Municipals Recorded Negative Returns

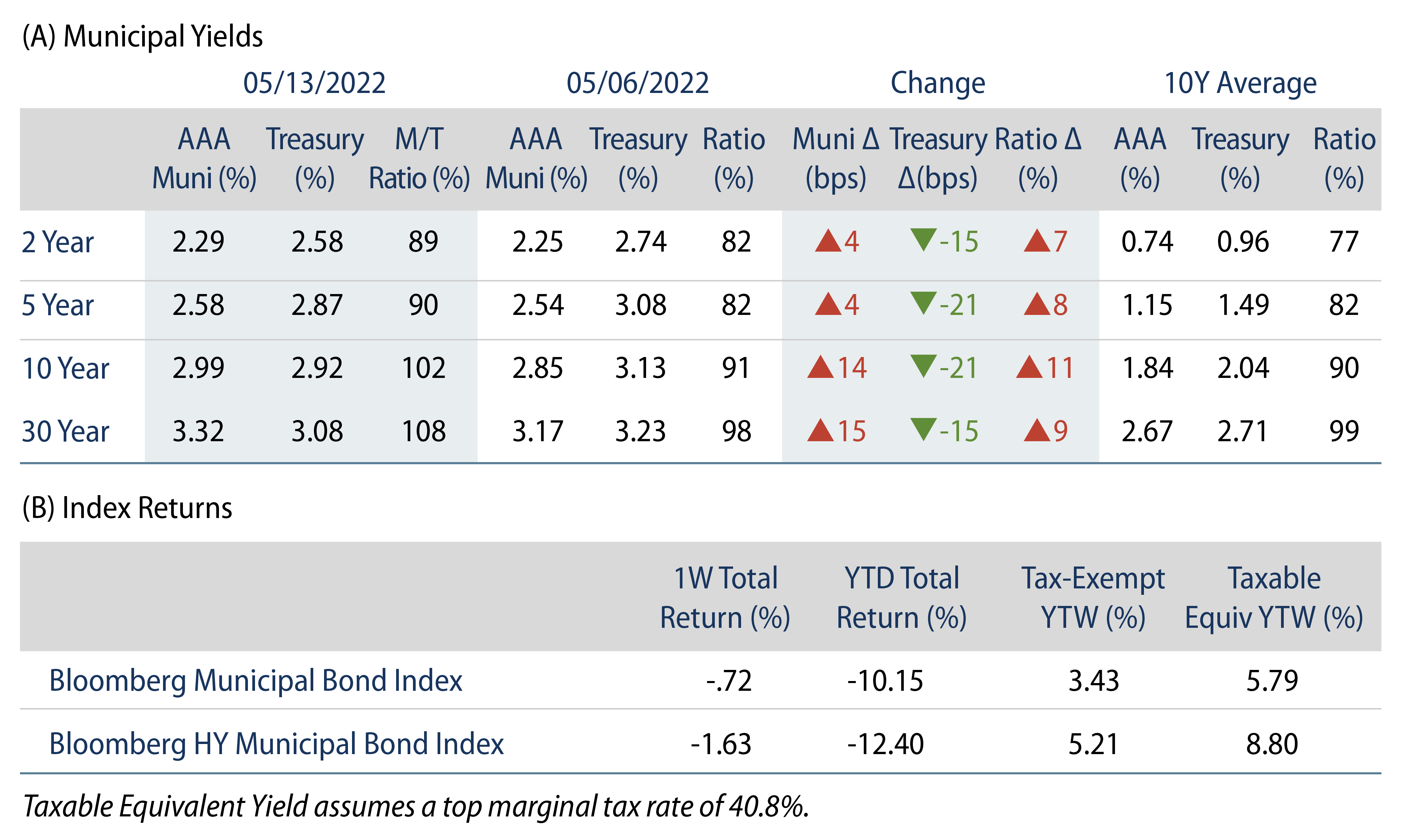

Negative muni returns continued last week despite a Treasury rally. Munis significantly underperformed the Treasury rally, resulting in Municipal/Treasury ratios exceeding 100% in 10- and 30-years. High-grade municipal yields moved 4-15 basis points (bps) higher across the curve as Municipal fund outflows persisted for an 18th consecutive week. The Bloomberg Municipal Index returned -0.72%, while the HY Muni Index returned -1.63%. This week we highlight and evaluate year-to-date (YTD) performance in the context of relative valuation and structural factors.

Municipal Technicals Remained Weak Amid Persistent Outflows and Elevated Supply

Fund Flows: During the week ending May 11, weekly reporting municipal mutual funds recorded $2.4 billion of outflows, according to Lipper. Long-term funds recorded $1.5 billion of outflows, high-yield funds recorded $825 million of outflows and intermediate funds recorded $656 million of outflows. The week’s fund outflows extend the current outflow streak to 18 consecutive weeks, and contribute to $55 billion of YTD net outflows.

Supply: The muni market recorded $15 billion of new-issue volume, up over 3x from the prior week. Total YTD issuance of $156 billion is 3% higher from last year’s levels, with tax-exempt issuance trending 13% higher year-over-year (YoY) and taxable issuance trending 25% lower YoY. This week’s new-issue calendar is expected to decline to $5 billion. Largest deals include $1.7 billion State of Illinois and $468 million Gilbert Water Resources Municipal Property Corporation transactions.

This Week in Munis: Putting YTD Performance in Context

This year’s global market downturn has led to an unpleasant surprise for municipal investors that often view their municipal allocation as a ballast. However, from a quantitative perspective, the poor performance of municipals can be explained by their underlying risk factors, and is not reflective of credit concerns or an unexplained dislocation in the municipal market.

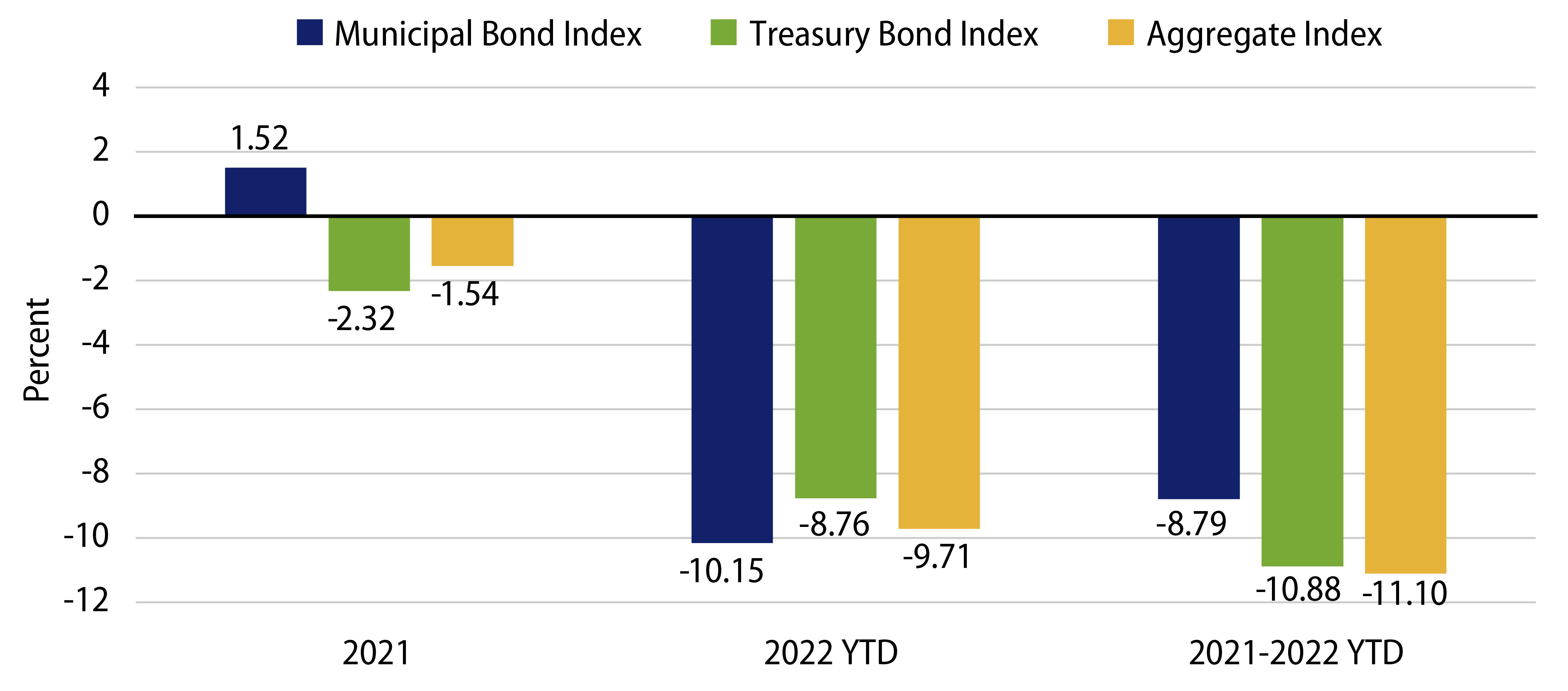

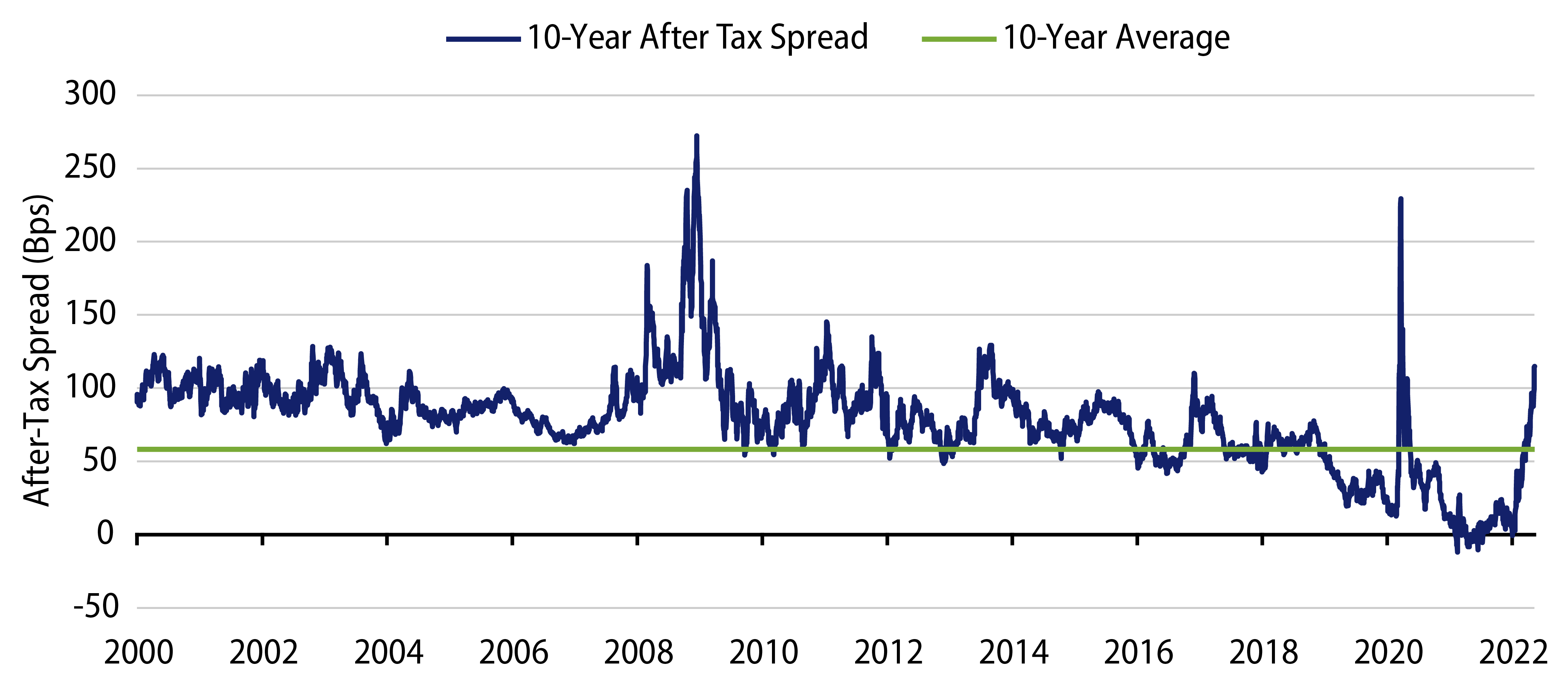

The Bloomberg Municipal Bond Index YTD return of -10.15% underperformed the Bloomberg Treasury Index and the broader Bloomberg Aggregate Index YTD returns of -8.76% and -9.71%, respectively. However, extending the holding period to the beginning of 2020, the Municipal Index has outperformed Treasury and the Aggregate indices by 209 and 232 bps, respectively (not considering the tax-benefit of municipal income). This could imply that at least a portion of the YTD negative performance can be attributed to a reversion to more normal valuations following significant outperformance of the asset class in 2021, which had driven Municipal/Treasury ratios to record lows, and municipal versus after-tax Treasury spreads to negative levels for the first time.

Municipal underperformance YTD can also be explained by the large proportion of callable bonds that comprise the muni market. Callable bonds provide higher duration-adjusted yields to investors when rate volatility is low. However, when rates rise, the negative price action of a callable bond is exacerbated by a simultaneous lengthening of duration, leading to significant price sensitivity to rising rates. In 2022, municipal indices experienced duration extension as rates increased, with the duration of the Bloomberg Municipal Index increasing one year and the duration of the Bloomberg Long Municipal Index lengthening by 3.4 years. The losses associated with this structure have been painful, but they could be attributed to the increased price sensitivity of rate movements in a rising-rate environment.

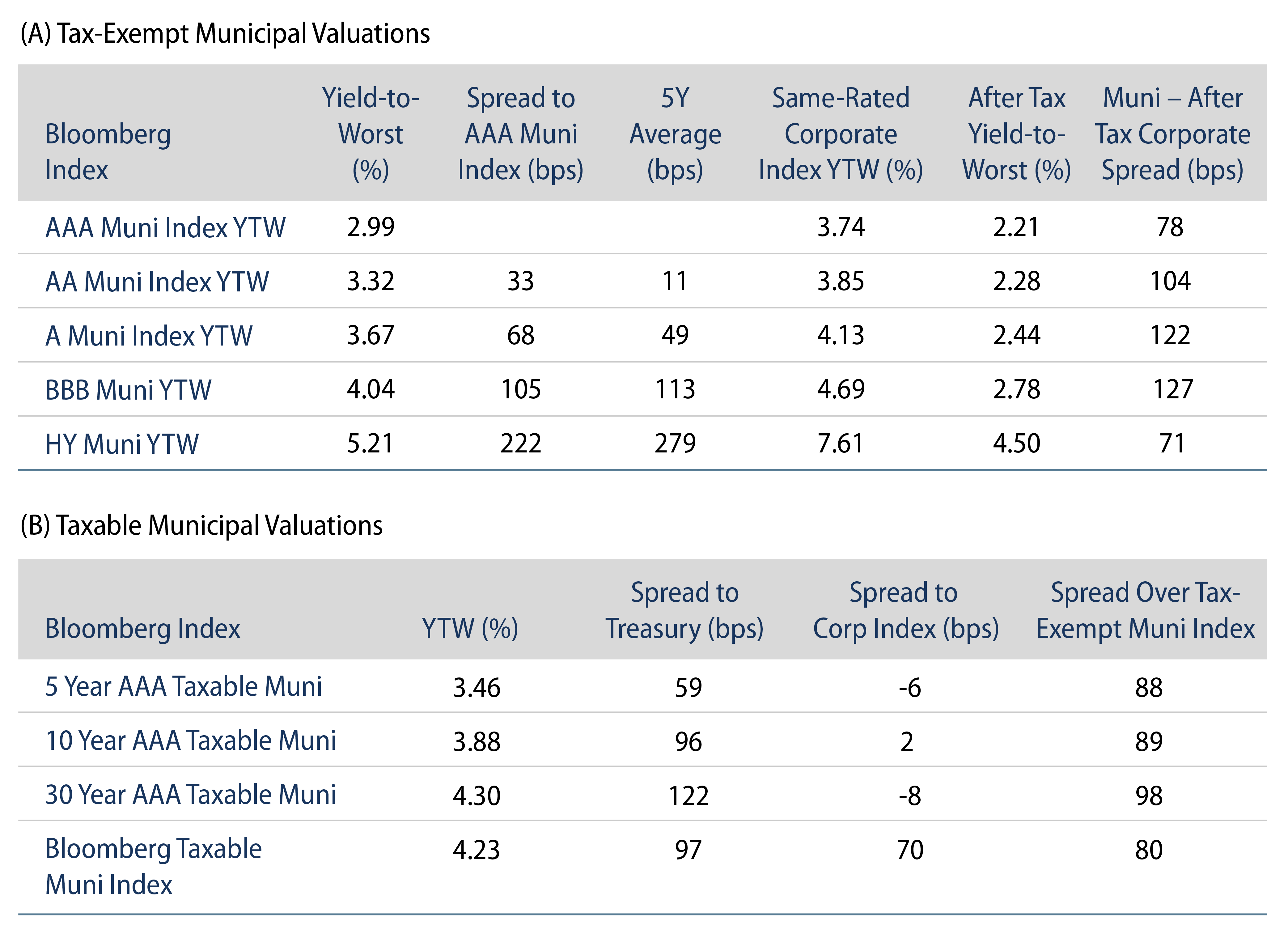

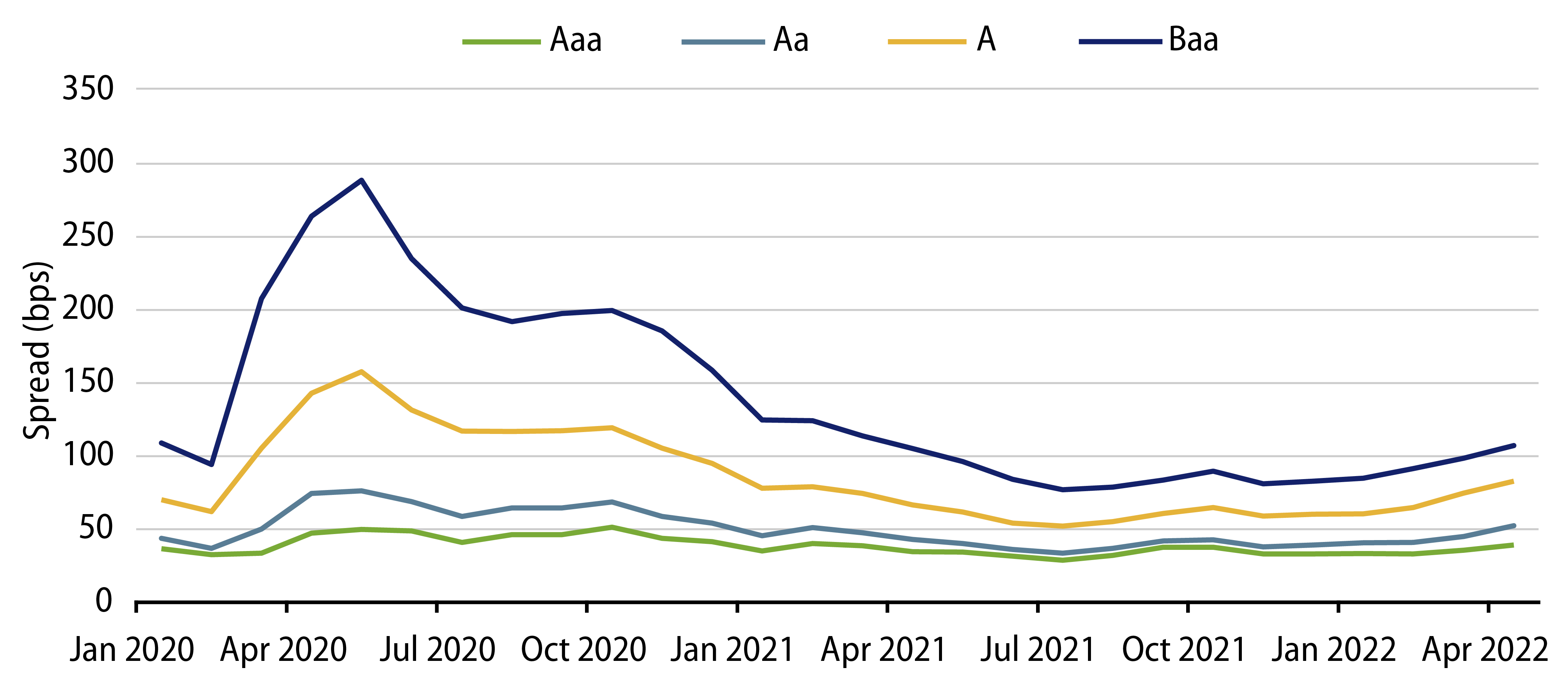

From a credit standpoint, in recent weeks we highlighted the stark contrast between negative municipal returns and strong credit conditions. Credit spreads support the relatively strong credit environment in the municipal market, as very little of the market’s woes can be attributed to the market’s avoidance of lower-credit bonds. Exhibit 3 shows that credit spreads within the Municipal Index have widened only modestly amid the current market volatility.

No asset class is immune to the global volatility that we are currently experiencing. Highly volatile periods in the past have often revealed new and negative information about certain asset classes. This seems not to be the case with municipal bonds in this current turbulent environment. While overall market volatility can be unpredictable, from a quantitative standpoint, municipal bonds have for the most part behaved predictably considering the interest rate moves, along with the embedded duration, structural and credit factors that an active manager such as Western Asset evaluates on a daily basis.