Municipals Rallied, Outperformed Treasuries

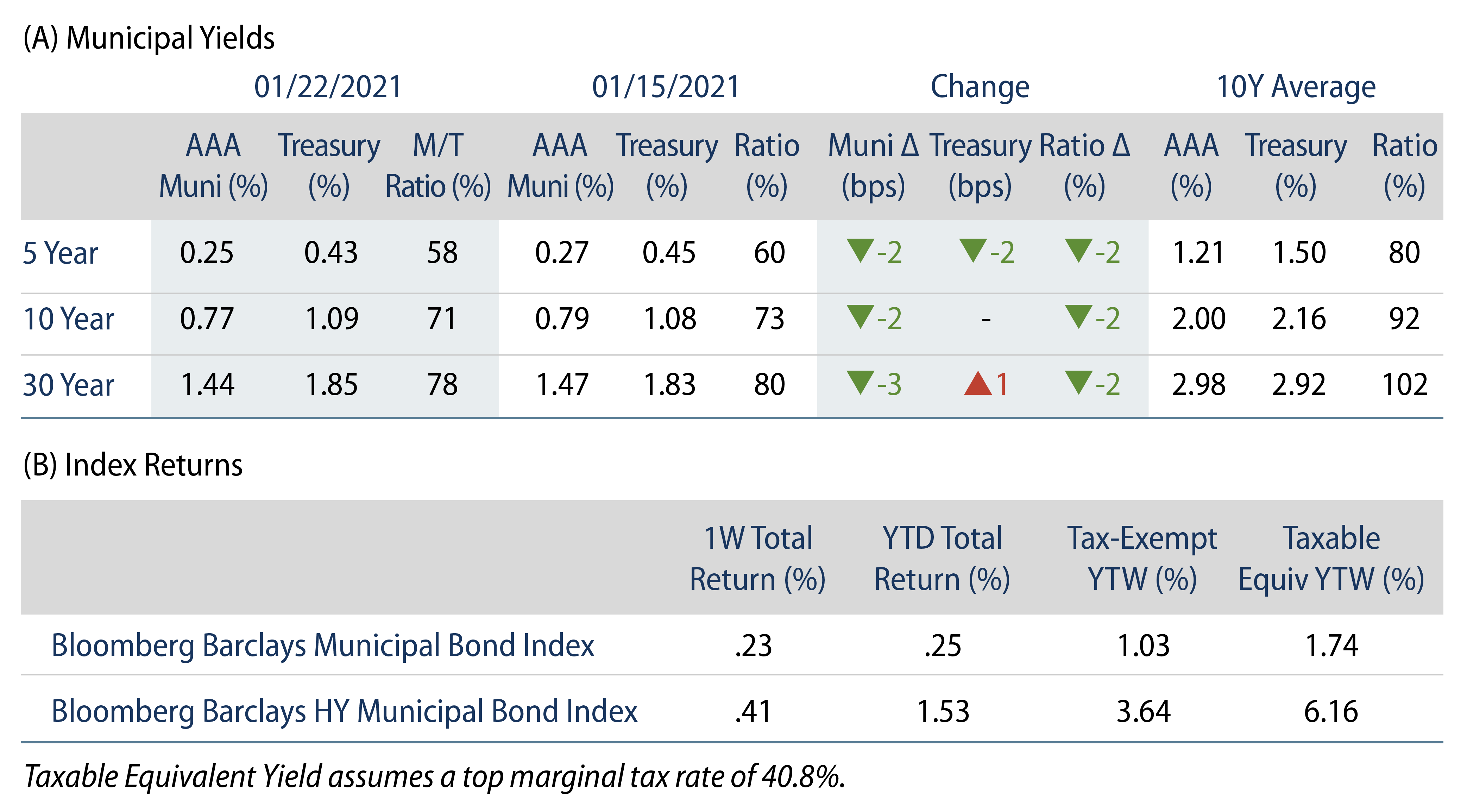

Municipals rallied and outperformed Treasuries during the week. Municipal mutual funds recorded an 11th consecutive week of inflows. AAA municipal yields moved 2-3 bps lower across the curve. Municipals outperformed Treasuries as ratios remained below historical averages. The Bloomberg Barclays Municipal Index returned 0.23%, while the HY Muni Index returned 0.41%. This week we evaluate the airport sector following an uptick in travel over the holidays and a large new issue pricing this week.

Technicals Remain Strong Due to Heavy Fund Flows

Fund Flows: During the week ending January 20, municipal mutual funds recorded an 11th consecutive week of net inflows totaling $2.4 billion, according to Lipper. Long-term funds recorded $1.4 billion of inflows, intermediate funds recorded $186 million of inflows and high-yield funds recorded $528 million of inflows. Year-to-date (YTD) net inflows total $11.1 billion.

Supply: The muni market recorded $9.5 billion of new-issue volume during the week, up 41% from the prior week. New issuance YTD reached $19.7 billion, up 14% year-over-year. This week’s new-issue calendar is expected to increase to $6.6 billion (-31% week-over-week). The largest deals include $1.1 billion Texas Municipal Gas Acquisition and Supply Corporation III and $759 million Los Angeles Airport (LAX) transactions.

This Week in Munis: Airports Ready for Takeoff?

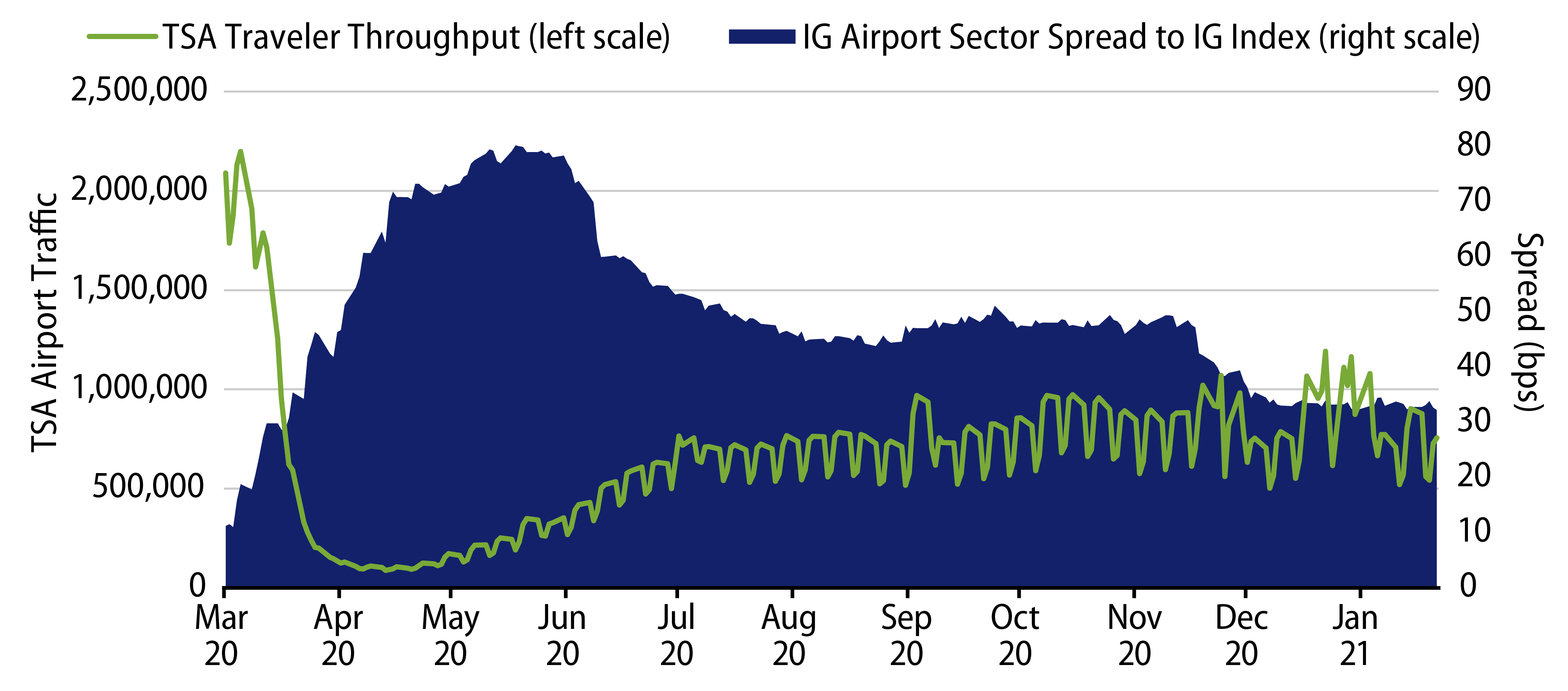

The airport sector was undoubtedly one of the hardest-hit segments of the municipal market during March and April 2020 as travel activity at US airports declined 90%-98%. TSA check-ins picked up through the holiday season to approximately 42% of prior-year levels during Thanksgiving, then accelerated to 61% of prior year traffic levels during the Christmas holiday. Post-holiday season, traffic has since reverted to 40% of last year’s level.

Even as the pandemic continues to remain a drag on traffic levels, the combination of strong balance sheets along with robust federal support received throughout the crisis has supported the sector throughout the pandemic. Many large airports in the investment-grade municipal bond index maintained over 500 days of cash on hand, which was further supported by $12 billion in economic relief that was allocated to the industry during 2020.

We expect improving traffic levels to continue to advance the fundamental picture for many US airports as vaccine efforts accelerate and pent-up travel demand materializes. Airports are also an essential element within the domestic infrastructure network to facilitate the free flow of goods, and as such they remain key to sustaining the economic recovery and could attract additional federal support as needed. As we seek securities that can rebound from improving conditions, at current valuations we believe select issuers within this segment offer risk-adjusted value and are positioned to outperform over the medium term.