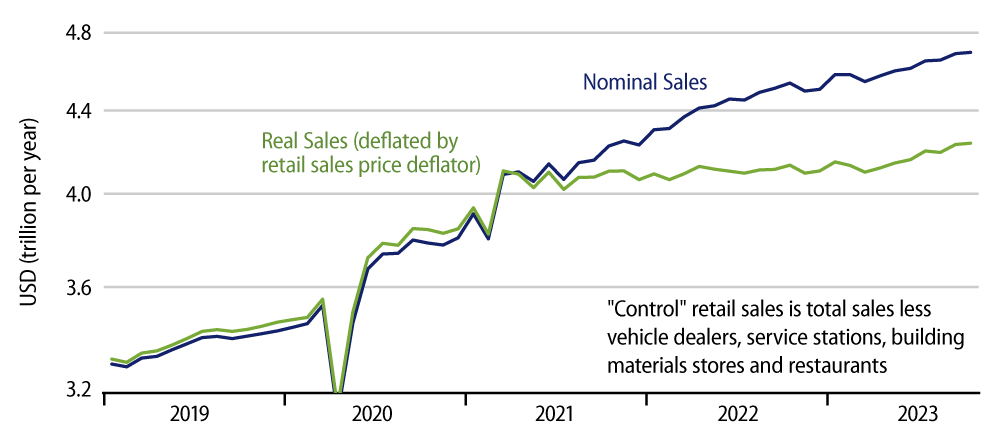

Headline retail sales declined by -0.1% in October, offset by a +0.1% revision to the September estimate. The more closely watched control sales aggregate rose 0.2%, with no revision to the estimated September level. These sales changes were softer than what we had seen in preceding months, but perhaps the bigger surprise is that there were no noticeable sales declines.

That is, retail sales and consumer spending in general had picked up over the June-September period, despite zero growth in real incomes and higher interest rates. There has been an expectation that sales and spending would soften as we head into the holiday season. That did not begin in October, at least not as evidenced by today’s retail sales data.

The pattern over June-September was that sales were flat in real terms at most store types, but with sizable gains occurring for online vendors and select brick-and-mortar store types such as electronics (think iPhones) and restaurants. In October, sales were flat pretty much everywhere upon adjusting for price changes, so little or no further growth, but, again, no pullback from elevated September levels.

The one area where sales rose noticeably in real terms was service stations, where nominal sales declined by only -0.3%. With gasoline prices down 5.7% and smaller price changes for other service station products, real service station sales likely rose more than 3%. Of course, this came after sharp net declines in real service station sales over the last 18 months.

All in all, this was a middling report. Retail sales did not rise substantially, the way they had in the preceding four months, but neither did they pull back. Barring more pronounced softness in November and December, consumer spending looks set to contribute positively to 4Q GDP growth, just not as much as it did in 3Q. For now, those looking for factors to dissuade the Fed from further rate hikes will have to content themselves with the benign inflation data released yesterday.