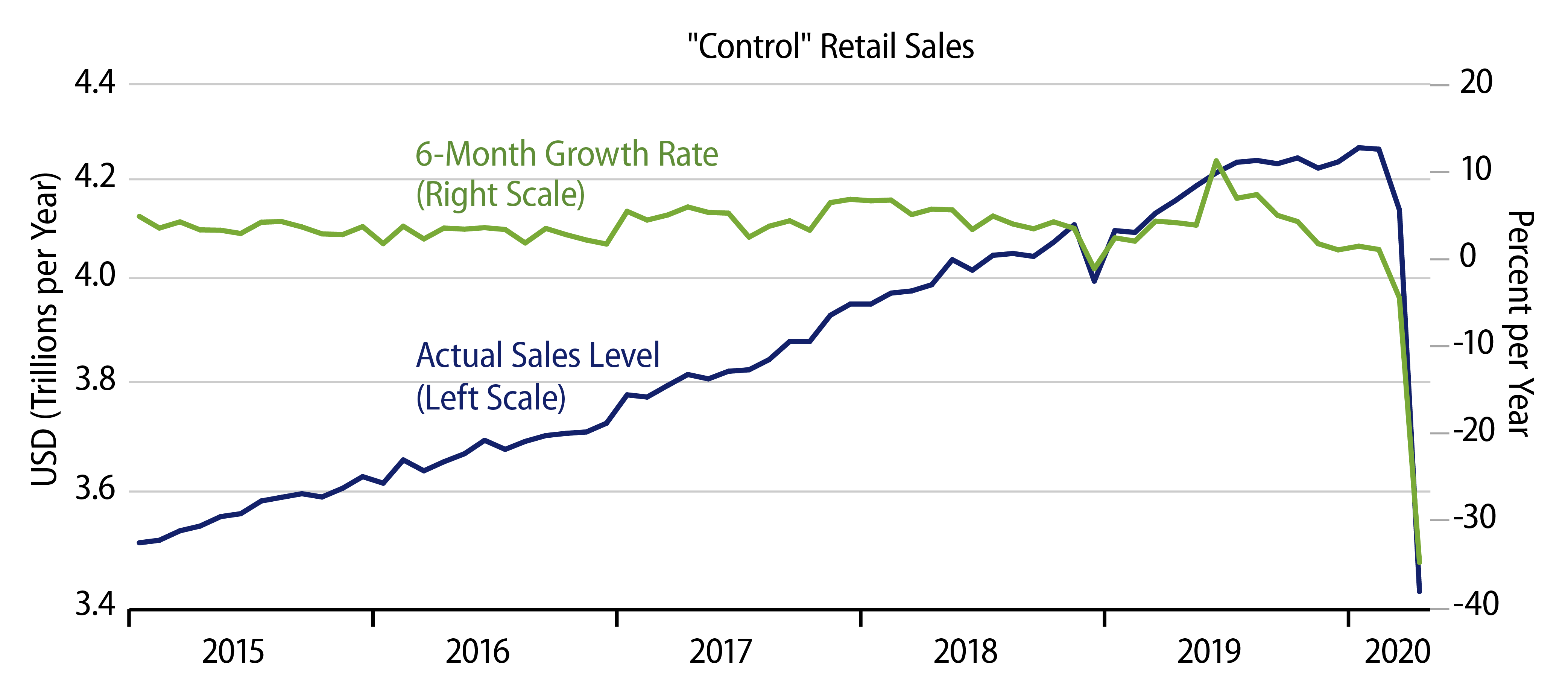

Retail sales declined 16.4% in April on top of an 8.3% decline in March, for a 23.3% cumulative drop across the two months. The “control” sales measure we track, total sales less those at vehicle dealers, building material stores and service stations declined 17.2%, following a 2.9% decline in March. Most other analysts also subtract restaurant sales from their control measure, and with that further abstraction, control sales declined 15.3% in April, following a 3.1% gain in March.

It should be clear from these disparate numbers that there was a lot of sturm und drang in the retail data. As sobering as the last few months’ retail declines are, they do provide some interesting detail about retail.

Some retail sectors that were hammered in March saw somewhat milder declines in April. Other sectors saw sales gains in March that could not be sustained in April, while still others have seen a rush of activity.

The sectors seeing milder-than-expected April declines were motor vehicle sales and restaurants. Remember, the shutdown set in about mid-March, so one would have expected so see sectors hard hit by the shutdown show sales declines (in dollar terms) just as sharp in April as those in March, since March sales showed half a month of shutdown effects, while April showed a full month of shutdown. With the Big 3 suspending production mid-March, vehicle sales declined 27.0% in March, or by -$26.3 billion. The decline in April was “only” 13.1%, or -$9.3 billion, suggesting either that vehicle sales slowed well before the general shutdown or else that some vehicle purchases could not be postponed any longer.

Similarly, restaurant sales dropped a staggering 29.8% in March, or by -$19.5 billion. In April, the drop looks just as bad in percent terms, -29.4%, but was much milder in dollar terms, -$12.5 billion. Here, it would appear that the resort to take-out and home delivery of food kept the April restaurant sales decline from being as sharp as it otherwise might have been.

March sales gains were very sharp for grocery and warehouse stores. With household hoarding largely complete and shelf inventories depleted, there was no way those March sales rates would be sustained. Indeed, grocery stores saw a sales drop of 13.1% or -$10.7 billion in April, following the 26.9% or $17.3 billion gain in March. Preliminary data suggest that warehouse stores saw sales drop 18.4% or -$5.7 billion in April, following a 12.9% or $5.4 billion gain in March.

Not surprisingly, nonstore (online) retailers continued to prosper in April, with sales up 8.4% or $6.1 billion, following a 4.9% or $3.4 billion gain in March. At the other end of the spectrum, but also not surprisingly, service station sales fell 28.8% or -$9.9 billion in April, following a decline of 16.5% or -$6.8 billion in March, though much of the declines here reflect sharply lower gas prices. Finally, sales at clothing, department, furniture, electronics and book/hobby/sporting stores all declined more sharply in April than in March.

With most store types re-opening for at least curbside service, hopefully April will be the low-water mark for retail in general and for the hard-hit store types recounted here. We believe the coming economic rebound will be sharper and quicker than most analysts expect, but in order for this to happen, of course, the stores must be open. With that re-opening slowly emerging, it is looking as though the nation is beginning to embark on phase 2 of what will prove to be a multi-phase “project” regarding our experience with this ailment.