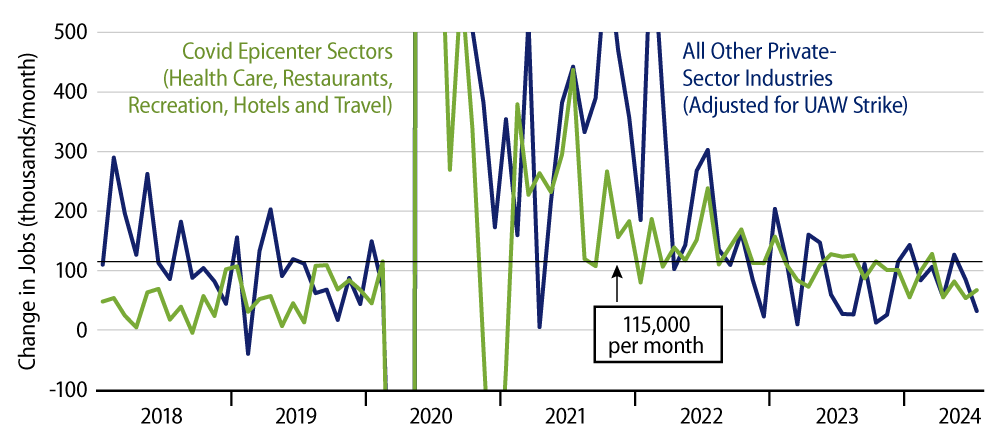

Nonfarm payrolls grew by just 114,000 for the month, down from the downwardly revised 179,000. Private-sector payroll jobs rose a scant 97,000 in July, although this gain was slightly abetted by a +13,000 revision to the June payroll total. Not only was job growth slow in what we call the Covid epicenter sectors (more on this below), but job growth in the rest of the economy also dropped substantially (see Exhibit 1). Furthermore, average workweeks declined more than enough to fully offset the job gains so that private-sector total hours worked declined in July.

Granted, the workweek and total hours worked data are very choppy month to month, and while the Labor Department stated that Hurricane Beryl did not affect the job count, the storm may have been a factor behind the workweek decline. Still, looking across the past few months, there has clearly been no net increase in average workweeks to offset the clearly decelerating trend for job growth.

Furthermore, most of the job growth reported for July occurred in just two industries: health care and construction, with health care jobs rising 55,000 and construction 25,000, thus 80,000 of the 97,000 total. The health care sector continues to restaff to offset the declines endured during the pandemic. Interestingly, job growth has ceased in recent months in the other Covid ''epicenter'' sectors: restaurants, recreation, accommodations and passenger travel.

The construction job gains are suspect. Construction payrolls do not look understaffed relative to pre-pandemic trends, and real construction spending has been declining across the board over the last few months. Yet, construction jobs have been reported as growing steadily, with average gains of 19,000 per month since January. Our guess is that construction payroll data for recent months will be revised down substantially when final, revised jobs data are reported next year.

Wage growth also moderated in July, with average hourly earnings showing a gain of only 0.2% or 2.8% annualized. Over the last six months, average hourly earnings have risen at an annualized rate of 3.4%, lower than the 3.5% growth that the Federal Reserve has indicated to be consistent with its 2.0% inflation target.

With the household employment survey, unemployment was reported as rising to 4.3%, nearly a percentage point above its June 2023 low. By some (admittedly obscure) reckonings, unemployment has risen enough to generate recession fears.

Given how distorted all the economic data are in this post-pandemic world, we don’t think the rise in unemployment to date is a convincing cogent signal of recession. Certainly, the other economic data—for now at least—are consistent with slowing but positive growth. However, everything in today’s employment report points to a coming rate cut by the Fed.

Meanwhile, overall inflation has been within the Fed’s targets for the last few months, and excluding (ostensibly overstated) shelter costs, inflation has been within target for over a year. Second, Fed comments have indicated they do not want the economy to slow much further. Finally, Mr. Powell’s explicit comments have already made cuts imminent, and today’s data only strengthen the case. Add in the broad range of cut-friendly indications within today’s data, and a September cut looks inevitable.