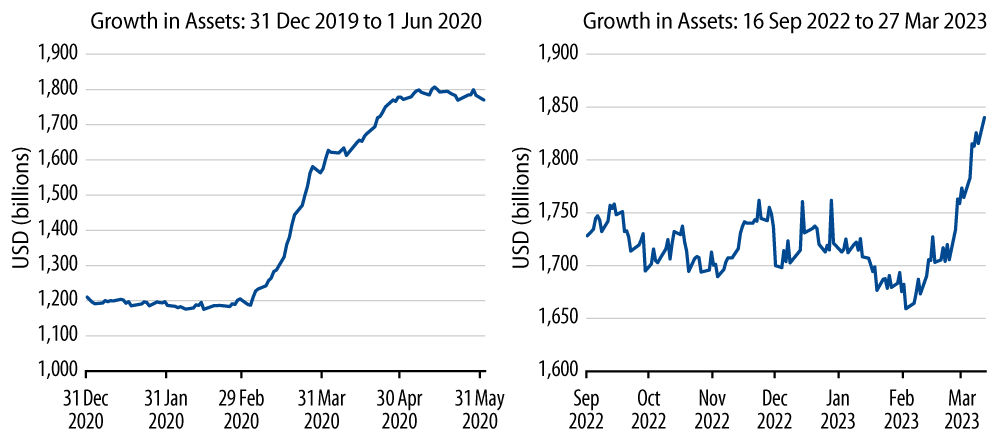

This increase has taken the US MMF industry assets to a record level of just over $5 trillion. Exhibit 1 shows the growth in the Government and agency institutional MMF category over early 2020 and the past six months, including March 2023.

Why Are Government MMFs So Attractive to Investors?

Government MMFs are widely used by retail and institutional investors, and their appeal can be explained by their robust regulatory framework, widespread availability for trading (providing ease of access and use), their competitive yields relative to bank deposits and other cash products, and the very high quality of their portfolio holdings.

Robust Regulation

Government MMFs comply with Rule 2a-7 of the Investment Company Act of 1940, an extensive set of regulations designed to manage risks associated with investing in short-term fixed-income securities. The rule covers interest rate, credit, diversification and liquidity risk and in turn supports a number of the key objectives MMF investors hold, including principal stability, daily liquidity and competitive levels of income.

Ease of Access and Use

A critical feature for Government MMFs’ appeal to investors is their ability to maintain an NAV of $1.00 and trade through similar mechanisms as bank deposit products. This feature allows the funds to be offered across a wide range of retail and institutional platforms as alternatives to deposits and other money market securities. These include institutional and retail brokerage, custody, trust, commercial bank and other sweep platforms, and also trading via MMF portals or directly with a fund’s transfer agent.

Their wide availability helps position Government MMFs as a convenient product alternative for cash investors, whether for day-to-day expenses, asset allocation or temporary defensive purposes. In turn, banks often support the availability of Government and other MMF strategies to their clients as an outlet to move unwanted cash away from their balance sheets.

Notably, unlike some other MMF types, Government MMFs are allowed to operate without fee and gate mechanisms linked to daily and weekly liquidity levels, which supports operational simplicity for distributors.

Another common attribute of Government MMFs investing in both direct securities and tri-party repo agreements is a late-day trading cutoff of 5pm ET for same-day settlement, which reinforces their attractiveness for sweep and other platforms.

Competitive Yields/High Policy Beta

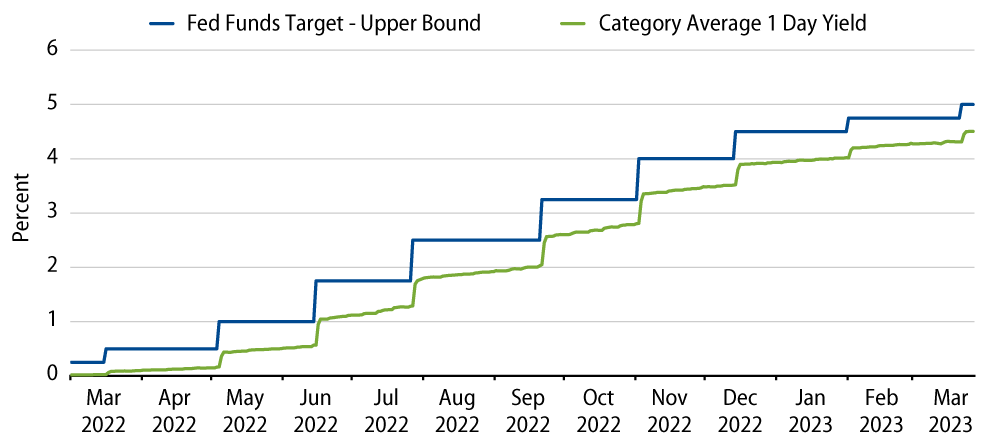

Government MMFs are effective pass-through investments for monetary policy, allowing cash investors to benefit from increases in the fed funds rate. As overnight money market securities—including US Treasury bills (T-bills), short-term government agency debt and repurchase agreements—reset their yields at higher levels in response to the Fed’s interest rate hikes, Government MMFs holding shorter average portfolio maturities have been able to pass on higher short-term rates to cash investors at a relatively fast pace.

Exhibit 2 shows the average daily yield for the institutional Government MMF sector compared to the upper bound of the fed funds target rate range from March 2022 to March 2023.

Permissible Investments

As mandated by Rule 2a-7, Government MMFs invest in two types of securities: direct holdings of short-term US government debt, such as T-bills or US government agency bonds (agencies), or tri-party repo agreements collateralized by US government obligations, including Treasury and agency securities.

Tri-Party Repo Agreements

A repo agreement is a contractual arrangement between two parties, whereby one party agrees to sell securities to another party at a specified price and with a commitment to buy the securities back at a later date for another (usually higher) specified price. Reverse repo agreements are an important investment tool used by investors to manage liquidity, generate attractive yields and invest surplus funds on a short-term basis.

Tri-party repo, used extensively by Government MMFs, requires a collateral agent (usually a custodian bank) to serve as an intermediary between the buyer and seller. The collateral agent minimizes the operational burden in the transaction, prices the securities under the transaction, and holds the collateral separately from the dealer's assets, layering in protection to the buyer in the event the dealer goes bankrupt.

Tri-party repo agreements are typically executed through highly rated counterparties such as large broker-dealers. The repo is over-collateralized at 102% by Treasuries or agencies, and the repo maturity is typically overnight or a little longer. The use of repos has the added benefit of often supporting the funds’ late day cutoff times, as counterparties provide late day capacity via their sponsored repurchase agreements.

The Fed’s Reverse Repo Facility

One of the largest tri-party repo counterparties for the Government MMF industry today is the Fed, via the RRP operated by the New York Fed’s open market desk. As of February 28, 2023, the RRP held over $2 trillion in balances, the majority of which represented large Government MMFs.

In 2013, the Federal Open Market Committee (FOMC) began using the RRP as a tool to support effective policy implementation by helping to control the fed funds rate. The RRP has become a key tool for the Fed to support the smooth functioning of the money markets by providing an outlet for excess liquidity in the monetary system, and generally help to avoid disruptions in rates at the front end.

Eligible counterparties for the RRP include primary dealers, 2a-7 MMFs, banks and government-sponsored enterprises. The RRP allows the Fed to temporarily reduce the supply of reserve balances in the banking system, and it allows investors to place short-term cash in the facility and earn a fixed rate of 5 bps above the lower bound of the fed funds target rate range (i.e., 4.80% versus the Fed’s target of 4.75% to 5.00%, as of March 23, 2023).

Conclusion

Today, Government MMFs are an important product within the cash investing landscape, providing an efficient mechanism for individuals and institutions to invest directly or indirectly into diversified pools of high-quality government or agency debt. SEC regulation and Fed policy both directly or indirectly recognize Government MMFs’ role in the transmission of monetary policy, and their appeal for retail and institutional investors.