Municipals Posted Positive Returns Last Week

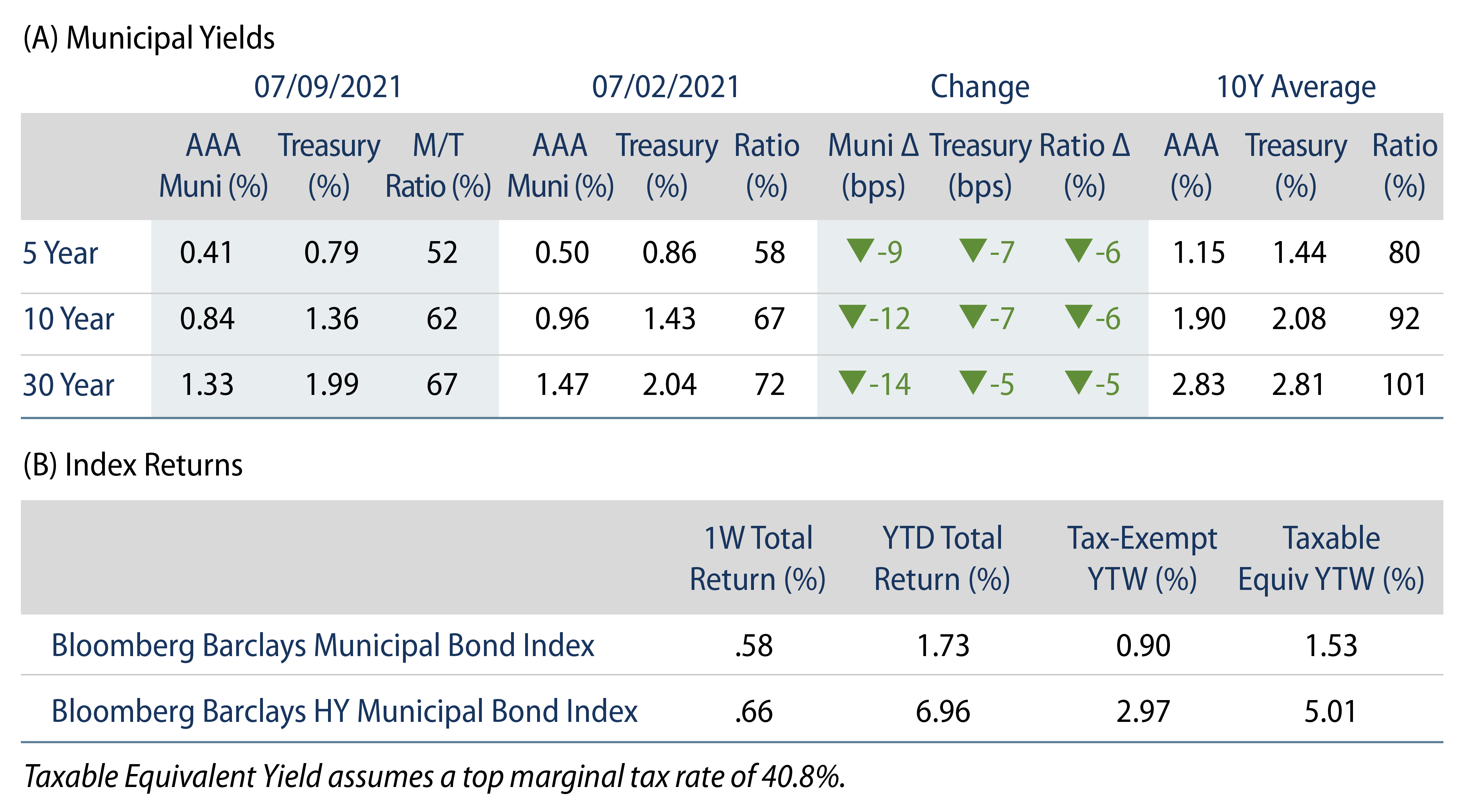

AAA municipal yields moved 9-14 bps lower during the week. US municipals outperformed Treasuries as muni technicals strengthened. The Bloomberg Barclays Municipal Index returned 0.58%, while the HY Muni Index returned 0.66%. The strong week of returns was supported by favorable technicals, as municipal mutual fund flows maintained a record pace as supply declined. This week, we highlight the recent upgrade of the state of Illinois by the major rating agencies.

Technicals Strengthen Around the July 4th Holiday

Fund Flows: During the week ending July 7, municipal mutual funds recorded $2.3 billion of net inflows. Long-term funds recorded $1.5 billion of inflows, high-yield funds recorded $683 million of inflows and intermediate funds recorded $971 million of inflows. Municipal mutual funds have now recorded inflows 59 of the last 60 weeks, extending the record inflow cycle by $126 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $64 billion.

Supply: The muni market recorded $4.5 billion of new-issue volume during the week (-42% week-over-week). Total issuance YTD of $231 billion is 14% higher from last year’s levels, with tax-exempt issuance trending 18% higher year-over-year and taxable issuance 2% higher. This week’s new-issue calendar is expected to double to $9 billion of new issuance. The largest deals include $589 million New York City Transitional Finance Authority and $469 million Water Works Board of the City of Birmingham transactions.

This Week in Munis: Illinois Upgrade

Last week, Standard & Poor’s upgraded its rating on State of Illinois General Obligation Bonds to BBB from BBB-, while maintaining a stable outlook. The upgrade follows Moody’s commensurate action of upgrading its rating of the state to Baa2 from Baa3 on the last day of June.

The rating upgrades come after Governor Pritzker’s signing of the Fiscal 2022 budget in mid-June, which was largely aligned with the original proposal highlighted in our February blog about Illinois’ inflection point. The approved budget included better than expected state revenues and expense controls that contributed to a balanced budget, as well as the paydown of Municipal Liquidity Fund liabilities, internally borrowed funds and outstanding bill backlogs. Importantly, the state remains burdened from a highly levered pension system, which is 39% funded as of June 2019. While the current signed budget does not fully contribute to the actuarial required contribution, the improved fiscal position and statutory commitment extends the timeline for the state to address some of its longer-term structural issues.

Illinois’ credit improvement is indicative of the post-pandemic municipal credit conditions following better than anticipated revenues and unprecedented federal support. The upgrades also represent a stark contrast to the pre-pandemic debate on whether the sixth most populous state would be downgraded to high-yield status.

Market valuations have largely priced in the state’s recovery, as tax-exempt Illinois spreads have largely reverted to or past pre-pandemic lows, rallying nearly 300 bps from pandemic wides. Meanwhile, taxable municipal spreads still offer moderate relative value to pre-pandemic levels. At current valuations, we remain cautious on adding exposure as the impact of federal support fades, and expect further credit improvement to remain contingent on the state’s ability to address structural pension issues without federal support.