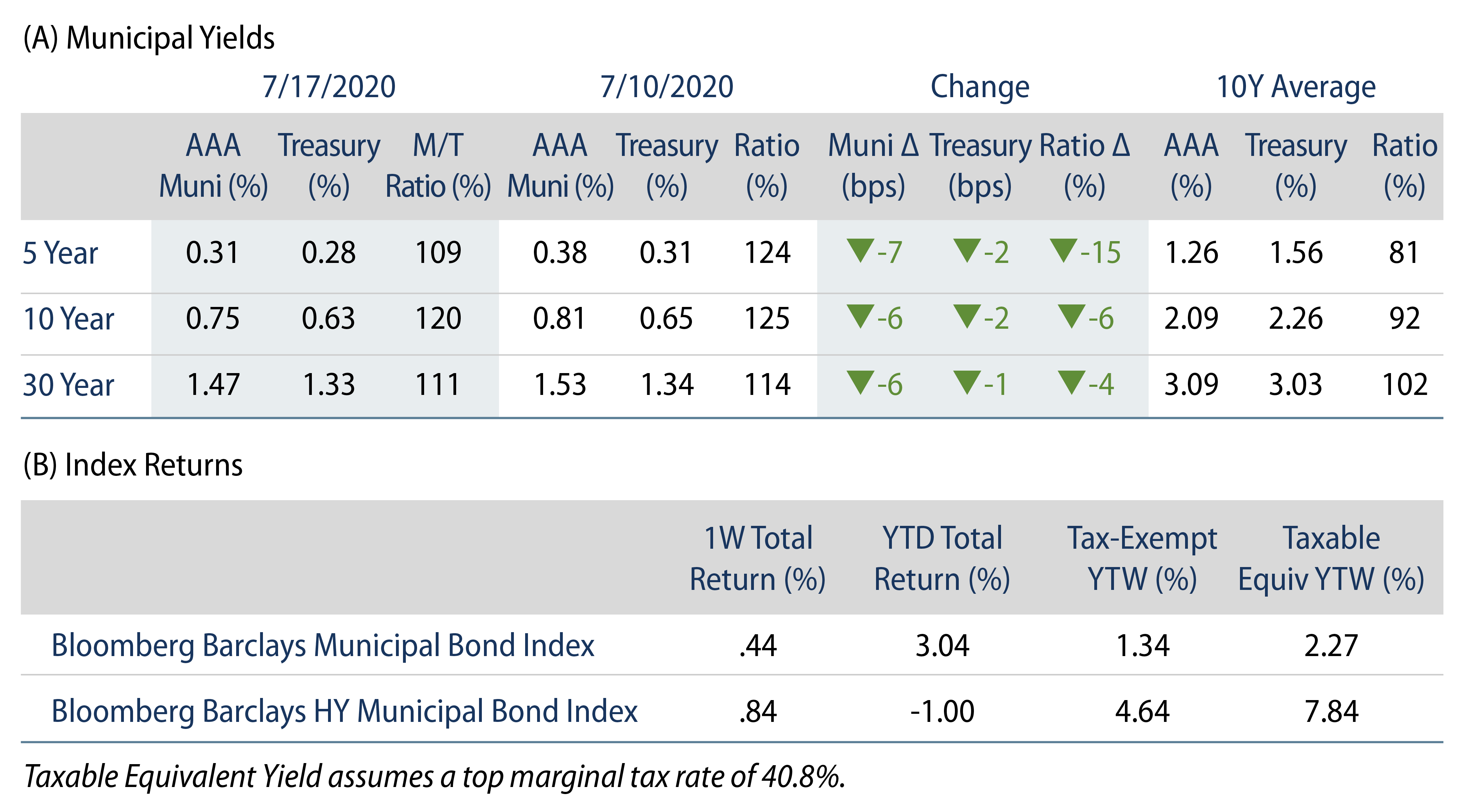

AAA municipal yields moved 6-7 bps lower during the week, outperforming Treasuries and driving municipal-to-Treasury ratios lower. Municipal mutual funds recorded a tenth consecutive week of inflows. The Bloomberg Barclays Municipal Index returned 0.44%, while the HY Muni Index returned 0.84%.

Technicals: Demand for Tax-Exempt Income Continues

Fund Flows: During the week ending July 15, municipal mutual funds reported a tenth consecutive week of inflows at $857 million, according to Lipper. Long-term funds recorded $402 million of inflows, high-yield funds recorded $124 million of inflows, and intermediate funds recorded $167 million of inflows. Year-to-date (YTD) municipal fund net outflows now total $756 million.

Supply: The muni market recorded $14.8 billion of new-issue volume last week, up 43% from the prior week. Issuance of $229 billion YTD is 32% above last year’s pace, primarily driven by taxable issuance which is 336% above last year’s levels. We anticipate approximately $9 billion in new issuance this week (-39% week-over-week), led by a $569 million State of Mississippi and a $362 million University of Rochester transaction.

This Week in Munis: High-Yield Fundamental Challenges Exposed in Retirement Facilities

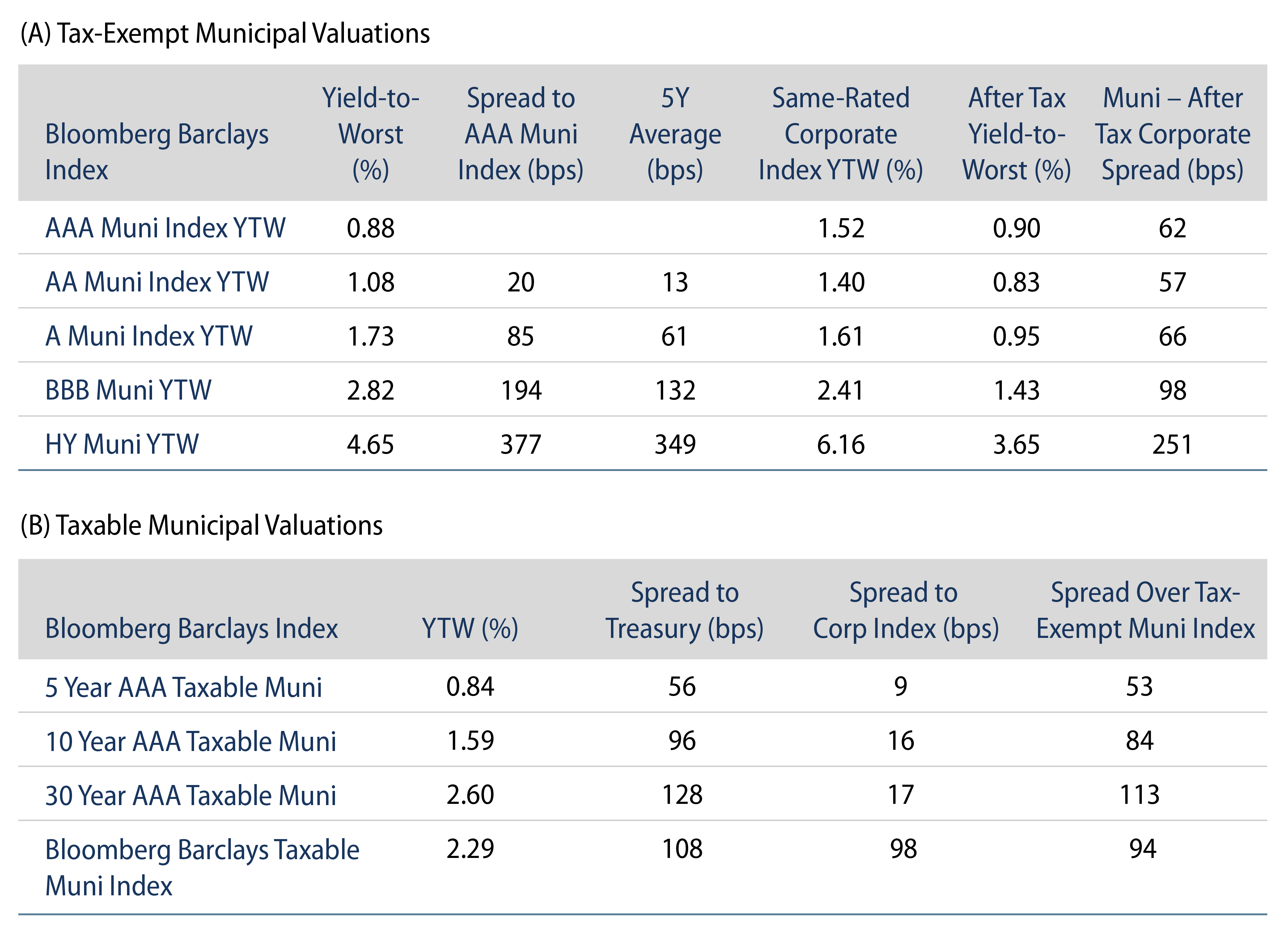

Following the nearly 20% price decline seen in the Bloomberg Barclays Municipal High Yield Index in March 2020, the index has since returned approximately 17% since the mid-March market lows, and is now down just 1.0% YTD.

The strong market sentiment continues to shrug off real fundamental stress that is occurring in the high-yield segment of the municipal market. First-time municipal defaults reached 44% YTD, approximately 29% above last year’s levels, according to Bloomberg. Approximately 64% of these defaults occurred in the Assisted Living and Continuing Care Retirement Communities (CCRCs) sector.

Despite supportive demographic trends of an aging populace, credit fundamentals of CCRCs have recently come under stress due to oversupply of facilities, labor shortages and improved technology that has enabled elders to stay in their homes longer. These challenges were dwarfed by the impact of COVID-19 as retirement facilities were identified as viral hotspots and where the first deaths in the nation occurred.

The Western Asset Municipal Team expects the intermediate-term prospects for the sector to remain challenged, and we will remain cautious on the sector. Traditional high-yield municipal spreads can offer value versus other high-yield fixed-income sectors, after taxes. However, a robust research process is necessary to navigate this area of the market which will likely not receive the same degree of federal aid that is expected to be received by the traditional investment-grade municipal market.