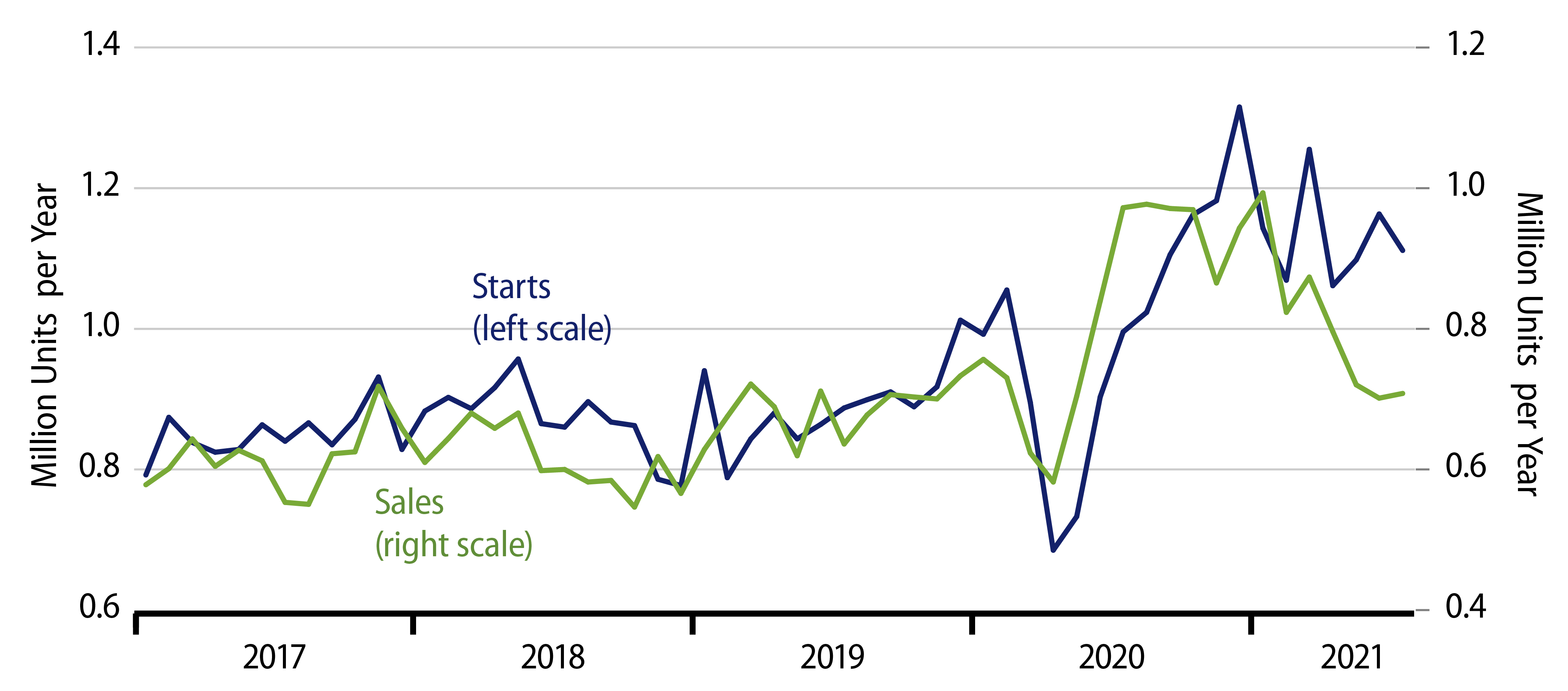

New-home sales rose a very slight 1.0% in July. Though there were some modest upward revisions on net to previous months’ sales estimates, there was nothing in today’s release to suggest a turnaround from the declining trend new-home sales have followed since August 2020—a downtrend that has also been echoed by single-family starts, as can be seen in the accompanying chart.

We have adjusted the scales in this chart to account for owner-builds, which show up in starts but not in new-home sales. With that adjustment, single-family starts have been running “hotter” than new-home sales since December 2020, and, indeed, inventories of unsold new homes have been increasing throughout this period. Though some analysts claim there is a shortage of new housing, the fact is that inventories of unsold new homes now equal six months’ worth of sales, an extraordinarily high rate and one exceeded on a sustained basis only during the housing crash of 2006-09.

As we have said before, homebuilding is not really weak but merely transitioning to a more sustainable pace. Various economic indicators have fallen lately into a nice rut, where growth has receded from the phenomenal pace of 3Q20 but where activity levels are still elevated relative to pre-pandemic norms. We see this in manufacturing and retail sales, and we are also seeing it in homebuilding.

Single-family housing starts and new-home sales have been declining for almost a year, but both are still well above 2019 levels. And those 2019 levels had not budged for years prior the onset of the pandemic. So, new-home activity is still at levels that have not been sustained since the mid-2000s housing bubble.

Total homebuilding—single- and multi-family combined—is occurring at a rate above 1.5 million units per year. Coming out of the housing bubble 13 years ago, we thought that US population growth and household formation rates were sufficient to sustain 1.4 million units per year. However, homebuilding never held above 1.2 million units per year during the long post-crisis expansion. Stay-at-home adult kids and high housing costs kept us from achieving the homebuilding rates that we thought were attainable.

Nothing has really changed since then. Housing costs are even higher, and there is no indication that millennials etc. are gainfully employed at higher rates than before the shutdown. Yet, somehow, folks seem to think that homebuilding will magically hold at faster rates than were seen prior to the pandemic.

These days, we hear a lot of concern about sustainable farming and sustainable business practices. In the real economy, however, if something is not sustainable it won’t be sustained. We have had a nice heady homebuilding boom over the past year plus, as demand pent up during the shutdown was sated and as some urbanites rediscovered the pleasures of the suburbs. However, that boomy activity is gradually but steadily pulling back to more sustainable levels.

This is going to be a drag on GDP growth, and builders are going to have to brace for more strenuous competition to coax sales out of homebuyers. However, the modest pullback in housing activity we’re seeing is really only a return to more sustainable homebuilding levels, and we all have to get used to it.